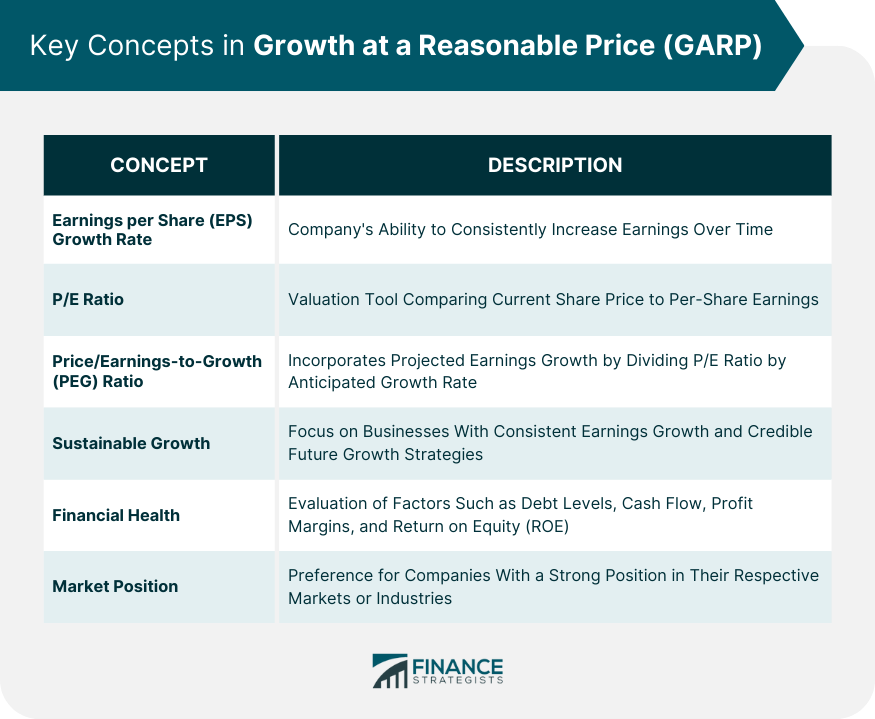

Growth at a Reasonable Price is an investment strategy bridging the middle ground between growth and value investing. It focuses on buying undervalued stocks with solid sustainable growth potential. The basic premise of GARP is to avoid the extremes of both growth and value investing. GARP investors look for companies that are showing consistent earnings growth above broad market levels (i.e., growth investing) while avoiding high valuation multiples that growth investors might accept (i.e., value investing). Essentially, GARP investors aim to buy growth stocks before they become popular and get overpriced. Unlike pure growth investing, GARP investors avoid overpaying for future growth. Unlike pure value investing, they do not restrict themselves to potentially undervalued companies with slower growth prospects. This balanced approach aims to achieve good returns while minimizing risk. This represents a company's profit divided by the outstanding shares of its common stock. In essence, GARP investors are on the lookout for companies that can consistently increase their earnings over time. A solid EPS growth rate indicates that a company is boosting its profitability, which in turn can drive stock prices up, making it an attractive proposition for investors. In addition, consistent EPS growth is often seen as a sign of good management and a sustainable business model. The P/E ratio is a key valuation tool used by GARP investors to ascertain whether a stock is reasonably priced. It compares a company's current share price to its per-share earnings. While growth investors might be inclined to purchase stocks with high P/E ratios with the hope of robust future earnings growth, GARP investors are more conservative. They usually favor stocks with P/E ratios lower than the company's expected growth rate, as it indicates that the stock is priced reasonably compared to its earnings. PEG takes the P/E ratio analysis a step further by incorporating the company's projected earnings growth into the equation. The PEG ratio is calculated by dividing the P/E ratio of a stock by its anticipated earnings growth rate. A PEG ratio less than 1.0 is typically perceived as favorable by GARP investors. This is because it suggests that a stock is undervalued in relation to its earnings growth potential, thus providing an opportunity to acquire growth stocks at a reasonable price. GARP investors favor businesses that have demonstrated a consistent ability to grow earnings and have a credible and feasible strategy for maintaining this growth in the future. This sustainability is usually linked to the company's competitive advantages, operational efficiency, and effective capital allocation. Essentially, investors using the GARP strategy seek companies that can withstand market fluctuations and still deliver solid performance over the long term. This includes a comprehensive evaluation of various factors such as a company's debt levels, cash flow, profit margins, and return on equity (ROE). Companies with strong financial health are generally considered more capable of sustaining their earnings growth. For instance, low debt levels indicate that the company is not overburdened by debt repayments, which might otherwise eat into their profits. Similarly, robust cash flow ensures the company can meet its short-term liabilities, invest in growth opportunities, and weather any potential financial downturns. GARP investors often seek out companies that hold a robust position within their respective markets or industries. This strength could stem from several sources, such as a distinctive product or service, a powerful brand, a broad customer base, or substantial market share. A firm market position often equates to sustainable competitive advantages, which can enable the company to deliver consistent growth and fend off competition. The GARP approach offers the potential for high returns by focusing on stocks that are not only growing but also reasonably priced. By striking a balance between growth and value investing, GARP investors can benefit from both market trends. One of the primary advantages of the GARP approach is its balanced nature. It combines the best elements of growth investing and value investing, allowing investors to capture growth at a reasonable price. Since the GARP approach avoids extreme valuation levels, it may help investors minimize the potential downside risk of overpriced stocks. Also, because it targets companies with solid growth prospects, it reduces the risks of investing in companies with poor growth potential. What constitutes a "reasonable price" can vary greatly among investors. This subjectivity can make it challenging to implement the GARP strategy accurately. Just like any investment strategy, GARP carries risks. Even though the strategy aims to avoid overpriced stocks, there's always the risk that a GARP investor could still end up paying too much for a stock if its growth prospects do not materialize as expected. GARP investing is not immune to market fluctuations. If the overall market declines, even reasonably priced growth stocks may see their prices drop. GARP can be a valuable component of a well-diversified portfolio. Investors can increase returns and reduce risk by investing in GARP stocks alongside other asset types. In terms of asset allocation, GARP stocks can serve as a middle ground between growth stocks and value stocks. This can provide balance in a portfolio, potentially smoothing out returns over time. Historically, GARP stocks have tended to perform well during various market phases. They may outperform during bullish markets because of their growth characteristics and hold up better during bearish markets due to their reasonable valuations. Various market factors can influence the performance of GARP stocks, including interest rates, inflation, economic growth, and market sentiment. Understanding these factors can help investors better navigate the GARP strategy. Growth at a Reasonable Price is an investment strategy that strikes a balance between growth and value investing. GARP investors focus on companies with sustainable growth potential and reasonable valuations to achieve high returns while minimizing risks. Key concepts in GARP include EPS growth rate, P/E ratio, PEG ratio, sustainable growth, financial health, and market position. The advantages of GARP include the potential for high returns, a balanced approach between growth and value, and risk mitigation. However, there are limitations such as subjectivity in defining a "reasonable price" and the potential for overvaluation. GARP can be a valuable component of a diversified portfolio, providing balance and potentially smoothing out returns over time. Performance of GARP stocks may vary during different market phases, influenced by factors like interest rates and economic growth.What Is Growth at a Reasonable Price (GARP)?

Key Concepts in GARP

Earnings per Share (EPS) Growth Rate

Price-To-Earnings (P/E) Ratio

The PEG (Price/Earnings to Growth) Ratio

Sustainable Growth

Financial Health

Market Position

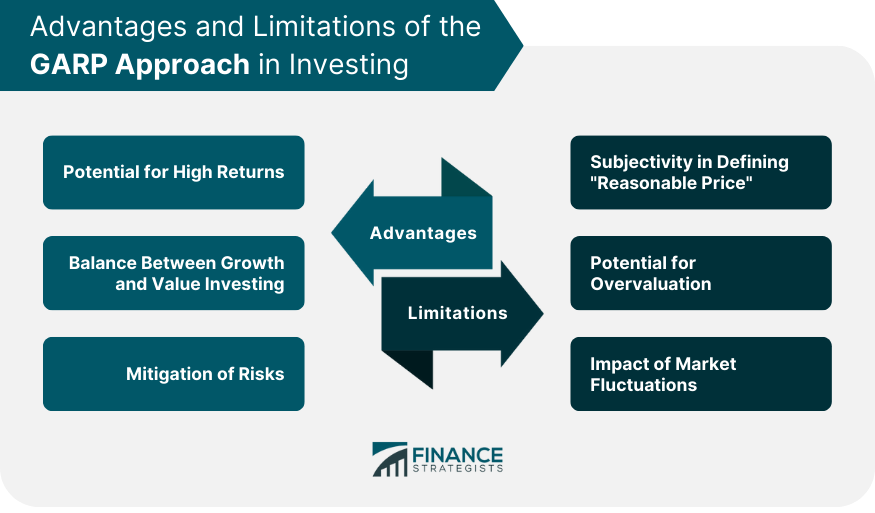

Advantages of the GARP Approach

Potential for High Returns

Balance Between Growth and Value Investing

Mitigation of Risks

Limitations and Risks of GARP Investing

Subjectivity in Defining "Reasonable Price"

Potential for Overvaluation

Impact of Market Fluctuations

GARP in the Context of Portfolio Management

Incorporating GARP Into a Diversified Portfolio

Role of GARP in Asset Allocation

GARP and Market Cycles

Performance of GARP During Different Market Phases

Market Factors Influencing GARP Stocks

Conclusion

Growth at a Reasonable Price (GARP) FAQs

GARP stands for Growth at a Reasonable Price, an investment strategy that focuses on identifying stocks with strong growth potential and reasonable valuations.

GARP combines elements of both growth investing and value investing. It seeks to find companies with above-average growth prospects but still trading at a reasonable price compared to their intrinsic value.

Investors looking for GARP stocks typically analyze a company's historical and projected earnings growth and its valuation metrics, such as the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio. The goal is to find companies that balance growth potential and reasonable valuation.

GARP allows investors to benefit from growth and value factors. Investors can tap into the potential for increased earnings and stock price appreciation by focusing on companies with growth potential. At the same time, considering the reasonable valuation helps to mitigate the risk of overpaying for a stock.

One risk of GARP investing is the potential for overpaying for a stock that may not deliver the expected growth. Additionally, accurately identifying companies with sustainable growth prospects can be challenging, and market conditions may impact the performance of GARP stocks. When implementing a GARP strategy, investors must conduct thorough research and diversify their portfolios.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.