Investor psychology is the study of the emotional and cognitive factors that influence the decision-making process of investors. It refers to the mental and emotional factors that influence an investor's decision-making process when it comes to buying, holding, or selling investments. This includes a range of cognitive biases and emotions that can impact an investor's perceptions, attitudes, and behaviors. Understanding investor psychology is crucial for making informed investment decisions and avoiding common pitfalls. Cognitive biases are systematic errors in thinking that can affect investors' judgment and decision-making. These biases often lead to irrational investment choices, undermining the potential for financial success. Overconfidence bias refers to the tendency of investors to overestimate their abilities and the accuracy of their predictions. This can lead to excessive trading and unnecessary risk-taking. To mitigate overconfidence bias, investors should maintain a humble approach and recognize the limits of their knowledge and expertise. Confirmation bias is the tendency to seek out information that confirms one's pre-existing beliefs while ignoring contradictory evidence. This can result in poor investment decisions based on incomplete or biased information. Investors should actively seek out diverse perspectives and challenge their beliefs to overcome confirmation bias. Anchoring bias occurs when investors rely too heavily on an initial piece of information, such as a stock's past performance, when making decisions. This can lead to irrational decision-making as investors fail to consider relevant new information. To combat anchoring bias, investors should focus on a broad range of data and avoid relying solely on historical performance. Loss aversion is the tendency for investors to feel the pain of a loss more intensely than the pleasure of an equal gain. This can result in an overly conservative investment strategy and missed opportunities. Investors should adopt a long-term perspective and focus on their overall investment goals to address loss aversion. Herd mentality refers to the tendency of investors to follow the crowd, often resulting in irrational market behavior. This can lead to market bubbles and crashes. To avoid herd mentality, investors should develop their investment strategy based on their risk tolerance and financial goals rather than following the latest trends. Emotional factors can also play a significant role in shaping investor behavior. Being aware of these emotions and their impact on decision-making is crucial for successful investing. Greed and fear are powerful emotions that can lead to irrational investment decisions. Greed can push investors to take excessive risks, while fear can cause them to sell prematurely or avoid investments altogether. To manage these emotions, investors should establish and stick to a disciplined investment plan, regardless of market conditions. Regret aversion is the tendency to avoid making decisions out of fear of feeling regret later. This can lead to missed investment opportunities and suboptimal portfolio performance. To overcome regret aversion, investors should focus on the long-term benefits of their decisions and accept that some level of risk is necessary for potential rewards. Overreaction occurs when investors respond too strongly to new information, while underreaction is the opposite, not responding enough. Both behaviors can lead to poor investment decisions and portfolio performance. Investors should strive for a balanced approach, carefully weighing new information against their existing knowledge and investment strategy. Investor psychology affects individual investors and contributes to broader market behavior, including market anomalies, bubbles, and crashes. Market anomalies are patterns or occurrences that contradict the Efficient Market Hypothesis, which states that financial markets are always perfectly rational and efficient. Anomalies, such as the January effect or momentum investing, suggest that investor psychology can create inefficiencies in the market. Understanding these anomalies can help investors identify potential opportunities and improve their investment strategies. Market bubbles occur when asset prices become significantly overvalued, often driven by investor enthusiasm and irrational exuberance. Conversely, market crashes are sudden, severe declines in asset prices, often triggered by panic selling. Both bubbles and crashes are fueled by investor psychology, highlighting the importance of managing emotions and biases in the investment process. The market efficiency debate revolves around the Efficient Market Hypothesis (EMH) and the behavioral finance perspective. While EMH argues that markets are always efficient and that prices reflect all available information, behavioral finance contends that investor psychology can create inefficiencies in the market. This debate underscores the importance of understanding the role of investor psychology in market behavior. To minimize the impact of investor psychology on decision-making, investors can adopt several strategies, including diversification, long-term investment approaches, using professional financial advisors, and improving financial education and self-awareness. Diversification is the process of spreading investments across a range of assets and sectors to reduce risk. By diversifying, investors can mitigate emotional biases, such as overconfidence and herd mentality, and better weather market volatility. A well-diversified portfolio helps investors stay focused on their long-term goals and reduces the likelihood of making impulsive decisions. A long-term investment approach involves focusing on the potential growth of assets over an extended period, rather than attempting to time the market or chase short-term gains. This strategy can help investors mitigate the impact of emotional factors, such as greed, fear, and regret aversion, and encourage more rational decision-making. Investors who adopt a long-term perspective are more likely to achieve their financial goals and avoid common psychological pitfalls. Professional financial advisors can help investors manage their emotions and biases by providing objective advice and guidance. Financial advisors can help investors develop a personalized investment strategy, assess their risk tolerance, and monitor portfolio performance. By relying on the expertise of a financial advisor, investors can make more informed decisions and better manage their investor psychology. Financial education and self-awareness are crucial for managing investor psychology. By improving financial literacy, investors can better understand market dynamics, investment products, and risk management. Furthermore, becoming aware of one's biases and emotions can help investors recognize when they may be making irrational decisions and take corrective action. Continuous learning and self-reflection are essential for overcoming the psychological barriers to successful investing. Investor psychology plays a significant role in the investment decision-making process, influencing individual investors and broader market behavior. Understanding the cognitive biases and emotional factors that shape investor behavior is critical for making informed investment decisions and avoiding common pitfalls. By adopting strategies such as diversification, a long-term investment approach, using professional financial advisors, and improving financial education and self-awareness, investors can better manage their investor psychology and increase their chances for financial success.What Is Investor Psychology?

Cognitive Biases in Investment Decisions

Overconfidence Bias

Confirmation Bias

Anchoring Bias

Loss Aversion

Herd Mentality

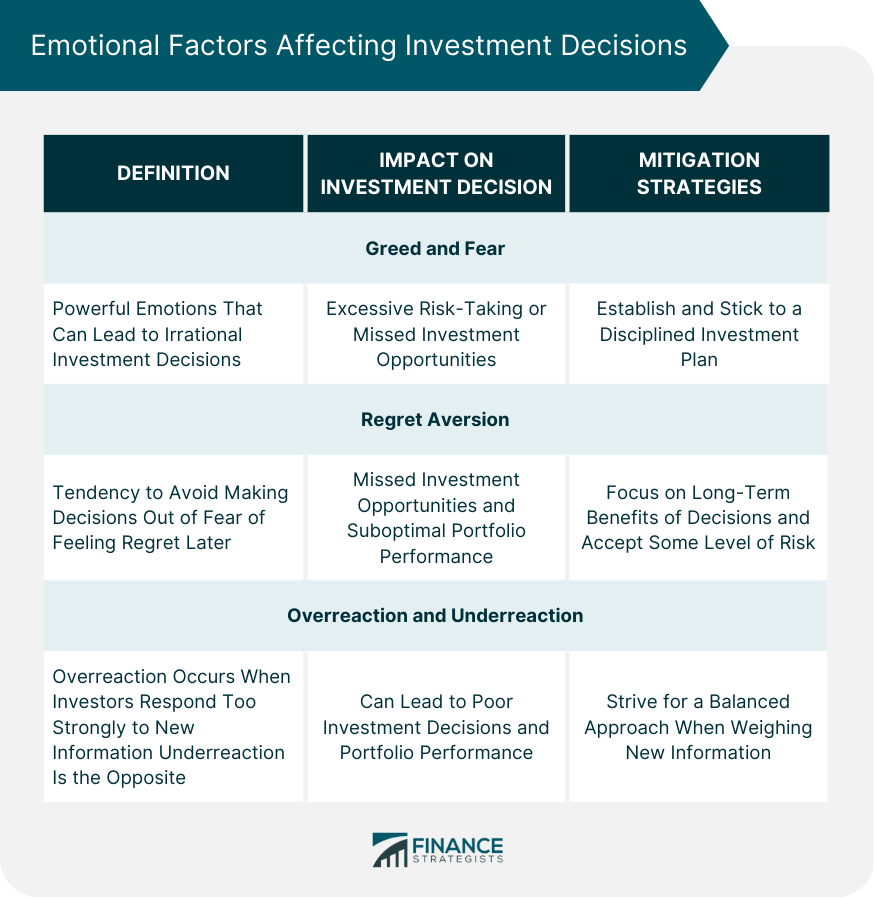

Emotional Factors Affecting Investment Decisions

Greed and Fear

Regret Aversion

Overreaction and Underreaction

Impact of Investor Psychology on Market Behavior

Market Anomalies

Market Bubbles and Crashes

Market Efficiency Debate

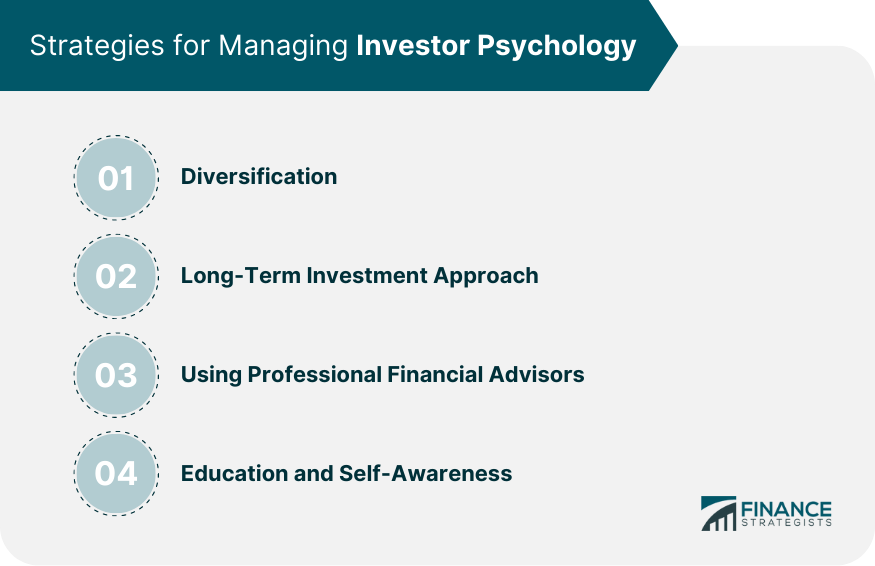

Strategies for Managing Investor Psychology

Diversification

Long-Term Investment Approach

Using Professional Financial Advisors

Education and Self-Awareness

Final Thoughts

Investor Psychology FAQs

Investor psychology is the study of the emotional and cognitive factors that influence the decision-making process of investors. It refers to the mental and emotional factors that influence an investor's decision-making process when it comes to buying, holding, or selling investments.

Cognitive biases are systematic errors in thinking that can affect investors' judgment and decision-making. These biases often lead to irrational investment choices, undermining the potential for financial success.

Greed, fear, regret aversion, overreaction, and underreaction are some emotional factors that can affect investment decisions.

Investors can use several strategies to manage their investor psychology, such as diversification, a long-term investment approach, using professional financial advisors, and improving financial education and self-awareness.

Investor psychology affects individual investors and contributes to broader market behavior, including market anomalies, bubbles, and crashes. Understanding the impact of investor psychology on market behavior is crucial for making informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.