Retirement scenario analysis is a crucial aspect of retirement planning that helps individuals evaluate and prepare for various financial outcomes during their retirement years. This process involves examining multiple scenarios based on different assumptions about factors such as investment returns, inflation, and life expectancy. A thorough retirement scenario analysis can help individuals make informed decisions about their retirement strategies, reducing the likelihood of financial shortfalls and increasing the chances of achieving their financial goals. One of the first steps in retirement scenario analysis is determining your desired retirement age and estimating your life expectancy. This information will help you calculate the number of years you can expect to spend in retirement, which is essential for estimating your retirement income needs. Once you have determined your retirement age and life expectancy, the next step is to estimate your annual retirement income needs. This can be done by calculating your anticipated living expenses, including housing, food, healthcare, and any additional financial goals you may have during retirement, such as travel or supporting family members. Your current savings and investment portfolio form the basis of your retirement scenario analysis. This information, combined with the key assumptions outlined below, will help you project the potential growth of your savings over time. Social Security benefits are an essential component of retirement income for many individuals. Estimating your future benefits based on your earnings history and projected retirement age will help you determine how much income you can expect from this source. If you are eligible for a pension or other retirement benefits from an employer or government program, these should also be included in your retirement scenario analysis. Inflation can significantly impact your retirement savings and income needs. When performing a retirement scenario analysis, it's essential to consider how inflation rates and cost of living adjustments may affect your financial projections. Your retirement scenario analysis should take into account the expected rates of return on your investments, which can greatly influence the growth of your savings and the amount of income you can generate during retirement. Taxes can have a significant impact on your retirement savings and income. Be sure to consider the tax implications of your various retirement scenarios, including potential changes to tax laws in the future. Deterministic modeling involves using fixed assumptions to project your retirement outcomes. This approach has limitations, as it doesn't account for the variability and uncertainty inherent in financial markets and economic conditions. Stochastic modeling, such as Monte Carlo simulations, can provide a more comprehensive analysis of potential retirement scenarios by incorporating the variability and uncertainty of key factors, such as investment returns and inflation. Sensitivity analysis involves stress-testing specific variables and analyzing the potential impact of changes in those variables on your retirement outcomes. This can help you identify areas of your retirement plan that may require adjustments to improve your likelihood of success. The conservative scenario assumes lower expected rates of return, higher inflation, and higher healthcare costs. This scenario provides a more cautious outlook for your retirement planning. The moderate scenario incorporates average expected rates of return, average inflation, and average healthcare costs. This scenario represents a middle-of-the-road approach to retirement planning. The aggressive scenario assumes higher expected rates of return, lower inflation, and lower healthcare costs. This scenario presents a more optimistic outlook for your retirement planning. After developing conservative, moderate, and aggressive scenarios, it's important to compare and contrast the outcomes to determine the probability of success for each scenario. This analysis can help you identify potential adjustments needed to meet your retirement goals. Proper asset allocation and diversification can help mitigate the risks associated with investing and improve the likelihood of achieving your desired retirement outcomes. Adopting effective saving and investing strategies can help you grow your retirement savings and reach your financial goals. Incorporating tax-efficient strategies into your retirement planning can help you minimize your tax liability and maximize your retirement income. Insurance products, such as annuities and long-term care insurance, can provide additional income streams and protection during retirement. Estate planning is an essential aspect of retirement planning that ensures your assets are distributed according to your wishes and minimizes the potential tax burden on your heirs. It's crucial to review and update your retirement scenario analysis assumptions periodically to ensure they remain relevant and accurate. As you monitor your retirement plan, be prepared to make adjustments as needed to adapt to life changes, market conditions, and any deviations from your initial assumptions. Your retirement plan should be flexible enough to adapt to unexpected life changes and market conditions, ensuring that you remain on track to achieve your financial goals. Retirement scenario analysis serves as a vital component in securing a stable financial future. By evaluating a range of potential outcomes based on varying assumptions, individuals can make well-informed decisions about their retirement strategies, thereby increasing their likelihood of achieving their desired financial goals and minimizing potential shortfalls. This process entails establishing retirement goals, identifying key variables and assumptions, employing various analysis techniques, developing and evaluating different scenarios, and implementing effective retirement strategies. Regular monitoring and adjustment of the retirement plan ensures that individuals remain adaptable to life changes and market conditions while seeking professional guidance and support can further enhance the success of their retirement planning.What Is Retirement Scenario Analysis?

Establishing Retirement Scenario Analysis

Determining Retirement Age and Life Expectancy

Estimating Annual Retirement Income Needs

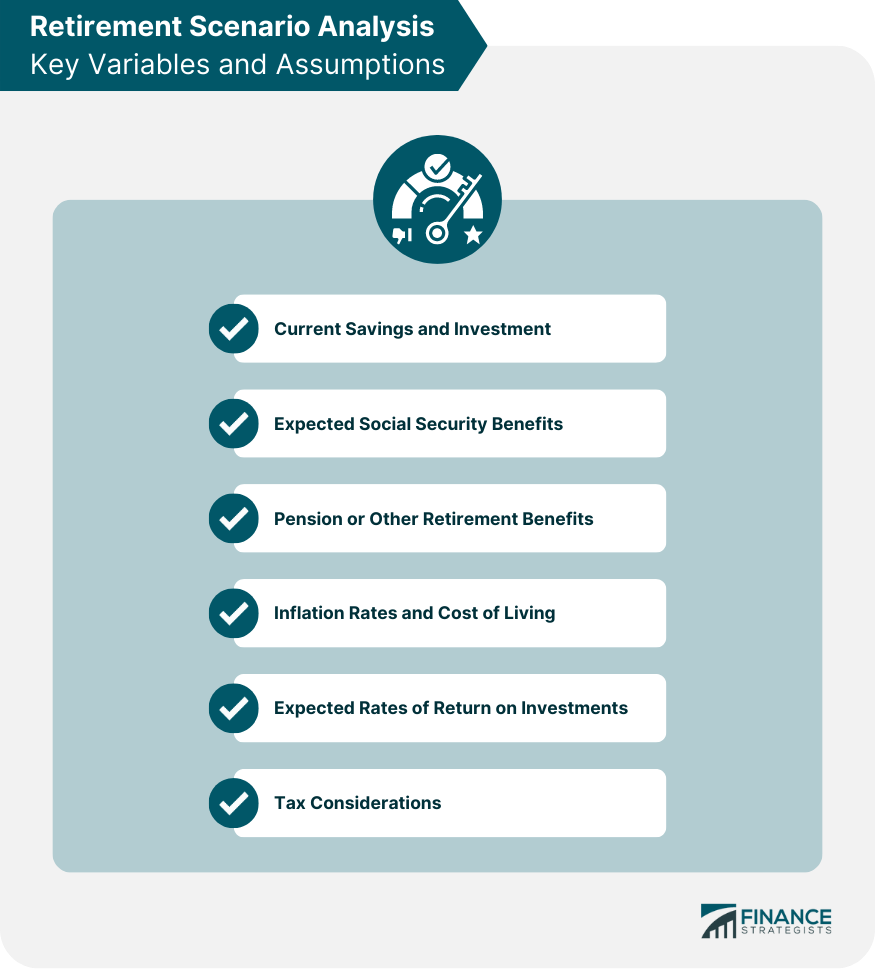

Retirement Scenario Analysis Key Variables and Assumptions

Current Savings and Investment Portfolio

Expected Social Security Benefits

Pension or Other Retirement Benefits

Inflation Rates and Cost of Living Adjustments

Expected Rates of Return on Investments

Tax Considerations

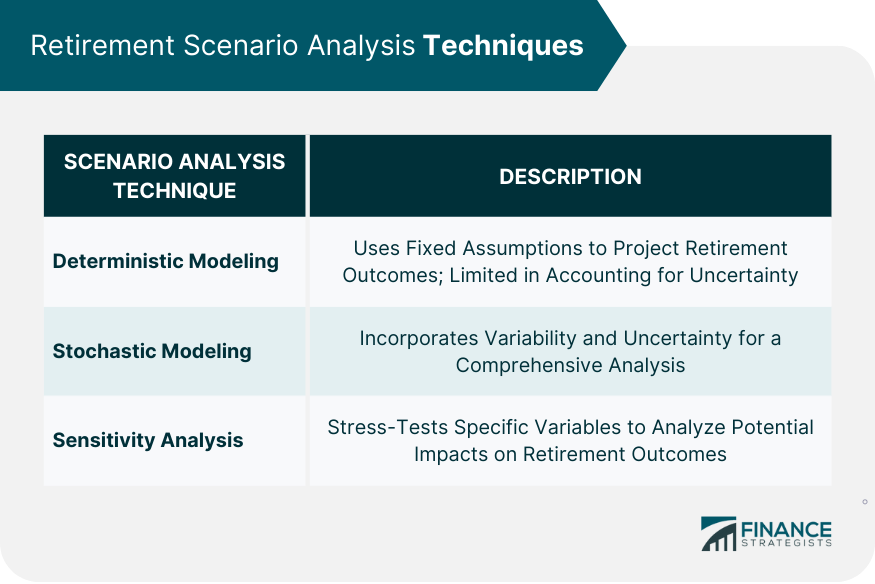

Retirement Scenario Analysis Techniques

Deterministic Modeling

Stochastic Modeling (Monte Carlo Simulations)

Sensitivity Analysis

Developing and Evaluating Retirement Scenarios Analysis

Conservative Scenario

Moderate Scenario

Aggressive Scenario

Implementing Retirement Scenario Strategies

Asset Allocation and Diversification

Saving and Investing Strategies

Tax-Efficient Retirement Planning

Utilizing Insurance Products

Estate Planning Considerations

Monitoring and Adjusting Retirement Scenario Analysis

Periodic Reviews and Updates to Assumptions

Making Adjustments as Needed

Adapting to Life Changes and Market Conditions

Conclusion

Retirement Scenario Analysis FAQs

Retirement scenario analysis is a critical aspect of retirement planning that involves examining various financial outcomes during retirement based on different assumptions. This process helps individuals make informed decisions about their retirement strategies, increasing the chances of achieving their financial goals and reducing the likelihood of financial shortfalls.

Retirement scenario analysis considers key variables and assumptions, such as expected rates of return on investments, inflation rates, and cost of living adjustments. By incorporating these factors into multiple scenarios, individuals can evaluate the potential impact of different economic conditions on their retirement outcomes.

The primary techniques used in retirement scenario analysis include deterministic modeling, which involves fixed assumptions, stochastic modeling (such as Monte Carlo simulations) that accounts for variability and uncertainty, and sensitivity analysis, which stress-tests specific variables to analyze their potential impact on retirement outcomes.

Retirement scenario analysis can guide individuals in implementing effective retirement strategies, such as proper asset allocation and diversification, saving and investing strategies, tax-efficient planning, and utilizing insurance products. By comparing different scenarios, individuals can identify areas of their retirement plan that may require adjustments to improve their likelihood of success.

It's essential to periodically review and update your retirement scenario analysis assumptions to ensure their relevance and accuracy. This frequency may vary depending on individual circumstances, but generally, it's recommended to review your retirement plan at least once a year or whenever significant life changes or market conditions occur that could impact your retirement goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.