Leasehold improvement refers to modifications made to a rental property to tailor it to the specific needs of a tenant. Such improvements can range from simple fixture installations to more complex alterations like building additional spaces or ensuring regulatory compliance. The purpose of leasehold improvements is to adapt a leased property to better serve the tenant's requirements, thereby enhancing the rental value and utility of the property. For landlords and tenants, understanding leasehold improvements is crucial as they directly affect rental agreements, negotiations, and financial obligations. They carry significant financial implications, affecting accounting practices and tax deductions. In a broader context, leasehold improvements reflect market trends and economic conditions, making them an important aspect of the real estate and business sectors. As businesses seek greater customization and landlords aim to attract quality tenants, leasehold improvements are becoming an integral part of lease agreements. These improvements typically involve adding new features or facilities to a property. Examples include constructing a new office space in a previously open floor plan, installing partitions, or adding additional restroom facilities. This category includes any changes to the existing layout or appearance of a property, such as updating light fixtures, replacing flooring, or remodeling an outdated kitchen area. At times, leasehold improvements are necessary for a property to comply with local building codes, the Americans with Disabilities Act (ADA), or other regulations. These modifications can include installing wheelchair ramps or altering restrooms for accessibility. Leasehold improvements play a crucial role in accounting, especially within the framework of the Generally Accepted Accounting Principles (GAAP). According to GAAP, leasehold improvements should be capitalized rather than expensed. This means they are recorded as long-term assets on the balance sheet instead of being immediately deducted from revenue on the income statement. When leasehold improvements are capitalized, they are considered fixed assets and depreciated over their useful life. The cost of these improvements increases the carrying amount of the asset on the balance sheet. Leasehold improvements is depreciated over the shorter of their useful life or the remaining lease term. If a renewal period is likely, and it is clear at the inception of the lease, the lease term can include the renewal period. Under Section 179 of the IRS Tax Code, businesses can deduct the full cost of certain types of property from their income, including leasehold improvement property. However, the total amount that can be deducted is subject to a limit. In addition to Section 179 deductions, the Tax Cuts and Jobs Act of 2017 expanded bonus depreciation to include used property and increased the deduction percentage to 100%. Leasehold improvements qualify for bonus depreciation. The classification of leasehold improvements as Qualified Improvement Property (QIP) under IRS regulations has added benefits. QIP is any improvement made to an interior portion of a nonresidential building after the date the building was first placed in service. Leasehold improvements play a significant role in landlord-tenant relationships and are typically a subject of negotiation in lease agreements. Often, a landlord will offer to cover a certain amount of the cost for leasehold improvements as an incentive to attract or keep a tenant. This agreement, known as a Tenant Improvement Allowance (TIA), is negotiated during the lease or renewal process. The question of who owns the leasehold improvements often arises. In most cases, leasehold improvements, once installed, become the property of the landlord since they are affixed to the real estate. The responsibilities of both parties should be clearly outlined in the lease agreement. This includes the scope of improvements, costs, maintenance, and eventual removal of the improvements. Though often used interchangeably, leasehold improvements and tenant improvements have distinct differences. The key difference lies in who undertakes and finances the improvements. Leasehold improvements are generally initiated and financed by the tenant, while tenant improvements are usually commissioned and financed by the landlord. The financial implications of this difference are significant. Who bears the cost of the improvements can influence the lease negotiations, rental rates, and terms of the lease. The health of the real estate market can greatly influence leasehold improvements. When the market is strong, landlords may be less inclined to offer TIAs. However, in a softer market, landlords may offer more generous TIAs to attract and retain tenants. General economic conditions can also influence leasehold improvements. For instance, during economic downturns, businesses may opt to renovate their existing spaces rather than move to new locations. Technology is revolutionizing leasehold improvements. Tenants increasingly demand smart technologies in their spaces, such as advanced HVAC systems for improved energy efficiency, integrated security systems, and IoT-enabled devices for better operational control. Sustainability is also shaping the future of leasehold improvements. There is a growing demand for green improvements, such as energy-efficient lighting, low-VOC materials, and water-efficient plumbing fixtures. Looking forward, we can expect the focus on sustainability and technology in leasehold improvements to continue. As tenants demand more customization and landlords seek to attract and retain quality tenants, the prevalence and complexity of leasehold improvements are likely to increase. Leasehold improvements, encompassing new additions, renovations, remodeling, and compliance modifications, significantly influence the dynamics of landlord-tenant relationships and carry notable accounting and tax implications. Under GAAP, they are capitalized, becoming long-term assets subject to depreciation, and can offer tax benefits through Section 179 deductions and bonus depreciation. Leasehold improvements also act as a pivot in lease agreements, affecting negotiation strategies and financial responsibilities between the parties. Their relevance extends to reflect real estate market health and broader economic trends, making them a valuable barometer of business and property market conditions. With rising technological advancements and the sustainability trend, leasehold improvements are transforming, increasingly integrating smart technologies and eco-friendly features. As customization remains a priority for tenants and landlords aim for quality tenancy, leasehold improvements' prominence, and complexity are set to continue expanding in the future.What Is Leasehold Improvement?

Categories of Leasehold Improvements

New Additions

Renovations and Remodeling

Modifications for Compliance

Accounting for Leasehold Improvements

Role of GAAP

Capitalizing Leasehold Improvements

Depreciation of Leasehold Improvements

Taxation and Leasehold Improvements

Section 179 of the IRS Tax Code

Bonus Depreciation

Qualified Improvement Property (QIP)

Leasehold Improvement and Landlord-Tenant Relationships

Negotiating Leasehold Improvements in Lease Agreements

Ownership of Leasehold Improvements

Tenant and Landlord Responsibilities

Leasehold Improvements vs Tenant Improvements

Key Differences

Financial Implications

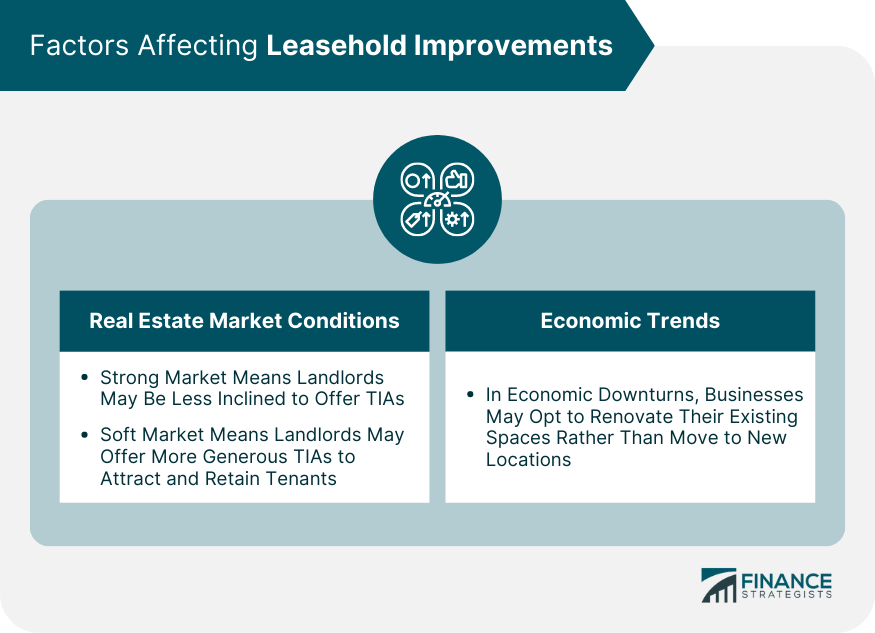

Economic and Market Factors Affecting Leasehold Improvements

Impact of Real Estate Market Conditions

Influence of Economic Trends

Future of Leasehold Improvements

Technological Impact on Leasehold Improvements

Sustainability and Leasehold Improvements

Trends and Predictions

Conclusion

Leasehold Improvement FAQs

Leasehold Improvement refers to alterations or modifications made to a rental property to suit the specific needs of a tenant. This could range from basic fixture installations to more complex changes, such as constructing additional spaces or ensuring regulatory compliance.

Leasehold Improvements are capitalized as per the Generally Accepted Accounting Principles (GAAP), meaning they are recorded as long-term assets on the balance sheet and depreciated over their useful life or the remaining lease term, whichever is shorter.

Leasehold Improvements have significant tax implications. Businesses can deduct the full cost of leasehold improvement property under Section 179 of the IRS Tax Code, subject to certain limits. They also qualify for bonus depreciation, which allows for additional deductions.

Leasehold Improvements play a key role in landlord-tenant relationships. They are usually a subject of negotiation in lease agreements, often affecting the rental terms and financial obligations. In most cases, these improvements become the property of the landlord once installed.

The future of Leasehold Improvements is being shaped by technological advancements and sustainability trends. Tenants increasingly demand smart technologies and green improvements in their spaces. This means the integration of advanced systems for energy efficiency, security, and operational control, as well as the use of eco-friendly materials.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.