Market-based valuation, also known as comparable analysis, is a valuation method that involves comparing the financial metrics and market prices of similar assets to determine their value. This approach is based on the principle that the price of an asset in a competitive market is the best indicator of its fair value. For example, the price of a company's stock reflects the market's perception of the company's current and future prospects. There are several types of market-based valuation, including comparable company analysis, comparable transaction analysis, and ratio analysis. Each of these approaches has its unique advantages and limitations, and the choice of approach depends on the type of asset being valued and the availability of relevant data. Comparable company analysis (CCA) is a market-based valuation approach that involves comparing the financial metrics of a company to those of similar companies in the same industry. This method is widely used in valuing publicly traded companies, where there is a significant amount of comparable data available. The first step in CCA is to identify a group of companies that are similar to the company being valued in terms of industry, size, and business model. Once the group of comparable companies is identified, their financial metrics, such as revenue, earnings, and cash flow, are compared to those of the target company. The valuation is then based on the multiples of the comparable companies, such as the price-to-earnings (P/E) ratio or the enterprise value-to-EBITDA (EV/EBITDA) ratio. Comparable transaction analysis (CTA) is a market-based valuation approach that involves comparing the financial metrics of a company to those of similar companies that have been recently acquired or sold. This method is particularly useful in valuing private companies or in situations where there is limited comparable data available. In CTA, the financial metrics of the target company are compared to those of similar companies that have been recently acquired or sold. The valuation is then based on the multiples of the comparable transactions, such as the acquisition price-to-revenue ratio or the sale price-to-EBITDA ratio. Ratio analysis is a market-based valuation approach that involves comparing the financial ratios of a company to those of similar companies in the same industry. This method is particularly useful in valuing companies or in situations where there is limited comparable data available. In ratio analysis, the financial ratios of the target company are compared to those of similar companies in the same industry. The valuation is then based on the multiples of the comparable ratios, such as the price-to-earnings ratio or the price-to-sales ratio. Industry trends can significantly impact the valuation of an asset. For example, if the industry is experiencing growth and expansion, the valuation of companies in that industry is likely to be higher due to increased demand and favorable market conditions. Conversely, if the industry is in decline or experiencing disruptions, the valuation of companies in that industry is likely to be lower due to decreased demand and unfavorable market conditions. Macroeconomic conditions, such as interest rates, inflation, and GDP growth, can also impact the valuation of an asset. For example, if interest rates are low and the economy is expanding, the valuation of companies is likely to be higher due to favorable market conditions. Conversely, if interest rates are high and the economy is in recession, the valuation of companies is likely to be lower due to unfavorable market conditions. Market conditions, such as the level of competition and the availability of capital, can also impact the valuation of an asset. For example, if the market is highly competitive and there is a surplus of capital, the valuation of companies is likely to be higher due to increased demand and favorable market conditions. Conversely, if the market is less competitive and there is a shortage of capital, the valuation of companies is likely to be lower due to decreased demand and unfavorable market conditions. The financial performance of the target company is one of the most critical factors that influence the accuracy of market-based valuation. A company with strong financial performance, such as high revenue growth, profitability, and cash flow, is likely to be valued higher than a company with weak financial performance. Conversely, a company with weak financial performance is likely to be valued lower than a company with strong financial performance. The competitive landscape is another critical factor that can impact the valuation of an asset. A company operating in a highly competitive market may have lower valuations due to the increased risk associated with the competition. Conversely, a company operating in a less competitive market may have higher valuations due to the decreased risk associated with the competition. Market-based valuation is a simple and easy-to-understand approach that does not require complex financial models or assumptions. This makes it accessible to a wide range of investors and analysts, regardless of their level of expertise. Market-based valuation takes into account the current market conditions and supply and demand dynamics, providing a more accurate estimate of an asset's value compared to other valuation methods that rely on assumptions and projections. Market-based valuation incorporates multiple factors such as industry trends, market conditions, and financial performance, providing a comprehensive analysis of the asset being valued. Market-based valuation is widely used and accepted in the financial industry, making it a standard approach to valuing assets. This ensures that the valuation is consistent with industry practices and standards, making it easier to compare the valuations of different assets. Market-based valuation depends on the availability of comparable data. This can be a challenge, particularly when valuing private companies or assets that are not traded in public markets. This can lead to inaccurate valuations or incomplete analysis. Market-based valuation may not capture the unique aspects of the asset being valued, particularly if the asset has unique assets or business models. This can lead to a situation where the valuation does not accurately reflect the true value of the asset. Market-based valuation does not consider future potential, which means that the valuation may not accurately reflect the growth potential of the asset, particularly if the asset is in a high-growth industry or has a unique business model. Market-based valuation is susceptible to market volatility, which can impact the accuracy of the valuation. If the market experiences sudden changes in supply and demand dynamics, the valuation may become outdated or inaccurate. Market-based valuation is a valuable tool in financial analysis that utilizes the principles of supply and demand in a competitive market to determine the fair value of an asset. It is a straightforward and accessible approach that reflects current market conditions, incorporates multiple factors, and is widely accepted in the financial industry. However, it is not without limitations, such as the availability of comparable data, the consideration of future potential, and susceptibility to market volatility. Therefore, investors and analysts should carefully consider the factors that influence market-based valuation, such as industry trends, macroeconomic conditions, market conditions, financial performance, and the competitive landscape, to ensure an accurate valuation. With a comprehensive understanding of market-based valuation and its advantages and limitations, investors and analysts can make informed decisions in valuing different types of assets and achieving their investment objectives.What Is Market-Based Valuation?

Methods of Market-Based Valuation

Comparable Company Analysis

Comparable Transaction Analysis

Ratio Analysis

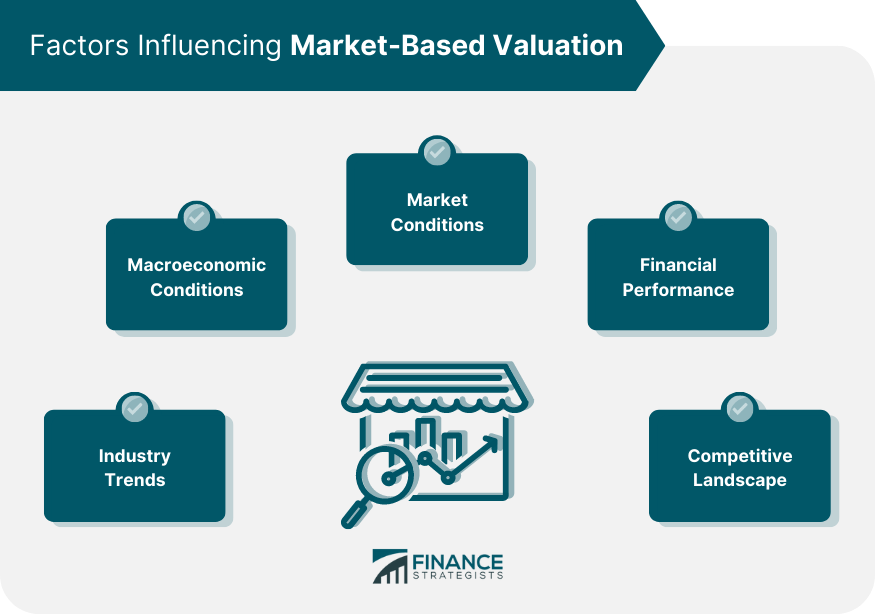

Factors Influencing Market-Based Valuation

Industry Trends

Macroeconomic Conditions

Market Conditions

Financial Performance

Competitive Landscape

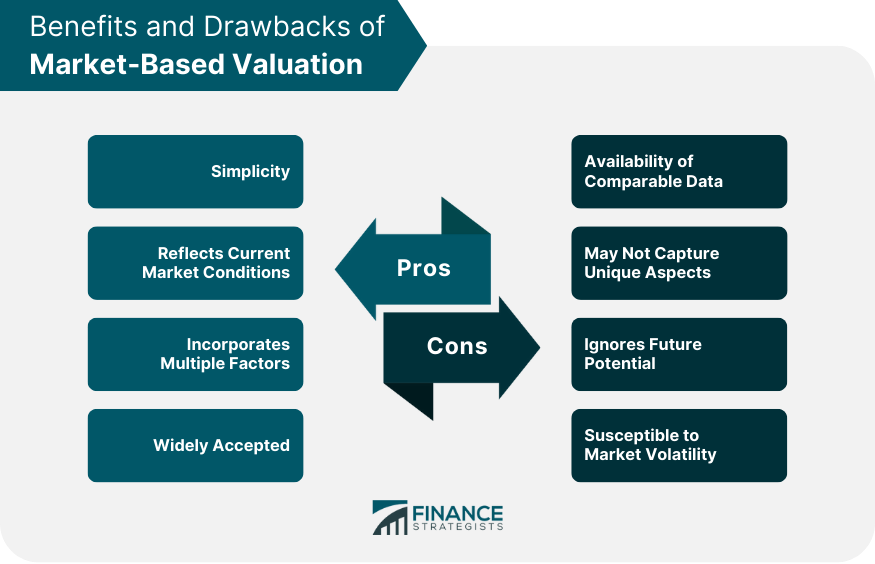

Benefits and Drawbacks of Market-Based Valuation

Benefits

Simplicity

Reflects Current Market Conditions

Incorporates Multiple Factors

Widely Accepted

Drawbacks

Availability of Comparable Data

May Not Capture Unique Aspects

Ignores Future Potential

Susceptible to Market Volatility

Final Thoughts

Market-Based Valuation FAQs

A market-based valuation is a method used to determine the value of an asset by comparing it to similar assets that have recently been sold in the market.

To calculate a market-based valuation, an appraiser identifies comparable assets that have recently been sold in the market and examines the prices at which they were sold. The appraiser then applies adjustments to account for any differences between the comparable assets and the asset being valued.

One advantage of a market-based valuation is that it is based on actual market transactions, which can provide a more accurate reflection of the current value of the asset. It is also a relatively simple method, and the availability of data on recent sales can make the valuation process quicker and less expensive.

One limitation of a market-based valuation is that it relies on the availability of data on comparable assets that have recently been sold in the market. If there are few recent sales or the market for the asset is illiquid, it can be difficult to obtain accurate data for the valuation. Additionally, differences between the comparable assets and the asset being valued can make it challenging to apply adjustments accurately.

A market-based approach is commonly used to value assets that are traded on a public exchange, such as stocks, bonds, and commodities. It can also be used to value real estate, but adjustments may need to be made to account for differences in the properties being compared.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.