Cyclical stocks are stocks of companies that are highly sensitive to the economic cycle. These companies typically perform well during periods of economic expansion and may experience significant declines during periods of economic contraction. Some examples of cyclical industries include technology, consumer discretionary, and materials. Understanding cyclical stocks is important for investors because these stocks can be highly volatile and carry a higher level of risk than other types of stocks. Cyclical stocks can provide investors with opportunities for growth and higher returns, but it's crucial to thoroughly research and understand the potential risks and rewards associated with investing in these types of stocks. Several factors can impact the performance of cyclical stocks, including interest rates, consumer spending, and global economic conditions. Interest rates can have a significant impact on cyclical stocks. When interest rates are low, borrowing costs are also low, which can stimulate economic growth and lead to increased demand for cyclical industries such as consumer discretionary and materials. However, when interest rates rise, borrowing costs increase, which can slow economic growth and negatively impact cyclical stocks. Consumer spending is another key factor that affects cyclical stocks. During periods of economic growth, consumers are more likely to spend money on discretionary items, such as electronics or vacations, which can benefit cyclical industries such as technology and consumer discretionary. However, during economic downturns, consumers may cut back on spending, which can negatively impact cyclical stocks. Global economic conditions can also impact the performance of cyclical stocks. For example, if there is a recession in a major global economy, it can lead to decreased demand for products and services offered by cyclical industries. Cyclical stocks can offer investors an opportunity for growth during periods of economic expansion. As the economy grows, so too does demand for products and services offered by cyclical industries. Cyclical stocks can also offer higher returns than other types of stocks during periods of economic growth. This is because the earnings of cyclical companies tend to increase along with the economy, leading to higher stock prices and potential gains for investors. Some cyclical stocks may offer dividends to investors, providing a steady stream of income. This can be particularly appealing for investors who are looking for regular cash flow from their investments. During periods of economic downturn, cyclical stocks may be undervalued, providing an opportunity for investors to purchase stocks at a lower price. If the economy rebounds, these stocks may then increase in value, potentially leading to significant gains for investors. Cyclical stocks can be highly volatile, with prices fluctuating rapidly based on changes in economic conditions. This volatility can make investing in cyclical stocks a risky proposition for some investors. The performance of cyclical stocks is also impacted by company-specific factors, such as management decisions, competitive pressures, and market share. Investors should carefully evaluate individual companies before investing in their stocks. Timing is crucial when investing in cyclical stocks. If an investor enters the market at the wrong time, they may not be able to fully realize the potential benefits of investing in cyclical stocks. It can be difficult to time the market, and investors should be prepared for the possibility of short-term losses. Cyclical stocks are often impacted by changes in interest rates. If interest rates rise, the cost of borrowing increases, which can negatively impact cyclical companies that rely on borrowing to finance their operations. Investing in cyclical stocks requires careful evaluation of potential risks and rewards, as well as a solid investment strategy. Here are a few strategies that investors can consider when investing in cyclical stocks. One common strategy for investing in cyclical stocks is to buy when prices are low and sell when they are high. This requires careful monitoring of economic trends and the stock market, as well as a willingness to hold onto investments for a longer period of time. Including a mix of cyclical and non-cyclical stocks in a portfolio can help to spread risk and provide a more stable investment base. Diversification can help to protect against losses in one sector while providing opportunities for growth in another. Some investors rotate in and out of cyclical sectors based on economic trends. For example, an investor may focus on consumer discretionary stocks during periods of economic growth, but shift towards defensive stocks during periods of economic contraction. This strategy involves investing a fixed amount of money in a cyclical stock on a regular basis, regardless of market conditions. This can help to smooth out fluctuations in stock prices and reduce risk. Cyclical stocks are stocks of companies that are highly sensitive to the economic cycle, performing well during periods of economic expansion and experiencing significant declines during periods of economic contraction. The benefits of investing in cyclical stocks include opportunities for growth, higher returns, dividends, and low valuation. However, investing in cyclical stocks also carries risks, such as volatility, company-specific risk, timing risk, and interest rate risk. Investors can use strategies such as diversification, sector rotation, and dollar-cost averaging to invest in cyclical stocks. However, it's important to carefully evaluate potential risks and rewards and consider personal financial goals and risk tolerance before investing in cyclical stocks. Investing in cyclical stocks can be a risky but potentially rewarding strategy for investors looking to grow their wealth. By understanding the factors that impact cyclical stocks, evaluating potential risks and rewards, and developing a solid investment strategy, investors can make informed decisions about including cyclical stocks in their portfolios. As with any investment, it's important to do your research and consider your personal financial goals and risk tolerance before investing in cyclical stocks.What Are Cyclical Stocks?

Factors Affecting Cyclical Stocks

Interest Rates

Consumer Spending

Global Economic Conditions

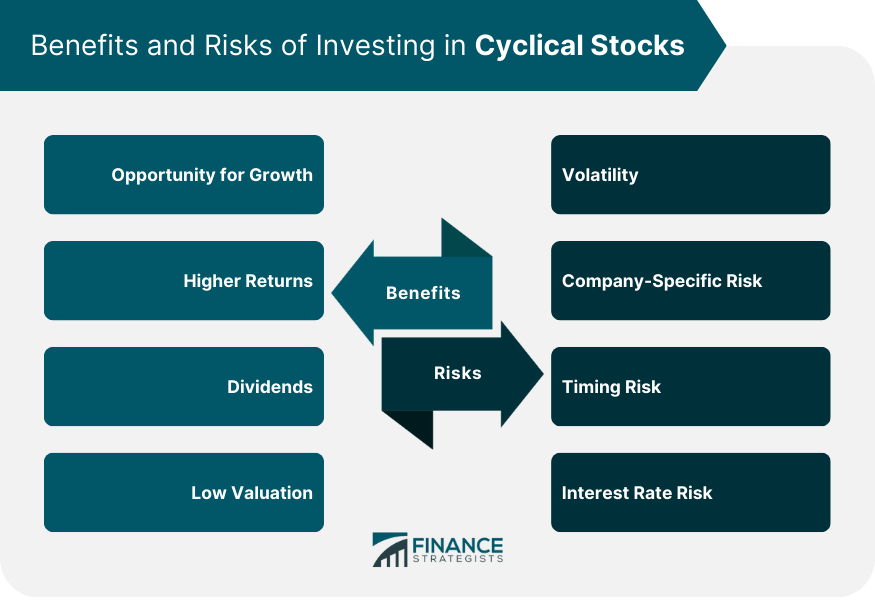

Benefits to Investing in Cyclical Stocks

Opportunity for Growth

Higher Returns

Dividends

Low Valuation

Risks Associated With Investing in Cyclical Stocks

Volatility

Company-Specific Risk

Timing Risk

Interest Rate Risk

Strategies for Investing in Cyclical Stocks

Buy Low, Sell High

Diversification

Sector Rotation

Dollar-Cost Averaging

Bottom Line

Cyclical Stocks FAQs

Cyclical stocks are stocks of companies that are highly sensitive to the economic cycle, often performing well during periods of economic expansion.

The risks of investing in cyclical stocks include economic risk, volatility, company-specific risk, timing risk, interest rate risk, and market risk.

The benefits of investing in cyclical stocks include opportunities for growth, higher returns, diversification, low valuation, and dividends.

Strategies for investing in cyclical stocks include buying low and selling high, diversification, focusing on quality, sector rotation, and dollar-cost averaging.

It's important to carefully evaluate your personal financial goals and risk tolerance when considering investing in cyclical stocks, and to do your research to understand the potential benefits and risks associated with these types of stocks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.