Trend trading is a trading strategy that aims to identify and capitalize on market trends. It involves analyzing price movements and identifying the direction in which an asset's price is moving over a specific period. Trend traders seek to enter trades in the direction of the prevailing trend and hold onto their positions until the trend shows signs of reversing. This strategy is based on the belief that markets tend to exhibit sustained price movements in one direction for a certain period before changing course. Trend trading holds significant importance in wealth management due to its potential for generating profits and managing risk. It provides a systematic approach to managing risk, as traders can use various techniques. Additionally, trend trading can be used in combination with other investment strategies to enhance portfolio diversification and optimize investment outcomes. One of the key principles of trend trading is identifying optimal entry and exit points. Trend traders look for signals that indicate the start of a new trend or the continuation of an existing trend. These signals can be based on technical indicators, such as moving averages or trendlines, or chart patterns, such as breakouts or trend reversals. The goal is to enter trades as early as possible to maximize profit potential and exit before the trend reverses. Effective risk management is essential in trend trading. Traders need to carefully manage their risk exposure to protect against potential losses. This involves setting stop loss levels, which are predetermined price levels at which a trade will be automatically exited to limit losses. Traders may also use trailing stops, which adjust the stop loss level as the trade moves in their favor, allowing for potential profits to be protected. Risk management strategies also include position sizing, which determines the appropriate amount of capital to allocate to each trade based on risk tolerance and the size of the trading account. Trend traders rely on technical indicators and chart patterns to identify trends and make trading decisions. Technical indicators, such as moving averages, relative strength index (RSI), or stochastic oscillators, provide insights into the strength and momentum of a trend. Chart patterns, such as breakouts or trendlines, help traders visually identify the direction and duration of a trend. These tools and patterns aid in confirming the presence of a trend and provide signals for entry and exit points. The breakout strategy is a popular trend trading strategy that involves identifying key support or resistance levels and entering trades when the price breaks above resistance or below support. Breakouts often signify the start of a new trend or the continuation of an existing trend. Traders using this strategy aim to capture the momentum of the breakout and ride the trend until it shows signs of reversal. The moving averages strategy is based on the use of moving averages to identify trends and generate trading signals. Traders typically use two moving averages, such as a shorter-term moving average and a longer-term moving average. When the shorter-term moving average crosses above the longer-term moving average, it generates a buy signal, indicating the start of an uptrend. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it generates a sell signal, indicating the start of a downtrend. The trend reversal strategy focuses on identifying potential turning points in a trend. Traders using this strategy look for signs that a trend is losing momentum and about to reverse direction. This can include the analysis of candlestick patterns, such as doji or engulfing patterns, or the use of technical indicators that signal trend exhaustion, such as the RSI or the MACD. When a potential trend reversal is identified, traders may enter trades in the opposite direction of the prevailing trend. The trend-following strategy aims to capture and ride trends for as long as possible. Traders using this strategy enter trades in the direction of the prevailing trend and hold onto their positions until there are clear signs of trend exhaustion or reversal. Trend-following traders often use trailing stops to protect profits and let winning trades run. This strategy assumes that trends persist and that there is profit potential in following the market's direction. Trend trading allows traders to capitalize on strong and sustained price movements in the market. By entering trades in the direction of the trend, traders have the potential to capture significant profits as the trend continues. Traders focus on identifying and following trends, reducing the complexity and noise associated with short-term market fluctuations. This simplicity can help traders stay disciplined and avoid emotional decision making. Trend trading strategies can be applied to various asset classes, such as stocks, bonds, commodities, or currencies, allowing for exposure to different markets and reducing overall portfolio risk. Trend trading is not immune to false signals and whipsaws, where the price temporarily reverses before resuming the trend. These false signals can lead to losses or premature exits from trades. Traders need to be aware of these risks and use additional confirmation tools or filters to reduce the impact of false signals. Trend trading requires discipline and the ability to stick to the trading plan even during periods of drawdown or when trades do not immediately go in the desired direction. It can be psychologically challenging to stay committed to the strategy and avoid impulsive decisions based on short-term market fluctuations. Trend trading focuses on capturing trends and may miss out on short-term market movements or range-bound periods. Traders employing trend trading strategies accept that they will not participate in every market move and are willing to forgo short-term opportunities for the potential profits offered by sustained trends. Risk management is a critical aspect of trend trading. Setting appropriate stop loss levels is essential to limit potential losses and protect capital. Stop loss levels are predetermined price levels at which a trade will be automatically exited if the market moves against the trader's position. Traders should determine stop loss levels based on their risk tolerance, the volatility of the market, and the specific characteristics of each trade. Trailing stops are a risk management technique used in trend trading to protect profits while allowing for potential further gains. Trailing stops adjust the stop loss level as the trade moves in the trader's favor. If the market price moves in the desired direction, the trailing stop will move the stop loss level closer to the current market price, securing profits and protecting against potential reversals. This technique allows traders to capture more significant profits if the trend continues while limiting losses if the trend reverses. Proper position sizing is crucial in trend trading to manage risk effectively. Position size refers to the amount of capital allocated to each trade. Traders should determine position sizes based on their risk tolerance, account size, and the specific risk-reward characteristics of each trade. By properly managing position sizes, traders can control their exposure to potential losses and maintain consistency in their risk management approach. Charting platforms and software provide essential tools for trend traders to analyze price movements, identify trends, and generate trading signals. These platforms offer a wide range of technical indicators, chart patterns, and drawing tools that facilitate trend analysis. They also provide real-time or historical market data, allowing traders to monitor price movements and make informed trading decisions. Technical analysis tools play a significant role in trend trading. These tools include various technical indicators, such as moving averages, trendlines, oscillators, or momentum indicators. Traders use these tools to identify trends, confirm trend reversals, and generate trading signals. Each technical indicator has its strengths and weaknesses, and traders may combine multiple indicators to increase the accuracy of their analysis. Algorithmic trading systems, or trading robots, can be utilized by trend traders to automate the execution of trades based on predefined rules and parameters. These systems use algorithms to analyze market data, identify trends, and generate trading signals. By automating the trading process, algorithmic trading systems remove emotional biases and enable faster execution. They can also monitor multiple markets simultaneously and take advantage of opportunities that may arise across different asset classes. Trend trading is a trading strategy that aims to identify and capitalize on market trends. It provides a systematic approach to trading by focusing on price movements and entering trades in the direction of the prevailing trend. Trend trading can be beneficial in wealth management, as it offers the potential for profits in strong trends, simplifies decision making, and provides diversification benefits. However, it is not without limitations, including false signals, psychological challenges, and the inability to capture all market moves. Effective risk management, the use of technical analysis tools, and the incorporation of appropriate technologies can enhance the success of trend trading strategies. Traders should carefully consider their risk tolerance, adhere to proper risk management techniques, and continually monitor and adapt to market conditions to optimize their trend trading outcomes.What Is Trend Trading?

Principles of Trend Trading

Entry and Exit Points

Risk Management Strategies

Technical Indicators and Chart Patterns

Trend Trading Strategies

Breakout Strategy

Moving Averages Strategy

Trend Reversal Strategy

Trend-Following Strategy

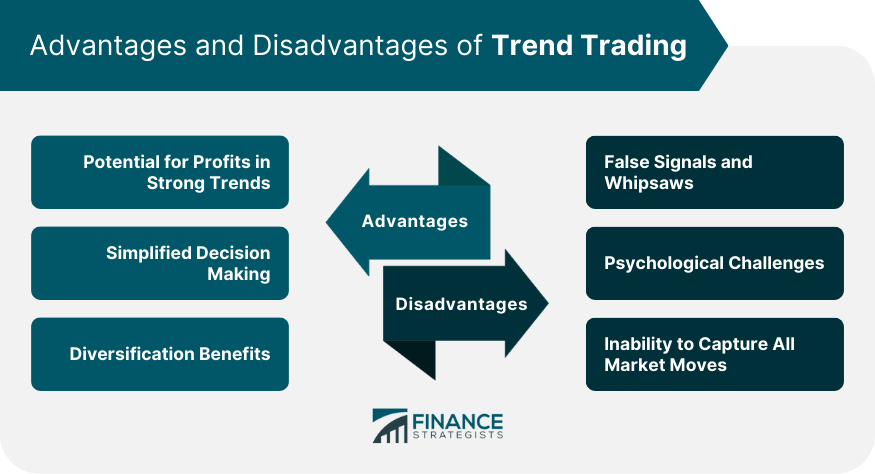

Advantages of Trend Trading

Potential for Profits in Strong Trends

Simplified Decision Making

Diversification Benefits

Disadvantages of Trend Trading

False Signals and Whipsaws

Psychological Challenges

Inability to Capture All Market Moves

Risk Management in Trend Trading

Setting Stop Loss Levels

Using Trailing Stops

Managing Position Sizes

Tools and Technology for Trend Trading

Charting Platforms and Software

Technical Analysis Tools

Algorithmic Trading Systems

Conclusion

Trend Trading FAQs

Trend trading is a trading strategy that aims to identify and capitalize on market trends. It involves analyzing price movements and entering trades in the direction of the prevailing trend. The goal is to ride the trend and capture profits until signs of a trend reversal occur.

Trend trading is important in wealth management as it provides a systematic approach to trading, allows for potential profits in strong trends, simplifies decision making, and offers diversification benefits. It helps wealth managers optimize portfolio performance by taking advantage of sustained price movements in the market.

The principles of trend trading include identifying optimal entry and exit points, employing risk management strategies, and using technical indicators and chart patterns to confirm trends and generate trading signals. These principles guide traders in their decision making and help them capitalize on trends effectively.

The advantages of trend trading include the potential for profits in strong trends, simplified decision making by focusing on price movements, and diversification benefits. Trend trading can enhance portfolio performance and provide opportunities for long-term growth.

The disadvantages of trend trading include the occurrence of false signals and whipsaws, psychological challenges in staying disciplined during drawdowns, and the inability to capture all market moves. Traders must be aware of these limitations and employ proper risk management techniques to mitigate potential losses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.