Net Unrealized Appreciation is a tax strategy that can provide significant benefits for investors holding appreciated company stock in a qualified employer-sponsored retirement plan. Net Unrealized Appreciation refers to the difference between the cost basis of company stock held in a qualified employer-sponsored retirement plan and the stock's current fair market value. This appreciation has yet to be realized or taxed, as the stock has not sold. For investors with substantial amounts of company stock in their retirement plan, understanding NUA can help them minimize taxes and maximize the value of their investments when taking distributions. The key components of NUA include the cost basis of the securities, the fair market value of the securities, and the eligibility criteria to utilize NUA. Calculating NUA involves two steps: 1. Fair Market Value of the Securities: Determine the current fair market value of the company stock held in the retirement plan. 2. Cost Basis of the Securities: Calculate the original cost basis of the company stock, which is typically the purchase price of the stock. NUA is the difference between the fair market value and the cost basis. To utilize NUA, investors must meet certain requirements: Distribution From a Qualified Employer Plan: NUA can only be applied to company stock held in a qualified employer-sponsored retirement plan, such as a 401(k) or a 403(b) plan. Lump-Sum Distribution: The company stock must be distributed as a lump-sum distribution, typically due to a triggering event such as retirement, reaching age 59½, or separation from the employer. Taxable Event: The distribution of the company stock must be taxable, meaning taxes are due upon distribution. NUA offers two primary tax advantages: Lower Tax Rate for Long-Term Capital Gains: When company stock is eventually sold, the NUA portion is taxed at the long-term capital gains rate, which is typically lower than the ordinary income tax rate. Tax Deferral on Unrealized Appreciation: The NUA portion of the stock is taxed once it is sold, providing tax deferral on the unrealized appreciation. Using NUA allows investors to reallocate their assets into other investments, promoting diversification and potentially reducing risk. NUA can be a valuable estate planning tool, as the appreciated stock can be passed on to heirs with a stepped-up basis, reducing the taxable gain. Holding a large amount of company stock can expose investors to concentration risk, as the performance of their investments is tied to the success of a single company. The value of company stock can fluctuate with market conditions, potentially reducing the benefits of NUA. Some investors may need more company stock or may need to meet the eligibility criteria to take advantage of NUA. While NUA offers tax advantages, selling shares to utilize NUA can trigger taxable events, requiring careful planning to minimize tax liabilities. When considering NUA, investors should also evaluate alternative distribution options: Tax-Deferred Growth: Assets continue to grow tax-deferred within the IRA. Flexibility: Investors have more investment options and can control their withdrawals. Loss of NUA Benefits: Rolling over company stock into an IRA forfeits the opportunity to utilize NUA tax benefits. Required Minimum Distributions (RMDs): IRA owners must start taking RMDs at a certain age, whereas NUA does not have this requirement. Continued Tax-Deferred Growth: Assets continue to grow tax-deferred within the new employer's plan. Simplicity: Consolidating assets in a single plan can simplify management. Limited Investment Options: The new employer's plan may have fewer investment options. Loss of NUA Benefits: Rolling over company stock into another employer's plan forfeits the opportunity to utilize NUA tax benefits. Immediate Access to Funds: Investors have immediate access to their assets. Opportunity to Utilize NUA: A lump-sum distribution allows investors to take advantage of NUA tax benefits. Tax Liability: Lump-sum distributions can result in a significant tax bill if not managed properly. Loss of Tax-Deferred Growth: Assets are no longer growing tax-deferred. Careful planning is essential to maximize NUA benefits. Investors should consider the timing of distributions in relation to their overall financial goals, tax situation, and market conditions. Investors should consult with tax and financial advisors to ensure their NUA strategy is aligned with their overall financial plan and to navigate the complexities of the tax code. NUA should not be considered in isolation but as part of a comprehensive financial plan that takes into account an investor's risk tolerance, investment goals, and tax situation. Understanding NUA's taxation and reporting requirements is essential for investors seeking to take advantage of this strategy. Ordinary Income Tax: Upon distribution, the cost basis of the company stock is taxed as ordinary income. Long-Term Capital Gains Tax: When the company stock is eventually sold, the NUA portion is taxed at the long-term capital gains rate. Form 1099-R: Upon distribution of the company stock, the plan administrator issues Form 1099-R, which reports the taxable amount and the cost basis of the distributed shares. Form 8949 and Schedule D: When the company stock is sold, investors must report the sale on Form 8949 and Schedule D of their federal income tax return, detailing the cost basis, the sale proceeds, and the NUA. Understanding Net Unrealized Appreciation NUA) and its benefits and drawbacks is crucial for investors with significant company stock holdings in their retirement plans. By carefully evaluating the appropriateness of NUA in their individual situation and seeking professional guidance for implementation, investors can potentially minimize taxes and maximize the value of their investments.What Is Net Unrealized Appreciation (NUA)?

Importance of Understanding NUA for Investors

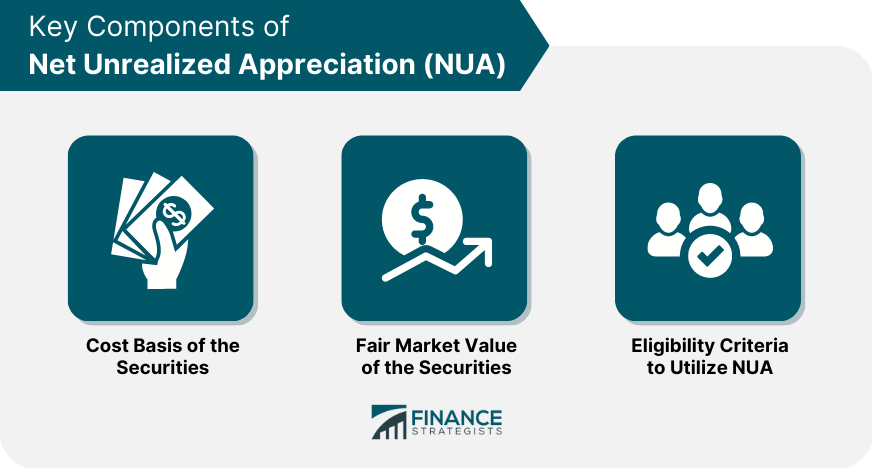

Key Components of NUA

Determining NUA

Calculating NUA

Eligibility Criteria for NUA

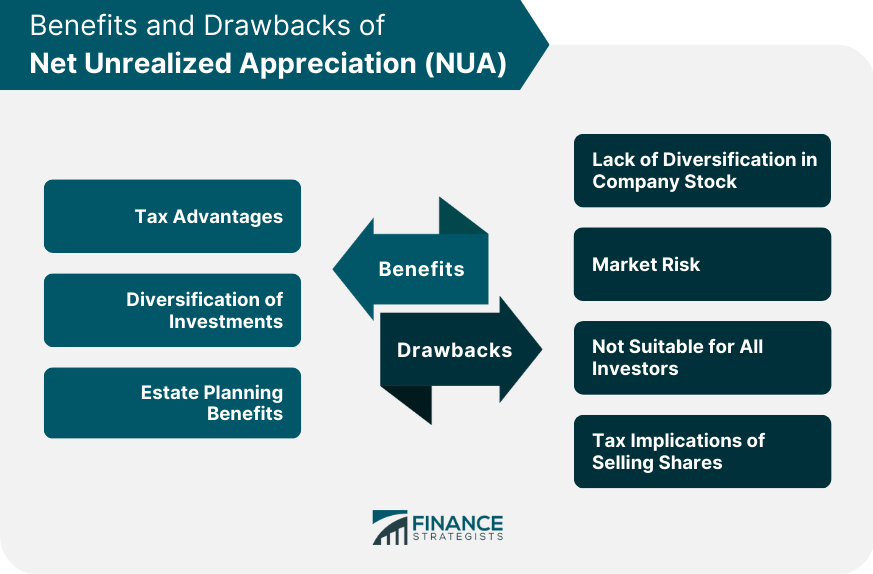

Benefits of NUA

Tax Advantages

Diversification of Investments

Estate Planning Benefits

Potential Drawbacks and Risks of NUA

Lack of Diversification in Company Stock

Market Risk

Not Suitable for All Investors

Tax Implications of Selling Shares

NUA vs. Other Distribution Options

Rollover to an IRA

Advantages

Disadvantages

Direct Rollover to Another Employer's Plan

Advantages

Disadvantages

Lump-Sum Distribution

Advantages

Disadvantages

How to Implement an NUA Strategy

Timing of Distributions

Coordinating With Financial and Tax Advisors

NUA as Part of a Comprehensive Financial Plan

NUA Taxation and Reporting Requirements

Taxation of NUA

Reporting Requirements for NUA

Conclusion

Net Unrealized Appreciation (NUA) FAQs

Net Unrealized Appreciation (NUA) is the difference between the cost basis of an employer's company stock held in a qualified retirement plan and the stock's current market value.

NUA is taxed as a capital gain when the stock is sold, and it is not subject to the same tax treatment as regular retirement plan distributions.

Yes, NUA can be rolled over into an IRA, but only the cost basis of the stock is eligible for rollover treatment, and the NUA amount is subject to taxation.

NUA treatment is available to employees with company stock in a qualified retirement plan and meet certain requirements, such as reaching age 59 1/2 or leaving their job.

The benefits of NUA treatment include potentially lower taxes on the NUA amount, the ability to diversify retirement assets, and the potential for greater long-term investment growth outside of the retirement plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.