Fisher Transform is a technical indicator, devised by John F. Ehlers, which seeks to create a nearly Gaussian probability distribution for commodity or stock prices. Named after the Fisher function, this indicator essentially converts prices into a Gaussian normal distribution, enabling traders to spot price reversals with higher accuracy. The Fisher Transform Indicator applies advanced mathematical calculations to prices. Its transformative quality helps to delineate extreme price movements, providing traders with critical information for their investment decisions. The Fisher Transform Indicator has immense value to traders and investors alike. This tool not only helps identify turning points in the market but also provides potential buy and sell signals. With a basis in advanced statistical theory, this indicator can offer a different perspective on price action, thus expanding the scope of a trader's strategy. The importance of the Fisher Transform indicator cannot be overstated. Through its identification of extreme price movements, the tool provides invaluable information about potential market reversals. By distorting price data to fit a nearly perfect Gaussian distribution, the Fisher Transform also enhances the predictability of future price movements, offering traders a significant edge in volatile markets. The Fisher Transform Indicator utilizes complex mathematical algorithms to convert commodity and stock prices into a more normal distribution. This conversion allows for more accurate identification of extreme price movements and potential reversals. At its core, the Fisher Transform Indicator alters price data to approximate a Gaussian distribution. This transformation sharpens reversal signals and clarifies price extremes, making it easier for traders to identify market turning points. By producing more precise information about market conditions, the Fisher Transform Indicator helps traders to make informed decisions with higher confidence. The Fisher Transform Indicator is classified as an oscillator, meaning that its value swings above and below a central point. This characteristic allows traders to identify overbought and oversold conditions, providing potential clues about market reversals. Just as importantly, the Fisher Transform Indicator is bound by mathematical limits. This bounded nature restricts the range of possible values, making the indicator's signals more accurate and reliable than those of some other oscillators. One of the Fisher Transform Indicator's key features is its ability to identify major market trends. By converting price data into a Gaussian distribution, the indicator enhances the visibility of price extremes, providing clearer signals about potential reversals. By effectively identifying market trends, the Fisher Transform Indicator helps traders to develop more informed strategies. This ability can be particularly useful in volatile markets, where discerning a clear trend can often be challenging. The Fisher Transform Indicator doesn't just identify market trends—it also generates potential buy and sell signals. These signals are typically produced when the indicator's value crosses above or below zero, signaling a potential price reversal. These signals, when combined with other technical analysis tools, can guide traders in their investment decisions. The ability of the Fisher Transform Indicator to provide actionable signals adds an additional layer of functionality to this versatile tool. One significant advantage of the Fisher Transform Indicator is its ability to smooth out price data. By transforming this data into a more normal distribution, the indicator eliminates much of the noise associated with price movements, providing traders with a clearer picture of market trends. This smoothing effect enhances the accuracy of the Fisher Transform Indicator's signals, helping traders to make more informed investment decisions. It's a powerful tool for those seeking to extract meaningful insights from volatile market data. The Fisher Transform Indicator is known for its high degree of signal accuracy. By transforming price data into a Gaussian distribution, the indicator provides clearer signals about potential market reversals. This improved signal accuracy can be a game-changer for traders. By providing clearer, more reliable signals, the Fisher Transform Indicator helps traders to make investment decisions with greater confidence, reducing the risk associated with uncertain market conditions. Another key advantage of the Fisher Transform Indicator is its ability to detect price reversals at an early stage. This early detection can provide traders with a valuable head start, enabling them to capitalize on potential opportunities before other market participants. By detecting price reversals early, the Fisher Transform Indicator allows traders to take advantage of market trends while they're still developing. This can provide a significant advantage, particularly in fast-moving markets where timing is crucial. Despite its many advantages, the Fisher Transform Indicator is not without its limitations. One of these is that it's a lagging indicator, meaning that it relies on past price data to generate its signals. As a result, the Fisher Transform Indicator may not always provide timely signals, particularly in fast-moving markets. This characteristic can potentially lead to missed opportunities, especially when market conditions change rapidly. Therefore, traders should use the Fisher Transform Indicator in conjunction with other tools to mitigate this limitation. The Fisher Transform Indicator can be sensitive to market volatility. While its transformative properties help to smooth out price data, extreme market volatility can distort the indicator's signals, potentially leading to inaccurate readings. It's crucial for traders to understand this limitation and to use the Fisher Transform Indicator cautiously during periods of high market volatility. Cross-verifying signals with other indicators can help mitigate this issue. While the Fisher Transform Indicator provides valuable signals, it's not infallible. Traders should always seek additional confirmation before acting on these signals. This can be achieved by using other technical indicators or by employing fundamental analysis techniques. By seeking additional confirmation, traders can reduce the risk of false signals and improve the overall reliability of their trading strategy. The Fisher Transform Indicator can play a significant role in asset allocation strategies. By providing early signals about market reversals, the indicator helps traders to adjust their portfolios in response to changing market conditions. Traders can use the Fisher Transform Indicator to optimize their asset allocation strategies, thereby enhancing their portfolio's risk-reward profile. It's an invaluable tool for those seeking to balance their investment portfolios in line with market trends. The Fisher Transform Indicator is not just a tool for identifying market trends—it's also a valuable risk management tool. By providing accurate signals about market reversals, the indicator helps traders to manage their risk more effectively. The Fisher Transform Indicator's ability to identify overbought and oversold conditions can alert traders to potential risks, enabling them to adjust their positions accordingly. By integrating the Fisher Transform Indicator into their risk management techniques, traders can enhance their resilience to market volatility. The Fisher Transform Indicator has wide-ranging applications in trading and investment. Whether it's identifying potential trading opportunities, managing risk, or optimizing asset allocation strategies, this indicator offers valuable insights that can inform a wide range of investment decisions. Traders can use the Fisher Transform Indicator to enhance their trading strategies, taking advantage of the tool's accuracy and predictive power. By integrating this tool into their decision-making processes, traders can improve their ability to navigate complex market conditions. The Relative Strength Index (RSI) is a popular technical indicator used to identify overbought and oversold conditions. While both the RSI and the Fisher Transform Indicator can identify these conditions, they do so in different ways. The RSI measures the speed and change of price movements, while the Fisher Transform Indicator transforms price data to create a Gaussian distribution. This difference in approach can provide traders with a more nuanced understanding of market conditions, offering valuable insights that one indicator alone may not provide. The Moving Average Convergence Divergence (MACD) is another popular technical indicator used to identify potential buy and sell signals. The MACD relies on moving averages, while the Fisher Transform Indicator transforms price data to create a more normal distribution. While both indicators can provide valuable signals, the Fisher Transform Indicator's transformative approach may offer an additional layer of accuracy. Traders can use both tools in conjunction to maximize their insights into market conditions. The Stochastic Oscillator is a momentum indicator that compares a particular closing price of a security to a range of its prices over a certain period. While the Stochastic Oscillator and Fisher Transform Indicator both identify overbought and oversold conditions, the Fisher Transform Indicator does so using a more advanced statistical method. By using both the Stochastic Oscillator and the Fisher Transform Indicator, traders can gain a more comprehensive understanding of market conditions, enhancing their ability to make informed investment decisions. The Fisher Transform Indicator is a powerful technical analysis tool that transforms price data into a nearly perfect Gaussian distribution. This transformation allows the indicator to identify potential market reversals with high accuracy, providing valuable insights that can inform a range of investment decisions. By transforming price data, the Fisher Transform Indicator enhances the visibility of market trends, making it easier for traders to identify potential trading opportunities. Its ability to provide accurate and reliable signals makes it an invaluable tool for traders. The Fisher Transform Indicator offers several advantages, including the smoothing of price data, improved signal accuracy, and early detection of price reversals. However, it also has limitations, such as being a lagging indicator, sensitive to market volatility, and requiring additional confirmation for its signals. Despite its limitations, the Fisher Transform Indicator is an effective tool for wealth management. By providing valuable signals about market conditions, it helps traders to manage their investments more effectively. Whether it's used in asset allocation strategies, risk management techniques, or for identifying trading opportunities, the Fisher Transform Indicator is a versatile tool that can enhance any trading strategy.What Is the Fisher Transform Indicator?

Importance of the Fisher Transform Indicator

How the Fisher Transform Indicator Works

Key Features of the Fisher Transform Indicator

Oscillator Characteristics

Identification of Market Trends

Potential Signal Generation

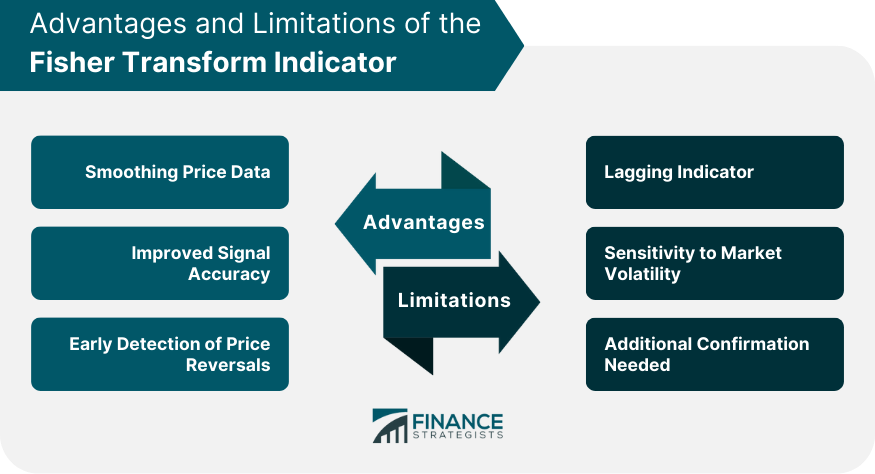

Advantages of Using the Fisher Transform Indicator

Smoothing Price Data

Improved Signal Accuracy

Early Detection of Price Reversals

Limitations of Using the Fisher Transform Indicator

Lagging Indicator

Sensitivity to Market Volatility

Additional Confirmation Needed

Practical Use and Implementation of the Fisher Transform Indicator

Asset Allocation Strategies

Risk Management Techniques

Trading and Investment Applications

Comparison With Other Technical Indicators

Relative Strength Index (RSI)

Moving Average Convergence Divergence (MACD)

Stochastic Oscillator

Conclusion

Fisher Transform Indicator FAQs

The Fisher Transform Indicator is a technical analysis tool that transforms price data into a nearly perfect Gaussian distribution. This transformation allows it to identify potential market reversals with high accuracy.

The Fisher Transform Indicator works by transforming price data into a Gaussian distribution, enhancing the visibility of market trends and making it easier for traders to identify potential trading opportunities.

The Fisher Transform Indicator offers several advantages, including the smoothing of price data, improved signal accuracy, and early detection of price reversals.

The Fisher Transform Indicator is a lagging indicator, meaning it relies on past price data to generate its signals. It is also sensitive to market volatility and requires additional confirmation for its signals.

The Fisher Transform Indicator can be used in wealth management to inform asset allocation strategies, risk management techniques, and to identify potential trading opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.