Single-family offices are privately owned organizations that cater exclusively to the wealth management and advisory needs of an ultra-high-net-worth (UHNW) family. These offices provide a range of financial and non-financial services tailored to the unique requirements and preferences of the family. The concept of single-family offices dates back to the 19th century when wealthy families, such as the Rockefellers, established private offices to manage their wealth and personal affairs. Over time, single-family offices have evolved to address the increasing complexity of managing significant wealth and the diverse needs of UHNW families.

Single-family offices provide bespoke portfolio management services, including asset allocation, investment selection, and performance monitoring, to help clients achieve their financial goals. Risk assessment and management services assist clients in identifying, evaluating, and mitigating potential risks associated with their investment portfolios. Single-family offices often facilitate access to alternative investments, such as private equity, hedge funds, real estate, and collectibles, to diversify clients' portfolios and enhance returns. Tax planning services help clients minimize their tax liabilities and maximize tax-efficient strategies. Retirement planning services enable clients to prepare for their post-work lives by developing income generation strategies and managing retirement accounts. Estate planning services address clients' wealth transfer needs, including the creation of wills, trusts, and charitable giving strategies. Succession planning services ensure the smooth transfer of family businesses or wealth management responsibilities to the next generation. Single-family offices may provide guidance on family communication and conflict resolution to maintain harmony and preserve family values. Financial education services help younger family members understand wealth management principles and prepare them for future financial responsibilities. Single-family offices assist clients in developing and implementing charitable giving strategies, including the establishment of foundations and donor-advised funds. Impact investing services enable clients to align their investments with their social and environmental values. Single-family offices may provide guidance on establishing and managing foundations to support clients' philanthropic endeavors. Real estate management services help clients manage and maintain their residential, commercial, and investment properties. Travel and event planning services assist clients in organizing personal and family events, vacations, and other lifestyle experiences. Personal security and privacy services ensure the safety and confidentiality of clients and their families. Single-family offices offer a high level of customization and control, allowing families to tailor services to their specific needs and preferences. Privacy and confidentiality are often critical concerns for UHNW families, and single-family offices can provide a secure and discreet environment to manage their wealth and personal affairs. Single-family offices can facilitate the integration and coordination of various services, ensuring seamless and efficient wealth management. A family-centric approach allows single-family offices to focus on the unique needs, values, and dynamics of the family, fostering trust and long-term relationships. Establishing and maintaining a single-family office can be resource-intensive and costly, particularly for smaller UHNW families or those with less complex needs. Single-family offices may have limited access to specialized expertise and investment opportunities compared to multi-family offices or other wealth management firms. Ensuring the continuity and succession of the single-family office can be challenging, particularly when key professionals retire or the family's needs evolve over time. Single-family offices must navigate an increasingly complex regulatory environment and ensure compliance with various financial and tax regulations. Families should start by evaluating their specific needs and goals, such as investment management, estate planning, philanthropy, and lifestyle services, to determine if a single-family office is the most suitable solution. Deciding on the appropriate legal and operational structure for the single-family office is crucial, as it can impact governance, tax, and regulatory considerations. Recruiting a team of experienced professionals, such as portfolio managers, tax advisors, estate planners, and lifestyle specialists, is essential to delivering comprehensive and high-quality services. Establishing robust governance and operational processes can ensure the smooth functioning of the single-family office and facilitate communication and decision-making among family members and professionals. Regularly reviewing and updating the single-family office's strategy, services, and performance is essential to adapt to the evolving needs and goals of the family. Multi-family offices provide a range of wealth management and advisory services to multiple UHNW families, offering economies of scale and access to a broader range of expertise and investment opportunities. Private banks and wealth management firms cater to HNW and UHNW clients, providing investment management, financial planning, and other services, often at a lower cost than single-family offices. Hybrid solutions combine the features of single-family offices, multi-family offices, and other wealth management providers, offering a tailored and flexible approach to wealth management. Single-family offices play a vital role in wealth management for ultra-high-net-worth clients by providing a customized, family-centric approach to managing, preserving, and growing their wealth. These offices offer a range of financial and non-financial services tailored to the unique needs and preferences of the family. When considering the establishment of a single-family office, families must carefully weigh the advantages, challenges, and alternatives to ensure that it is the most suitable solution for their wealth management needs. By thoroughly evaluating their specific requirements, goals, and resources, families can choose the most appropriate approach to managing their wealth and preserving it for future generations.What Are Single-Family Offices?

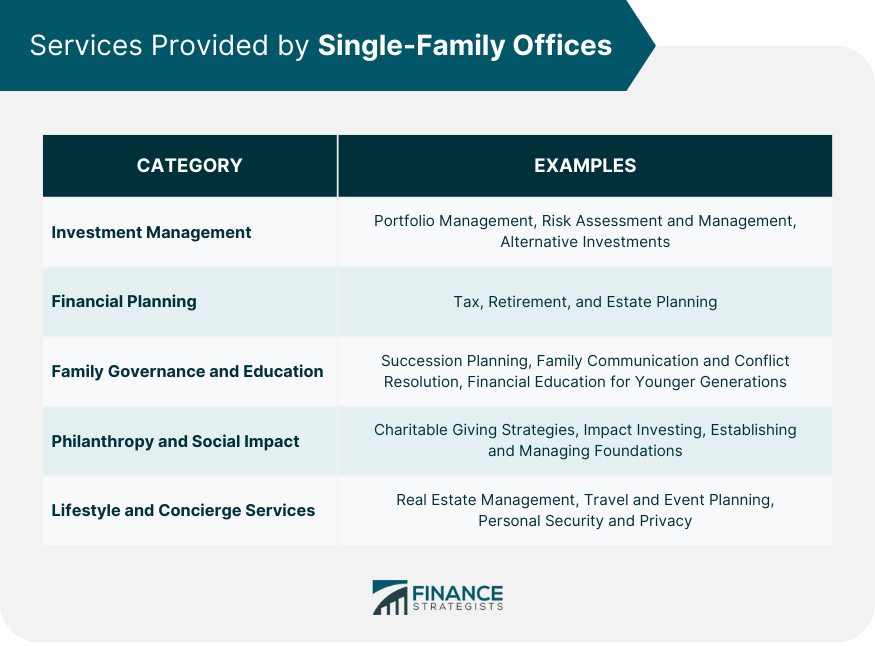

Services Provided by Single-Family Offices

Investment Management

Portfolio Management

Risk Assessment and Management

Alternative Investments

Financial Planning

Tax Planning

Retirement Planning

Estate Planning

Family Governance and Education

Succession Planning

Family Communication and Conflict Resolution

Financial Education for Younger Generations

Philanthropy and Social Impact

Charitable Giving Strategies

Impact Investing

Establishing and Managing Foundations

Lifestyle and Concierge Services

Real Estate Management

Travel and Event Planning

Personal Security and Privacy

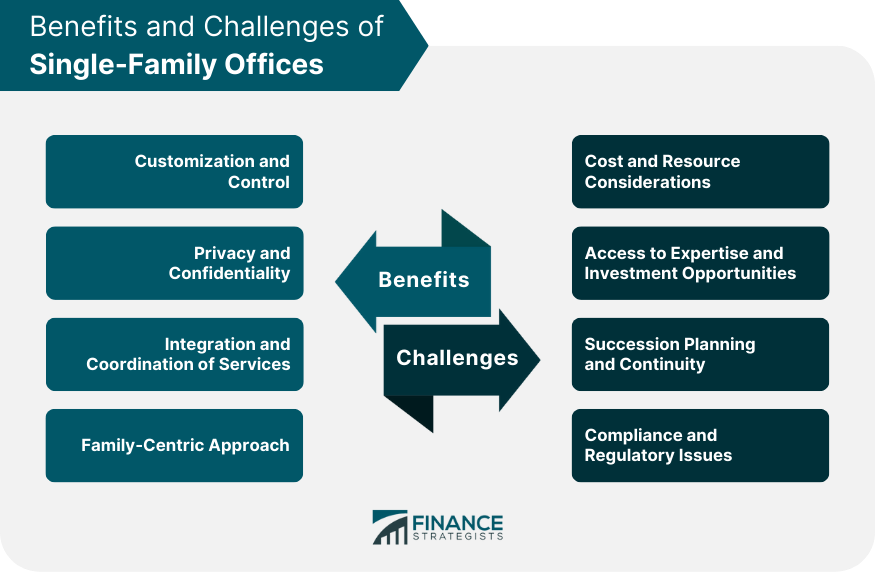

Advantages of Single-Family Offices

Customization and Control

Privacy and Confidentiality

Integration and Coordination of Services

Family-Centric Approach

Challenges of Single-Family Offices

Cost and Resource Considerations

Access to Expertise and Investment Opportunities

Succession Planning and Continuity

Compliance and Regulatory Issues

Establishing a Single-Family Office

Identifying the Family's Needs and Goals

Structuring the Single-Family Office

Building the Team of Professionals

Implementing Governance and Operational Processes

Ongoing Management and Review

Alternatives to Single-Family Offices

Multi-Family Offices

Private Banks and Wealth Management Firms

Hybrid Solutions

Conclusion

Single-Family Offices FAQs

A single-family office is a wealth management firm that is exclusively dedicated to managing the financial affairs of one wealthy family. It is established by families with substantial assets to manage their investments, tax and estate planning, philanthropic activities, and other financial needs.

Single-family offices offer a wide range of services tailored to meet the needs of the specific family they serve. These services may include investment management, financial planning, tax planning, trust and estate planning, philanthropy, family governance, and more. The goal is to provide customized and comprehensive solutions to help the family achieve their financial and personal objectives.

A single-family office serves only one wealthy family, while a multi-family office serves several families. The services provided by a single-family office are highly customized to meet the specific needs of the family, whereas a multi-family office provides more standardized services to multiple families. Single-family offices also tend to have a smaller staff and more personalized attention, whereas multi-family offices have larger teams and more resources to draw upon.

Having a single-family office provides a family with a high degree of control, customization, and privacy in managing their wealth. The family can work closely with their dedicated team of professionals to develop and implement a comprehensive financial strategy that aligns with their goals and values. Single-family offices also provide a high level of confidentiality and discretion, which can be important for families that wish to keep their financial affairs private.

Single-family offices are typically established by ultra-high-net-worth families with significant wealth, typically in excess of $100 million. These families may have complex financial needs, multiple business interests, or a desire for greater control and customization in managing their wealth. The establishment of a single-family office can help ensure that the family's financial affairs are managed efficiently and effectively, enabling them to focus on other priorities such as philanthropy, business interests, or personal pursuits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.