A periodic payment plan is a financial strategy where an individual regularly contributes or withdraws money from an investment account. This method helps in managing risk and encourages disciplined investing or spending. Periodic payment plans are designed to help individuals accumulate wealth or provide a steady income. The benefits include dollar-cost averaging, budgeting ease, and a reduced emotional impact on investment decisions. An annuity is a financial product that provides a steady stream of income, typically during retirement. They are contracts between an individual and an insurance company. Immediate annuities start paying out income shortly after purchase, providing immediate financial security. They are suitable for individuals seeking immediate income during retirement. Deferred annuities accumulate earnings until a future date, at which point they start paying out. They are ideal for long-term growth and tax-deferred savings. A systematic investment plan is a method of investing in mutual funds through regular, fixed contributions. They help investors capitalize on market fluctuations and reduce risk. Fixed SIPs involve investing a predetermined amount at regular intervals. This approach enables investors to benefit from dollar-cost averaging, irrespective of market conditions. Flexible SIPs allow investors to adjust their contributions based on market conditions or personal financial situations. This strategy provides greater control and customization for the investor. A systematic withdrawal plan is a strategy to withdraw a specific amount from an investment at regular intervals. It can provide a steady income during retirement or other life stages. Fixed SWPs involve withdrawing a predetermined amount at regular intervals. This approach provides a consistent income stream and can help preserve the investment's principal. Variable SWPs allow investors to adjust withdrawal amounts based on market conditions or personal financial needs. This flexibility can help maintain a balance between income generation and capital preservation. The principal amount is the initial sum invested or the remaining balance of an investment. It is the foundation on which interest and returns are generated. The interest rate is the percentage at which an investment grows or pays out income. It is a crucial determinant of the overall return on investment. Payment frequency refers to how often contributions or withdrawals are made. Common frequencies include monthly, quarterly, or annually and can impact the total return on investment. The payment amount is the specific sum contributed or withdrawn during each payment cycle. It can affect the speed at which wealth is accumulated or depleted. The duration of the plan is the time period over which contributions or withdrawals are made. Longer durations can lead to greater wealth accumulation or more sustainable income streams. Taxes can significantly impact the net return on investment. Understanding the tax treatment of various payment plans is crucial for optimizing returns and minimizing liabilities. Individuals should consider their specific financial goals, such as retirement income, wealth accumulation, or funding a child's education, when selecting a payment plan. Risk tolerance is the level of investment risk an individual is willing to accept. A suitable payment plan should align with an investor's risk appetite and financial objectives. The time horizon is the period over which an individual plans to invest or receive income. Longer time horizons may allow for more aggressive investments, while shorter time horizons may necessitate more conservative strategies. Liquidity needs refer to an individual's requirement for readily accessible funds. Investors should consider their short-term and long-term liquidity needs when choosing a payment plan to ensure it aligns with their financial goals. As mentioned earlier, taxes can significantly impact the net return on investment. Investors should understand how their chosen payment plan is taxed to minimize tax liabilities and optimize returns. Various costs and fees, such as management fees, sales charges, and account maintenance fees, can erode the overall return on investment. Investors should compare payment plans and choose one with reasonable costs and fees. Dollar-cost averaging involves investing a fixed amount at regular intervals, reducing the impact of market volatility. This approach can result in a lower average cost per share over time, potentially leading to higher returns. Periodic payment plans encourage consistent contributions, promoting disciplined investing habits. This approach can help investors avoid impulsive decisions and maintain a long-term perspective. Periodic payment plans facilitate long-term wealth accumulation by allowing investors to benefit from the power of compounding. Consistent investments, coupled with market growth, can lead to substantial wealth creation over time. Some payment plans offer flexibility in terms of contribution or withdrawal amounts, allowing investors to adapt to changing financial circumstances. This adaptability can help maintain an appropriate investment strategy. By spreading investments over time, periodic payment plans can help reduce exposure to market risks. This approach allows investors to benefit from market fluctuations without exposing their entire portfolio to short-term volatility. Periodic payment plans are subject to market fluctuations, which can lead to fluctuations in investment values. However, by consistently investing over time, investors can mitigate the impact of these fluctuations. Inflation risk is the possibility that the rate of inflation will outpace investment returns, eroding purchasing power. To counteract inflation risk, investors should select payment plans with the potential for higher returns. Interest rate risk is the potential for changes in interest rates to negatively impact investment values. Investors should consider this risk when choosing fixed-income investments, such as bonds or annuities. Credit risk is the potential for an issuer to default on their financial obligations. Investors should consider the creditworthiness of issuers when selecting investments for their payment plans. Liquidity risk refers to the possibility of being unable to sell an investment quickly and at a reasonable price. Investors should consider this risk when selecting investments for their payment plans, particularly if they have short-term liquidity needs. Periodic payments can provide a reliable income stream during retirement, ensuring financial security and stability. They can help retirees maintain their desired lifestyle and cover essential expenses. There are various strategies to generate a steady income during retirement, including annuities, dividend-paying stocks, bonds, and real estate investments. A diversified approach can help reduce risk and ensure consistent income. Annuities can provide a guaranteed income stream during retirement, offering financial stability and predictability. They can be tailored to meet an individual's specific income needs and preferences. Dividend-paying stocks can provide a growing income stream, as well as the potential for capital appreciation. This strategy can help retirees keep pace with inflation and maintain their purchasing power. Bonds can provide a steady income through interest payments while preserving capital. However, they are subject to interest rate risk, and investors should consider this when selecting bonds for their retirement income strategy. Real estate investments, such as rental properties or real estate investment trusts (REITs), can generate passive income and potential appreciation. They can also provide diversification and hedge against inflation. Retirees should consider the tax implications of their income sources and strive to minimize taxes and fees. This may involve strategically drawing from different accounts, such as tax-deferred and tax-free accounts, to optimize after-tax income. Periodic payment plans offer numerous benefits, such as dollar-cost averaging, disciplined investing, and long-term wealth accumulation. However, they also come with potential drawbacks and risks, such as market fluctuations and inflation risks. Several strategies can generate retirement income, including annuities, dividend-paying stocks, bonds, and real estate investments. Ultimately, the selection of a periodic payment plan should be based on individual needs, goals, and risk tolerance. By carefully considering various factors, such as investment objectives, time horizon, and tax implications, investors can make informed decisions and select the most suitable payment plan to achieve their financial goals. Achieving your financial goals can be complex and time-consuming. Seeking professional wealth management services can help you navigate the intricacies of periodic payment plans and other investment strategies.What Is a Periodic Payment Plan?

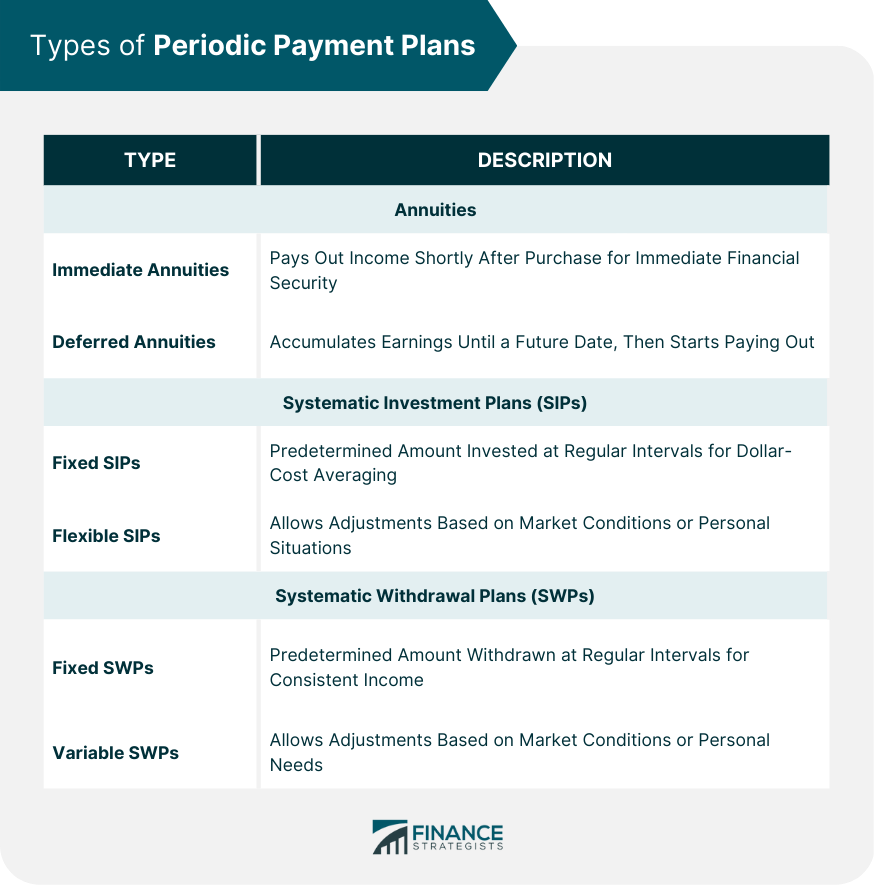

Types of Periodic Payment Plans

Annuities

Immediate Annuities

Deferred Annuities

Systematic Investment Plans (SIPs)

Fixed SIPs

Flexible SIPs

Systematic Withdrawal Plans (SWPs)

Fixed SWPs

Variable SWPs

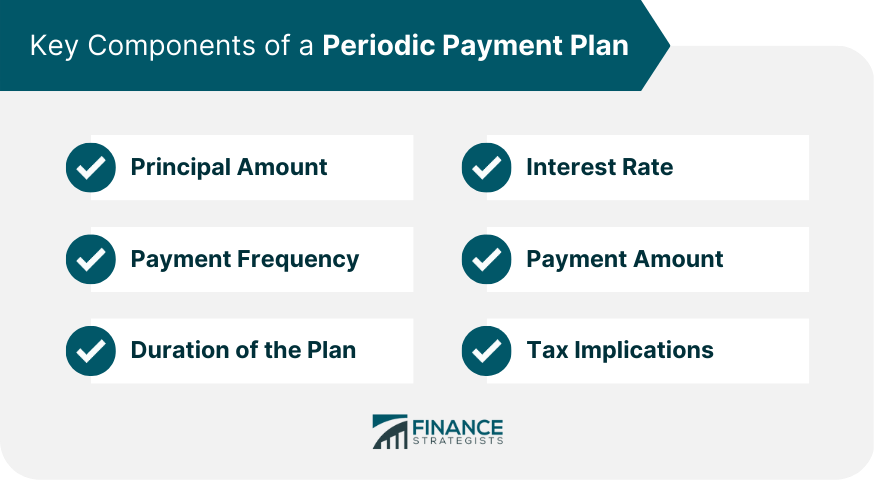

Key Components of a Periodic Payment Plan

Principal Amount

Interest Rate

Payment Frequency

Payment Amount

Duration of the Plan

Tax Implications

Factors to Consider When Choosing a Periodic Payment Plan

Investment Objectives

Risk Tolerance

Time Horizon

Liquidity Needs

Tax Implications

Costs and Fees

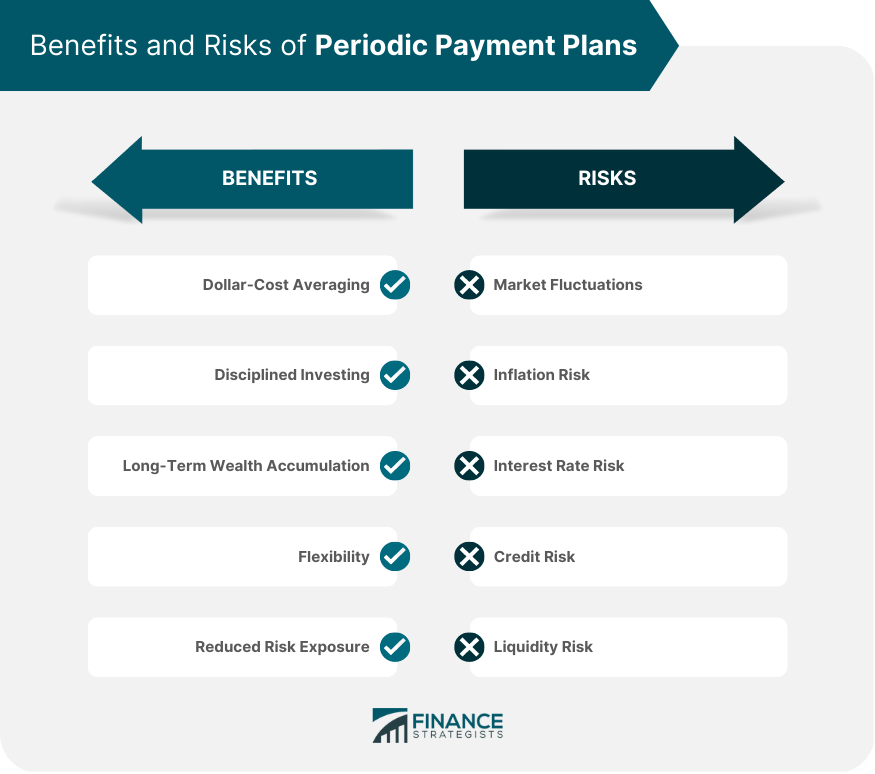

Benefits of Periodic Payment Plans

Dollar-Cost Averaging

Disciplined Investing

Long-Term Wealth Accumulation

Flexibility

Reduced Risk Exposure

Potential Drawbacks and Risks of Periodic Payment Plans

Market Fluctuations

Inflation Risk

Interest Rate Risk

Credit Risk

Liquidity Risk

Periodic Payment Plans in Retirement Planning

Importance of Periodic Payments in Retirement

Strategies for Creating a Retirement Income Stream

Annuities

Dividend-Paying Stocks

Bonds

Real Estate Investments

Managing Taxes and Fees in Retirement

Final Thoughts

Periodic Payment Plan FAQs

A Periodic Payment Plan is a financial strategy that involves regularly contributing or withdrawing money from an investment account. It promotes disciplined investing, helps manage risk, and encourages long-term wealth accumulation by leveraging dollar-cost averaging and reducing the emotional impact on investment decisions.

The main types of Periodic Payment Plans include annuities, systematic investment plans (SIPs), and systematic withdrawal plans (SWPs). Annuities provide a steady income stream, typically during retirement. SIPs involve regular, fixed contributions to mutual funds, while SWPs enable the withdrawal of specific amounts from an investment at regular intervals.

To select the right Periodic Payment Plan, consider factors such as your investment objectives, risk tolerance, time horizon, liquidity needs, tax implications, and costs and fees associated with the plan. Evaluating these factors will help you choose a plan that aligns with your unique financial goals and risk appetite.

Benefits of Periodic Payment Plans include dollar-cost averaging, disciplined investing, long-term wealth accumulation, flexibility, and reduced risk exposure. Potential drawbacks and risks include market fluctuations, inflation risks, interest rate risks, credit risks, and liquidity risks.

Periodic Payment Plans can play a crucial role in retirement planning by providing a reliable income stream during retirement. Strategies for creating a retirement income stream include annuities, dividend-paying stocks, bonds, and real estate investments. By diversifying your income sources and managing taxes and fees, you can optimize your retirement income and ensure financial security.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.