Weak longs refer to investors who possess a long position in a stock, but instead of riding out the market's ebbs and flows, they exit their position at the first sign of trouble. Their primary objective is to leverage the potential upside of security without facing any significant losses. However, this strategy often leads them to lose out on potential gains as they avoid the possibility of temporary declines. In contrast to weak longs, many other investors, particularly those who adopt a value investing approach, are willing to maintain their positions even in times of temporary market downturns. They base their investment decisions on thorough fundamental analysis, focusing on the intrinsic value of the security rather than its price movements. These investors accept market fluctuations as part of investing and are often patient, waiting for the market to acknowledge the value they originally saw. Understanding the distinct characteristics of weak longs is crucial for both investors and traders as it offers insights into certain market behaviors and volatility. Weak longs often display a number of defining characteristics that separate them from other types of investors. One of the key defining traits of weak longs is their short-term trading perspective. Unlike long-term investors who invest with a long-term horizon and are less concerned about short-term market fluctuations, weak longs are more interested in making quick profits. Their decisions are heavily influenced by short-term trends rather than the long-term potential of a stock. Another significant characteristic of weak longs is their high sensitivity to price changes. Even minor fluctuations can trigger a reaction, causing them to sell their positions quickly. This reaction is largely due to their risk-averse nature and a desire to protect their capital. However, this often leads to premature exits, causing them to miss out on potential profits if the stock price recovers. Weak longs typically adopt a speculative investment approach. Instead of thoroughly analyzing a company's fundamentals and potential growth, they are more likely to base their decisions on market rumors, trends, or other speculative factors. This speculative approach can make their investments riskier and more unpredictable. Weak longs are predominantly driven by fear. The fear of potential losses often dominates their decision-making process, prompting them to exit positions at the first sign of trouble. While this approach can sometimes protect them from severe losses during a market downturn, it can also lead to missed opportunities during market recoveries. Due to their short-term outlook and sensitivity to price changes, weak longs often engage in frequent trading. While this might offer more opportunities for profits, it also results in higher transaction costs. These costs, including broker fees and taxes on short-term capital gains, can significantly erode their overall profits. Short-term traders, including day traders and swing traders, can be considered weak longs due to their focus on short-term price movements. These investors rarely hold positions for an extended period and prefer to capitalize on small, immediate gains. Their decisions are heavily influenced by technical analysis and short-term market trends rather than the fundamental value of security. Momentum traders, another subset of weak longs, ride the wave of current market trends, buying securities that are going up and selling those that are going down. They generally operate under the principle that "the trend is your friend," moving in and out of positions quickly to secure profits before the momentum changes. Speculators, while not exclusively weak longs, often display similar characteristics. They purchase securities based on anticipation of a price increase rather than on the fundamental value of the stock. This practice exposes them to significant risk if their predictions are incorrect, leading to substantial losses. Fear and greed are the primary driving forces behind weak longs. Fear of losing their capital makes these investors sell their positions at the first sign of a price drop. On the other hand, the desire for quick profits entices them to enter positions that may not have strong fundamental value but display promising price movements. Market volatility significantly impacts the behavior of weak longs. Increased volatility, characterized by larger price swings, often triggers fear among these investors, causing them to exit their positions hastily. This action can exacerbate the volatility, leading to a self-perpetuating cycle. During market downturns, weak longs typically respond by liquidating their positions in fear of further price drops. This reaction can contribute to market instability and potentially deepen the downturn. Their swift exit often prevents them from partaking in subsequent recoveries, resulting in missed opportunities. Weak longs usually enter a position when they perceive a positive price momentum. They often rely heavily on technical analysis to identify bullish patterns and trends as their entry points. However, their focus on price movements rather than fundamental analysis can make their decisions more susceptible to market noise. Weak longs typically exit their positions when they observe the first signs of a downturn. Their exit points are usually predetermined based on a set percentage of loss they are willing to take. The problem with this approach is that it doesn't consider the fundamental value of security or the possibility of market recovery. Stop-loss orders play a crucial role in the trading strategy of weak longs. A stop-loss order is an order placed with a broker to buy or sell a security when it reaches a certain price. Weak longs often use stop-loss orders to limit their potential losses. However, while stop-loss orders can protect against substantial losses, they can also lock in minor losses and prevent participation in potential recoveries. One of the significant limitations of the weak long strategy is the difficulty of timing the market accurately. Trying to predict the best time to enter and exit the market is nearly impossible consistently. As a result, weak longs might often exit positions too soon, miss out on potential gains, or enter too late, thereby eroding their profits. Given their approach to trading, weak longs often make frequent trades, which leads to increased transaction costs. These costs can significantly eat into their potential profits. Moreover, the tax implications of short-term trades can further reduce the net gains. The nature of weak long trading can be emotionally taxing. The constant need to monitor the market and make quick decisions can lead to stress and eventual burnout. This stress, in turn, can impact decision-making, leading to poor trade choices and losses. Weak longs can add to market volatility, especially during periods of uncertainty. Their tendency to sell positions quickly at the first sign of a downturn can accelerate market declines, making the market more unstable and unpredictable. In a bull market, weak longs can add to the upward momentum by quickly buying into rising stocks. However, in a bear market, they can exacerbate the downward spiral by rapidly selling off their positions. Weak longs often contribute to stock price momentum. When they jump onto rising stocks, they can help drive prices even higher. However, the flip side is that they can also hasten price drops when they exit their positions swiftly. To protect your investments, it's essential to recognize the signs of weak longs. Rapid price increases followed by equally swift declines, especially in the absence of significant news or changes in fundamentals, could indicate the presence of weak longs. One effective strategy to mitigate the impact of weak longs is to take a long-term, value-based investment approach. By focusing on the fundamentals and the intrinsic value of a security, you can ride out the short-term fluctuations caused by the actions of weak longs. To protect your investments from weak longs, it's crucial to diversify your portfolio across different asset classes and sectors. Diversification can help mitigate the risk of market volatility and provide a buffer against the unpredictable movements caused by weak longs. Weak longs refer to investors who quickly abandon their long positions at the first signs of a market downturn. These individuals are characterized by their short-term perspective, swift reaction to market fluctuations, and susceptibility to fear and greed. They are predominantly found among short-term traders, momentum traders, and speculators. Their trading strategy revolves around seeking rapid profits by capitalizing on short-term trends, and employing stop-loss orders to limit potential losses. However, this approach carries significant risks, including the challenge of market timing, increased transaction costs, and emotional stress. As an investor, it's crucial to recognize the signs of weak longs and adopt strategies such as long-term, value-based investing and diversification to mitigate their impact. Given the complexities associated with investing, especially in volatile markets, it may be wise to consider seeking professional wealth management services to ensure a robust and sound investment strategy.What Are Weak Longs?

Characteristics of Weak Longs

Short-Term Trading Outlook

Sensitivity to Price Changes

Speculative Investment Strategy

Fear-Driven Decision Making

Frequent Trading and Higher Transaction Costs

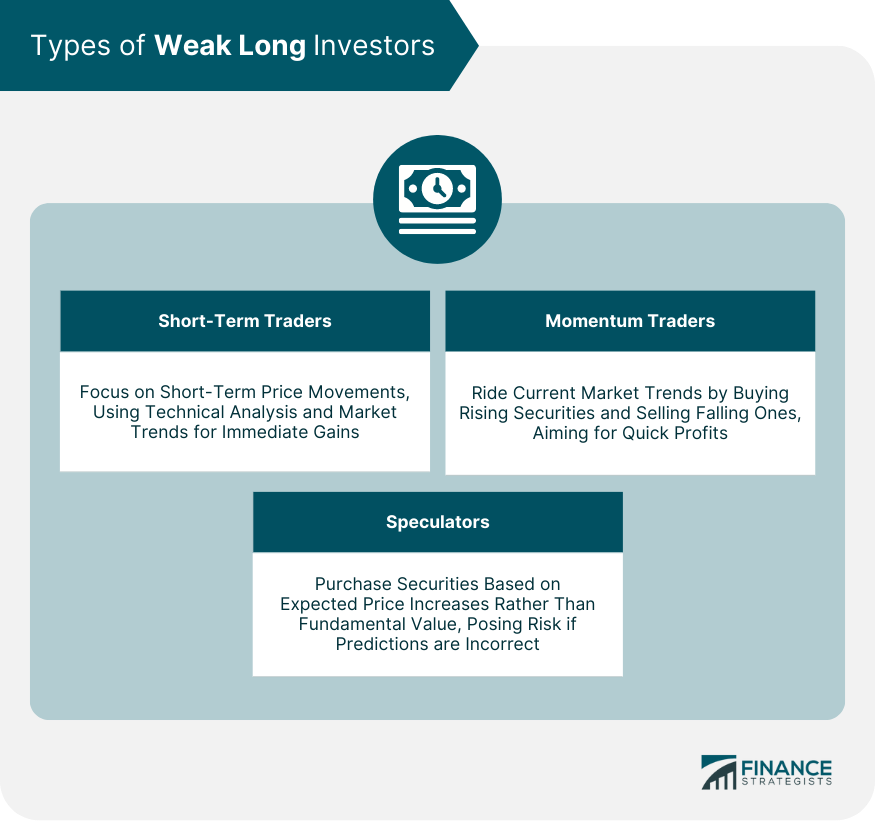

Types of Weak Long Investors

Short-Term Traders

Momentum Traders

Speculators

Psychology of Weak Longs

Role of Fear and Greed

Impact of Market Volatility

How Weak Longs Respond to Market Downturns

Trading Strategy of Weak Longs

Entry Points

Exit Points

Stop-Loss Orders

Risks and Limitations of Weak Long Strategy

Market Timing Challenges

Increased Transaction Costs

Emotional Stress and Trading Burnout

Weak Longs in the Context of Market Behavior

Influence on Market Volatility

Role in Bull and Bear Markets

Effect on Stock Price Momentum

Tips for Dealing With Weak Longs as an Investor

Recognize the Signs of Weak Longs

Mitigate the Impact of Weak Longs

Protect Investments From Weak Longs

Final Thoughts

Weak Longs FAQs

Weak longs are investors who hold a long position in stock but exit their position quickly at the first sign of a price drop.

Weak longs are characterized by their short-term outlook, sensitivity to price changes, and their tendency to make swift decisions based on market fluctuations.

Short-term traders, momentum traders, and speculators often display weak long behavior due to their focus on quick profits and aversion to losses.

The weak long strategy carries significant risks such as the challenge of accurately timing the market, higher transaction costs due to frequent trades, and potential emotional stress and burnout.

Strategies to mitigate the impact of weak longs include taking a long-term, value-based investment approach, diversifying your portfolio, and seeking professional wealth management services.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.