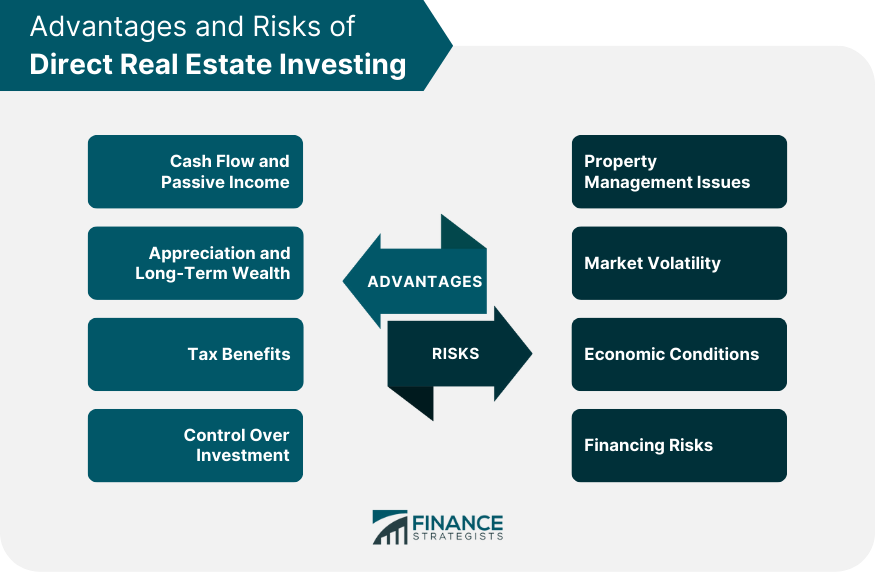

Direct real estate investing refers to the process of purchasing and managing physical properties, such as residential or commercial buildings, with the intent of generating income and building wealth through rental income, property appreciation, or both. This form of investment allows individuals to have direct ownership and control over their real estate assets, as opposed to indirect investing through real estate investment trusts (REITs) or other financial instruments. Direct real estate investing can play an important role in an individual's overall investment strategy. By offering diversification, potential cash flow, and long-term appreciation, direct real estate investments can help build wealth and create a stable income source. One of the main benefits of direct real estate investing is the potential for consistent cash flow through rental income. By investing in income-producing properties, investors can generate a steady stream of passive income that can be used to cover expenses, pay down debt, or reinvest in additional properties. Moreover, as property values and rental rates increase over time, investors can benefit from growing cash flow, which can serve as a hedge against inflation and provide long-term financial stability. Direct real estate investing can also contribute to long-term wealth through property appreciation. As property values increase over time, investors can build equity in their assets and potentially benefit from substantial capital gains when they eventually sell their properties. In addition, by strategically investing in up-and-coming neighborhoods or markets with strong growth potential, investors can potentially maximize their property appreciation and generate significant wealth over the long term. Another advantage of direct real estate investing is the various tax benefits associated with owning and managing properties. Some of these benefits include deductions for mortgage interest, property taxes, and depreciation, as well as the ability to defer capital gains taxes through strategies like 1031 exchanges. These tax advantages can help investors reduce their overall tax liability, increase their cash flow, and ultimately boost their investment returns. Direct real estate investing provides investors with a high degree of control over their investments. Unlike indirect investments through REITs or other financial instruments, direct investors can actively manage their properties, make decisions about renovations, set rental rates, and choose tenants. This level of control allows investors to more effectively manage their assets and make strategic decisions that can enhance property value, optimize cash flow, and minimize risks. One of the challenges of direct real estate investing is the need to effectively manage properties. This may include tasks such as finding and screening tenants, handling maintenance and repairs, and dealing with legal and regulatory issues. For investors who lack experience or are not prepared to dedicate the time and effort required to manage their properties, these responsibilities can be overwhelming and may negatively impact their investment returns. Direct real estate investing can also be subject to market volatility, as property values and rental rates can fluctuate based on local market conditions, economic factors, and other variables. This volatility can create uncertainty for investors and potentially result in lower returns or even losses if property values decline or rental income is insufficient to cover expenses. The performance of direct real estate investments is closely tied to broader economic conditions. Factors such as job growth, interest rates, and consumer confidence can all impact property values and rental demand, and a downturn in the economy can lead to decreased demand, lower rental rates, and potential losses for investors. As a result, it is essential for investors to carefully consider the overall economic climate and potential risks when investing in real estate directly. Financing risks are another concern for direct real estate investors. Obtaining financing for investment properties can be more difficult than for primary residences, and investors may face higher interest rates, more stringent lending requirements, or the need for larger down payments. Additionally, investors who rely on financing to purchase properties may be vulnerable to changes in interest rates, which can affect their cash flow and overall investment returns. Location is a critical factor when investing in real estate directly. The location of a property can significantly impact its value, appreciation potential, and rental demand. Investors should research local market trends, economic indicators, and neighborhood characteristics to identify areas with strong growth potential and to minimize risk. Selecting the right property type is essential for successful direct real estate investing. Investors should consider their investment goals, risk tolerance, and management capabilities when choosing between residential, commercial, or other property types. Each type of property has unique characteristics, risks, and potential returns, and understanding these differences can help investors make more informed decisions. Understanding local market trends and demand is crucial for direct real estate investors. Investors should research factors such as population growth, job growth, and housing supply to assess the potential demand for rental properties in a given area. By identifying markets with strong fundamentals and high demand, investors can potentially reduce risks and maximize their investment returns. Securing financing is an important aspect of direct real estate investing. Investors should carefully consider their financing options, including traditional mortgages, hard money loans, or private lenders, to find the best fit for their investment strategy and financial situation. Understanding the terms, costs, and potential risks associated with different financing options can help investors make more informed decisions and optimize their investment returns. Having a clear exit strategy is essential for successful direct real estate investing. Investors should consider potential exit strategies, such as selling the property, refinancing, or exchanging the property through a 1031 exchange, and develop a plan that aligns with their investment goals and market conditions. The first step to getting started in direct real estate investing is to educate yourself on the fundamentals of real estate and conduct thorough research. This may include reading books, attending seminars or webinars, and following industry news to gain a solid understanding of the real estate market, investment strategies, and potential risks. Before diving into direct real estate investing, it is essential to set clear investment goals. These goals should consider factors such as the desired level of cash flow, appreciation potential, risk tolerance, and time horizon. By establishing clear objectives, investors can better focus their efforts and make more informed decisions about their investments. Developing a network of industry professionals, such as real estate agents, lenders, property managers, and other investors, can be invaluable for direct real estate investors. These connections can provide valuable advice, resources, and support, helping investors identify investment opportunities and navigate the challenges of property ownership and management. Finally, investors must actively seek out and evaluate potential investment properties that align with their goals and risk tolerance. This process may involve researching local markets, analyzing property data, and conducting property inspections to identify properties with strong potential for cash flow and appreciation. Direct real estate investing offers numerous advantages, including potential cash flow, appreciation, tax benefits, and control over investment decisions. However, it also comes with inherent risks, such as property management issues, market volatility, economic conditions, and financing risks. By carefully considering factors such as location, property type, market trends, financing options, and exit strategies, investors can make more informed decisions and increase their chances of success in direct real estate investing. Direct real estate investing can be a rewarding and profitable endeavor for those willing to put in the time, effort, and resources to educate themselves, set clear goals, and develop a well-defined investment strategy. By understanding the advantages, risks, and key considerations involved in direct real estate investing, individuals can position themselves for success and potentially build long-term wealth and financial stability through property ownership.Definition of Direct Real Estate Investing

Advantages of Direct Real Estate Investing

Cash Flow and Passive Income

Appreciation and Long-Term Wealth

Tax Benefits

Control Over Investment

Risks of Direct Real Estate Investing

Property Management Issues

Market Volatility

Economic Conditions

Financing Risks

Factors to Consider When Investing in Real Estate Directly

Location

Property Type

Market Trends and Demand

Financing Options

Exit Strategies

How to Get Started in Direct Real Estate Investing

Educate Yourself and Conduct Research

Set Investment Goals

Build a Network

Identify Investment Opportunities

Conclusion

Direct Real Estate Investing FAQs

Direct real estate investing involves purchasing physical properties, such as homes or commercial buildings, with the intention of generating income.

Direct real estate investing offers potential cash flow, appreciation, long-term wealth, tax benefits, and control over the investment.

Direct real estate investing carries risks such as property management issues, market volatility, economic conditions, and financing risks.

Some important factors include location, property type, market trends and demand, financing options, and exit strategies.

You can start by educating yourself on real estate investing, setting investment goals, building a network, and identifying investment opportunities. Consider seeking guidance from a professional.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.