An Asset Swapped Convertible Option Transaction (ASCOT) is a pivotal financial instrument in the financial markets, allowing the separation of a convertible bond into its constituent parts: the bond and the embedded option. This strategic division facilitates effective risk management, attracts a diverse range of investors, and potentially lowers financing costs, making it a versatile tool for both issuers and investors. Key features and benefits of an ASCOT include a wider investor base, lower financing costs, robust risk management, and potential tax and regulatory advantages. These include credit risk, the possibility of the bond issuer defaulting; market risk, vulnerability to changes in interest rates, equity prices, and credit spreads; operational risk from system, process, or control failures; and legal and regulatory risk due to changing laws or regulations. Understanding these factors is crucial when considering an ASCOT. The ASCOT structure originated in the late 1990s as a financial innovation of investment banks. Faced with the complex challenges of hedging the risks in convertible bonds, banks devised this instrument to separate the different risk components. This way, they could hedge each part individually. Since its inception, the use of ASCOT has expanded across financial markets, finding its way into the strategies of hedge funds, institutional investors, and corporate finance departments. ASCOTs play a critical role in financial markets due to their versatility and risk management capabilities. They allow investors to access the benefits of convertible bonds, such as potential upside in the underlying equity, without exposure to the associated equity and interest rate risks. This makes ASCOTs a powerful tool for risk diversification and yield enhancement in portfolio management. A convertible bond is a type of debt instrument that gives the holder the right to convert it into a predetermined number of shares in the issuing company. Convertible bonds offer the potential for capital appreciation if the company's stock price rises, while providing the security of interest income from the bond. There are several types of convertible bonds, including vanilla convertibles, mandatory convertibles, and convertible preferred stocks. Each type has its unique features and risk-return profile, making them suitable for different investment strategies and market conditions. An asset swap involves two financial transactions: the purchase of a bond and the simultaneous agreement to swap the bond's cash flows for a set of different cash flows. This allows the investor to transform the bond's credit risk, interest rate risk, and currency risk into a different risk profile that matches their needs. In an ASCOT, the asset swap is used to separate the convertible bond into two components: a straight bond and an embedded option. The straight bond part is swapped for a fixed or floating rate cash flow, while the option part is sold as a separate transaction. Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Options come in two types: calls, which give the right to buy, and puts, which give the right to sell. In an ASCOT, the option transaction represents the embedded option in the convertible bond. This is sold separately from the bond component, allowing the investor to manage the option risk independently from the bond risk. The ASCOT process involves three main steps. First, the investor purchases a convertible bond from the issuer. Second, they enter into an asset swap agreement with a counterparty, usually a bank, to exchange the bond's cash flows for a different set of cash flows. Third, they sell the embedded option to another counterparty, typically an option market maker. The key parties in an ASCOT include the investor, the bond issuer, the swap counterparty, and the option counterparty. Each party has a different role and bears different risks in the transaction. The cash flows in an ASCOT consist of the interest payments and principal repayment from the bond, the swap payments, and the premium from the sale of the option. These cash flows can be tailored to match the investor's risk profile and investment objectives. One of the key benefits of ASCOT is that it can lower financing costs for the bond issuer. By separating the bond and the option, the issuer can attract a wider range of investors, potentially reducing the yield they have to offer on the bond. ASCOTs can appeal to a diverse range of investors, from conservative bondholders to aggressive equity traders. This opens up new sources of capital for issuers and increases liquidity in the financial markets. For investors, ASCOTs offer powerful risk management tools. By isolating the bond and option components, investors can hedge each risk separately, tailoring their exposure to match their risk tolerance and market view. ASCOTs can also offer tax and regulatory benefits. For instance, the interest payments on the bond component can be tax-deductible, while the option component can be treated as a separate derivative for regulatory capital purposes. The main risk in an ASCOT is credit risk, which is the risk that the bond issuer will default on its payments. This risk is borne by the investor and can be mitigated through careful credit analysis and diversification. Market risk is another significant risk in ASCOTs. It refers to the risk of loss due to changes in market variables such as interest rates, equity prices, and credit spreads. Market risk can be managed through appropriate hedging strategies and dynamic risk management. Operational risk refers to the risk of loss due to failures in systems, processes, or controls. In an ASCOT, operational risk can arise from the complexity of the transaction and the need for coordination among the different parties. Legal and regulatory risk is the risk of loss due to changes in laws or regulations, or due to legal disputes. In an ASCOT, legal risk can arise from the contractual arrangements among the parties, while regulatory risk can come from changes in capital or tax regulations. ASCOTs can contribute to portfolio diversification by providing exposure to a unique combination of credit risk, interest rate risk, and equity risk. This can help reduce the overall risk of the portfolio and enhance its risk-adjusted return. By separating the bond and option components, ASCOTs can potentially offer higher yields than traditional convertible bonds. The investor can earn interest on the bond, receive swap payments, and collect a premium from selling the option. ASCOTs can be used in various hedging strategies to manage the risks in a portfolio. For example, the bond component can be used to hedge against credit risk, while the option component can be used to hedge against equity risk. In corporate finance, ASCOTs can be used as a flexible financing tool. Investment banks play a crucial role in ASCOTs as intermediaries. They structure and facilitate the transactions, acting as the counterparty in the asset swap and the buyer of the option. In this role, investment banks can earn fees and trading profits while managing their risk exposure through hedging. Hedge funds often use ASCOTs as part of their investment strategies. They can take positions in the bond or the option, depending on their market view and risk appetite. Hedge funds can also use ASCOTs to create arbitrage opportunities, exploiting price discrepancies between the convertible bond and its components. Technological innovations can significantly impact the future of ASCOT. Advances in financial modelling and risk management software can enhance the pricing and hedging of ASCOTs. Additionally, the rise of blockchain technology could potentially revolutionize the settlement and custody of these complex instruments. Regulatory changes can also influence the future of ASCOT. Regulators around the world are scrutinizing the derivatives market more closely following the financial crisis. New regulations could impact the structure, pricing, and risk management of ASCOTs. Evolving market conditions can have profound effects on ASCOT. Changes in interest rates, credit spreads, and equity volatility can alter the risk-return profile of ASCOTs. Investors need to monitor these market conditions closely and adjust their strategies accordingly. In conclusion, the Asset Swapped Convertible Option Transaction (ASCOT) holds significant importance in financial markets, acting as a unique instrument that combines the facets of bonds and options. It presents numerous benefits such as lower financing costs, wider investor reach, and effective risk management, alongside potential tax and regulatory benefits, bolstering its appeal to a diverse range of market participants. However, understanding the potential risks, including credit, market, operational, and legal and regulatory risks, is crucial for an informed approach to ASCOTs. Despite these challenges, the nuanced structure and strategic benefits of ASCOTs underscore their critical role in shaping modern financial strategies. As market conditions evolve, the importance of ASCOTs in the financial landscape is likely to grow, providing continued opportunities for savvy investors and financial professionals.Definition of ASCOT

However, ASCOTs are not without risks and challenges. Brief History of ASCOT

Importance of ASCOT in Financial Markets

Understanding the Components of an ASCOT

Convertible Bond

Definition and Features

Types of Convertible Bonds

Asset Swap

Definition and Mechanics

Importance in ASCOT

Options Transactions

Basics of Options

Role in ASCOT

Mechanics of an Asset Swapped Convertible Option Transaction (ASCOT)

Detailed Breakdown of ASCOT Process

Parties Involved in ASCOT

Cash Flows in ASCOT

Key Features and Benefits of Asset Swapped Convertible Option Transaction (ASCOT)

Lower Financing Costs

Access to a Wider Investor Base

Risk Management

Tax and Regulatory Implications

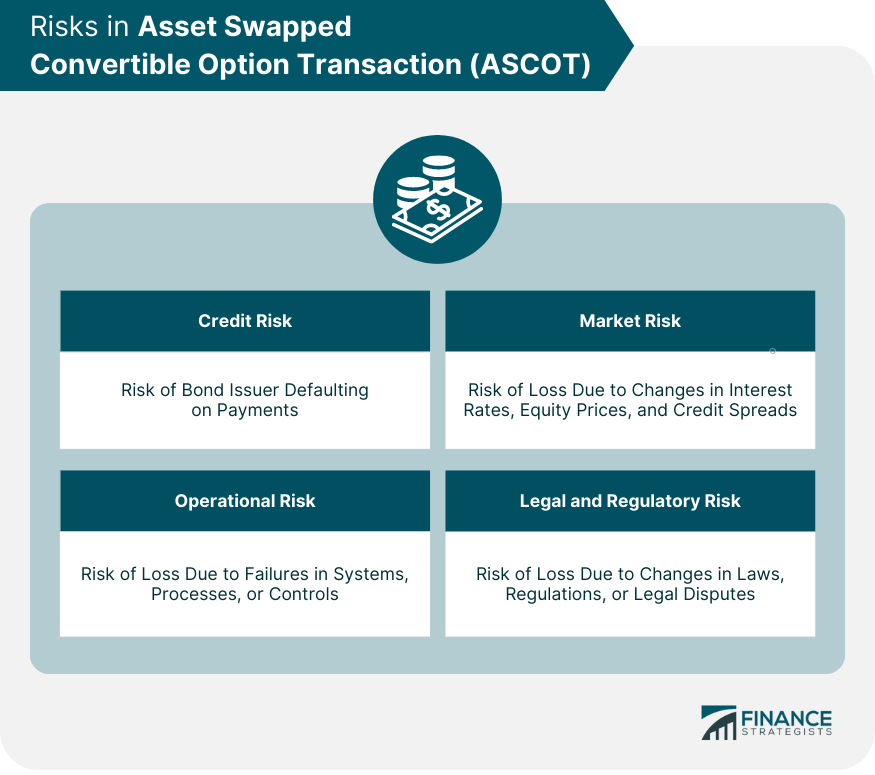

Risks and Challenges in Asset Swapped Convertible Option Transaction (ASCOT)

Credit Risk

Market Risk

Operational Risk

Legal and Regulatory Risk

Role of Asset Swapped Convertible Option Transaction (ASCOT) in Portfolio Management

Diversification

Yield Enhancement

Hedging Strategies

Case Studies: Application of Asset Swapped Convertible Option Transaction (ASCOT)

ASCOT in Corporate Finance

A company can issue a convertible bond, then enter into an ASCOT to separate the bond and option components. This can allow the company to reduce its financing costs and manage its capital structure more effectively.ASCOT in Investment Banking

ASCOT in Hedge Funds

Future of Asset Swapped Convertible Option Transaction (ASCOT)

Impact of Technological Innovations on ASCOT

Potential Regulatory Changes

Evolving Market Conditions and Their Effect on ASCOT

Conclusion

Asset Swapped Convertible Option Transaction (ASCOT) FAQs

An Asset Swapped Convertible Option Transaction (ASCOT) is a financial instrument that separates the components of a convertible bond, specifically the bond itself and the embedded option. This allows the components to be managed separately, providing more effective risk management.

An ASCOT involves three main steps. First, an investor purchases a convertible bond. Then, they enter an asset swap agreement, which exchanges the bond's cash flows for a different set of cash flows. Lastly, the investor sells the embedded option in the bond as a separate transaction.

The key benefits of an ASCOT include lower financing costs, access to a wider investor base, effective risk management, and potential tax and regulatory benefits. By separating the bond and option components, investors can manage each risk separately, tailoring their exposure to match their risk tolerance and market view.

The main risks associated with an ASCOT include credit risk, market risk, operational risk, and legal and regulatory risk. These risks can be mitigated through careful credit analysis, appropriate hedging strategies, robust operational controls, and legal and regulatory compliance.

An ASCOT can contribute to portfolio management through diversification, yield enhancement, and hedging strategies. It provides exposure to a unique combination of credit risk, interest rate risk, and equity risk, which can help reduce the overall risk of the portfolio and enhance its risk-adjusted return.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.