The theoretical value of a right refers to the intrinsic worth assigned to an entity, which is derived from abstract economic models or calculations. This concept is applicable across various domains, encompassing financial rights, assets, options, and more. Theoretical value is often regarded as the fair value, representing the reasonable price at which an asset should be priced, based on specific assumptions and factors. Investors extensively utilize theoretical value in their strategies to assess the perceived worth of assets or options, enabling them to make well-informed financial decisions. It serves as a guiding principle, assisting investors in evaluating the intrinsic value of different financial instruments. It is essential to note that theoretical value is a theoretical calculation and may not necessarily align with the actual market value. The purpose of theoretical value is manifold. Primarily, it provides a benchmark for pricing assets in financial markets. By understanding the intrinsic worth of an asset, investors can compare it to its current market price and identify potential investment opportunities. Moreover, theoretical value also serves as a tool for risk management, offering insight into potential price volatility and risk factors. Equipped with an understanding of an asset's theoretical value, investors can take informed actions. They can determine whether to buy, sell, or hold assets based on their comparison of the theoretical value and the market price. Similarly, wealth managers can use this concept to optimize their clients' portfolios and manage risk. Theoretical value is not immune to the influence of the market conditions. Factors such as supply and demand dynamics, overall market sentiment, and fluctuations in prices can have an impact on an asset's theoretical value. It is crucial for investors and wealth managers to keep a close eye on these market conditions, as they can provide important clues about potential shifts in an asset's theoretical value. Similarly, market liquidity, the efficiency of the market, and transaction costs also play a role in influencing theoretical value. High liquidity and efficient markets often lead to prices that reflect an asset's theoretical value more accurately, while transaction costs can affect the final yield from an asset. The broader economic climate also plays a substantial role in determining the theoretical value. Economic indicators such as inflation rates, interest rates, employment figures, and GDP growth can all have a significant impact on an asset's theoretical value. For instance, rising interest rates could reduce the theoretical value of a bond. Additionally, economic factors such as tax laws, trade policies, and geopolitical events can influence the theoretical value. An understanding of these macroeconomic factors can help wealth managers predict future trends in theoretical values, thereby informing their investment strategies. Theoretical value also hinges on factors specific to the company or asset in question. These can range from a company's financial health—indicated by revenue growth, profit margins, and debt levels—to its competitive positioning and corporate governance. For instance, strong financial health and a dominant market position can boost a company's theoretical value. On the other hand, poor corporate governance or high debt levels can undermine it. Hence, a thorough analysis of company-specific factors is crucial for calculating accurate theoretical values. DCF analysis is a commonly used method for determining theoretical value. It operates on the principle that the value of an asset is equal to the present value of its future cash flows. By discounting these cash flows to their present value, investors can calculate the theoretical value of an asset. However, DCF analysis is only as reliable as the accuracy of its assumptions. Misestimating future cash flows or the discount rate can lead to incorrect valuations. Despite this, it remains a popular tool due to its flexibility and comprehensive nature. Comparable company analysis involves comparing the asset or company in question to similar entities within the same industry or sector. This is done using various financial metrics and ratios such as price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-EBITDA (EV/EBITDA). This method assumes that companies in the same sector should be valued similarly. However, it relies on the availability of comparable companies and accurate financial data. It also assumes a degree of similarity that may not always exist, given the unique circumstances of each company. Option pricing models like the Black-Scholes model or the binomial option pricing model are used to calculate the theoretical value of options. These models use various inputs like the current stock price, the option's strike price, the time to expiration, the risk-free interest rate, and the stock's volatility to arrive at a theoretical value. While these models provide a mathematical approach to option valuation, they also come with their assumptions and limitations. They are based on factors like constant volatility and returns, which may not reflect real-world conditions. In the realm of investment decision-making, the theoretical value offers crucial insights. By comparing the theoretical value with the market price, investors can identify undervalued or overvalued assets. Undervalued assets may present buying opportunities, while overvalued assets might be best avoided or sold if already owned. The theoretical value also helps in identifying trends and foreseeing possible price movements. As such, it equips investors with the knowledge to take proactive steps, whether it's buying, selling, or holding assets. Portfolio optimization involves assembling a portfolio in a way that maximizes returns for a given level of risk. Here, the theoretical value plays an instrumental role by helping to identify assets that offer the best risk/reward ratio. By pinpointing under or overvalued assets, wealth managers can adjust the portfolio composition accordingly. This approach, rooted in the principles of diversification and efficient frontier, contributes towards the creation of an optimal portfolio that aligns with the investor's objectives and risk tolerance. Theoretical value also plays a critical role in risk management. By estimating the fair value of an asset, it provides an indication of potential price volatility and associated risk. Assets that deviate significantly from their theoretical value may carry higher risk. Wealth managers can use this information to devise risk management strategies. These might involve diversification, hedging, or even exiting certain positions. Thus, understanding theoretical value helps in mitigating risk and protecting the portfolio against adverse market movements. Despite its usefulness, theoretical value is not without its limitations. There is a degree of subjectivity and uncertainty involved in determining theoretical value. For instance, DCF analysis relies heavily on assumptions about future cash flows and discount rates. If these assumptions are off-mark, the calculated theoretical value can be significantly skewed. In addition, even the best economic models cannot account for every possible variable. Unforeseen events, whether they are market-based, economic, or company-specific, can cause the actual value to deviate significantly from the theoretical value. Market volatility can also impact the theoretical value. High volatility can create a discrepancy between the theoretical value and the market price. This is especially true in the short term, where market sentiment and speculation can drive prices away from their theoretical values. However, over the long term, prices tend to reflect the theoretical value more accurately. Nonetheless, investors and wealth managers should remain aware of the impact of volatility and build it into their strategies. Regulatory and legal challenges can also affect the theoretical value. Changes in laws and regulations can impact the business environment, and hence, the value of assets. For instance, changes in tax laws could affect a company's profitability, thereby influencing its theoretical value. Furthermore, in some jurisdictions, wealth managers might face legal constraints on how they can use theoretical value. For instance, certain types of speculative investing may be regulated or even prohibited. These factors underscore the importance of understanding the legal and regulatory context in wealth management. The theoretical value of a right refers to the intrinsic worth derived from economic models or calculations. It represents a fair price at which an asset, right, or option should reasonably trade in an ideal market. Determining the theoretical value is an exercise that combines various financial models and methodologies. The Discounted Cash Flow (DCF) analysis, Comparable Company Analysis, and Option Pricing Models serve as the fundamental tools in this process. It's vital to remember that while these methods provide insightful data, they come with their own assumptions and limitations. Therefore, they require careful interpretation and shouldn't be relied upon in isolation. Nevertheless, the importance of the theoretical value in wealth management cannot be overstated. It is a pivotal tool that informs investment decisions, enables portfolio optimization, and aids in effective risk management.What Is a Theoretical Value (Of a Right)?

Purpose of Theoretical Value

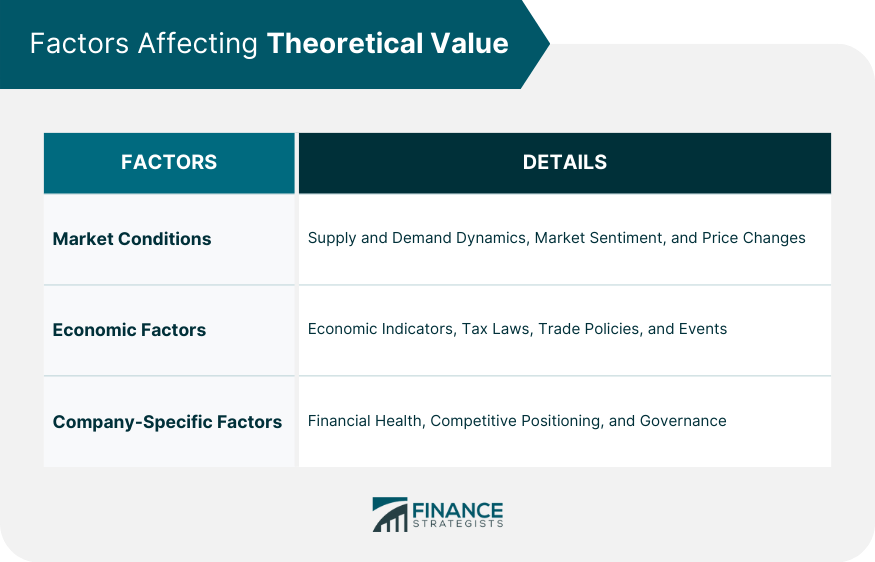

Factors Influencing Theoretical Value

Market Conditions

Economic Factors

Company-Specific Factors

Determining Theoretical Value

Discounted Cash Flow (DCF) Analysis

Comparable Company Analysis

Option Pricing Models

Application of Theoretical Value

Investment Decision-Making

Portfolio Optimization

Risk Management

Limitations of Theoretical Value

Subjectivity and Uncertainty in Determining Theoretical Value

Impact of Market Volatility on Theoretical Value

Regulatory and Legal Challenges

Final Thoughts

Theoretical Value (Of a Right) FAQs

The theoretical value is an estimate of the intrinsic worth of an entity, derived from economic models or calculations. It's often used in financial and investment contexts to denote the fair value of assets, rights, or options.

Theoretical value is determined using various financial models and methodologies. Some popular ones include Discounted Cash Flow (DCF) analysis, Comparable Company Analysis, and Option Pricing Models. Each of these methods has its unique strengths and limitations.

Theoretical value plays a critical role in wealth management as it helps in investment decision-making, portfolio optimization, and risk management. Understanding the theoretical value of assets allows wealth managers to spot undervalued or overvalued assets, optimize the risk/reward ratio, and devise appropriate risk management strategies.

Theoretical value is influenced by a host of factors. These include market conditions, broader economic factors, and company-specific factors. Changes in any of these can lead to shifts in the theoretical value.

Theoretical value, while useful, has certain limitations. These include the subjectivity and uncertainty inherent in its calculation, the impact of market volatility, and regulatory and legal challenges. These factors can cause the actual value to deviate significantly from the theoretical value.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.