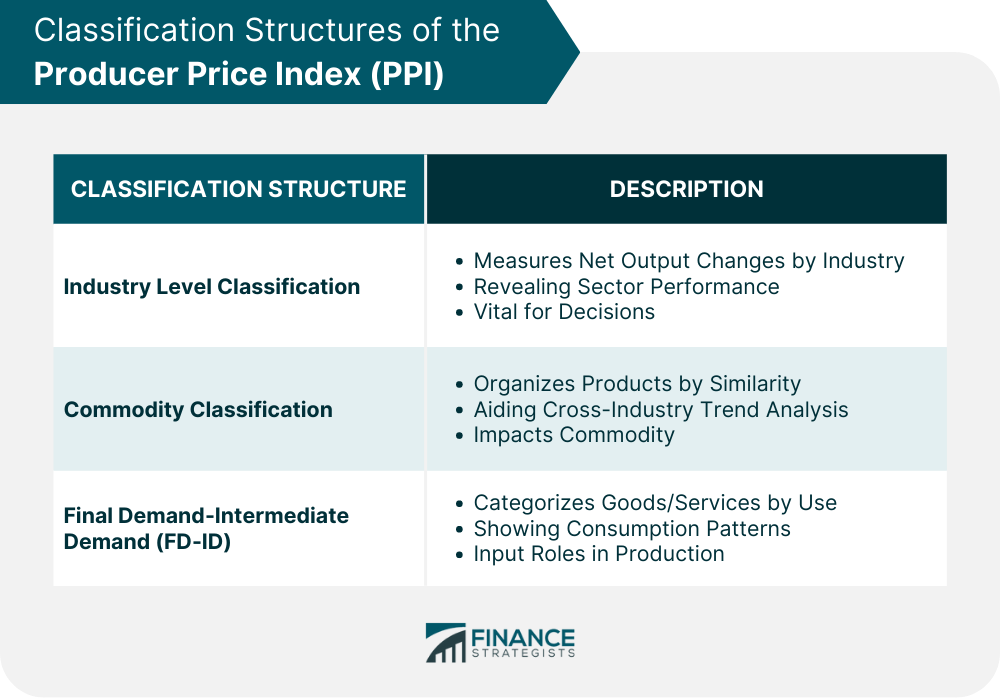

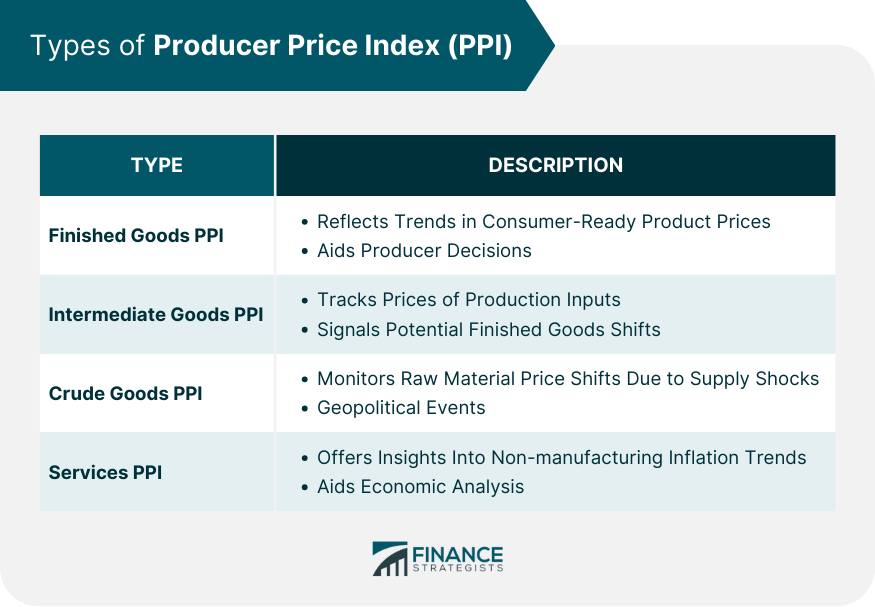

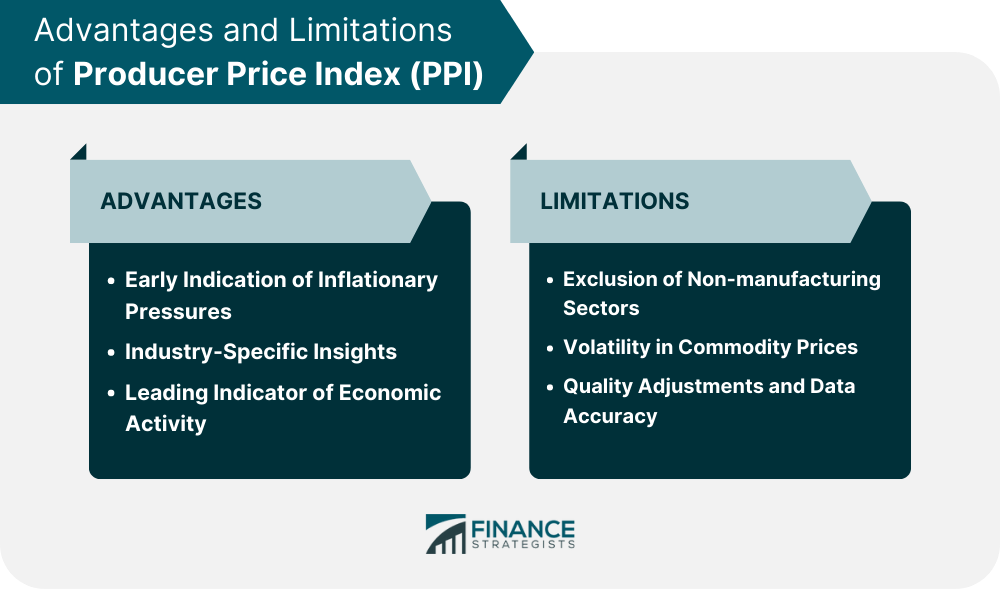

The Producer Price Index, or PPI, is a collection of roughly 10,000 indices used to calculate inflation by tracking the changes in wholesale prices for producers. The Producer Price Index stands in contrast with the Consumer Price Index which measures the change in prices at the retail level, rather than at the producer level. The PPI is a figure published by the Bureau of Labor Statistics (BLS). According to bls.gov, "PPIs are available for the output of nearly all industries in the goods-producing sectors of the U.S. economy and the PPI program covers approximately 72 percent of the service sector's output." The PPI sample includes data from over 25,000 establishments providing approximately 100,000 price quotations per month. The PPI index computes the change in prices using three primary classification structures: Industry Level Classification measures the changes in total net output by industry, which is the aggregate sales prices for an industry's output sold outside the industry. Commodity Classification organizes products and services by overall similarity, material composition, and end use, regardless of industry classification. This approach is particularly useful in capturing trends that cut across industries and shed light on broader consumption patterns. Commodity Classification allows analysts to uncover connections between seemingly unrelated industries and assess the impact of changes in specific commodities on various sectors of the economy. Final Demand-Intermediate Demand (FD-ID) categorizes goods and services according to whether the buyer is an end user, known as "final demand,"or is used as inputs for the production of another good, known as "intermediate demand." This classification represents a nuanced categorization that distinguishes between goods and services based on their role in the production and consumption chain. It separates items according to whether they are destined for direct consumption by end users (final demand) or if they are utilized as inputs for the creation of other goods and services (intermediate demand). The uses of the Producer Price Index include: A contract adjustment tool—a clause can be added to long-term contracts that the contract may be adjusted using the percent change in the PPI An indicator of inflation, either at the overall producer level or for particular industries and products A comparison of input and output costs A "deflator" of other economic data, such as calculating the "real" growth of a nation's Gross Domestic Product rather than its nominal growth Finished Goods PPI, or the Producer Price Index for Finished Goods, reflects the trend in prices for products that are ready for sale to the end consumer. These can range from consumer products like electronics, apparel, and food items, to capital equipment and construction. The Finished Goods PPI tracks changes over time in the selling prices received by domestic producers for their output. It's crucial to observe these fluctuations as they indicate how much consumers will likely need to pay for these products, and whether there's a trend of increasing or decreasing prices at the retail level. The Intermediate Goods PPI captures the average change over time in the prices received by domestic producers for intermediate goods. These are products that are used in the production of other goods but aren't final products themselves. Examples include raw materials that have been processed but not yet turned into finished products, such as steel rods, refined oils, and milled grain. Changes in the Intermediate Goods PPI can signal potential future changes in the Finished Goods PPI. If there's a significant increase in the prices of intermediate goods, it could eventually result in higher costs for finished products, given that these intermediates are used in their production. The Crude Goods PPI tracks the average change over time in prices received by primary producers for crude goods. These are products in their raw or unprocessed state, like fresh fruits, grains, live animals, and crude oil. Such goods often undergo further processing before they're transformed into intermediate or finished goods. Due to the nature of crude goods, this PPI is highly susceptible to supply and demand shocks. Events like natural disasters, geopolitical tensions, or significant global economic shifts can drastically affect the Crude Goods PPI. This category includes everything from retail and wholesale trade services, transportation, healthcare, and finance. Given the rising importance of the service sector in many economies, this index provides invaluable insights into non-manufacturing inflationary trends. Monitoring the Services PPI is essential, especially in economies where the service sector constitutes a significant portion of the GDP. Shifts in this index can offer hints about broader economic health, wage trends, and potential future shifts in consumer spending habits. By tracking the average change in selling prices from the perspective of domestic producers, the PPI provides early signals of inflation or deflation. It's often used alongside the Consumer Price Index (CPI) to offer a comprehensive picture of price dynamics. While the CPI captures price changes from a consumer's viewpoint, the PPI reflects costs from a producer's angle. Together, they provide a 360-degree view of price trends, helping analysts and policymakers make informed decisions. By being aware of trends in the Producer Price Index, particularly in the categories directly affecting their operations, companies can anticipate costs and adjust their prices accordingly. This foresight ensures profitability and competitive pricing, while also avoiding sudden price shocks to consumers. A steadily rising PPI might indicate that inflationary pressures are building up, prompting central banks to consider tightening monetary policy to stave off rampant inflation. Conversely, a declining PPI might signal deflationary pressures, leading to policy easing. The PPI provides valuable lead time, allowing for proactive, rather than reactive, policy measures. The PPI serves as an early indicator of potential inflationary pressures in the economy. By tracking changes in the prices of goods and services at the producer level, it provides insight into cost fluctuations before they are reflected in consumer prices. This enables policymakers and businesses to anticipate inflation trends and make timely adjustments to monetary and pricing strategies. It offers a granular perspective on price changes within various industries. This level of detail is valuable for understanding the specific dynamics affecting different sectors of the economy. Policymakers, investors, and businesses can use this information to tailor their strategies to the unique challenges and opportunities within each industry, enhancing decision-making and risk management. As a forward-looking economic indicator, the PPI can signal shifts in economic activity. Changes in producer prices can provide insight into shifts in demand, supply chain disruptions, and changes in production costs. These fluctuations can reflect broader economic trends, making the PPI a valuable tool for forecasting economic performance and identifying potential turning points in the business cycle. One of the main criticisms of the PPI is its focus primarily on the manufacturing sector, often leaving out significant portions of the non-manufacturing economy. While the Services PPI has bridged this gap to some extent, many argue that the index still doesn't fully capture the broader economic landscape, especially in service-dominated economies. The PPI, especially the Crude Goods PPI, is highly sensitive to volatility in commodity prices. Short-term supply and demand shocks can lead to sharp swings in the index, which might not necessarily reflect long-term trends. This volatility can sometimes muddy the waters, making it harder for analysts to discern underlying price dynamics. Making quality adjustments to the PPI is challenging. As products improve or deteriorate over time, their intrinsic value changes. However, accurately capturing these qualitative shifts in an index number is not straightforward. Additionally, data collection methods and accuracy can vary across countries and sectors, sometimes leading to discrepancies in reported figures. The Producer Price Index (PPI) refers to a collection of indices used to gauge inflation by tracking changes in wholesale prices for producers. The PPI's three classification structures—Industry Level, Commodity, and Final Demand-Intermediate Demand—provide valuable insights into economic trends, helping policymakers, businesses, and investors make informed decisions. Despite its advantages, the PPI also has limitations, such as its focus on manufacturing, susceptibility to commodity price volatility, and challenges in quality adjustments. Nevertheless, its role as an early inflation indicator, source of industry-specific data, and leading economic trend predictor underscores its significance in enhancing economic understanding and aiding decision-making processes across various sectors.What Does PPI Mean in Finance?

3 Classification Structures of the PPI

Industry Level Classification

By tracking the aggregate sales prices of an industry's output sold outside the industry, this classification offers insights into the economic health and performance of different sectors.

This information becomes invaluable for policymakers, investors, and businesses seeking to understand trends and make informed decisions based on industry-specific dynamics.Commodity Classification

Final Demand-Intermediate Demand (FD-ID)

What Is a PPI Used For?

Types of Producer Price Index

Finished Goods PPI

Intermediate Goods PPI

Crude Goods PPI

Services PPI

Significance of PPI

Inflation Measurement and Analysis

Pricing Decisions by Businesses

Economic Forecasting and Policy-Making

Advantages of the Producer Price Index (PPI)

Early Indication of Inflationary Pressures

Industry-Specific Insights

Leading Indicator of Economic Activity

Limitations of the Producer Price Index

Exclusion of Non-manufacturing Sectors

Volatility in Commodity Prices

Quality Adjustments and Data Accuracy

Conclusion

Producer Price Index (PPI) FAQs

PPI stands for the Producer Price Index.

The Producer Price Index, or PPI, is a collection of roughly 10,000 indices used to calculate inflation by tracking the changes in wholesale prices for producers.

One use for the PPI is as an indicator of inflation, either at the overall producer level or for particular industries and products.

The PPI sample includes data from over 25,000 establishments providing approximately 100,000 price quotations per month.

The PPI is contrasted by the Consumer Price Index, which measures the change in prices at the retail level, rather than at the producer level.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.