Risk parity is an investment strategy that seeks to allocate risk equally across various asset classes within a portfolio, rather than focusing on traditional asset allocation methods that prioritize capital allocation. By balancing risk exposure, risk parity aims to enhance portfolio diversification and achieve more consistent, risk-adjusted returns over time. The primary goal of risk parity is to construct a portfolio that can withstand different market conditions and economic cycles. Risk parity helps investors achieve this goal by focusing on risk allocation rather than capital allocation, leading to improved diversification, more stable returns, and reduced portfolio volatility. Risk parity is grounded in several key principles, including the importance of diversification, the use of leverage to balance risk exposures, and the need for ongoing portfolio management and rebalancing to maintain risk parity over time. The primary asset classes in a Risk Parity portfolio are equities, fixed income, commodities, and alternatives. Each asset class has a unique risk and return profile that contributes to the overall risk of the portfolio. The allocation of each asset class is based on its contribution to the portfolio's overall risk, rather than its market value. Equities are a common component of Risk Parity portfolios. They provide exposure to the equity risk premium, which is the excess return that equities are expected to provide over a risk-free asset. Equities are typically more volatile than other asset classes and can have a significant impact on the portfolio's risk. Fixed income securities, such as bonds, provide exposure to interest rate risk and credit risk. They are typically less volatile than equities and can help to reduce the portfolio's overall risk. However, the low yields in the current market environment make it challenging to generate significant returns from fixed income investments alone. Commodities, such as gold, oil, and agricultural products, provide exposure to inflation risk and commodity-specific risks. They can be more volatile than fixed income securities but less volatile than equities. Commodities can provide diversification benefits to the portfolio, as they often have low correlations with other asset classes. Alternative investments, such as real estate, hedge funds, and private equity, provide exposure to unique risks and return opportunities. They can be less liquid and more complex than other asset classes, but they can provide diversification benefits and potentially higher returns. Risk factors are the underlying drivers of risk in a portfolio. The primary risk factors in a Risk Parity portfolio are equity risk, interest rate risk, inflation risk, and credit risk. Equity risk is the risk of loss from investing in stocks. It is typically the most significant risk factor in a portfolio and can have a significant impact on the portfolio's overall risk. Interest rate risk is the risk of loss from changes in interest rates. It is particularly relevant for fixed income securities, which have a fixed coupon rate. When interest rates rise, the value of fixed income securities typically falls, leading to a loss. Inflation risk is the risk of loss from the erosion of purchasing power due to inflation. It is particularly relevant for fixed income securities, as their returns may not keep up with inflation over time. Credit risk is the risk of loss from default or credit downgrade of a borrower. It is particularly relevant for fixed income securities that are issued by corporations or governments. Risk parity portfolios often incorporate investments from different geographic regions to further diversify risk exposures and reduce the impact of regional economic shocks. Investments across various industry sectors help spread risk and enhance portfolio diversification. Allocating investments across multiple risk factors can further reduce portfolio risk and improve stability. The first step in implementing risk parity is to identify the investor's risk tolerance, which will inform the risk budgeting process and guide the construction of the risk parity portfolio. With risk tolerances established, the risk budget is allocated across various asset classes, focusing on achieving equal risk contribution from each asset class. Risk parity portfolios are constructed by optimizing asset allocation to achieve the desired risk balance, typically using advanced quantitative methods and optimization algorithms. In some cases, leverage may be employed to balance risk exposures across asset classes, allowing for a greater allocation to lower-risk assets while maintaining the desired risk balance. Regular portfolio rebalancing is essential to maintain risk parity over time, as market conditions and risk exposures change. Risk parity portfolios should be evaluated based on risk-adjusted returns, which take into account both returns and risk exposures. Risk parity portfolios can be compared to traditional portfolios to assess their performance in terms of risk-adjusted returns and overall diversification. Benchmarking risk parity portfolios against appropriate indices or peer groups can help evaluate their performance relative to other investment strategies. Risk parity portfolios aim to reduce portfolio volatility by balancing risk exposures across various asset classes. By diversifying risk exposures, risk parity portfolios can help mitigate the impact of market downturns, potentially leading to more stable returns during periods of market turbulence. Risk parity portfolios are designed to achieve more consistent returns by balancing risk exposures, resulting in fewer extreme ups and downs in portfolio performance. By focusing on risk allocation rather than capital allocation, risk parity reduces the reliance on any single asset class, promoting a more balanced and resilient portfolio. Risk parity strategies allow for flexibility in asset allocation, making it easier for investors to adjust their portfolios in response to changing market conditions. Risk parity portfolios are designed to be adaptable to different market shifts and economic cycles, helping investors navigate various financial environments more effectively. Risk parity strategies can be complex to implement, requiring advanced analytical tools, optimization algorithms, and ongoing portfolio management. The complexity of risk parity strategies may be a barrier for some investors, particularly those who lack access to advanced analytical tools and resources. Risk parity strategies rely on historical data to estimate risk exposures, which may not accurately predict future risks or market behavior. Risk assessments and estimations are subject to potential inaccuracies, which could impact the effectiveness of risk parity strategies. The use of leverage in risk parity portfolios can increase risk exposure, potentially leading to greater losses during market downturns. While leverage can help balance risk exposures across asset classes, it can also amplify losses, making the portfolio more vulnerable to market fluctuations. Risk parity plays an increasingly important role in modern portfolio management as investors seek more diversified, resilient portfolios that can withstand market turbulence and deliver more consistent returns. When considering risk parity, investors should weigh the benefits, such as enhanced diversification and improved risk-adjusted returns, against the potential limitations, including complexity and leverage concerns. Ultimately, the suitability of risk parity as an investment strategy depends on individual investors' risk tolerances, financial objectives, and access to the necessary tools and resources to implement and manage risk parity portfolios effectively.What Is Risk Parity?

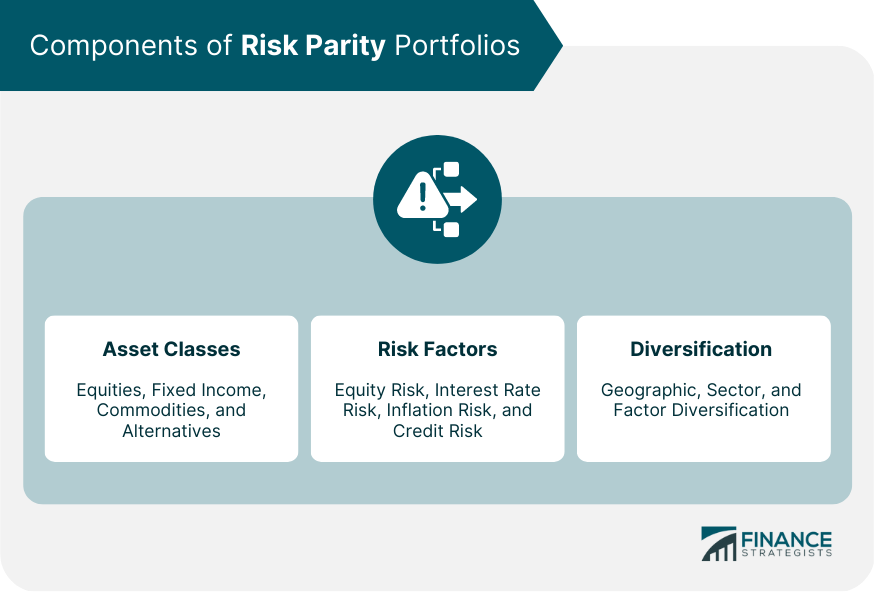

Components of Risk Parity Portfolios

Asset Classes

Equities

Fixed Income

Commodities

Alternatives

Risk Factors

Equity Risk

Interest Rate Risk

Inflation Risk

Credit Risk

Diversification

Geographic Diversification

Sector Diversification

Factor Diversification

Implementing Risk Parity in Portfolio Management

Risk Budgeting

Identifying Risk Tolerances

Allocating Risk Across Asset Classes

Portfolio Construction

Optimizing Asset Allocation

Leveraging

Rebalancing

Performance Measurement

Evaluating Risk-Adjusted Returns

Comparing With Traditional Portfolios

Benchmarking

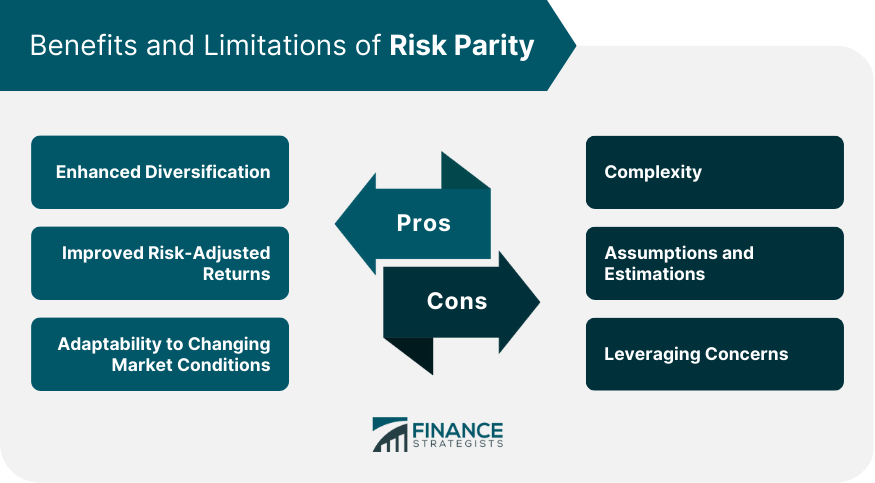

Benefits of Risk Parity in Portfolio Management

Enhanced Diversification

Reducing Portfolio Volatility

Mitigating the Impact of Market Downturns

Improved Risk-Adjusted Returns

Achieving More Consistent Returns

Reducing the Reliance on a Single Asset Class

Adaptability to Changing Market Conditions

Flexibility in Asset Allocation

Responding to Market Shifts and Economic Cycles

Criticisms and Limitations of Risk Parity

Complexity

Difficulty in Implementation

Requirement of Advanced Analytical Tools

Assumptions and Estimations

Dependence on Historical Data

Potential Inaccuracies in Risk Assessments

Leveraging Concerns

Increased Risk Exposure

Potential for Amplified Losses

Conclusion

Risk Parity FAQs

Risk Parity is an investment strategy that seeks to allocate portfolio risk equally across various asset classes. The goal is to create a balanced portfolio that can withstand different market conditions and generate consistent returns.

Risk Parity works by allocating investments across different asset classes, such as equities, bonds, and commodities, based on their risk contribution to the portfolio. Each asset class is assigned a weight that represents its contribution to the portfolio's overall risk, rather than its market value. This approach aims to balance the portfolio's risk exposure by giving more weight to less volatile asset classes and less weight to more volatile asset classes.

The main benefit of Risk Parity is the potential for better risk-adjusted returns. By balancing the portfolio's risk exposure, Risk Parity aims to generate consistent returns regardless of the market environment. Additionally, Risk Parity can offer diversification benefits by investing in different asset classes that have low correlations with each other.

The primary risk of Risk Parity is that it relies on the assumption that historical relationships between asset classes will continue in the future. If these relationships break down, the portfolio's risk could increase, leading to significant losses. Additionally, Risk Parity may not perform as expected in extreme market conditions, such as a financial crisis or a market bubble.

Risk Parity is suitable for long-term investors who are willing to tolerate short-term volatility for the potential of long-term returns. It may be particularly suitable for investors who are looking for a diversified portfolio that can generate consistent returns across different market conditions. However, it may not be suitable for investors who cannot tolerate short-term fluctuations in the portfolio's value or who have specific investment goals or constraints that are not compatible with the Risk Parity approach.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.