Sector investing is an investment strategy that involves allocating assets to specific industries or sectors of the economy. Investors focus on these sectors in order to take advantage of market trends and capitalize on growth opportunities. By concentrating on specific sectors, investors can achieve targeted exposure to the industries that have the most potential for growth. This approach allows them to potentially benefit from the outperformance of certain sectors, while managing risk through diversification. Diversification is a key principle in investing, as it helps to reduce risk by spreading investments across various asset classes and sectors. Sector investing can play a crucial role in achieving diversification within a portfolio. By investing in different sectors, investors can avoid being overly exposed to one particular industry or market segment. This approach can potentially help to reduce volatility and improve overall portfolio performance during various market conditions. The technology sector is comprised of companies that develop and manufacture electronic devices, software, and related services. This sector has been a significant driver of economic growth and innovation in recent years. Investing in the technology sector can provide exposure to cutting-edge advancements and high-growth potential. However, it is essential to be aware of the risks associated with rapidly changing technologies and market conditions. Health care is a diverse sector that includes companies involved in pharmaceuticals, biotechnology, medical devices, and health care services. This sector is typically characterized by its resilience, as demand for health care products and services tends to remain consistent, regardless of economic conditions. Investing in the health care sector can provide stability and potential for long-term growth. However, it is crucial to consider factors such as regulatory changes, patent expirations, and emerging technologies that can impact the industry. The financial sector encompasses a broad range of companies, including banks, insurance firms, asset managers, and investment companies. These companies play a crucial role in facilitating economic growth and providing financial services to businesses and consumers. Investing in the financial sector can offer exposure to economic trends and interest rate fluctuations. However, investors should be cautious of factors such as regulatory changes, credit risk, and market volatility that can impact the performance of financial companies. Consumer discretionary refers to the sector that includes companies producing goods and services that are considered non-essential, such as luxury items, entertainment, and leisure. The performance of this sector is closely tied to consumer spending and overall economic health. Investing in the consumer discretionary sector can provide growth potential during periods of economic expansion. However, this sector can be more sensitive to economic downturns, as consumers may reduce spending on non-essential items during challenging times. The consumer staples sector comprises companies that produce essential goods and services, such as food, beverages, and household products. This sector is generally considered more defensive, as demand for these goods and services remains relatively stable, regardless of economic conditions. Investing in the consumer staples sector can provide a level of stability and income through dividends. However, it is important to be aware of factors such as changing consumer preferences and competitive pressures that can impact the performance of these companies. The energy sector consists of companies involved in the exploration, production, and distribution of oil, natural gas, and other energy sources. This sector is heavily influenced by global economic conditions, geopolitics, and supply and demand dynamics. Investing in the energy sector can offer exposure to global economic trends and potential for growth during periods of increased energy demand. However, investors should be aware of the risks associated with volatile commodity prices and regulatory changes impacting the industry. The industrials sector includes companies involved in manufacturing, construction, transportation, and defense. This diverse sector plays a vital role in the overall economy, as it provides goods and services necessary for economic growth and development. Investing in the industrials sector can offer exposure to economic cycles and potential for growth during periods of expansion. However, investors should be mindful of risks associated with cyclical industries, such as economic downturns and changes in global trade policies. The materials sector comprises companies involved in the production and processing of raw materials, such as metals, chemicals, and construction materials. This sector's performance is closely tied to global economic trends and industrial production. Investing in the materials sector can provide potential for growth during periods of increased demand for raw materials. However, investors should be aware of risks related to commodity price fluctuations, geopolitical events, and environmental regulations that can impact the industry. The telecommunications sector includes companies providing communication services, such as wireless, broadband, and satellite services. This sector has experienced significant growth in recent years, driven by the increasing demand for connectivity and data services. Investing in the telecommunications sector can offer exposure to the expanding digital economy and potential for long-term growth. .However, investors should consider risks such as intense competition, regulatory changes, and technological advancements that can affect the industry. The utilities sector consists of companies that provide essential services, such as electricity, natural gas, and water. These companies are typically characterized by their stable revenues, predictable cash flows, and relatively high dividend yields. Investing in the utilities sector can provide a source of stable income and lower volatility within a portfolio. However, investors should be aware of risks associated with regulatory changes, infrastructure investments, and the transition to renewable energy sources. Economic indicators, such as GDP growth, inflation, and employment rates, can provide insights into the health of the overall economy and the performance of specific sectors. Understanding market cycles and how different sectors perform during various economic stages can help investors make informed decisions. By analyzing economic indicators and market cycles, investors can identify trends and potential opportunities within specific sectors. However, it is crucial to consider both short-term and long-term factors, as well as the potential for unexpected events that may impact sector performance. Sector rotation is an investment strategy that involves shifting assets between sectors based on their performance during different phases of the economic cycle. The idea is to invest in sectors expected to outperform during a given economic phase, then rotate into other sectors as the economy transitions to a new phase. Sector rotation can potentially enhance returns and reduce risk by capitalizing on changing market conditions. However, investors should be aware that predicting economic phases and sector performance can be challenging, and there is no guarantee that a sector rotation strategy will consistently outperform the market. The top-down approach to sector investing involves analyzing macroeconomic factors, such as GDP growth, interest rates, and inflation, to identify sectors that may benefit from the prevailing economic conditions. Investors then select individual stocks within those sectors based on their analysis. Using a top-down approach can help investors identify sectors with strong growth potential in the current economic environment. However, it is essential to recognize that macroeconomic factors can change rapidly, and focusing solely on top-down analysis may overlook individual company performance within a sector. The bottom-up approach to sector investing focuses on analyzing individual companies within a sector, regardless of the prevailing economic conditions. Investors evaluate factors such as financial performance, competitive advantage, and management quality to identify strong performers within a sector. Utilizing a bottom-up approach can help investors uncover undervalued stocks or companies with strong growth potential within a sector. However, it is important to recognize that a bottom-up approach may overlook broader economic trends and sector dynamics, which can have a significant impact on a company's performance. Tactical asset allocation is a strategy that involves adjusting the weightings of different sectors within a portfolio based on short-term market trends and economic conditions. This approach aims to capitalize on temporary market inefficiencies and outperform the market by actively adjusting sector allocations. Implementing tactical asset allocation can potentially enhance portfolio returns by taking advantage of changing market conditions. However, investors should be aware of the risks associated with market timing and the potential for underperformance if they fail to accurately predict market trends. Concentration risk arises when an investor's portfolio is heavily weighted towards a single sector, making it more susceptible to fluctuations in that sector's performance. Overexposure to a particular sector can lead to increased portfolio volatility and potential for significant losses if the sector underperforms. To mitigate concentration risk, investors should consider diversifying their investments across multiple sectors. This approach can help to reduce volatility and improve overall portfolio performance during various market conditions. Market timing risk is the potential for underperformance resulting from attempting to predict market trends and make investment decisions based on those predictions. Accurately predicting market movements and sector performance is challenging, and investors may miss out on potential gains if their predictions are incorrect. To manage market timing risk, investors should consider adopting a long-term investment strategy and maintain a well-diversified portfolio. This approach can help to reduce the impact of short-term market fluctuations and provide a more stable path to achieving investment goals. Focusing too heavily on a single sector can lead to underperformance if other sectors outpace the chosen sector. It is essential for investors to maintain a balanced approach to sector investing, taking into consideration both the potential benefits and risks associated with each sector. By diversifying investments across various sectors, investors can better manage risk and potentially enhance overall portfolio performance. It is crucial to regularly review and adjust sector allocations as market conditions and individual investment goals evolve. Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges and provide exposure to a specific sector or index. Sector ETFs allow investors to easily gain exposure to a particular sector without having to invest in individual stocks. Investing in sector ETFs can provide instant diversification and a cost-effective way to gain exposure to various sectors. However, investors should be aware of the fees associated with ETFs and the potential for tracking errors that may result in underperformance relative to the underlying index. Mutual funds are pooled investment vehicles that invest in a diversified portfolio of stocks or bonds, often focused on a specific sector. Sector-focused mutual funds offer investors professional management and the potential for diversification within a given sector. Investing in sector mutual funds can provide a convenient way to gain exposure to specific sectors while benefiting from professional management. However, investors should consider factors such as management fees and the potential for underperformance relative to the overall market. Sector indices are market indices that track the performance of specific sectors within the broader stock market. These indices can provide investors with valuable insights into the performance and trends of individual sectors. Monitoring sector indices can help investors identify sector trends and potential investment opportunities. However, it is essential to recognize that sector indices only provide a broad overview of sector performance and may not fully capture the nuances of individual companies within a sector. Financial news and analysis sources, such as newspapers, websites, and financial television networks, provide valuable information on market trends, economic indicators, and sector performance. Staying informed through these sources can help investors make well-informed investment decisions. Utilizing financial news and analysis sources can help investors stay up-to-date on market developments and better understand the factors driving sector performance. However, investors should be cautious about relying solely on these sources, as they may not always present a complete or unbiased picture of the market. Diversification is a fundamental principle in investing that helps to reduce risk by spreading investments across various asset classes and sectors. A well-diversified portfolio can help to mitigate the impact of individual sector performance and provide a more stable path to achieving investment goals. By incorporating sector investing as part of diversified investment strategies, investors can potentially enhance returns and reduce risk. It is essential to continuously evaluate and adjust sector allocations based on individual investment objectives and market conditions. Sector investing can be a valuable tool for investors looking to capitalize on the growth potential of specific industries and manage risk through diversification. By understanding the various sectors, identifying trends, and utilizing appropriate investment strategies, investors can incorporate sector investing as a component of a comprehensive investment strategy. It is crucial for investors to maintain a balanced approach to sector investing and consider both the potential benefits and risks associated with each sector. By regularly reviewing and adjusting sector allocations, investors can better navigate changing market conditions and work towards achieving their long-term investment goals.Definition of Sector Investing

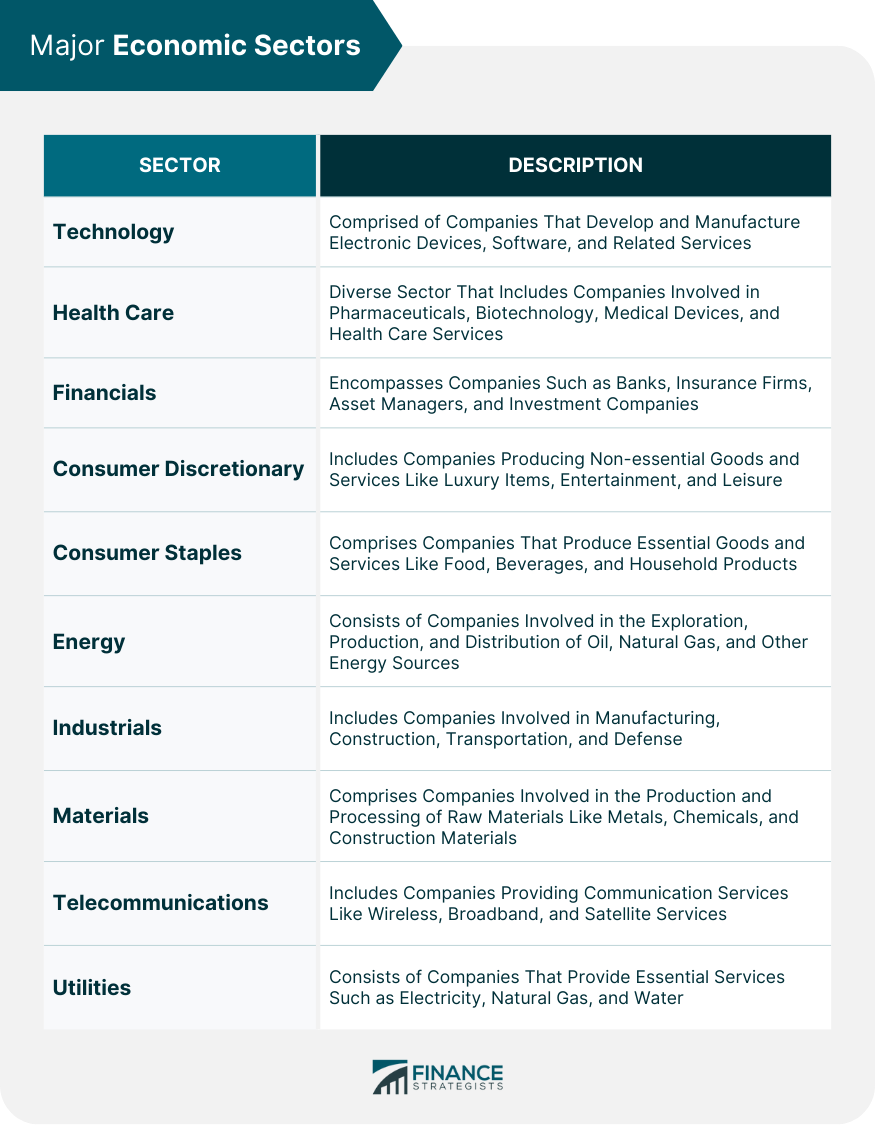

Major Economic Sectors

Technology

Health Care

Financials

Consumer Discretionary

Consumer Staples

Energy

Industrials

Materials

Telecommunications

Utilities

Identifying Sector Trends

Economic Indicators and Market Cycles

Sector Rotation Theory

Investment Strategies in Sector Investing

Top-Down Approach

Bottom-Up Approach

Tactical Asset Allocation

Risks and Limitations of Sector Investing

Concentration Risk

Market Timing Risk

Overemphasis on Single Sectors

Sector Investing Tools and Resources

Exchange-Traded Funds (ETFs)

Mutual Funds

Sector Indices

Financial News and Analysis Sources

Bottom Line

Sector Investing FAQs

Sector investing involves investing in a particular sector of the economy such as healthcare, technology or energy.

Sector investing involves focusing on a particular industry or sector, whereas traditional investing involves investing across a range of industries.

Sector investing can provide diversification and the opportunity to take advantage of industry-specific trends and growth potential.

Sector investing can be volatile and subject to industry-specific risks such as regulatory changes, economic downturns and shifts in consumer behavior.

You can get started with sector investing by researching and analyzing different sectors and identifying the best investment opportunities. Consider consulting with a financial advisor for guidance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.