Investment education is the process of learning about various investment opportunities, strategies, and risks to make informed decisions about how to invest your money. It helps to reduce investment risks and achieve financial goals. Investment education is crucial in today's rapidly changing financial landscape. It empowers all individuals to make informed decisions about their financial future, helping them achieve their long-term goals. Investment education is not just for experienced investors; it is for everyone who wants to learn more about investing. Whether an individual is just starting out or has been investing for years, there is always more to learn about the world of investing. Investment education can help individuals better understand the different investment options available, how to manage risk, and how to create a diversified portfolio. Investment education is essential for anyone who wants to achieve financial stability and security. It helps individuals to make informed decisions about their finances. Without a basic understanding of investing, people may make hasty or uninformed decisions, resulting in significant financial losses. Another reason investment education is crucial is that it can help individuals to achieve their financial goals. Whether someone is saving for retirement, a down payment on a home, or their children's education, investing can be an effective way to grow their money over time. However, to achieve these goals, individuals need to understand how to invest and which investment options are best suited to their needs. Finally, investment education is critical because it can help individuals to build long-term wealth. Investing is one of the most effective ways to grow your money over time, and with the right knowledge and approach, individuals can build significant wealth over the long term. However, investing is not without risks, and individuals need to understand how to minimize those risks while still achieving their financial goals. Investment education covers a range of topics related to investing, including the different types of investments available and how they work. This includes stocks, bonds, mutual funds, and other investment vehicles. Investment education also covers topics such as how to evaluate the performance of investments, how to manage risk, and how to create a diversified investment portfolio. In addition to these core topics, investment education may also cover more specialized topics, such as alternative investments, international investing, and socially responsible investing. Common stocks represent ownership in a corporation. Shareholders of common stocks typically have voting rights and may receive dividends. Preferred stocks are hybrid securities with characteristics of both stocks and bonds. They typically pay fixed dividends and claim more assets and earnings than common stocks. Stock valuation involves determining the intrinsic value of a stock to decide whether it is overvalued, undervalued, or fairly valued. Various methods, such as discounted cash flow analysis and price-to-earnings ratios, are used to value stocks. Government bonds are debt securities issued by federal, state, or local governments to finance their operations. They are generally considered low-risk investments. Corporate bonds are debt securities issued by companies to raise capital. The risk and return profile of corporate bonds depends on the creditworthiness of the issuing company. Municipal bonds are debt securities state or local governments issued to finance public projects. They often provide tax advantages to investors. Bond valuation involves determining the fair value of a bond. It typically involves discounting the bond's future cash flows, such as interest payments and principal repayment, to determine its present value. Open-end funds are investment vehicles that pool investors' money to buy a diversified portfolio of stocks, bonds, or other securities. They issue new shares and redeem existing shares at the net asset value (NAV) per share. Closed-end funds issue a fixed number of shares through an initial public offering (IPO) and trade on stock exchanges. Their share price can deviate from their NAV, trading at a premium or discount. Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges like individual stocks. They typically track an index or a specific investment theme and offer intraday liquidity, lower costs, and tax efficiency. Real estate investing involves purchasing, owning, managing, renting, or selling real property for profit. It can provide diversification, income generation, and potential appreciation in value. Private equity refers to investments in private companies or the privatization of public companies. It typically involves longer investment horizons and higher risk in exchange for potentially higher returns. Hedge funds are actively managed investment funds that employ various strategies to generate returns. They often use leverage, derivatives, and short-selling techniques, catering to sophisticated investors and institutions. Commodities are raw materials or primary agricultural products that can be bought, sold, or traded. Investors can gain exposure to commodities through physical ownership, futures contracts, or commodity-focused funds. Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks. They are highly volatile and speculative investments, offering potential high returns but also carrying significant risks. Fundamental analysis involves evaluating a company's financial health, competitive position, and market conditions to determine its intrinsic value. Investors use financial statements, industry trends, and economic indicators to make informed decisions. Technical analysis focuses on historical price movements and trading volume to identify patterns and trends that can predict future price movements. It relies on tools like moving averages, trend lines, and oscillators to generate buy and sell signals. Passive investing is an investment strategy that aims to replicate the performance of a specific market index or benchmark. It typically involves buying and holding index funds or ETFs and requires minimal trading and management. Active investing involves actively managing a portfolio to outperform a specific benchmark or market index. It requires ongoing research, analysis, and decision-making by the investor or a professional money manager. Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach helps reduce the impact of market volatility and eliminates the need to time the market. Dividend reinvestment is a strategy that involves reinvesting dividends received from stocks or funds back into the same investment. This helps compound returns and accelerates the growth of the investment over time. Risk tolerance refers to an investor's willingness and ability to accept the potential for losses in exchange for potential gains. Determining one's risk tolerance is essential to build a suitable investment portfolio. Investment horizon is the length of time an investor expects to hold their investments before needing to access the funds. It helps determine the appropriate asset allocation and risk profile for the portfolio. Asset classes are categories of investments that have similar risk and return characteristics. Examples include stocks, bonds, real estate, and cash. Allocating funds across different asset classes helps diversify the portfolio and manage risk. Diversification involves spreading investments across various assets, sectors, and regions to reduce overall portfolio risk. Rebalancing is the process of adjusting the portfolio's allocations periodically to maintain the desired level of diversification and risk. Portfolio performance evaluation involves assessing the returns and risk of a portfolio relative to its objectives and benchmark. It helps investors understand the effectiveness of their investment strategies and make necessary adjustments. If you are new to investing and want to learn more, there are many resources available to help you get started. One option is to read books on investing, which can provide you with a solid foundation of knowledge on the subject. Another option is to take online courses or attend investment seminars and workshops, which can provide you with more in-depth knowledge and insights from industry experts. Finally, if you are looking for personalized guidance, you may want to consider working with a financial advisor who specializes in investment planning. A financial advisor can help you develop an investment strategy tailored to your individual needs and goals and provide ongoing support and guidance as you navigate the world of investing. Whatever approach you choose, the most important thing is to start educating yourself about investing and take control of your financial future. Investment education is a crucial process for anyone who wants to achieve financial stability, make informed decisions about their finances, and build long-term wealth. With investment education, individuals can learn about the different investment options available, how to manage risk, and how to create a diversified portfolio. The key topics covered in investment education include various types of investments such as stocks, bonds, mutual funds, real estate, and alternative investments. Investment strategies such as fundamental and technical analysis, passive and active investing, and dollar-cost averaging are also discussed. Additionally, investment education resources such as books, online courses, seminars, workshops, and financial advisors are available for those looking to expand their knowledge. It is essential to start educating oneself about investing and take control of one's financial future to achieve financial goals and make informed investment decisions.What Is Investment Education?

Importance of Investment Education

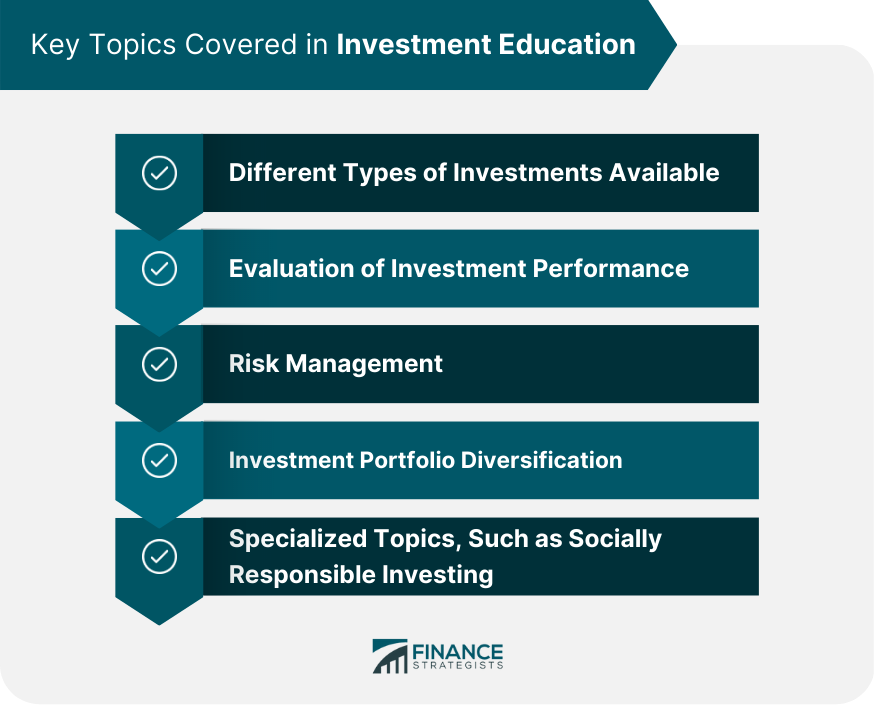

Key Topics Covered in Investment Education

Types of Investments Discussed in Investment Education

Stocks

Common Stocks

Preferred Stocks

Stock Valuation

Bonds

Government Bonds

Corporate Bonds

Municipal Bonds

Bond Valuation

Mutual Funds

Open-End Funds

Closed-End Funds

Exchange-Traded Funds (ETFs)

Real Estate

Alternative Investments

Private Equity

Hedge Funds

Commodities

Cryptocurrencies

Investment Strategies

Fundamental Analysis

Technical Analysis

Passive Investing

Active Investing

Dollar-Cost Averaging

Dividend Reinvestment

Asset Allocation and Portfolio Management

Risk Tolerance

Investment Horizon

Asset Classes

Diversification and Rebalancing

Portfolio Performance Evaluation

Investment Education Resources

Conclusion

Investment Education FAQs

Investment education refers to learning about various investment opportunities, strategies, and risks to make informed decisions about how to invest your money.

Investment education is important because it helps individuals to make informed investment decisions that can lead to better financial outcomes. It also helps to reduce the risks associated with investing by providing individuals with the knowledge and skills needed to assess and manage risk.

Key topics covered in investment education include understanding different types of investments, such as stocks, bonds, and mutual funds, evaluating the performance of investments, managing risk, and creating a diversified investment portfolio.

There are many ways to get started with investment education, including reading books on investing, taking online courses, attending investment seminars and workshops, and working with a financial advisor specializing in investment planning.

Actually, investment education is for everyone who wants to learn more about investing, regardless of their level of experience. Whether you are just starting out or have been investing for years, investment education can help you make more informed investment decisions and achieve your financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.