A tangency portfolio is a portfolio that lies at the point where the efficient frontier is tangent to the highest possible capital market line (CML) in the risk-return space. This portfolio offers the highest risk-adjusted return for a given level of risk, combining optimal diversification and asset allocation. The tangency portfolio is an essential concept in portfolio theory, as it represents the optimal mix of assets that maximize an investor's risk-adjusted returns. By constructing a tangency portfolio, investors can achieve the highest possible return for a given level of risk based on their risk tolerance and investment objectives. The efficient frontier is a curve that represents the set of optimal portfolios that offer the highest expected return for a given level of risk. The tangency portfolio is the specific portfolio on the efficient frontier with the highest Sharpe ratio and is tangent to the CML, a straight line that connects the risk-free rate with the tangency portfolio. Modern Portfolio Theory (MPT), developed by Harry Markowitz in the 1950s, is a framework for constructing optimal investment portfolios by considering the relationship between risk and return. MPT emphasizes the importance of diversification and asset allocation to achieve the highest possible risk-adjusted returns. In MPT, the tangency portfolio is the optimal portfolio that provides the highest risk-adjusted return among all possible portfolios. By constructing a tangency portfolio, investors can align their investment decisions with the principles of MPT, ensuring that they maximize their potential returns for a given level of risk. MPT relies on several key assumptions, such as the existence of a risk-free rate, rational and risk-averse investors, and normally distributed asset returns. These assumptions impact the construction and performance of the tangency portfolio, as they determine the shape of the efficient frontier and the location of the tangency portfolio on the risk-return space. The first step in constructing a tangency portfolio is to identify the relevant asset classes (e.g., stocks, bonds, real estate) and individual assets within those classes. This involves selecting a diverse set of investments that offer varying levels of risk and return, providing the foundation for effective diversification and asset allocation. To construct a tangency portfolio, investors must estimate the expected returns, standard deviations (a measure of risk), and correlations (the degree to which asset returns move together) for each asset in the portfolio. These estimates are typically based on historical data and can be used to calculate the portfolio's overall risk and return characteristics. Mean-variance analysis is a mathematical optimization technique used to identify the tangency portfolio. By inputting the expected returns, standard deviations, and correlations of the individual assets, investors can calculate the portfolio weights that maximize the portfolio's Sharpe ratio, which represents the risk-adjusted return of the portfolio. Once the efficient frontier has been identified through mean-variance analysis, the tangency portfolio can be selected as the point on the frontier that is tangent to the highest possible CML. This portfolio represents the optimal mix of assets that maximizes risk-adjusted returns, given the investor's risk tolerance and investment objectives. The tangency portfolio is a valuable tool for investment management and asset allocation, as it helps investors construct an optimal mix of assets that maximizes their risk-adjusted returns. By using the principles of the tangency portfolio, investment managers can develop tailored investment strategies for their clients, addressing their unique risk preferences and financial objectives. The tangency portfolio can also serve as a performance benchmark for investors and investment managers, allowing them to assess the effectiveness of their investment strategies and asset allocations. By comparing the performance of their portfolios to that of the tangency portfolio, investors can identify areas for improvement and adjust their strategies accordingly. The principles of the tangency portfolio can also be applied to risk management and hedging strategies, as they help investors identify and mitigate potential sources of risk within their portfolios. By constructing a tangency portfolio, investors can effectively diversify their investments, reducing their exposure to market volatility and other sources of risk. One of the primary benefits of the tangency portfolio is that it promotes diversification and risk reduction. By investing in a range of asset classes with varying levels of risk and return, the tangency portfolio can help investors reduce the overall volatility of their investments, mitigating the impact of market fluctuations on their portfolio. The tangency portfolio is designed to maximize risk-adjusted returns, which means that it offers the highest possible return for a given level of risk. This is particularly important for investors with specific risk tolerance and investment objectives, as it enables them to achieve their goals while minimizing the potential for loss. The tangency portfolio concept is applicable to both risk-averse and risk-seeking investors, as it can be tailored to suit different risk preferences and investment horizons. By adjusting the portfolio's asset allocation and risk exposure, investors can construct a tangency portfolio that aligns with their unique financial goals and risk tolerance. One limitation of the tangency portfolio approach is its reliance on historical data and assumptions to estimate expected returns, standard deviations, and correlations. This can lead to inaccuracies in the construction of the portfolio, as past performance may not accurately predict future results, and market conditions can change over time. The tangency portfolio is sensitive to changes in input parameters, such as expected returns, standard deviations, and correlations. Small changes in these estimates can significantly alter the composition of the portfolio and its risk-return profile, potentially leading to suboptimal investment decisions and outcomes. Another criticism of the tangency portfolio is the potential overreliance on mathematical optimization techniques, such as mean-variance analysis. These methods can sometimes result in overly complex and concentrated portfolios that may not perform as expected in real-world market conditions, particularly during periods of increased volatility and uncertainty. The tangency portfolio approach does not account for behavioral finance factors, such as investor psychology and cognitive biases, which can significantly influence investment decisions and outcomes. By ignoring these considerations, the tangency portfolio may not fully reflect the unique preferences and behaviors of individual investors, leading to suboptimal investment outcomes. An alternative to the tangency portfolio is an equal-weighted portfolio, in which each asset is assigned an equal weight within the portfolio. This approach is simpler to implement and can sometimes outperform the tangency portfolio, particularly during periods of market instability or when the underlying assumptions of the tangency portfolio are not accurate. Factor-based portfolios are another alternative to the tangency portfolio, focusing on specific factors (such as value, momentum, or quality) that have been shown to drive investment returns. By targeting these factors, investors can construct a portfolio that potentially outperforms the tangency portfolio and offers additional diversification benefits. Adaptive asset allocation strategies are dynamic approaches that adjust portfolio weights based on changing market conditions and evolving investor preferences. These strategies can provide a more flexible alternative to the tangency portfolio, as they allow investors to respond more quickly to changes in the market and better align their investments with their risk tolerance and financial objectives. The tangency portfolio is an essential concept in modern finance, representing the optimal mix of assets that maximizes risk-adjusted returns for a given level of risk. By leveraging the principles of Modern Portfolio Theory, the tangency portfolio helps investors achieve diversification, risk reduction, and optimal asset allocation. The tangency portfolio plays a critical role in modern finance, as it provides a framework for constructing optimal investment portfolios and managing risk. By understanding the principles of the tangency portfolio, investors can make more informed investment decisions, improving their overall financial outcomes. When applying the tangency portfolio approach, investors must consider the limitations and criticisms of the method, such as its reliance on historical data, sensitivity to changes in input parameters, and potential overreliance on optimization techniques. By addressing these concerns and considering alternative portfolio construction methods, investors can develop a more comprehensive and effective investment strategy. For investors looking to apply the tangency portfolio approach in their investment strategy, it's essential to seek the guidance of professional wealth management services.What Is Tangency Portfolio?

Modern Portfolio Theory and Tangency Portfolio

Overview of Modern Portfolio Theory

Role of Tangency Portfolio in MPT

Key Assumptions of MPT and Their Impact on the Tangency Portfolio

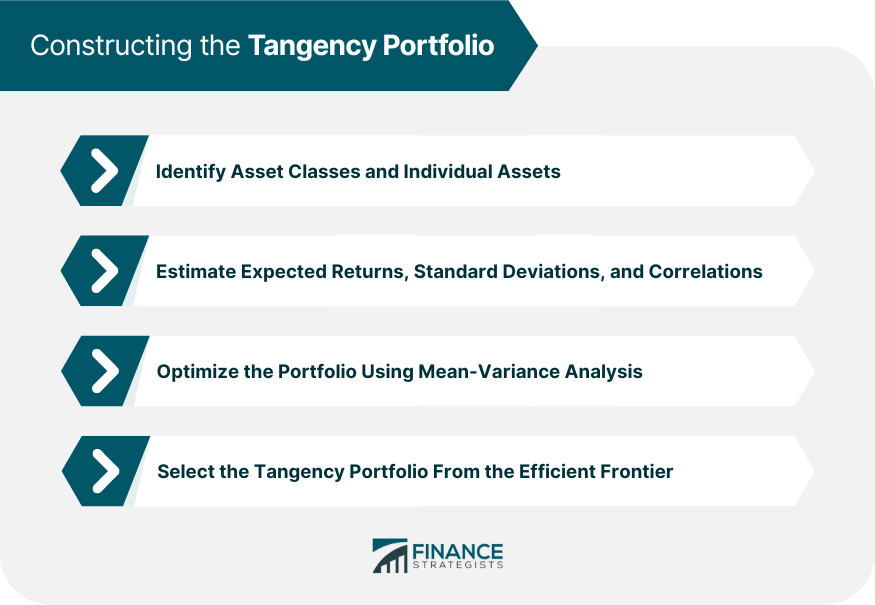

Constructing the Tangency Portfolio

Identify Asset Classes and Individual Assets

Estimating Expected Returns, Standard Deviations, and Correlations

Optimizing the Portfolio Using Mean-Variance Analysis

Selecting the Tangency Portfolio from the Efficient Frontier

Practical Applications of the Tangency Portfolio

Investment Management and Asset Allocation

Performance Benchmarking

Risk Management and Hedging Strategies

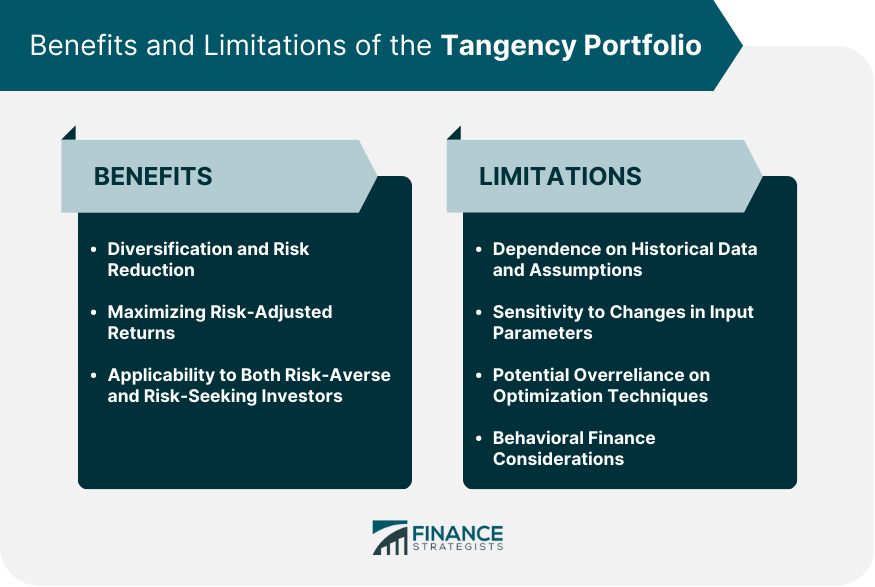

Benefits of the Tangency Portfolio

Diversification and Risk Reduction

Maximizing Risk-Adjusted Returns

Applicability to Both Risk-Averse and Risk-Seeking Investors

Limitations and Criticisms of the Tangency Portfolio

Dependence on Historical Data and Assumptions

Sensitivity to Changes in Input Parameters

Potential Overreliance on Optimization Techniques

Behavioral Finance Considerations

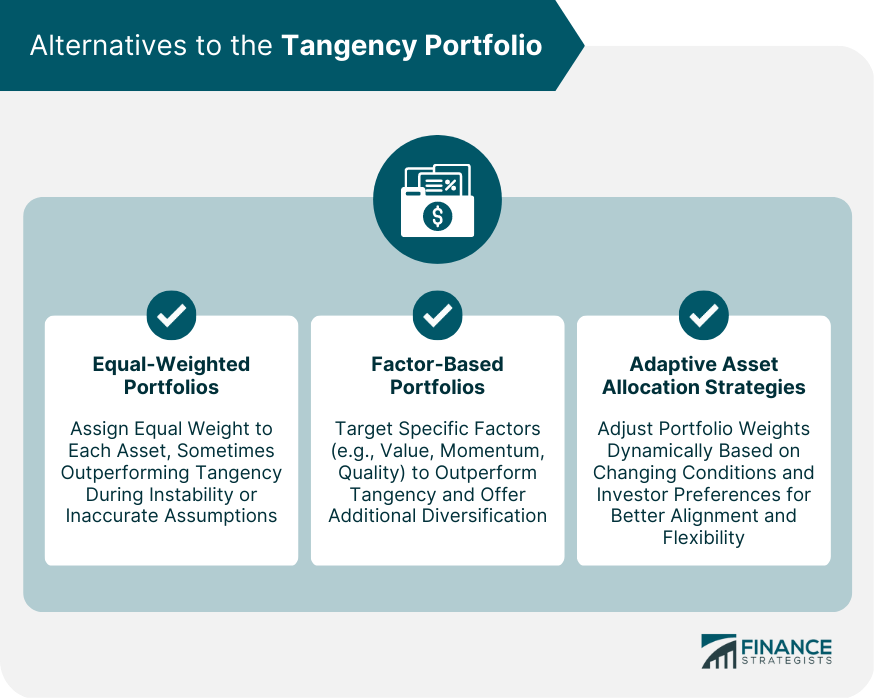

Alternatives to the Tangency Portfolio

Equal-Weighted Portfolios

Factor-Based Portfolios

Adaptive Asset Allocation Strategies

Final Thoughts

Tangency Portfolio FAQs

A tangency portfolio is a portfolio that lies at the point where the efficient frontier is tangent to the highest possible capital market line (CML) in the risk-return space. It represents the optimal mix of assets that maximize an investor's risk-adjusted returns.

To construct a tangency portfolio, investors must identify the relevant asset classes and individual assets, estimate their expected returns, standard deviations, and correlations, and optimize the portfolio using mean-variance analysis. The tangency portfolio is then selected as the point on the efficient frontier that is tangent to the highest possible CML.

The benefits of the tangency portfolio include diversification and risk reduction, maximizing risk-adjusted returns, and its applicability to both risk-averse and risk-seeking investors.

The limitations of the tangency portfolio include its dependence on historical data and assumptions, sensitivity to changes in input parameters, potential overreliance on optimization techniques, and the lack of consideration for behavioral finance factors.

Alternatives to the tangency portfolio include equal-weighted portfolios, factor-based portfolios, and adaptive asset allocation strategies. These alternatives offer different approaches to constructing an optimal investment portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.