Effective financial management is paramount for both individuals and businesses. It not only provides control over one's income, expenses, and investments but also prevents financial mishaps. For businesses, efficient management of finances ensures profitability and facilitates growth, while for individuals, it enables them to meet personal goals and ensures financial security. Differentiating between business and personal bank accounts is essential for streamlined financial management. This distinction ensures that personal expenses and business transactions do not overlap, making it easier to track income and expenditure. Additionally, this separation of accounts also aids in regulatory compliance, especially during tax filing and legal proceedings. A personal bank account is a financial tool initiated by an individual to efficiently administer their personal financial affairs. The primary use of these accounts extends to managing one's earnings, such as salaries or other forms of income, accumulating personal savings, and facilitating transactions related to individual expenditures. It plays an essential role in budgeting personal expenses, ensuring financial security, and even enabling the fulfillment of individual financial goals. Personal bank accounts typically come with features like ATM access for cash withdrawal and deposit, monthly maintenance fees that vary depending on the bank, and interest rates that can be earned on the account balance. These accounts may also offer online and mobile banking services, allowing individuals to check balances, transfer funds, and make bill payments from the comfort of their homes. A business bank account represents a separate, designated account used by enterprises to execute their financial dealings. These accounts encompass various activities ranging from managing revenue derived from sales to handling expenditures associated with operational necessities. It is also a crucial tool for managing cash flow, ensuring that businesses have sufficient funds for their operations while also investing in growth and expansion opportunities. Business bank accounts often feature higher transaction limits to accommodate large volumes of business transactions. They also offer merchant services like credit and debit card processing, which is critical for businesses accepting card payments. Furthermore, these accounts may offer payroll capabilities, allowing businesses to manage employee salaries and benefits with ease. Business bank accounts are designed to handle a higher volume of transactions compared to personal accounts. This makes them well-suited for businesses that have a large number of incoming and outgoing transactions, such as retail businesses or service providers. There can be significant differences in the fees and charges associated with personal and business bank accounts. Business accounts often come with higher monthly fees and transaction charges due to the enhanced services they provide. Additionally, business accounts may also incur charges for merchant services and payroll processing. One significant difference between business and personal bank accounts lies in the legal protections they offer. With a business bank account, the personal assets of the business owner are legally separated from the business's liabilities. This means that in the event of a legal issue, the business owner's personal assets are protected. Keeping separate accounts is beneficial for tax reporting. With a clear delineation between personal and business finances, it is easier to accurately report business income and expenses for tax purposes. A business bank account also makes it easier to substantiate business expenses if audited by the tax authorities. Having separate business and personal accounts aids in maintaining clear and organized financial records. This separation makes it easier to track income and expenses, simplifying the accounting and auditing processes. Using a business bank account can help portray a professional image to clients, vendors, and partners. It signifies that the business is an established entity and promotes trust and credibility. Having a separate business account can protect personal assets in case of legal troubles or business debt. As business bank accounts create a distinct legal separation between business and personal assets, they can prevent personal assets from being seized to pay off business liabilities. The bank's reputation is an important factor to consider when opening a business account. A reputable bank often guarantees reliable and quality services, and it also helps enhance the credibility of the business. The services offered by the bank should cater to the business's specific needs. This might include merchant services, online banking, high transaction limits, payroll services, or other specific services that the business requires. Understanding the bank's fee structure is crucial before opening a business account. This includes monthly fees, transaction fees, and any additional charges for extra services. It's important to assess whether the cost of maintaining the account aligns with the business's budget and whether the benefits justify the costs. Understanding the difference between a personal bank account and a business bank account is crucial for proper financial management. Both types of accounts serve different purposes and come with distinct features. A business bank account not only accommodates a larger volume of transactions but also offers features like merchant services and payroll capabilities that are instrumental for business operations. Differentiating these accounts can result in clear financial records, a professional business image, and personal liability protection. When considering opening a business account, factors such as the bank's reputation, offered services, and fee structure should be taken into account. The right financial decisions can ensure streamlined business operations, clear financial management, and enhanced business growth.Differentiating Between Business and Personal Accounts

Personal Bank Account

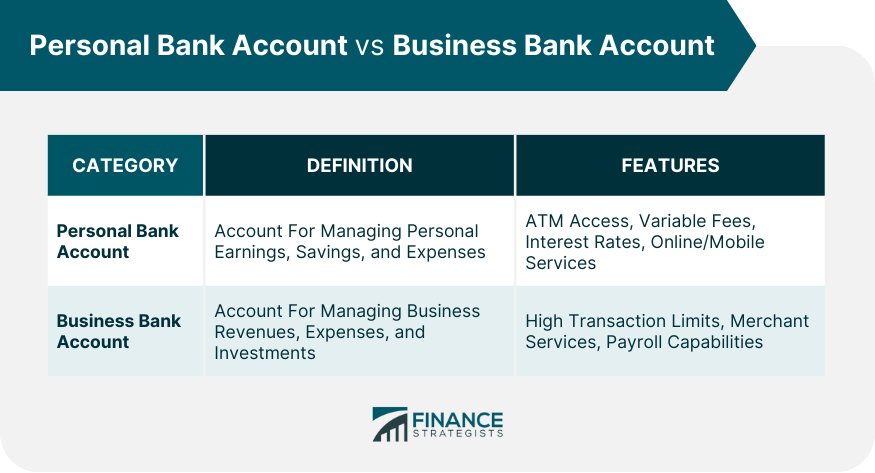

Definition and Primary Use

Typical Features of Personal Bank Accounts

Business Bank Account

Definition and Primary Use

Features of Business Bank Accounts

Key Differences Between Personal and Business Bank Accounts

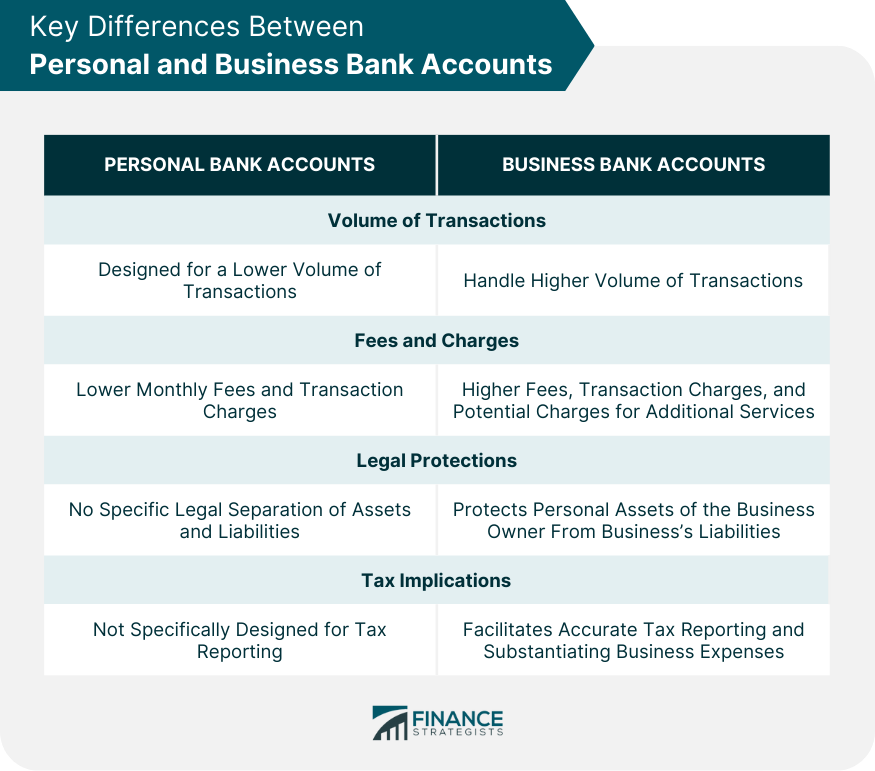

Volume of Transactions

Fees and Charges

Legal Protections

Tax Implications

Advantages of Separating Business and Personal Accounts

Clear Financial Records

Professional Image

Personal Liability Protection

Considerations Before Opening a Business Account

Bank's Reputation

Offered Services

Fee Structure

Bottom Line

Business vs Personal Bank Account FAQs

Differentiating between personal and business bank accounts is crucial for effective financial management, ensuring a clear distinction between personal expenses and business transactions. It simplifies tracking income and expenses, aids in regulatory compliance during tax filings and legal proceedings and shields personal assets from business liabilities.

Personal bank accounts typically feature ATM access, monthly maintenance fees, and the ability to earn interest on the account balance. They may also offer online and mobile banking services. Business bank accounts, on the other hand, are designed to handle larger transaction volumes and may offer additional services like credit and debit card processing, payroll capabilities, and higher transaction limits.

A business bank account creates a legal separation between your personal assets and your business's liabilities. This means that in the event of business debt or legal issues, your personal assets are protected and cannot be seized to offset the business liabilities.

A business bank account signifies that the business is an established entity. It separates personal transactions from business transactions, portraying a professional image to clients, vendors, and partners and promoting trust and credibility.

Before opening a business bank account, consider the bank's reputation, the services offered by the bank, and the fee structure. Ensure that the bank's services cater to your business's specific needs and that the cost of maintaining the account aligns with your business budget.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.