Yes, you can transfer Bitcoins to your bank account. Transferring Bitcoins to a bank account involves a series of steps that enable you to convert your digital assets into traditional fiat currency. By using a secure Bitcoin wallet, linking your bank account, and following the necessary verification procedures, you can initiate a transfer and have the equivalent amount of funds credited to your bank account. The ability to transfer Bitcoins to your bank account opens up a world of opportunities for cryptocurrency users, providing a seamless bridge between the digital realm and the traditional financial system. Through a secure and well-guided process, you can unlock the value of your digital assets and utilize them for real-world purposes, whether it's for everyday expenses, investments, or other financial requirements. The process of transferring Bitcoins to a bank account involves several essential steps: Bitcoin wallets come in various forms, each catering to different user preferences and security needs. Software wallets, such as desktop, mobile, or web-based wallets, offer convenience and ease of use for regular transactions. On the other hand, hardware wallets, such as USB devices, provide enhanced security by storing private keys offline. Users should carefully consider their specific use case, frequency of transactions, and security concerns before making a wallet selection. To comply with regulatory standards and prevent illicit activities, reputable cryptocurrency exchanges and wallet providers require users to complete a Know Your Customer (KYC) verification process. This process involves submitting valid identification documents and personal information. KYC ensures that users' identities are authenticated, reducing the risk of fraudulent activities and promoting a safer environment for cryptocurrency transactions. Once the Bitcoin wallet is set up and the KYC verification is complete, users need to link their bank accounts to the wallet. This linkage facilitates the seamless transfer of funds between the Bitcoin wallet and the traditional banking system. Users should ensure they provide accurate bank account details to avoid transfer complications or delays. With the wallet and bank account linked, users can initiate the transfer by specifying the amount of Bitcoin they wish to convert to their bank account's local currency. It is crucial to review the transaction details carefully before confirming the transfer to avoid errors or potential loss of funds. Once the transfer request is submitted, it is broadcasted to the Bitcoin network for validation. Bitcoin transactions' speed and cost can vary depending on the network's congestion and the transaction fees chosen by users. During times of high network activity, transaction fees may increase, leading to longer processing times. It is essential for users to stay informed about the current network conditions and adjust their preferences accordingly to optimize the transfer experience. After the transfer request is submitted, the Bitcoin network's miners validate the transaction by solving complex mathematical puzzles. Each validation adds confirmation to the transaction, and users typically need to wait for a certain number of confirmations (often six confirmations) before the transfer is considered finalized. Once the necessary confirmations are achieved, the funds are credited to the user's bank account in the local fiat currency. Ensuring a smooth and secure transfer experience requires diligent attention to security practices and market conditions. Here are some essential tips for successful Bitcoin-to-bank account transfers: • Update Wallet and Security Software: Keeping the Bitcoin wallet and associated software up to date is crucial to protect against potential security threats. Wallet providers frequently release security patches and updates to address vulnerabilities and enhance user protection. • Beware of Scams and Phishing Attempts: The cryptocurrency space is rife with scammers and phishing attempts. Users should be cautious of unsolicited messages, fake websites, and dubious investment opportunities. Always verify the authenticity of the sender and the website before sharing any personal or financial information. • Maintain Detailed Transaction Records: In many jurisdictions, cryptocurrency transactions are subject to taxation. Keeping meticulous records of Bitcoin transfers, including dates, amounts, and equivalent fiat values, will prove invaluable when calculating tax liabilities. • Implement Two-Factor Authentication (2FA): Enabling two-factor authentication adds an additional layer of security to the Bitcoin wallet. With 2FA, users must provide a second verification step, such as a one-time code sent to their mobile device, before accessing their account, offering an extra safeguard against unauthorized access. Transferring Bitcoins to a bank account, while generally a straightforward process, may come with some common challenges that users should be aware of. These challenges include: Transaction Delays: Bitcoin transactions require confirmation from the network, which can take some time. During periods of high network congestion, the confirmation process may be slower, leading to delays in the transfer. Fluctuating Transaction Fees: Transaction fees for Bitcoin transfers can vary depending on the network's activity. During busy periods, transaction fees may increase, leading to higher costs for users who wish to expedite their transfers. Exchange Rate Volatility: Bitcoin's value is known for its price volatility, which means that the value of your Bitcoins may fluctuate significantly during the transfer process. As a result, the amount you receive in your bank account may vary due to changes in the exchange rate. Bank Account Linking Issues: Some users may encounter challenges when linking their bank accounts to their Bitcoin wallets. This could be due to incorrect account information or technical issues with the wallet provider. Transaction Errors: Users must double-check all transaction details, including wallet addresses and transfer amounts, to avoid errors that could lead to the loss of funds. Tax Reporting: Transferring Bitcoins to a bank account may have tax implications, and users need to keep accurate records for tax reporting purposes. Account Restrictions: Some banks may have restrictions or policies regarding cryptocurrency-related transactions, which could impact the transfer process. The process of transferring Bitcoins to your bank account offers a gateway to unlocking the value of your digital assets. By using a secure Bitcoin wallet, linking your bank account, and completing the necessary verification procedures, you can initiate the transfer with confidence and have the equivalent amount of funds credited to your account. However, it is essential to be aware of common challenges that may arise during the transfer process. These challenges include potential transaction delays, fluctuating transaction fees, exchange rate volatility, and issues with bank account linking. Users should also be cautious of transaction errors, stay informed about tax reporting requirements, and be mindful of any account restrictions imposed by banks. By staying informed and being proactive in addressing potential challenges, you can navigate the transfer process successfully and make the most of your Bitcoin journey.Can You Transfer Bitcoins to Your Bank Account?

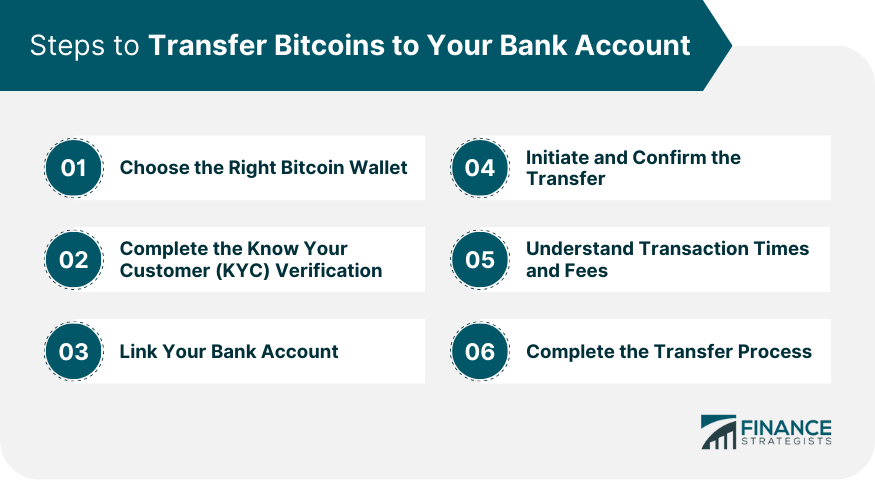

Steps to Transfer Bitcoins to Your Bank Account

Step 1: Choose the Right Bitcoin Wallet

Step 2: Complete the KYC Verification

Step 3: Link Your Bank Account

Step 4: Initiate and Confirm the Transfer

Step 5: Understand Transaction Times and Fees

Step 6: Complete the Transfer Process

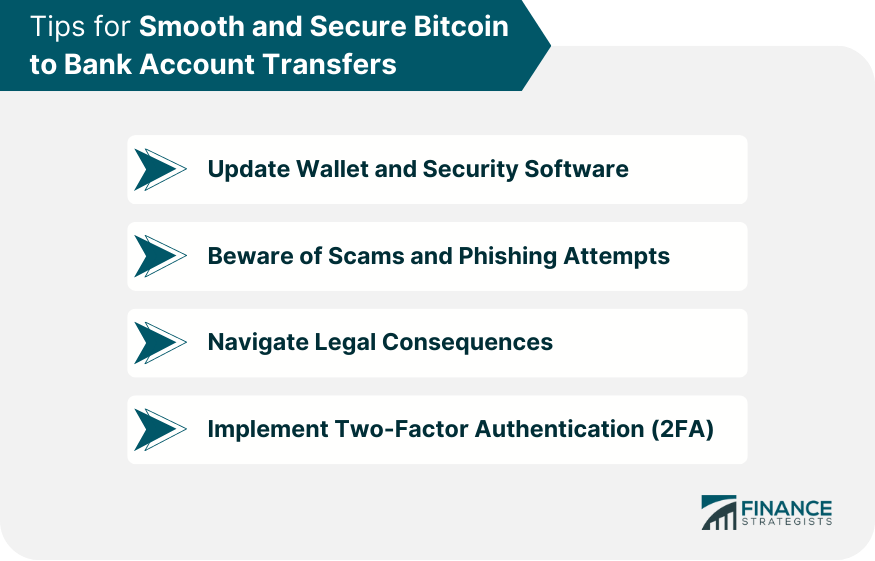

Tips for Smooth and Secure Bitcoin to Bank Account Transfers

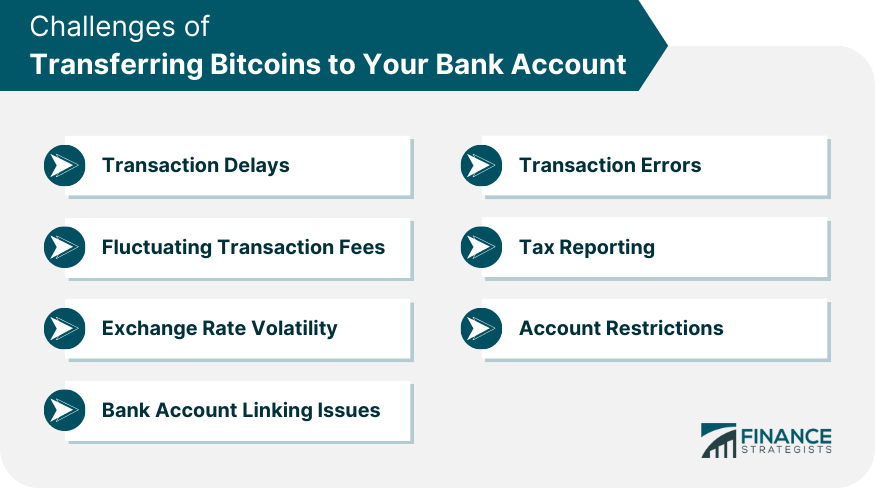

Challenges of Transferring Bitcoins to Your Bank Account

Conclusion

How to Transfer Bitcoins to Your Bank Account FAQs

To transfer Bitcoins to your bank account, set up a secure Bitcoin wallet, link your bank account, and initiate the transfer with the desired amount. Once confirmed, the equivalent funds will be credited to your bank account.

You can choose between software wallets (desktop, mobile, or web-based) for regular use or hardware wallets (USB devices) for enhanced security. Consider your usage and security preferences before making a selection.

Yes, reputable exchanges and wallet providers require KYC verification to comply with regulations and prevent illicit activities. Submit valid identification documents and personal information for authentication.

The transfer time varies based on network activity. It may take a few minutes to hours to receive sufficient confirmations (typically six) before the transfer is considered finalized.

If you face any challenges, double-check your transaction details, contact customer support for your wallet provider or exchange, and stay informed about network conditions to optimize the transfer experience.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.