A bank account pending transaction and a posted transaction represent two different stages in the banking process. A pending transaction is one that has been initiated but not yet completed or cleared by the bank. It's a temporary hold of a certain amount, reducing the available balance, but it doesn't affect the current balance until finalized. Conversely, a posted transaction is a completed transaction that has been fully processed by the bank. It directly impacts the current balance, reflecting the actual amount deducted from the account. The key difference between these two lies in their processing status and impact on the account balance. Understanding the distinction between a bank account's pending and posted transactions is crucial for effective account management and avoiding potential banking issues. There are significant differences between pending and posted transactions, and understanding these differences is crucial for the effective management of your bank account. The key difference between pending and posted transactions lies in their status of processing. While pending transactions represent initiated but not yet finalized transactions, posted transactions have been fully processed and finalized. Pending transactions are temporary and subject to change, whereas posted transactions are permanent and cannot be easily modified or reversed. These differences are significant for account holders as they affect the available balance in their accounts. Pending transactions reduce the available balance but do not affect the current balance until they post. Posted transactions, however, are reflected in the current balance. Keeping track of these transactions helps in avoiding overdraft fees and managing the account more effectively. On a bank statement, pending transactions are usually listed separately from posted transactions. It's important to review both sections to understand your total expenditures and remaining balance. A pending transaction, as the term implies, is a transaction that has been initiated but has not yet been cleared by the bank. It indicates a transaction that is currently being processed but is not yet finalized. When you use your debit or credit card for a transaction, the merchant sends a request to your bank for authorization. The bank then checks if you have sufficient funds or credit to complete the transaction. If you do, the bank places a hold on the funds, and the transaction becomes pending. This process is instant and ensures that the funds are set aside for the merchant. Typical examples of pending transactions include hotel bookings, gas station payments, online purchases, or any transaction where the final amount may not be immediately known. For instance, when you check into a hotel, the hotel might put a hold on a certain amount on your card. This pending transaction is typically higher than your expected bill to cover any additional expenses during your stay. The duration of a pending transaction can vary greatly depending on the nature of the transaction. While some transactions may only be pending for a day or two, others can remain pending for several days or even a week. Various factors influence how long a transaction remains pending. These include the merchant's processing time, the type of transaction, bank holidays, and the bank’s specific policies. Posted transactions, in contrast to pending transactions, have been fully processed and have cleared your account. This means the bank has transferred the funds from your account to the merchant's account. Once the merchant finalizes the transaction and submits the batch of transactions to their bank, the pending transaction becomes a posted transaction. During this process, the bank removes the hold on the funds, and the amount is deducted from your account. Posted transactions include all finalized transactions, such as completed ATM withdrawals, payments that have cleared, and settled credit card transactions. The timeframe of a posted transaction can vary. Most transactions post within a day or two of the transaction date, but some may take longer due to the reasons mentioned earlier. The speed of posting a transaction can depend on several factors, such as the merchant’s banking practices, the type of transaction, and the bank’s processing speed. For instance, banks generally do not process transactions on weekends or holidays, which can delay the posting of a transaction. Both pending and posted transactions impact your account balance, but they do so in different ways. Impact of Pending Transactions: Pending transactions impact your account by reducing your available balance. The bank earmarks these funds to ensure that they are available for withdrawal by the merchant once the transaction posts. However, they do not affect your current balance until they post. Impact of Posted Transactions: Posted transactions directly impact your current balance. Once a transaction posts, it moves from the pending transactions and is subtracted from the current balance of your account. Comparing the Impacts: While both types of transactions reduce your balance, their timing and permanence are different. Pending transactions temporarily hold funds, but the final amount can change before posting. Posted transactions are final, and the amounts do not change after they post. Banking transactions, usually seamless, can occasionally encounter problems. These issues may involve both pending and posted transactions, potentially disrupting your financial activities. A comprehensive understanding of these scenarios and appropriate handling can help ensure your banking operations remain smooth. Issues with pending transactions include long hold times, double charges, and transactions that don't post. Sometimes, a pending transaction might drop off without posting, which can be confusing and lead to unintentional overdrafts if not carefully monitored. Problems with posted transactions often involve disputes about the transaction amount, unauthorized transactions, or errors that need to be corrected. Resolving these issues typically involves contacting the bank or the merchant. Proactive account management can help avoid many transaction-related issues. Regularly reviewing account activity, promptly addressing discrepancies, and understanding the terms and conditions of your account are effective ways to mitigate potential problems. Pending and posted transactions are vital elements in managing a bank account effectively. A pending transaction, initiated but not yet finalized, temporarily lowers the available balance but doesn't affect the current balance. Conversely, a posted transaction, fully processed, impacts the current balance directly. The understanding of these transaction states allows for better account oversight and can prevent potential financial missteps. Challenges may arise, such as extended pending periods or discrepancies in posted transactions, yet these can be addressed by understanding the bank's policies and maintaining regular communication with both your bank and the relevant merchants. Proactively monitoring your account activity, coupled with a thorough knowledge of your bank's transaction processing times and dispute resolution procedures, provides a strong foundation for successful account management.Bank Account Pending Transaction vs Posted Transaction Overview

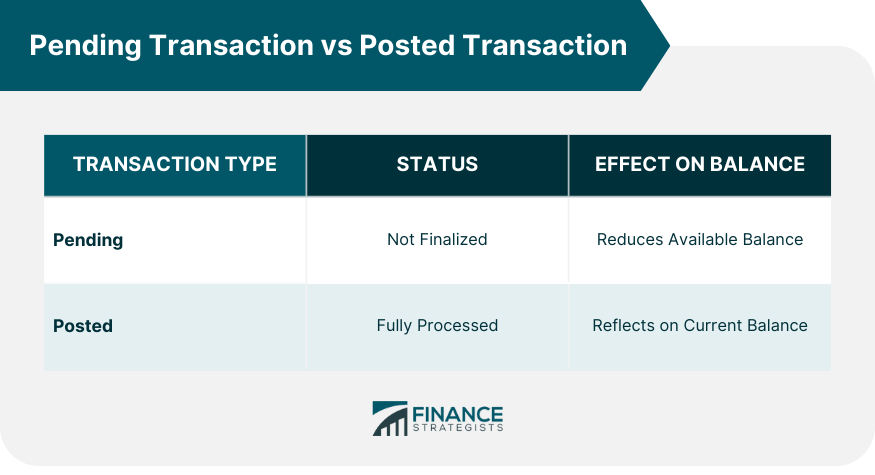

Pending Transaction vs Posted Transaction

Key Differences

Significance of These Differences for Account Holders

Understand Bank Statements: Pending and Posted Transactions

Understand a Pending Transaction

How a Transaction Becomes Pending

Examples of Pending Transactions

Potential Duration of a Pending Transaction

Factors That Influence Pending Transaction Time

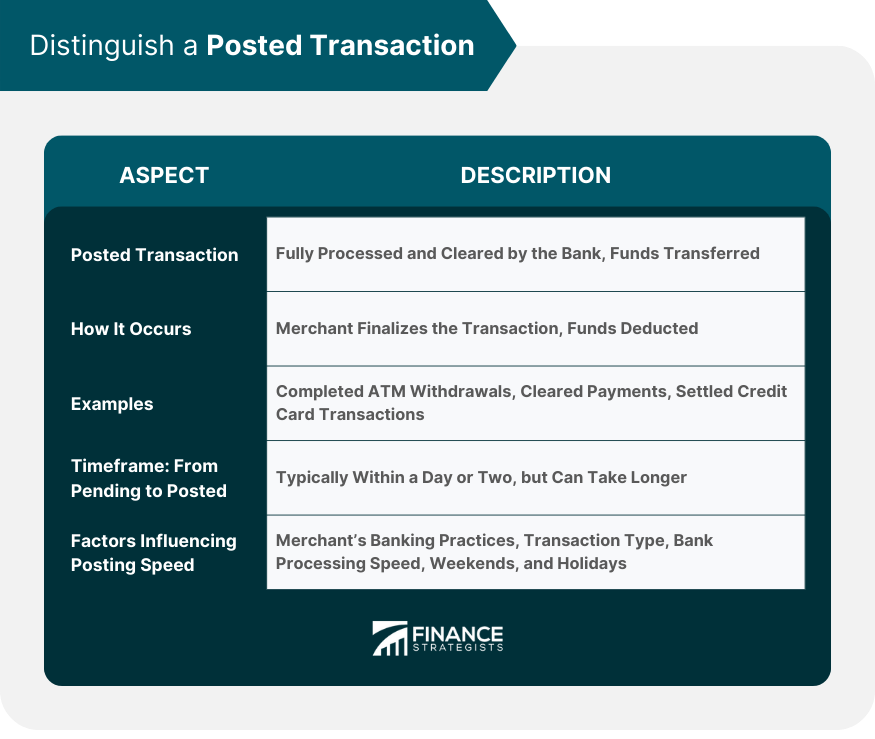

Distinguish a Posted Transaction

How a Pending Transaction Becomes a Posted Transaction

Examples of Posted Transactions

Timeframe of a Posted Transaction: From Pending to Posted

Factors Influencing the Speed of Posting a Transaction

Impacts on Account Balance

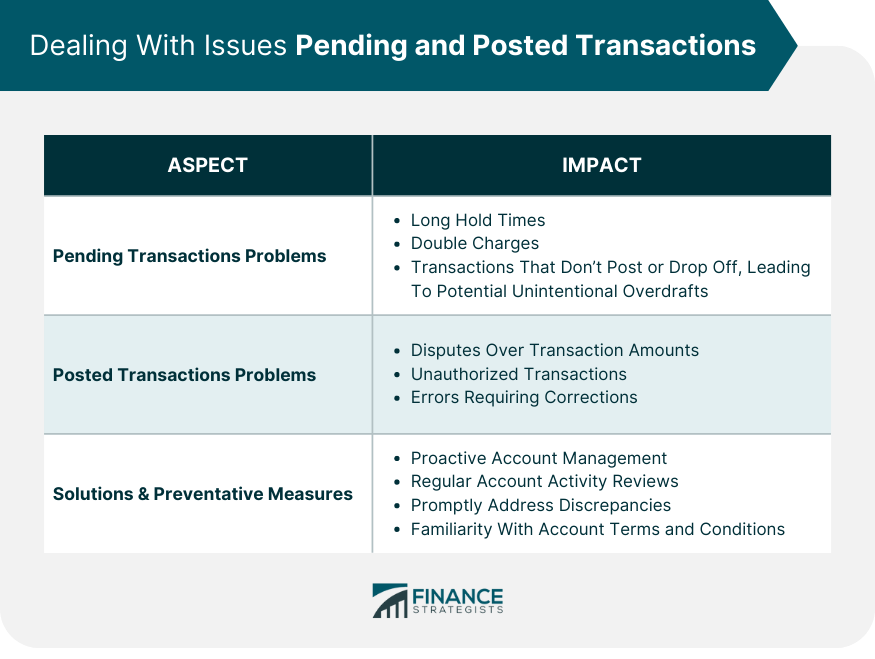

Dealing With Issues: Pending and Posted Transactions

Typical Problems With Pending Transactions

Typical Problems With Posted Transactions

Solutions and Preventative Measures

Conclusion

Bank Account Pending Transaction vs Posted Transaction FAQs

A pending transaction represents a transaction that has been initiated but not yet finalized. It temporarily reduces your available balance but does not affect your current balance. On the other hand, a posted transaction is one that has been fully processed and has cleared your account. It directly impacts your current balance.

A transaction could stay in a pending state for several days due to factors such as the merchant's processing time, bank holidays, or the specific policies of your bank. Also, certain types of transactions, like hotel bookings or gas station payments, may remain pending for longer because the final amount may not be known immediately.

Cancellation of a pending transaction largely depends on the policies of the issuing bank and the merchant. In some cases, the merchant may be able to cancel the transaction. However, in most cases, you'll have to wait for the transaction to post before disputing it.

To resolve issues with posted transactions, you typically need to contact your bank or the merchant. This might be necessary if you notice unauthorized transactions or errors in the posted amount. It's always advisable to promptly address any discrepancies you identify.

Regular review of your account activity can help you catch and address issues early. Understanding the terms and conditions of your account, especially regarding transaction processing times and dispute resolution procedures, can also help. Additionally, maintaining open communication with your bank and merchants can prevent and resolve potential issues.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.