An investment menu is a list of investment options that are offered by an investment manager or plan sponsor to their clients or employees, respectively. The investment menu provides investors with a range of investment options to choose from, each with its own investment objective, risk level, and potential return. Investors can use the investment menu to construct a diversified investment portfolio that meets their individual investment goals and risk tolerance. The investment menu also serves as a guide for investors to make informed investment decisions, based on their understanding of the various investment options available to them. Individual stocks represent partial ownership in a company. Investors can buy shares of publicly traded companies through a brokerage account. The value of individual stocks may fluctuate based on the company's financial performance, market conditions, and other factors. ETFs are investment funds that hold a diversified portfolio of stocks or other assets. They trade on stock exchanges like individual stocks, providing investors with easy access to diversified investments. ETFs typically have lower fees than mutual funds and can be an efficient way to diversify a portfolio. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management, but often come with higher fees compared to ETFs. Government bonds are debt securities issued by national governments to finance public projects and manage debt. They are generally considered lower risk investments, as they are backed by the government. Corporate bonds are debt securities issued by companies to raise capital for various purposes, such as business expansion or debt refinancing. They typically offer higher interest rates than government bonds but carry higher risk. Municipal bonds are debt securities issued by local governments or public entities to fund public projects like schools, hospitals, and infrastructure. They often offer tax advantages to investors, as interest earned may be exempt from federal and sometimes state and local taxes. REITs are companies that own, operate, or finance income-producing real estate properties. They trade on stock exchanges like individual stocks, providing investors with an easy way to invest in real estate while offering liquidity and diversification. Investors can also buy physical properties, such as residential or commercial real estate, to generate rental income or benefit from appreciation in property value. This option typically requires more capital and management effort compared to REITs. Real estate crowdfunding platforms allow investors to pool their money and invest in real estate projects, providing access to diversified real estate investments with lower capital requirements than direct property ownership. Money market funds are mutual funds that invest in short-term debt securities, such as Treasury bills and commercial paper. They aim to maintain a stable value and offer higher interest rates than traditional savings accounts, while still providing liquidity and low risk. CDs are time deposits offered by banks with a fixed interest rate and maturity date. They typically offer higher interest rates than savings accounts but have penalties for early withdrawal. Treasury bills are short-term government debt securities with maturities ranging from a few days to 52 weeks. They are considered low-risk investments and are often used as cash equivalents in investment portfolios. Commodities are physical goods, such as gold, oil, or agricultural products, that can be traded on futures exchanges. They provide a hedge against inflation and can add diversification to a portfolio. Hedge funds are pooled investment vehicles that use a variety of sophisticated investment strategies to generate returns. They often require high minimum investments and are typically limited to accredited investors. Hedge funds may provide diversification and potentially high returns, but they also carry higher fees and risks. Private equity refers to investments in privately held companies or assets. These investments can offer the potential for significant returns, but they often require substantial capital, have limited liquidity, and carry higher risks compared to publicly traded investments. Venture capital is a type of private equity focused on investing in early-stage, high-potential startups. Venture capital investments can offer significant returns if a startup becomes successful, but they also carry a high level of risk, as many startups fail. Risk tolerance is an individual's willingness to accept risk in pursuit of higher returns. Investors should consider their risk tolerance when selecting investments, aiming to strike a balance between potential returns and acceptable risk levels. Investors should define their specific financial goals, such as saving for retirement, buying a house, or funding a child's education. These goals will influence the investment menu and asset allocation strategies. The time horizon refers to the period an investor plans to hold an investment before needing to access the funds. Investors with longer time horizons can typically afford to take on more risk, as they have more time to recover from potential losses. Liquidity refers to the ease with which an investment can be converted into cash without affecting its price. Investors should consider their liquidity needs when selecting investments, as some options, like real estate or private equity, may have limited liquidity. Investment choices can have various tax implications, such as capital gains taxes, dividend taxes, or tax-exempt interest. Investors should consider the tax consequences of their investment choices and seek professional advice if needed. Diversification is the practice of spreading investments across various asset classes to reduce risk. A well-diversified portfolio is less likely to be affected by a single investment's poor performance, helping to protect against market volatility and downturns. Strategic asset allocation involves setting target allocations for different asset classes based on an investor's risk tolerance, investment goals, and time horizon. The portfolio is periodically rebalanced to maintain the target allocations, regardless of market conditions. Tactical asset allocation involves adjusting the portfolio's asset allocation based on short-term market opportunities or risks. This approach requires more active management and may involve higher trading costs. Dynamic asset allocation is a flexible approach that adjusts the portfolio's asset allocation in response to changing market conditions or an investor's financial situation. This strategy aims to take advantage of market trends while managing risk. Rebalancing involves adjusting the portfolio's asset allocation to maintain the desired level of diversification and risk. Investors can rebalance by selling assets that have performed well and using the proceeds to buy assets that have underperformed, or by contributing new funds to underweighted asset classes. Investors should regularly assess their portfolio's performance to ensure that it meets their investment goals and expectations. Performance can be measured using various metrics, such as total return, risk-adjusted return, or benchmark comparisons. Investors should also evaluate the risk level of their portfolio to ensure that it aligns with their risk tolerance. Risk can be assessed using metrics like standard deviation, beta, or Value at Risk (VaR). Investors should periodically review their investment menu and make necessary adjustments based on changes in their financial goals, risk tolerance, or market conditions. Regular reviews can help identify underperforming investments and ensure that the portfolio remains aligned with the investor's objectives. Investors may benefit from the expertise of financial advisors, portfolio managers, or other professionals when creating and maintaining an investment menu. These professionals can provide guidance on investment selection, asset allocation, and risk management, helping investors optimize their portfolios for long-term success. Creating a diversified investment menu is crucial for long-term financial success. An investment menu provides a range of investment options for investors to choose from, each with its own investment objective, risk level, and potential return. When creating an investment menu, investors should consider factors such as risk tolerance, investment goals, time horizon, liquidity needs, and tax implications. Diversification and asset allocation strategies, including strategic, tactical, and dynamic asset allocation, are also essential to reduce risk and protect against market volatility. Investors should regularly evaluate and monitor their investment menu's performance, risk level, and make necessary adjustments based on changes in their financial goals, risk tolerance, or market conditions. Utilizing professional services can also provide valuable guidance on investment selection, asset allocation, and risk management. By following these essential steps, investors can optimize their portfolios for long-term financial success.Definition of Investment Menu

Types of Investment Options

Stocks

Individual Stocks

Exchange-Traded Funds (ETFs)

Mutual Funds

Bonds

Government Bonds

Corporate Bonds

Municipal Bonds

Real Estate

Real Estate Investment Trusts (REITs)

Direct Property Ownership

Real Estate Crowdfunding Platforms

Cash Equivalents

Money Market Funds

Certificates of Deposit (CDs)

Treasury Bills

Alternative Investments

Commodities

Hedge Funds

Private Equity

Venture Capital

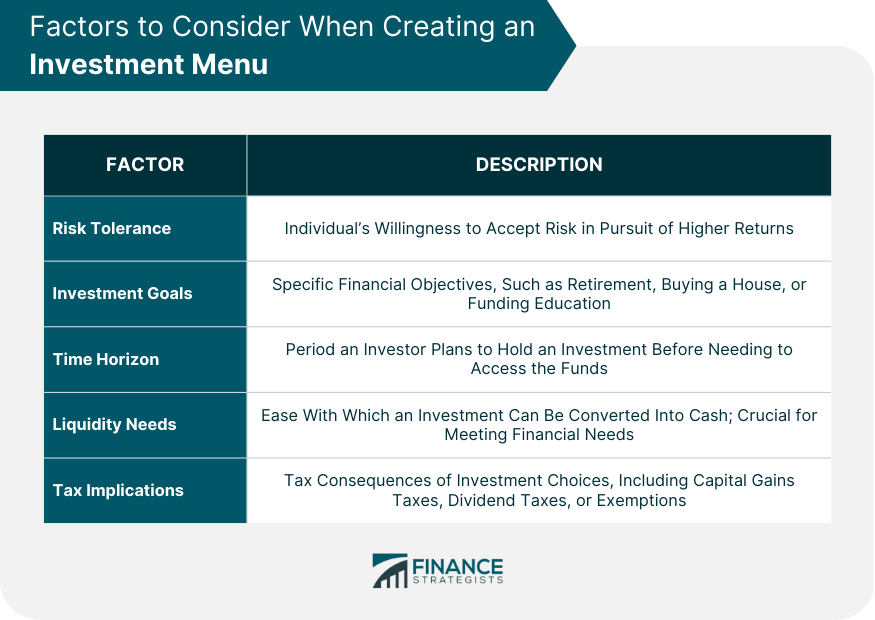

Factors to Consider When Creating an Investment Menu

Risk Tolerance

Investment Goals

Time Horizon

Liquidity Needs

Tax Implications

Diversification and Asset Allocation Strategies

Asset Allocation Methods

Strategic Asset Allocation

Tactical Asset Allocation

Dynamic Asset Allocation

Rebalancing Strategies

Investment Menu Evaluation and Monitoring

Performance Assessment

Risk Assessment

Periodic Reviews and Adjustments

Utilizing Professional Services

Final Thoughts

Investment Menu FAQs

An investment menu is a selection of various investment options designed to help investors build a diverse and well-balanced portfolio. It is crucial for managing risk and optimizing returns across different asset classes.

To create a diversified investment menu, consider various investment options, such as stocks, bonds, real estate, cash equivalents, and alternative investments. Additionally, assess your risk tolerance, investment goals, and time horizon to tailor your portfolio to your unique needs.

Common strategies include strategic asset allocation, tactical asset allocation, and dynamic asset allocation. These approaches help maintain diversification and manage risk by adjusting the portfolio's asset allocations according to individual needs and market conditions.

It's essential to review your investment menu periodically, such as annually or semi-annually, to ensure it remains aligned with your financial goals and risk tolerance. Regular reviews also help identify underperforming investments and make necessary adjustments based on market conditions.

Yes, utilizing professional services such as financial advisors, portfolio managers, or other investment professionals can provide valuable guidance on investment selection, asset allocation, and risk management, helping you optimize your investment menu for long-term success.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.