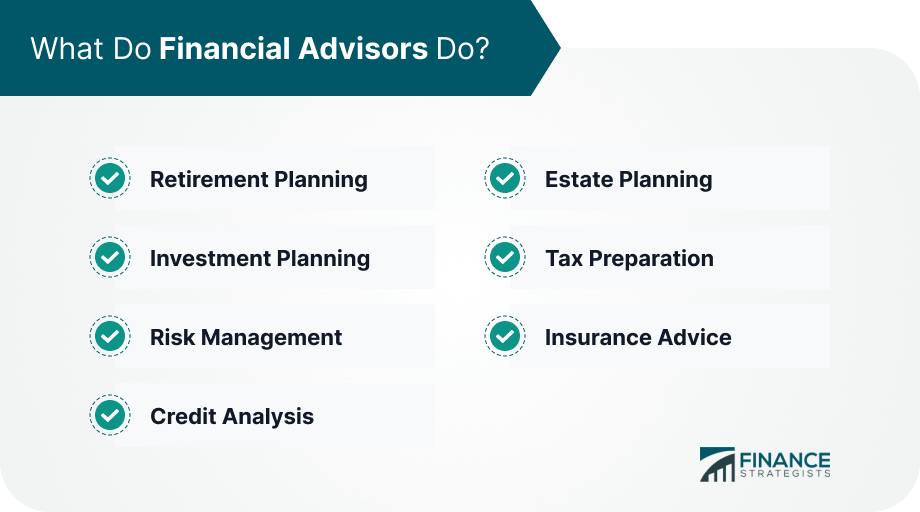

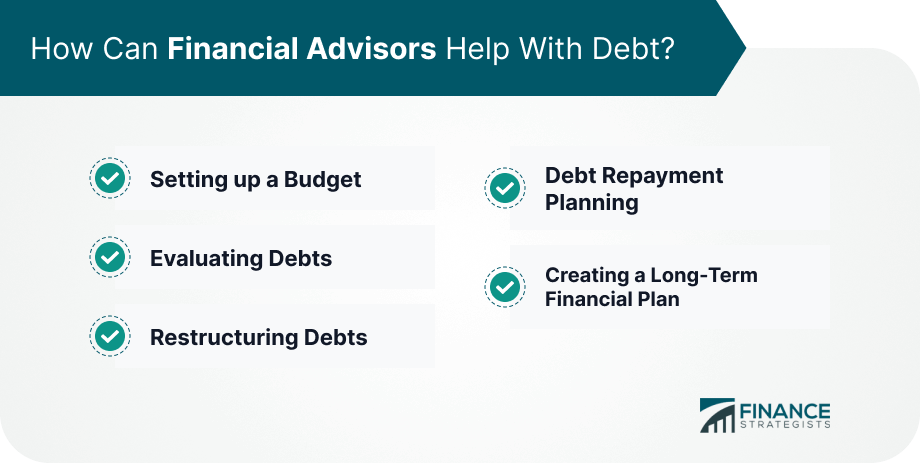

Financial advisors are professionals who offer guidance regarding a range of financial decisions. In order to do their job properly, they must have a strong grasp of the current economic environment and must understand customers’ goals, risk tolerance levels, time horizons, and financial profiles in detail. Customer debt is a common financial issue that many people struggle with. Debt advisors might help these individuals by evaluating debts in terms of interest rates and other factors in order to determine which ones are manageable and which can potentially cause trouble down the road. In addition to this type of analysis, the debt advisor may also help clients set up a budget or create a repayment plan for their debts. During long-term planning sessions, advisors may even be able to assist clients with creating plans for achieving important life goals such as early retirement or purchasing a home. Have a financial question? Click here. Financial advisors mainly help their clients come up with a comprehensive financial plan in order to prepare for the future. Different advisors may provide different types of advice; however, the most common kinds of services that they offer include the following: Financial advisors help individuals create a plan for their retirement by estimating how much money they will need to have saved, and figuring out when they should start withdrawing from their nest eggs. Advisors can help individuals invest their money in a way that will provide the best possible chance of success. This may include choosing stocks, bonds, or other types of investments that are likely to increase in value over time. Advisors help their clients create plans for safeguarding their money in the event of an emergency, such as a natural disaster or medical problem. They may also suggest strategies that will allow individuals to minimize risk while maximizing returns on their investments. Advisors can help people get their finances in order by analyzing their credit score and helping them work on improving it if necessary. Additionally, advisors can provide guidance on which types of loans are the best for a given individual’s needs. Financial advisors can also help individuals create a plan for their estate so that they can minimize the tax implications of passing on their assets to loved ones. Advisors can also help individuals minimize their tax burden by recommending strategies such as contributing to certain types of investment accounts or taking advantage of tax breaks. Lastly, many advisors offer advice on insurance products, such as life insurance, health insurance, and property and casualty insurance. Debt advisors may help debtors by evaluating their debts to see if any can be eliminated or consolidated. Advisors may also help individuals create a budget that will allow them to make timely payments on all of their outstanding bills. In some cases, they may even be able to negotiate with creditors in order to secure more favorable terms for the debtor. One of the primary ways that financial advisors help those who are struggling with debt is by helping them set up a budget. This includes working out a realistic plan for what the individual can spend and how much should be set aside to pay off debts. Advisors may also help their clients evaluate each of their debts in terms of interest rates, minimum monthly payments, or other factors. After determining which ones are the most manageable, the advisor will likely notify the debtor of his or her findings and make suggestions based on this analysis. Financial advisors might also work with creditors to negotiate more favorable repayment terms for their client's accounts. Depending on the type of debt that needs restructuring and the status of negotiations between creditor and debtor, advisors may either be one-on-one or as part of a group. In some cases, it may be necessary for the debtor to take more extreme measures in order to get their debt under control. In these situations, advisors can help create a plan that details exactly how much needs to be paid each month and when the entire debt will be repaid. Advisors may also help individuals create long-term financial plans that go beyond just getting out of debt. This may include setting aside money for retirement, investing in property or other assets, or simply budgeting more effectively. A financial advisor is a specifically qualified financial specialist who underwent trainings and certifications to best serve their clients. Their services do come with a cost and may differ from each other depending on the financial advisor you are working with. Learn more about how financial advisors are getting paid in this article: Financial Advisor Fees Ultimately, financial advisors can offer a wide variety of services that can be beneficial to those who are struggling with debt. By working with an advisor, debtors can develop a plan that is tailored specifically to their needs and gives them the best chance of becoming debt-free. What Are Financial Advisors?

What Do Financial Advisors Do?

Retirement Planning

Investment Planning

Risk Management

Credit Analysis

Estate Planning

Tax Preparation

Insurance Advice

How Can Financial Advisors Help With Debt?

Setting up a Budget

Evaluating Debts

Restructuring Debts

Debt Repayment Planning

Creating a Long-Term Financial Plan

The Bottom Line

Financial Advisor’s Role FAQs

A Financial Advisor helps individuals and businesses make informed financial decisions by providing guidance on investments, insurance, taxes, retirement planning, estate planning, and other areas of personal finance. They analyze an individual’s or organization’s current financial situation and develop strategies to help them reach their long-term financial goals.

A qualified Financial Advisor should have a degree in Finance or Economics and ideally be professionally certified by the appropriate industry body such as CFP, CFA, etc. Additionally, they should have considerable experience in the field, preferably from a reputable financial services firm.

A Financial Advisor can help individuals and businesses create realistic budgets that are aligned with their short-term and long-term financial goals. They will also provide advice on how to manage expenses and debts, as well as develop strategies to save money.

Financial Advisors can provide guidance on which investments are appropriate for an individual’s or business’s current financial situation and risk tolerance. They will also advise on the best methods to diversify investments, which can help reduce financial risk.

Good communication and interpersonal skills are essential for any Financial Advisor. They also need to have a good understanding of the various financial products available, as well as in-depth knowledge of taxation and legal regulations. Finally, they should be able to analyze financial data and develop strategies accordingly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.