Tail risk refers to the likelihood of extreme events causing significant losses in financial markets, which are typically rare and unpredictable. These events fall in the tails of a probability distribution, thus the term "tail risk." Tail risk is essential in finance as it highlights the potential for severe losses that can impact investors, financial institutions, and the overall stability of financial markets. Understanding and managing tail risk helps mitigate adverse consequences and maintain financial resilience. Fat-tailed distributions are probability distributions characterized by more frequent extreme events compared to a normal distribution. Tail risk is closely related to fat-tailed distributions, as these distributions are more likely to generate significant losses due to their increased probability of extreme events. Market events and shocks, such as economic crises, political turmoil, or natural disasters, can trigger tail risk events. These unexpected occurrences can lead to substantial market fluctuations and losses for investors. Illiquidity and market disruptions can contribute to tail risk, as they make it difficult for investors to buy or sell assets. This can exacerbate market volatility and lead to more significant losses during extreme events. Excessive leverage and interconnectedness among financial institutions can amplify tail risk. When highly leveraged institutions face losses, they may need to liquidate their positions, causing a domino effect that intensifies market volatility and losses. Behavioral biases and herding can also contribute to tail risk. Investors who follow the crowd or act based on emotions can create market bubbles or crashes, leading to extreme events and significant financial losses. VaR is a statistical measure that estimates the maximum potential loss of a portfolio over a specified time horizon and confidence level. VaR is commonly used to assess tail risk by quantifying the likelihood of large losses. Conditional Value at Risk, also known as Expected Shortfall, is a risk measure that estimates the average loss during extreme events, considering only the tail of the loss distribution. CVaR provides a more comprehensive assessment of tail risk compared to VaR. Extreme Value Theory is a statistical approach used to model and analyze extreme events in financial markets. EVT helps measure tail risk by focusing on the tails of distribution and estimating the probability of rare, extreme events. Stress testing and scenario analysis are techniques used to evaluate the impact of extreme events on a portfolio or financial institution. These methods help measure tail risk by simulating adverse market conditions and analyzing the potential losses under various scenarios. Portfolio diversification is a crucial strategy for managing tail risk, as it involves allocating investments across various asset classes, sectors, and regions. This approach helps reduce the overall portfolio risk by mitigating the impact of extreme events on any single investment. Options and derivatives, such as put options and futures contracts, can be used as hedging strategies to protect against tail risk. These financial instruments allow investors to limit potential losses by transferring the risk of adverse price movements to other market participants. Tail risk funds are specialized investment vehicles designed to profit during extreme market events. By investing in these funds, investors can offset potential losses in their portfolios and mitigate the impact of tail risk. Risk budgeting and capital allocation involve setting limits on the amount of risk an investor or institution is willing to take. Investors can better manage tail risk and maintain a balanced portfolio by allocating capital based on risk tolerance. Effective liquidity management is crucial for managing tail risk, as it ensures that investors can quickly buy or sell assets during extreme events. Maintaining adequate cash reserves and investing in liquid assets can help mitigate the impact of tail risk on a portfolio. Black Swan events are rare, unpredictable occurrences with significant financial market consequences. Coined by Nassim Nicholas Taleb, the term highlights the limitations of traditional risk management models in capturing extreme events. While tail risk refers to the likelihood of extreme events causing significant losses, Black Swan events specifically describe rare, unforeseeable occurrences with substantial impact. Tail risk is a broader concept that encompasses all extreme events, while Black Swan events are a specific subset of tail risk events. Preparing for Black Swan events involves adopting a flexible and adaptive risk management approach, considering traditional models' limitations. This may include diversifying investments, maintaining liquidity, and continuously reassessing risk exposure in light of evolving market conditions. Tail risk is a crucial aspect of financial risk management, emphasizing the need for understanding and managing the potential for extreme market events. Portfolio diversification, hedging strategies, and liquidity management are essential tools for mitigating tail risk. Investors and financial institutions must continuously adapt their risk management strategies to account for the potential impact of tail risk. Future developments in tail risk research may focus on improving risk measurement techniques, exploring the causes of extreme events, and developing new risk management strategies to better address tail risk. Investors seeking to protect their portfolios from tail risk events should consider working with wealth management professionals. What Is Tail Risk?

Causes of Tail Risk

Market Events and Shocks

Illiquidity and Market Disruptions

Excessive Leverage and Interconnectedness

Behavioral Biases and Herding

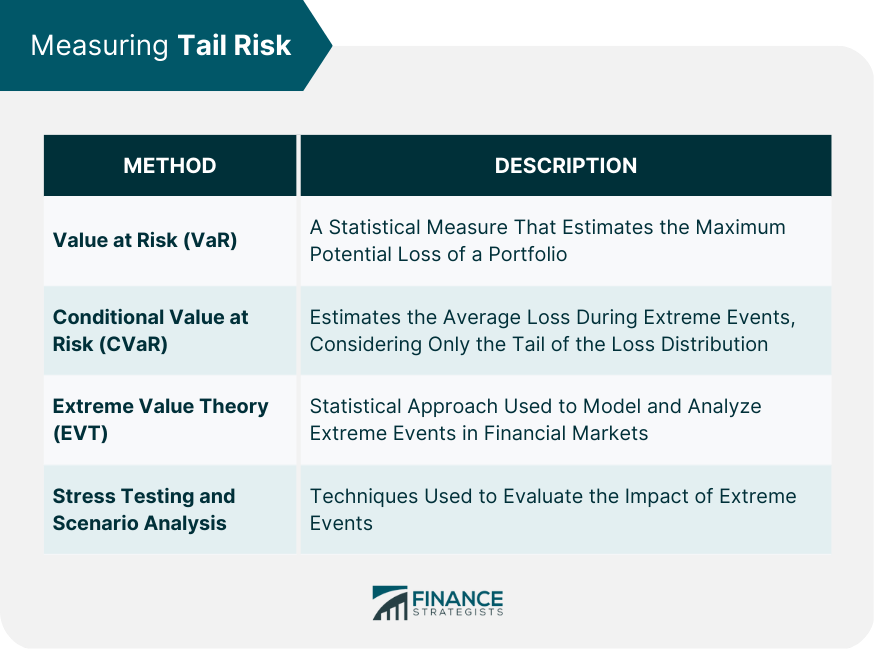

Measuring Tail Risk

Value at Risk (VaR)

Conditional Value at Risk (CVaR)

Extreme Value Theory (EVT)

Stress Testing and Scenario Analysis

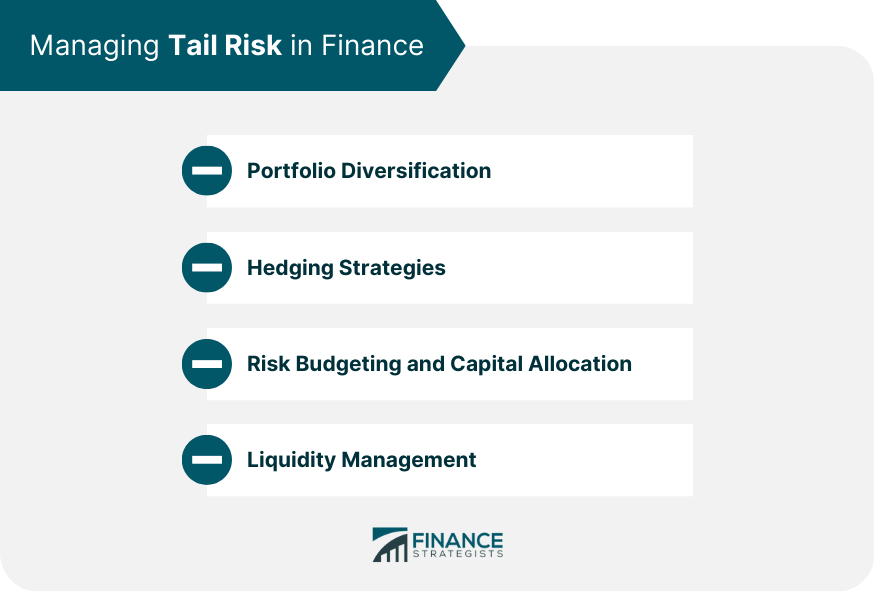

Managing Tail Risk in Finance

Portfolio Diversification

Hedging Strategies

Options and Derivatives

Tail Risk Funds

Risk Budgeting and Capital Allocation

Liquidity Management

Tail Risk and Black Swan Events

Differences Between Tail Risk and Black Swan Events

Preparing for Black Swan Events

Final Thoughts

Tail Risk FAQs

Tail risk refers to the likelihood of extreme events causing significant losses in financial markets, which are typically rare and unpredictable.

Fat-tailed distributions are probability distributions characterized by more frequent extreme events compared to a normal distribution. Tail risk is closely related to fat-tailed distributions, as these distributions are more likely to generate significant losses due to their increased probability of extreme events.

Market events and shocks, illiquidity and market disruptions, excessive leverage and interconnectedness among financial institutions, and behavioral biases and herding are some causes of tail risk.

Tail risk can be managed in finance through portfolio diversification, hedging strategies, tail risk funds, risk budgeting, and capital allocation, and liquidity management.

Tail risk refers to the likelihood of extreme events causing significant losses, while black swan events specifically describe rare, unforeseeable occurrences with substantial impact. Tail risk is a broader concept that encompasses all extreme events, while black swan events are a specific subset of tail risk events.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.