Zero dividend preferred stock refers to a unique type of preferred stock issued by companies that does not pay any dividends. It is a hybrid security with features of both debt and equity, and it offers investors the potential for capital appreciation without the regular income stream that dividends provide. This type of preferred stock is often used by companies as a financing tool to raise capital without increasing their dividend burden. The primary purpose of zero dividend preferred stock is to provide companies with an alternative way to raise capital without the obligation to pay regular dividends. This allows companies to maintain a more flexible capital structure, particularly during times when they wish to conserve cash or when they may not have sufficient earnings to distribute as dividends. Additionally, it can be an attractive option for investors seeking capital appreciation rather than current income. As the name suggests, the most significant feature of zero dividend preferred stock is that it does not require companies to pay any dividends. This can be particularly beneficial for companies that want to conserve cash or have an unpredictable cash flow. Investors who are more interested in potential capital gains rather than regular income may find this feature appealing as well. Zero dividend preferred stocks typically have a fixed par value, similar to other preferred stocks. This par value represents the initial price at which the stock is issued and can serve as a reference point for the stock's value. Unlike common stocks, the par value of zero dividend preferred stocks does not fluctuate significantly over time, providing a level of stability for investors. Zero dividend preferred stocks can be either cumulative or non-cumulative. Cumulative preferred stocks accumulate unpaid dividends, meaning that if a company does not pay a dividend in a given period, it must pay the missed dividends before paying dividends to common stockholders. In the case of zero dividend preferred stocks, this feature is irrelevant, as there are no dividends to accumulate. Some zero dividend preferred stocks may have convertible or callable features. Convertibility allows the investor to exchange their preferred shares for a predetermined number of common shares, potentially benefiting from the common stock's price appreciation. Callable features give the issuer the right to redeem the preferred stock at a specified price, usually at a premium to the par value, providing an exit strategy for the company. In the event of a company's liquidation, zero dividend preferred stockholders have a higher claim on the company's assets than common stockholders. This priority ensures that investors in zero dividend preferred stocks have a greater likelihood of recovering their initial investment in the event of a company's financial distress. One of the main advantages of zero dividend preferred stock is the lack of a dividend obligation. This allows companies to raise capital without the burden of paying regular dividends, providing flexibility in managing their cash flow and capital structure. As mentioned earlier, zero dividend preferred stockholders have priority over common stockholders in the event of a company's liquidation. This provides a degree of protection to investors and can make these stocks more attractive during times of financial uncertainty. While zero dividend preferred stocks do not provide regular income, they do offer the potential for capital appreciation. If a company performs well and its stock price increases, the value of the zero dividend preferred stock may also rise, providing a return on investment for shareholders. In some jurisdictions, zero dividend preferred stocks may offer tax benefits to investors. Since these stocks do not pay dividends, they may not be subject to dividend taxes, which can be advantageous for certain investors, particularly those in higher tax brackets. Zero dividend preferred stocks can be designed with various features, such as convertibility or callable options. This flexibility allows companies to tailor the preferred stock to meet their specific needs and objectives, while also making the investment more attractive to a broader range of investors. One of the main drawbacks of zero dividend preferred stocks is their lower yield compared to other types of preferred stocks. Since they do not pay dividends, investors seeking regular income may find these stocks less appealing, and their lower yield may not adequately compensate for the risk involved. Zero dividend preferred stocks may have limited liquidity compared to other types of securities. Due to their unique nature and the lack of dividend payments, there may be fewer investors interested in purchasing these stocks, resulting in lower trading volumes and potentially wider bid-ask spreads. Investors in zero dividend preferred stocks are exposed to higher credit risk compared to holders of traditional preferred stocks or bonds. If a company faces financial difficulties and is unable to meet its obligations, investors in zero dividend preferred stocks may not receive any return on their investment. Like other preferred stocks, zero dividend preferred stocks are sensitive to changes in interest rates. When interest rates rise, the value of these stocks may decline, as investors seek higher-yielding investments. This can result in capital losses for investors who need to sell their shares. Investors in zero dividend preferred stocks typically do not have voting rights. This means they have limited influence over a company's management and strategic decisions. For some investors, this lack of control may be a significant drawback. Companies issue zero dividend preferred stock through a public offering or a private placement. In a public offering, the stock is made available to a broad range of investors, while in a private placement, the stock is offered to a select group of investors, often institutional investors or accredited individuals. The issuance process typically involves engaging an investment bank or financial institution to underwrite the offering and handle the administrative tasks involved. Underwriters play a critical role in the issuance of zero dividend preferred stocks. They are responsible for assessing the company's financial health, determining the appropriate structure and pricing for the preferred stock, and marketing the offering to potential investors. In some cases, the underwriter may also commit to purchasing any unsold shares, providing a level of certainty to the issuer regarding the amount of capital raised. Companies issuing zero dividend preferred stocks are often required to register the offering with relevant regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States. The registration process involves providing detailed financial and operational information about the company, as well as disclosing any material risks associated with the investment. This information is typically made available to potential investors through a prospectus or offering memorandum. The valuation of zero dividend preferred stocks can be influenced by various factors, including the issuer's creditworthiness, interest rate environment, and the specific features of the preferred stock, such as convertibility or callable options. Additionally, market sentiment and the overall demand for this type of investment can also impact valuation. Valuing zero dividend preferred stocks can be more complex than valuing traditional preferred stocks or bonds, as they do not have a regular income stream. Investors may use a variety of methods, such as discounted cash flow analysis, comparable company analysis, or option pricing models, to estimate the value of these securities. In some cases, the valuation may be heavily influenced by the potential for capital appreciation or the value of embedded options, such as convertibility features. When assessing the attractiveness of zero dividend preferred stocks, investors often compare them to other types of securities, such as bonds, traditional preferred stocks, or common stocks. Factors such as yield, credit risk, potential for capital appreciation, and tax implications can be important considerations in determining whether zero dividend preferred stocks are a suitable investment for an individual's portfolio. Zero dividend preferred stocks are a unique type of hybrid security that offers certain advantages and disadvantages compared to other investments. While they provide companies with a means to raise capital without the obligation to pay dividends, their appeal to investors may be limited due to factors such as lower yields, limited liquidity, and higher credit risk. Understanding the features of zero dividend preferred stocks, as well as the potential benefits and drawbacks, is crucial for investors considering this type of investment. By carefully evaluating the specific characteristics of a zero dividend preferred stock and comparing it to other securities, investors can make informed decisions about whether this asset class aligns with their investment objectives and risk tolerance.What Is a Zero Dividend Preferred Stock?

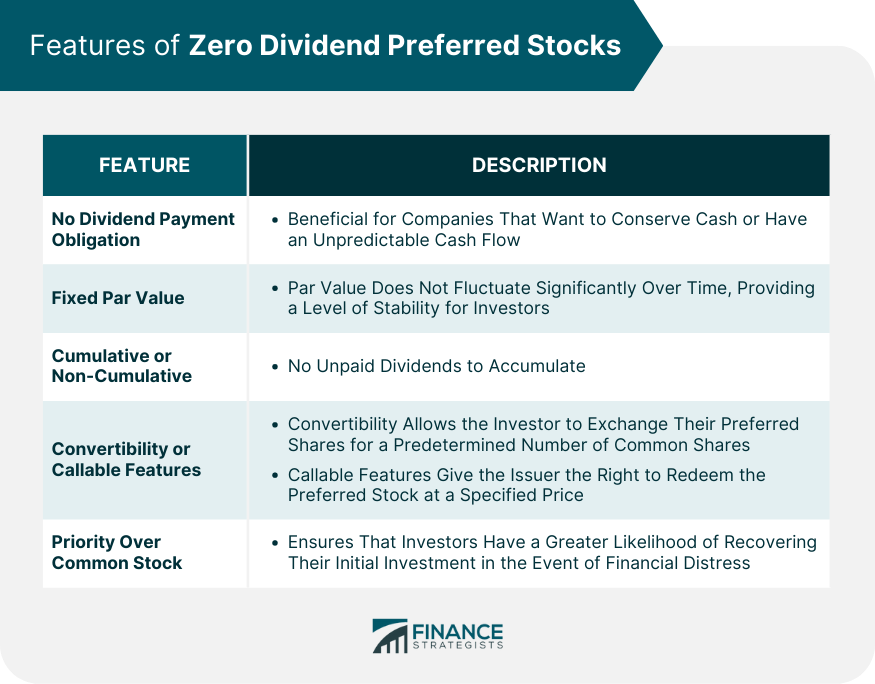

Features of Zero Dividend Preferred Stocks

No Dividend Payment Obligation

Fixed Par Value

Cumulative or Non-Cumulative

Convertibility or Callable Features

Priority Over Common Stock

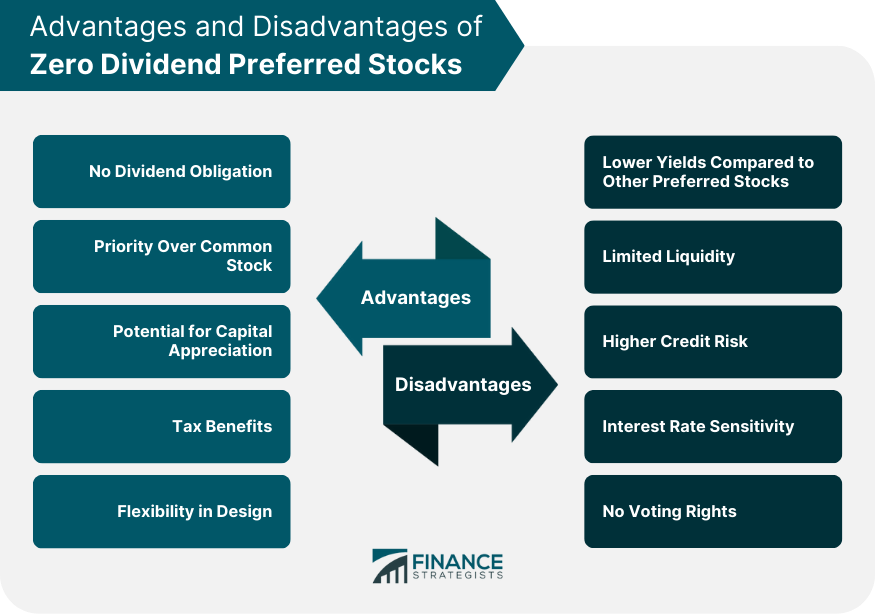

Advantages of Zero Dividend Preferred Stocks

No Dividend Obligation

Priority Over Common Stock

Potential for Capital Appreciation

Tax Benefits

Flexibility in Design

Disadvantages of Zero Dividend Preferred Stocks

Lower Yields Compared to Other Preferred Stocks

Limited Liquidity

Higher Credit Risk

Interest Rate Sensitivity

No Voting Rights

Issuance of Zero Dividend Preferred Stocks

How Zero Dividend Preferred Stock is Issued

Role of Underwriters

Registration Process

Valuation of Zero Dividend Preferred Stocks

Factors Affecting the Valuation

Calculation of Valuation

Comparison to Other Securities

Final Thoughts

Zero Dividend Preferred Stock FAQs

Zero dividend preferred stock is a type of preferred stock that doesn't pay dividends to shareholders but has priority over common stock.

Some advantages include no dividend payment obligation, potential for capital appreciation, tax benefits, and flexibility in design.

Some disadvantages include lower yields compared to other preferred stocks, limited liquidity, higher credit risk, interest rate sensitivity, and no voting rights.

The valuation of zero dividend preferred stock is based on several factors such as the company's financial health, credit rating, interest rates, and market demand.

No, zero dividend preferred stock may not be suitable for all investors as it carries some risks, such as credit risk and interest rate risk, and may not provide the desired level of income or liquidity. It is important to consult with a financial advisor before investing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.