A repurchase agreement, commonly known as a repo, is a short-term agreement to sell securities to buy them back at a slightly higher price. The short-term loan's interest rate, known as the repo rate, is determined by the difference between the initial sale price and the repurchase price. It is a financial transaction involving a sale and a future repurchase. Repurchase agreements play a crucial role in money markets, providing short-term liquidity for dealers in government securities. They also serve as an instrument for central banks in open market operations to control the money supply in an economy, thus influencing short-term interest rates. Repurchase agreements are vital in maintaining liquidity and establishing efficient funding mechanisms in the financial market. A standard repurchase agreement includes two main participants: the borrower (or the seller) and the lender (or the buyer). Their roles can be better understood when we dive into their responsibilities in the repo transaction. The borrower is the owner of the securities that are involved in the transaction. Their role involves selling these securities to the lender with the commitment to repurchase them at a specified date and price. The securities sold are usually high-quality ones, such as government bonds, as these tend to be more liquid and bear less risk. The borrower typically engages in a repo transaction to acquire short-term liquidity without giving up ownership of the securities in the long term. The lender, on the other hand, provides the borrower with the cash they need and, in exchange, receives the securities as collateral. This arrangement provides the lender with some security against the risk of default by the borrower. If such an unfortunate event occurs, the lender can sell the securities to recoup their funds. The parties' roles are defined from the perspective of the initial transaction. However, these roles are reversed in the second part of the agreement when the borrower repurchases the securities. A repurchase agreement transaction involves an initial sale of securities and a subsequent repurchase. At the start of a repo transaction, the borrower sells securities to the lender. This is a complex sale, as the borrower simultaneously agrees to repurchase the securities later. The lender pays the borrower an amount that is less than the value of the securities. This difference between the securities' value and the cash received is the "haircut" or "margin." It is a protective cushion for the lender against market fluctuations in the security's price or if the borrower defaults. The repurchase takes place on the date agreed upon by both parties during the initial transaction. The borrower buys back the securities from the lender, paying them the original sum of money plus an additional amount. This additional amount is the repo rate, akin to the interest on the cash that the lender provided to the borrower. The structure of a repurchase agreement ensures that both parties are protected to a certain extent. The borrower can gain liquidity while maintaining long-term ownership of their securities. At the same time, the lender earns interest on the cash they've provided while also having the option to sell the securities should the borrower default. There are several types of repurchase agreements, each with specific features and uses depending on the unique needs and strategies of the participating parties. Special repos are a type of repurchase agreement wherein the transaction is driven by the lender's demand for a specific security. These specific securities, often scarce in supply, can be in high demand for various reasons, such as hedging needs, delivery obligations, or speculative positions. Because the lender is motivated more by obtaining the particular collateral rather than by the interest earnings, these repos tend to have lower interest rates than other repos. In special repos, focusing on specific securities can mean more exposure to price volatility and associated collateral risk. Contrasting with special repos, a general collateral (GC) repo is a transaction in which the lender is indifferent to the specific securities used as collateral. As long as the securities are of agreed-upon quality and type (for example, government bonds), the lender does not concern itself with the particular security titles. Since the lender in a GC repo is mainly interested in the short-term loan's interest earnings rather than the specific collateral, GC repos typically command higher interest rates than special repos. It is a more traditional form of repo used by parties seeking cash or securities liquidity rather than specific securities. The parties' perspectives in a repo transaction are flipped in a reverse repo. A reverse repo is simply a repo viewed from the lender's perspective. Here, the lender buys the securities from the borrower, effectively providing a loan, and agrees to sell them back later at a higher price. Central banks commonly use this mechanism to absorb excess liquidity from the market, thereby helping to regulate the money supply and keep inflation in check. For other market participants, reverse repos can be a safe way to lend money and earn interest with a collateral guarantee. Term repos and open repos represent two distinct configurations of the repurchase agreement concerning the contract term. Term repos are repurchase agreements with a fixed end date. Both parties agree upfront on the exact date when the borrower will repurchase the securities. This arrangement offers certainty but with reduced flexibility. On the other hand, open repos have yet to have a definitive end date. The agreement can be rolled over and extended indefinitely, offering significant flexibility. Either party can terminate the agreement given a notice period, the length of which is usually predetermined in the contract. These agreements are typically used when the parties desire greater flexibility or when the cash need is unpredictable. Central banks use repos as a tool for implementing monetary policy. By buying and selling government securities in repo transactions, they can manage liquidity in the financial system and influence short-term interest rates. The repo market can be both domestic, involving parties from the same country, or international, involving parties from different countries. The US repo market is the most active, followed by the European market. Various factors influence the repo rate: Quality of Collateral: The value and quality of the collateral the borrower provides affect the repo rate. Borrower's Creditworthiness: The borrower's creditworthiness can impact the repo rate. Repo Term: The duration of the repurchase agreement can affect the repo rate. Central Bank Rates: Central bank rates set by monetary authorities also play a significant role in determining the repo rate. Apart from the repo rate, the pricing of repos can be influenced by other factors: Supply and Demand: The market's availability of funds and securities can impact repo pricing. Market Conditions: Overall market conditions, such as interest rate levels and liquidity, can affect repo pricing. Counterparty Risk: The perceived risk associated with the counterparty involved in the repo transaction can influence pricing. Collateral Type: The type of collateral offered in the repo agreement may affect the pricing terms. Market Expectations: Market expectations regarding future interest rates and economic conditions can impact repo pricing. As with all financial transactions, repurchase agreements carry their own set of risks. While these agreements are generally considered safe due to their secured nature, participants must still be mindful of potential risks, including counterparty, collateral, and operational risks. Understanding these risks is crucial for effective risk management and successful participation in repo transactions. Counterparty risk, sometimes called default risk, pertains to the risk that the other party involved in the repo will not fulfill their obligation. The root of this risk lies in the potential for the counterparty to default on their agreement or become insolvent before the conclusion of the agreement. For example, in a standard repo, the borrower (seller of securities) might fail to repurchase the securities as agreed upon, resulting in a loss for the lender. Alternatively, in reverse repo, the lender (the buyer of securities) may fail to sell back the securities, causing losses for the borrower. Counterparty risk is a significant consideration in repurchase agreements, and parties often mitigate it by dealing only with reputable counterparts and demanding collateral of higher value than the repo loan. Collateral risk is associated with a potential decline in the collateral's value during the repo term. Since the lender's primary protection in a repo agreement is the ability to sell the collateral if the borrower defaults, a decrease in the collateral's value could mean the lender cannot fully recoup the loan's value. For instance, if a borrower defaults and the lender needs to sell the securities used as collateral, a sharp drop in market prices could mean the collateral no longer covers the original loan value. The lender would then suffer a loss. This risk highlights the importance of the "haircut" or "margin" in repo transactions, which protects the lender against collateral value fluctuations. Operational risk in the context of repurchase agreements encompasses risks related to settlement failure, documentation errors, and other process-related issues that could disrupt the successful execution of a repo transaction. Settlement failures could arise if one party fails to deliver the securities or cash as per the agreement. Documentation errors, on the other hand, could create legal ambiguities and disputes. Other operational issues, such as incorrect interest calculation or miscommunication of repo terms, could also lead to financial losses or contractual disputes. Effective operational risk management in repo transactions typically involves rigorous controls, including robust systems for settlement and reconciliation, thorough documentation, and clear communication among transaction parties. The 2008 financial crisis brought increased attention to the risks associated with repo markets. Following the crisis, regulators worldwide have increased oversight and regulation of repos to mitigate systemic risk. Regulatory developments, such as the introduction of Basel III regulations, have increased capital and liquidity requirements for banks, impacting their repo activities. Furthermore, regulatory bodies like the Securities and Exchange Commission (SEC) in the U.S. have put measures in place to ensure greater transparency in these transactions. Firms and financial institutions often use repos to manage their short-term liquidity needs. By selling securities with an agreement to repurchase, they can obtain immediate cash. Some participants use repo transactions as a means of yield enhancement. This involves using the cash obtained from repo transactions to invest in higher-yielding assets. Repos can also facilitate leverage for investors by allowing them to use the borrowed funds to invest in other securities. They can enable short selling, where an investor borrows a security they believe will decrease in value. Repurchase agreements (repos) are short-term secured loans that are crucial in providing liquidity in the financial market. The transaction involves a borrower (seller of a security) and a lender (buyer providing cash against the security as collateral). The types of repurchase agreements include special, general collateral, reverse, term, and open repos, each uniquely tailored to address specific market conditions and requirements. Repos are instrumental in liquidity management, yield enhancement, leverage, and facilitating short positions, although they also present counterparty, collateral, and operational risks. Post the 2008 financial crisis, regulatory measures like Basel III have influenced repo activities by enforcing increased bank capital and liquidity requirements. Repo market dynamics continue to evolve due to regulatory changes, market trends, and technological innovations. The increasing influence of non-bank institutions and blockchain technology is reshaping repo markets, which remain crucial to financial markets, impacting short-term rates and aiding central bank policies.What Is a Repurchase Agreement (Repo)?

Parties Involved in a Repurchase Agreement

Borrower or Seller

Lender or Buyer

Process of Repurchase Agreements Transaction

Initial Sale

Repurchase

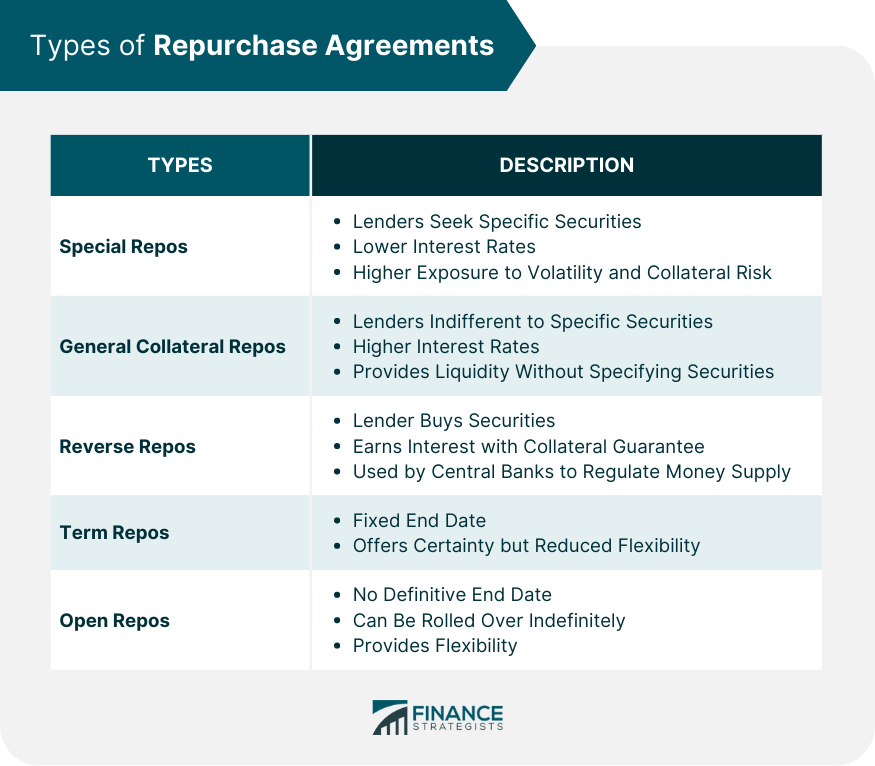

Types of Repos

Special Repos

General Collateral Repos

Reverse Repos

Term and Open Repos

Repurchase Agreement Markets

Role of Central Banks

Domestic and International Repo Markets

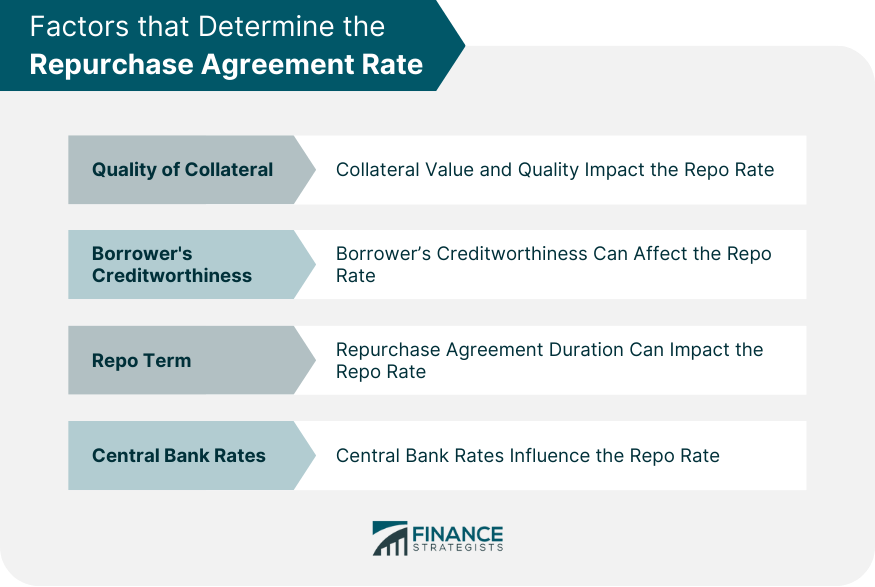

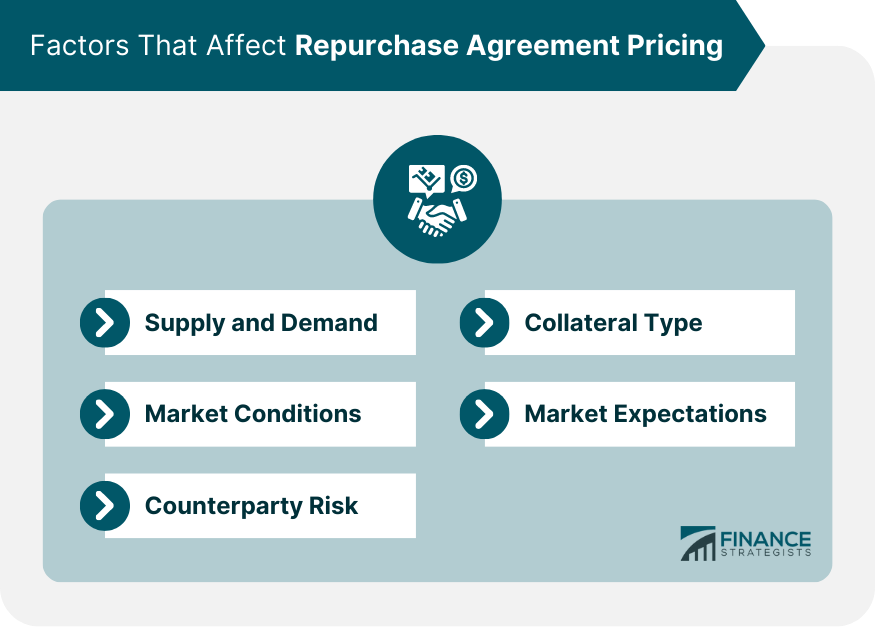

Pricing and Rates in Repos

Determining the Repo Rate

Factors Affecting Pricing

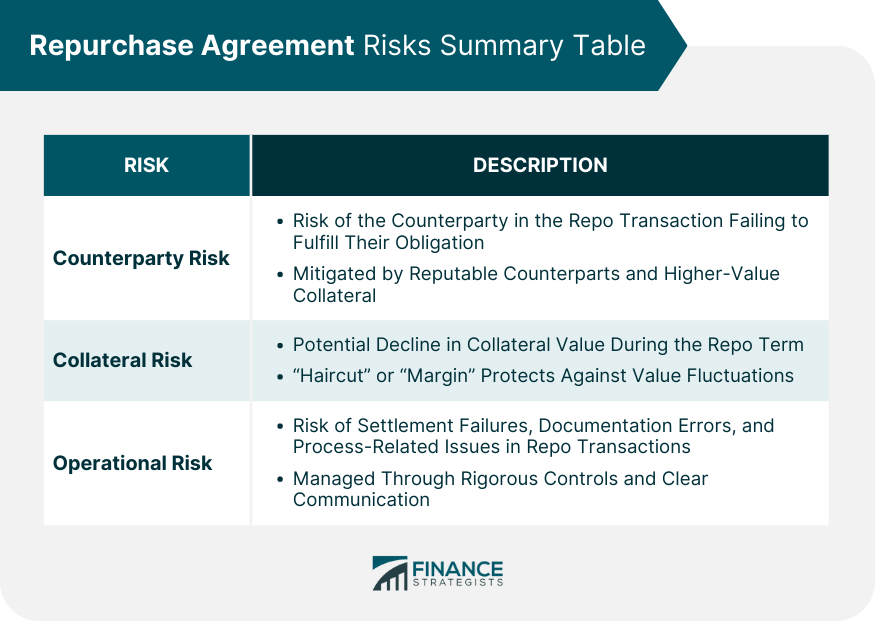

Repurchase Agreement Risks

Counterparty Risk: The Risk of Default

Collateral Risk: The Risk of Depreciation

Operational Risk: The Risk of Procedural Failures

Repurchase Agreement Regulation and Legal Aspects

Impact of the Global Financial Crisis

Regulatory Changes and Developments

Repurchase Agreement Usage in Financial Strategies

Liquidity Management

Yield Enhancement

Leverage and Short Positions

Final Thoughts

What Is a Repurchase Agreement? FAQs

A repurchase agreement, or repo, is a short-term agreement to sell securities and then repurchase them at a slightly higher price.

The different types of repurchase agreements include special repos, general collateral repos, reverse repos, and term and open repos.

In a repo transaction, the borrower (seller) sells a security to the lender (buyer), promising to buy it back later at a slightly higher price.

The primary risks involved in repurchase agreements include counterparty risk, collateral risk, and operational risk.

Repurchase agreements are regulated by regulatory bodies like the SEC in the U.S. and are subject to rules such as Basel III, which impose capital and liquidity requirements on banks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.