A business bank account is a crucial tool for any business, acting as a separate entity from personal finances to manage company money. It not only streamlines business transactions but also enhances credibility with customers, suppliers, and investors. Business bank accounts range from checking and savings accounts to merchant services and credit card accounts. Each has its distinct features catering to different business needs, such as day-to-day transactions, capital growth, or customer payment facilitation. Additionally, they offer features like online banking, payroll services, business loans, and overdrafts. Regular review and effective management of a business bank account are essential for optimal cash flow management and establishing a solid credit history. In the evolving business landscape, a business bank account is a non-negotiable aspect of successful financial management. Business checking accounts are fundamental for day-to-day operations. They allow for multiple deposits, withdrawals, and fund transfers. They're often accompanied by a debit card, enabling the business to make transactions easily. A business savings account is an excellent tool for businesses looking to grow their capital while maintaining liquidity. Interest earned on deposits helps grow the business’s funds over time. These accounts facilitate credit and debit card transactions, which are essential for businesses in the modern digital marketplace. They ensure efficient, secure handling of card payments, improving customer experience. Business credit cards offer an easy way to manage expenses and can improve a company's credit rating. They often come with additional benefits such as cashback and travel rewards. These are hybrid accounts combining features of checking and savings accounts, ideal for businesses wanting to earn interest while maintaining flexibility. These credit facilities can offer a lifeline when cash flow is tight, allowing businesses to continue operations and take advantage of growth opportunities. This feature enables businesses to manage their finances at any time, from any location. Online banking services offer bill pay, money transfers, and digital check deposits, among other services. These tools offer convenience and flexibility in managing business expenses. They can provide detailed transaction histories, making accounting tasks easier. Some business bank accounts offer payroll services, simplifying the process of paying employees and filing payroll taxes. Business bank accounts allow for efficient cash and check deposits and withdrawals, streamlining the payment process. 1. Identify the appropriate type of business bank account for your needs. 2. Choose a bank that offers the services you require. 3. Prepare the necessary documentation. 4. Complete the application process, either online or in person. 5. Fund your account. Typically, banks require the following documents: Business License Employer Identification Number (EIN) Articles of Incorporation Business owner’s identification Key considerations include: Bank's reputation and reliability Interest rates and fees Range of services offered Convenience factors such as location and online banking options Routine account reviews can help identify any unusual activity, errors, or opportunities for improvement. Bank fees can significantly impact your bottom line. Always be aware of the charges associated with your account, and consider ways to minimize these costs. Keeping detailed records is critical for tracking expenses, preparing financial statements, identifying tax deductions, and supporting tax returns. When closing or changing accounts, ensure you settle any outstanding balances, transfer automatic payments, and notify relevant parties of the change. A separate business bank account simplifies tax preparation and can help demonstrate tax compliance in case of an audit. Depending on the business structure, owners may be personally liable for the company's debts. Understanding this liability is vital for risk management. Businesses must abide by regulations from entities like the IRS, Financial Crimes Enforcement Network, and Office of Foreign Assets Control. A business bank account can help track income and expenses, making cash flow management more efficient. By managing a business bank account responsibly, businesses can build a solid credit history, which is useful when applying for loans or credit. A business bank account can provide critical data for forecasting and budgeting, aiding financial planning. The Business Bank Account is an integral part of any successful enterprise, providing a means to separate personal and business finances, streamline operations, and enhance credibility. Various types of business bank accounts cater to distinct needs, including checking accounts for everyday transactions, savings accounts for capital growth, and merchant services for handling card payments. These accounts offer vital features like internet banking, payroll services, and business loans. Opening a business bank account requires careful consideration and the right documentation. It is crucial to regularly review these accounts, understand bank fees, and keep detailed records. With careful management, a business bank account can significantly contribute to effective financial management, cash flow control, credit building, and strategic planning, proving to be a non-negotiable component in the evolving business landscape.Business Bank Accounts Overview

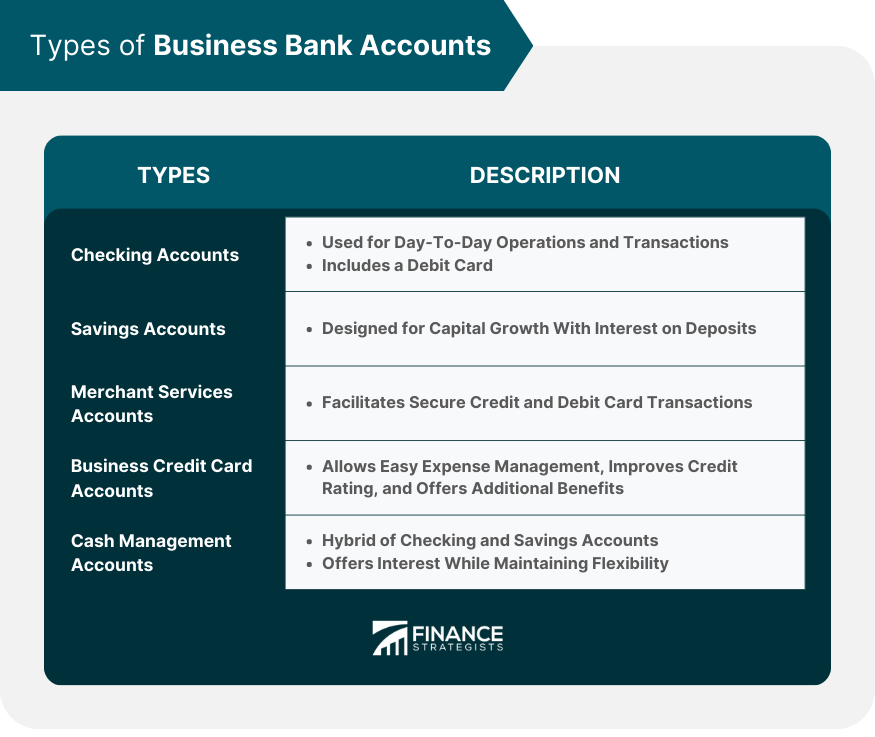

Types of Business Bank Accounts

Checking Accounts

Savings Accounts

Merchant Services Accounts

Business Credit Card Accounts

Cash Management Accounts

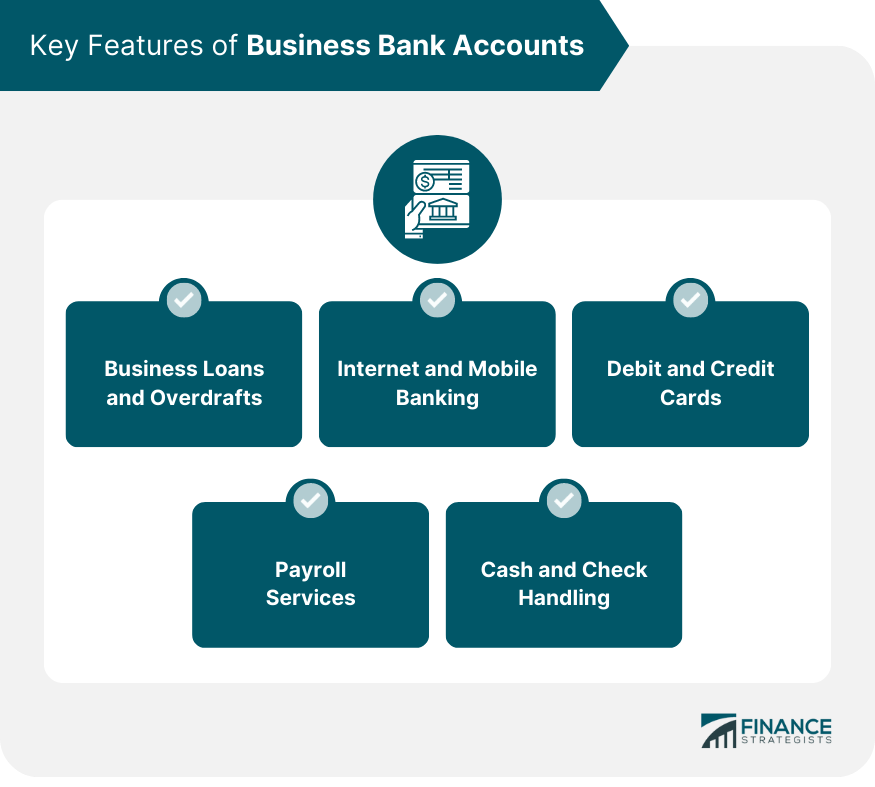

Key Features of Business Bank Accounts

Business Loans and Overdrafts

Internet and Mobile Banking

Debit and Credit Cards

Payroll Services

Cash and Check Handling

How to Open a Business Bank Account

Steps to Open a Business Bank Account

Documentation Required for Opening a Business Bank Account

Factors to Consider When Choosing a Business Bank Account

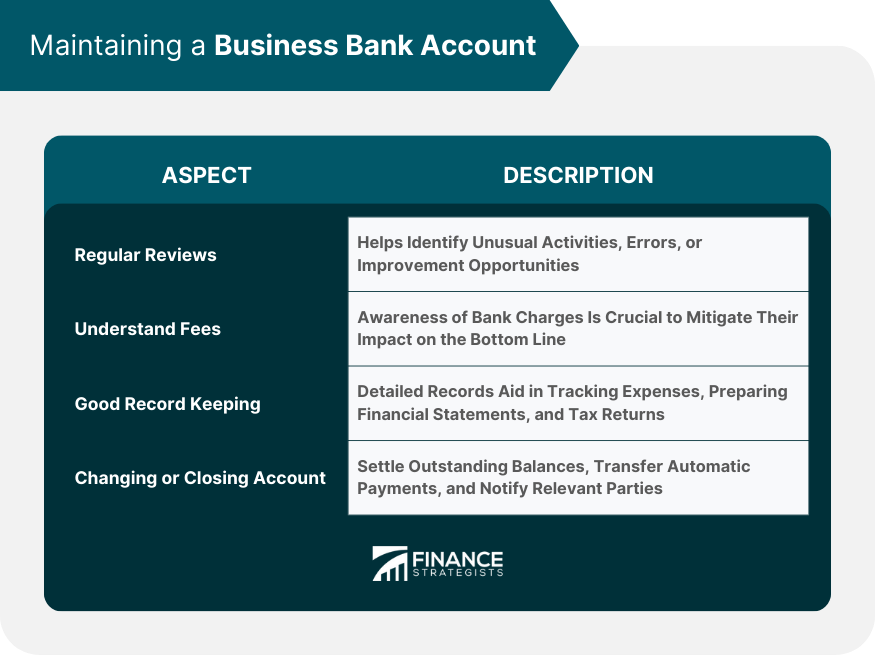

Maintaining a Business Bank Account

Regularly Review Your Business Bank Account

Understand and Manage Bank Fees

Good Record Keeping

Steps to Change or Close a Business Bank Account

Legal Aspects of Business Bank Accounts

Importance of Business Bank Accounts in Financial Management

Conclusion

Business Bank Accounts FAQs

A business bank account is designed to manage and separate a company's finances from personal finances. It allows for smoother cash flow, better financial record-keeping, compliance with legal requirements, and enhances credibility with customers and suppliers.

To open a business bank account, you need to choose a bank, decide on the type of account that suits your business needs, and prepare necessary documentation such as a business license, EIN, and Articles of Incorporation. Then you complete the application process either online or in person.

Regularly reviewing your business bank account can help identify any unusual activity, catch errors, and highlight areas for financial improvement. It aids in tracking income, expenses and managing cash flow.

Some key features to consider include low transaction fees, online and mobile banking options, payroll services, availability of business loans or overdrafts, and efficient cash and check handling. The exact needs can vary based on the size and nature of your business.

Responsible management of a business bank account can help build a solid credit history. By meeting financial obligations on time and maintaining a positive balance, businesses can demonstrate financial responsibility, making it easier to obtain loans or credit in the future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.