Core-satellite investing is an investment strategy that combines a diversified core portfolio with a selection of actively managed satellite investments. The core component provides stability and long-term growth, while the satellite component aims to generate higher returns and enhance overall portfolio performance. Core-satellite investing aims to strike a balance between risk and reward by combining passive and active investment strategies. This approach allows investors to capitalize on market opportunities while maintaining a solid, diversified foundation that reduces overall portfolio volatility. Core-satellite portfolios consist of two main components: the core, which is typically made up of passive investments like index funds and ETFs, and the satellite, which includes actively managed investments such as individual stocks and alternative assets. This combination aims to deliver both stability and growth potential. Core investments serve as the foundation of a core-satellite portfolio, providing diversification and long-term stability. They typically comprise a large portion of the portfolio and are designed to track broad market indices, thereby reducing the impact of individual security fluctuations. Index funds are passively managed investment vehicles that track specific market indices, providing investors with broad market exposure. These funds offer a cost-effective way to diversify and reduce risk in a core-satellite portfolio. ETFs are investment funds traded on stock exchanges that hold a diversified basket of assets, such as stocks or bonds. They provide investors with the benefits of diversification and low costs, making them a popular choice for the core component of a core-satellite portfolio. Passive mutual funds are another option for core investments in a core-satellite portfolio. Like index funds and ETFs, passive mutual funds track market indices, offering diversification benefits and lower costs compared to actively managed funds. Core investments provide broad market exposure and diversification, reducing the impact of individual security fluctuations on the overall portfolio. This helps to mitigate risk and create a more stable investment foundation. Passive investments, such as index funds and ETFs, typically have lower management fees and expenses compared to actively managed funds. This cost-efficiency can enhance overall portfolio returns over time. By tracking broad market indices, core investments offer long-term stability and predictable growth patterns. This can help investors maintain a consistent investment strategy and weather short-term market fluctuations. Satellite investments complement the core component by providing active management and the potential for higher returns. These investments allow investors to capitalize on market opportunities and customize their portfolio according to their risk tolerance and investment objectives. Individual stocks represent a common type of satellite investment, offering the potential for higher returns through active stock selection. Investors can pick specific companies they believe will outperform the market, based on their research and analysis. Active mutual funds are managed by professional portfolio managers who make investment decisions on behalf of the fund's investors. These funds can serve as satellite investments, providing investors with exposure to specific sectors or investment strategies that may enhance portfolio returns. Alternative investments, such as real estate, commodities, or private equity, can also be included in the satellite component of a core-satellite portfolio. Depending on market conditions, these investments can offer diversification benefits and the potential for higher returns. Satellite components aim to generate higher returns than the broader market by actively selecting investments. This can enhance overall portfolio performance and help investors achieve their financial goals more quickly. Satellite investments offer flexibility and customization, allowing investors to tailor their portfolio to their specific risk tolerance, investment objectives, and market outlook. This can result in a more personalized investment approach that better aligns with individual preferences. Active management of satellite investments can help investors capitalize on market opportunities and potentially outperform passive investments. By employing skilled portfolio managers or conducting thorough research, investors can identify undervalued assets and generate higher returns. An investor's risk tolerance is a key factor in determining the appropriate core-satellite allocation. Those with a higher risk tolerance may allocate a larger portion of their portfolio to satellite investments, while more risk-averse investors may prefer a higher allocation to the core component. Investment objectives should also be considered when determining core-satellite allocations. Investors seeking long-term growth and stability may prioritize the core component, while those focused on shorter-term gains may allocate more to the satellite component. The investor's time horizon plays a role in determining core-satellite allocations. Longer time horizons generally allow for a higher allocation to satellite investments, as investors have more time to recover from potential losses and capitalize on market opportunities. Investors should analyze options such as index funds, ETFs, and passive mutual funds to select core investments. This analysis should consider factors such as fees, performance, and diversification to determine the most suitable investments for the core component. Costs and fees can have a significant impact on long-term investment performance. When selecting core investments, investors should consider management fees, trading costs, and other expenses to ensure they are selecting cost-effective options. To select satellite investments, investors should identify investment themes and opportunities based on their research, market outlook, and personal preferences. This process involves evaluating individual stocks, active mutual funds, and alternative investments to determine which assets align with the investor's goals and risk tolerance. Investors should evaluate the active management strategies employed by potential satellite investments, including portfolio managers' track record and expertise. This evaluation can help investors select satellite investments more likely to generate superior returns. Regularly reviewing the performance of a core-satellite portfolio is essential to ensure that it remains aligned with the investor's goals and objectives. This process involves evaluating the performance of both the core and satellite components and individual investments within each component. In addition to assessing performance, investors should monitor market conditions and consider how they may impact their core-satellite portfolio. This can help investors identify opportunities for adjustment and rebalancing as needed. Rebalancing is the process of adjusting a portfolio's asset allocation to maintain target allocations. For core-satellite portfolios, this may involve adjusting the balance between core and satellite components or reallocating assets within each component. Adjusting the core and satellite components of a portfolio may be necessary due to changes in market conditions or the investor's objectives. Regular rebalancing can help ensure that the portfolio remains aligned with the investor's goals and risk tolerance. In bull markets, when stock prices are generally rising, core-satellite investing can help investors capture the broad market gains through the core component while potentially outperforming the market with well-selected satellite investments. This balanced approach can lead to enhanced returns during periods of strong market performance. During bear markets, when stock prices are generally declining, the core component of a core-satellite portfolio can provide some stability and diversification. Meanwhile, the satellite component can be adjusted to include defensive or counter-cyclical investments, which may help mitigate losses or even generate positive returns. In sideways markets, where stock prices fluctuate within a narrow range, core-satellite investing allows investors to maintain a stable core component while actively seeking out opportunities for higher returns through the satellite component. This strategy can help generate returns even when the broader market is stagnant. Core-satellite investing offers diversification benefits, as the core component provides broad market exposure while the satellite component allows for targeted investments in specific sectors or strategies. This can help reduce overall portfolio risk and volatility. By combining low-cost passive investments in the core component with actively managed satellite investments, core-satellite portfolios can achieve cost-efficiency without sacrificing the potential for higher returns. This balanced approach can enhance overall investment performance. Core-satellite investing allows for greater customization, as investors can tailor their satellite investments to suit their personal preferences, risk tolerance, and investment objectives. This flexibility can result in a more personalized investment strategy. One of the risks of core-satellite investing is the potential for underperformance if the satellite investments fail to generate higher returns than the market. This could lead to suboptimal portfolio performance compared to a purely passive or active investment strategy. Core-satellite investing can be more complex than other investment strategies, as it requires the ongoing management and monitoring of both core and satellite components. Investors must be diligent in their research, analysis, and portfolio adjustments to ensure optimal performance. The satellite component of a core-satellite portfolio involves active management, which can introduce risks such as manager underperformance, higher costs, and increased volatility. Investors must carefully evaluate the active management strategies of their satellite investments to minimize these risks. Core-satellite investing combines the stability and diversification benefits of passive investing with the potential for higher returns through active management. By understanding the key principles and strategies involved in building and managing a core-satellite portfolio, investors can effectively balance risk and reward to achieve their investment objectives. Each investor must evaluate the suitability of core-satellite investing based on their personal preferences, risk tolerance, and investment objectives. This approach may be particularly well-suited for those seeking a balance between cost efficiency, diversification, and the potential for higher returns. Successful core-satellite investing requires ongoing learning and adaptation to changing market conditions. By staying informed and adjusting their portfolio as needed, investors can maximize the potential benefits of this investment strategy and achieve their long-term financial goals.What Is Core-Satellite Investing?

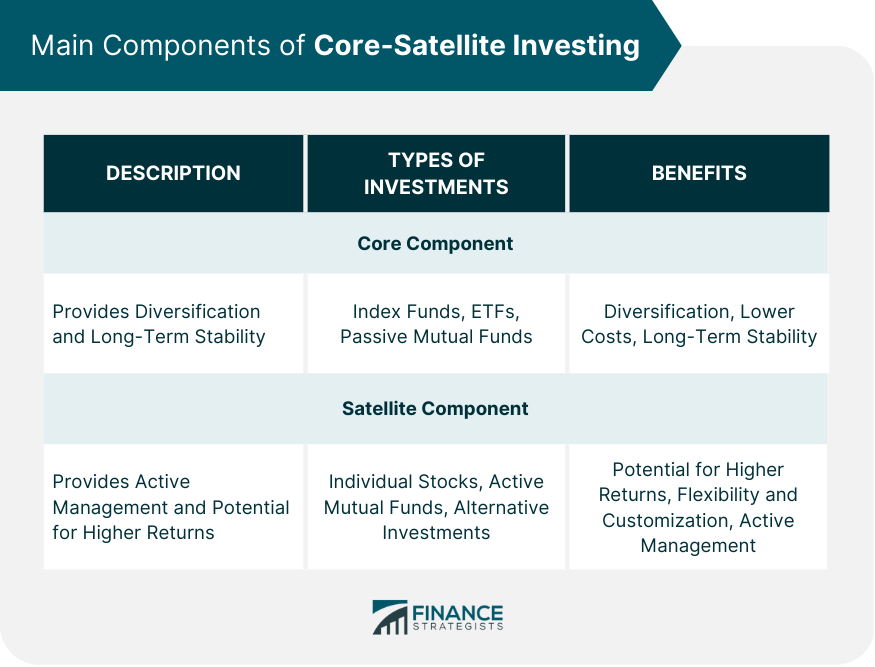

Main Components of Core-Satellite Investing

Core Component

Types of Core Investments

Index Funds

Exchange-Traded Funds (ETFs)

Passive Mutual Funds

Benefits of Core Investments

Diversification

Lower Costs

Long-Term Stability

Satellite Component

Types of Satellite Investments

Individual Stocks

Active Mutual Funds

Alternative Investments

Benefits of Satellite Investments

Potential for Higher Returns

Flexibility and Customization

Active Management

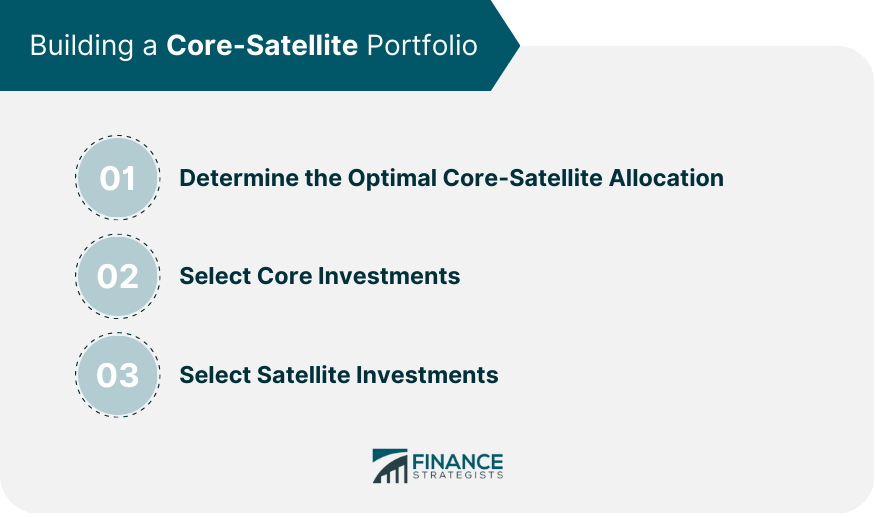

Building a Core-Satellite Portfolio

Determining the Optimal Core-Satellite Allocation

Risk Tolerance

Investment Objectives

Time Horizon

Selecting Core Investments

Analyzing Available Investment Options

Considering Investment Costs and Fees

Selecting Satellite Investments

Identifying Investment Themes and Opportunities

Evaluating Active Management Strategies

Monitoring and Rebalancing a Core-Satellite Portfolio

Regular Portfolio Reviews

Assessing Performance

Evaluating Market Conditions

Rebalancing Strategies

Maintaining Target Allocations

Adjusting Core and Satellite Components

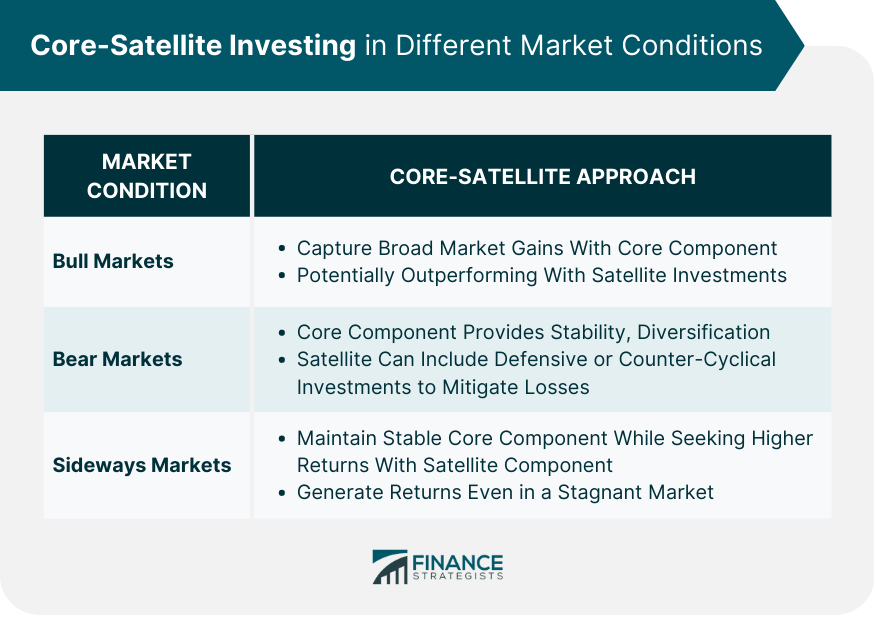

Core-Satellite Investing in Different Market Conditions

Bull Markets

Bear Markets

Sideways Markets

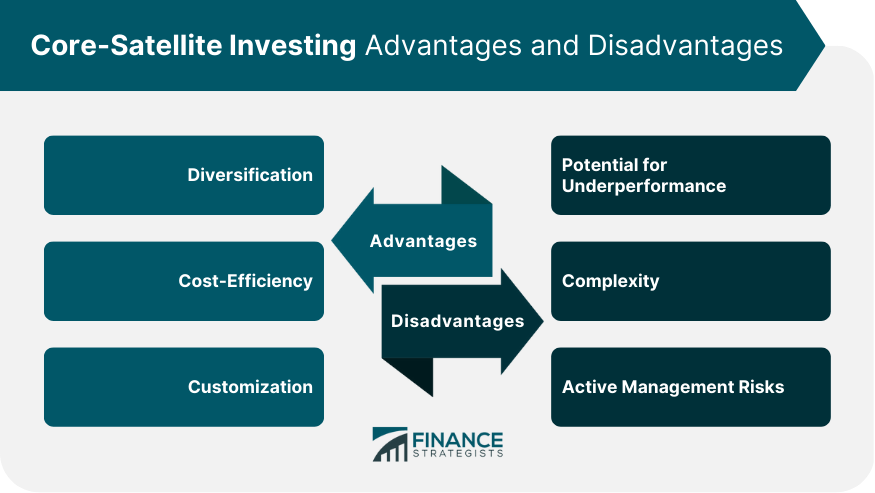

Advantages of Core-Satellite Investing

Diversification

Cost-Efficiency

Customization

Disadvantages of Core-Satellite Investing

Potential for Underperformance

Complexity

Active Management Risks

Final Thoughts

Core-Satellite Investing FAQs

Core-satellite investing is an investment strategy that combines a diversified core portfolio with a selection of actively managed satellite investments. The core component provides stability and long-term growth, while the satellite component aims to generate higher returns and enhance overall portfolio performance.

A core-satellite portfolio consists of two main components: the core, typically made up of passive investments like index funds and ETFs, and the satellite, which includes actively managed investments such as individual stocks and alternative assets.

Core investments provide broad market exposure and diversification, reducing the impact of individual security fluctuations on the overall portfolio. They also offer lower costs compared to actively managed funds and long-term stability by tracking broad market indices.

Satellite investments can include individual stocks, active mutual funds, and alternative investments such as real estate, commodities, or private equity.

The advantages of core-satellite investing include diversification, cost-efficiency, and customization. The potential disadvantages include the risk of underperformance if the satellite investments fail to generate higher returns than the market, complexity, and active management risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.