The financial decision-making process refers to the series of steps that individuals or businesses undertake to identify, evaluate, and select among different financial alternatives or options. It involves analyzing financial information, weighing the pros and cons of different choices, and making decisions that align with their overall financial goals and objectives. The financial decision-making process can encompass a wide range of activities, including budgeting, investing, borrowing, and managing risk, and it can be influenced by a variety of factors such as economic conditions, regulatory environment, and personal preferences. Effective financial decision-making requires a solid understanding of financial concepts and principles, as well as the ability to make informed choices based on relevant information and analysis. The first step in the financial decision-making process is identifying financial goals and objectives. For individuals, these goals may include saving for retirement, buying a home, or funding a child's education. For businesses, financial goals may include increasing profitability, expanding market share, or improving cash flow. To make informed financial decisions, it's essential to gather accurate and up-to-date financial information. This data can come from a variety of sources, such as bank statements, investment account records, and financial reports. Having accurate and current financial data is crucial for making informed decisions, as it helps individuals and businesses understand their financial health and identify potential opportunities or challenges. Analyzing financial data involves calculating and interpreting financial ratios and metrics, which can provide insights into a person's or company's financial performance, liquidity, solvency, and profitability. Cash flow analysis helps to understand the inflows and outflows of cash, which is essential for managing liquidity and ensuring that financial obligations can be met. Assessing risk involves evaluating the potential financial consequences of different decisions and understanding the likelihood of those consequences occurring. Once financial goals and objectives have been identified, and relevant financial information has been gathered and analyzed, it's time to develop alternative solutions. This may involve brainstorming various strategies to achieve the desired financial outcomes. Each potential strategy should be evaluated for its advantages and disadvantages, including the level of risk associated with the strategy and the potential return on investment. The best financial strategy should align with the individual's or organization's financial goals and objectives, take into account their risk tolerance, and provide the highest potential return on investment. Once the best strategy has been selected, it's time to put it into action. This may involve making investments, adjusting spending patterns, or seeking financing. After implementing a financial strategy, it's essential to monitor its performance and measure its effectiveness in achieving the desired financial goals and objectives. Based on the performance measurement, adjustments, and refinements may be necessary to ensure the financial strategy remains effective and on track to achieve the desired outcomes. An individual's level of financial knowledge and literacy can significantly impact financial decision-making. Personal preferences and risk tolerance also play a significant role in shaping financial decisions, as individuals and businesses must choose strategies that align with their comfort level and long-term objectives. Economic conditions and market trends can impact the success of financial strategies and should be considered during the decision-making process. Interest rates and inflation can also influence financial decisions, as they affect the cost of borrowing and the value of money over time. Taxation policies can have a significant impact on financial decision-making, as they affect the after-tax returns of various investment options and influence corporate financial decisions. Complying with financial regulations is crucial for individuals and businesses, as non-compliance can result in penalties, fines, and reputational damage. Financial planning software can help individuals and businesses organize their financial data, develop budgets, and forecast future financial performance. Budgeting and forecasting tools can be used to create detailed financial plans and projections, helping individuals and businesses understand their financial position and make informed decisions. Risk management techniques, such as diversification and hedging, can help individuals and businesses mitigate the potential negative consequences of financial decisions. Scenario analysis and simulation can be used to evaluate the potential outcomes of different financial strategies and assess the impact of various factors on financial performance. Financial advisors and consultants can provide valuable guidance and advice to individuals and businesses navigating the financial decision-making process. Certified Financial Planners (CFPs) are professionals who have met rigorous education, experience, and ethical requirements, and can help clients develop comprehensive financial plans and strategies. Working with financial professionals can help individuals and businesses make more informed financial decisions, as these experts can offer insights, guidance, and expertise based on their experience and knowledge. Ethical dilemmas can arise during the financial decision-making process, as individuals and businesses must balance the pursuit of financial goals with the need to adhere to ethical standards and principles. Corporate Social Responsibility (CSR) and sustainability initiatives are increasingly important factors in financial decision-making, as companies must consider the Environmental, Social, and Governance (ESG) impacts of their decisions. Adhering to ethical principles and engaging in responsible financial decision-making can contribute to long-term financial success, as it helps build trust, credibility, and positive relationships with stakeholders. The financial decision-making process involves identifying financial goals, gathering relevant information, analyzing data, developing alternative solutions, selecting the best strategy, implementing the chosen strategy, and monitoring and evaluating the decision. Key factors influencing financial decision-making include personal factors (financial knowledge, risk tolerance), economic factors (market trends, interest rates), and regulatory factors (taxation policies, compliance). Tools such as financial planning software, budgeting tools, risk management techniques, and scenario analysis can aid in decision-making. Financial professionals, such as advisors and certified planners, play a crucial role in providing guidance. Ethical considerations, including ethical dilemmas, corporate social responsibility, and sustainability, are important aspects of financial decision-making for long-term success.What Is a Financial Decision-Making Process?

Steps in the Financial Decision-Making Process

Identification of Financial Goals and Objectives

Personal Financial Goals

Business Financial Goals

Gathering Relevant Financial Information

Sources of Financial Data

Importance of Accurate and Up-To-Date Information

Analysis of Financial Data

Financial Ratios and Metrics

Cash Flow Analysis

Risk Assessment

Development of Alternative Solutions

Identifying Possible Strategies

Evaluating the Pros and Cons of Each Strategy

Selection of the Best Financial Strategy

Criteria for Choosing the Best Strategy

Implementation of the Selected Strategy

Monitoring and Evaluation of the Financial Decision

Performance Measurement

Adjustments and Refinements of the Strategy

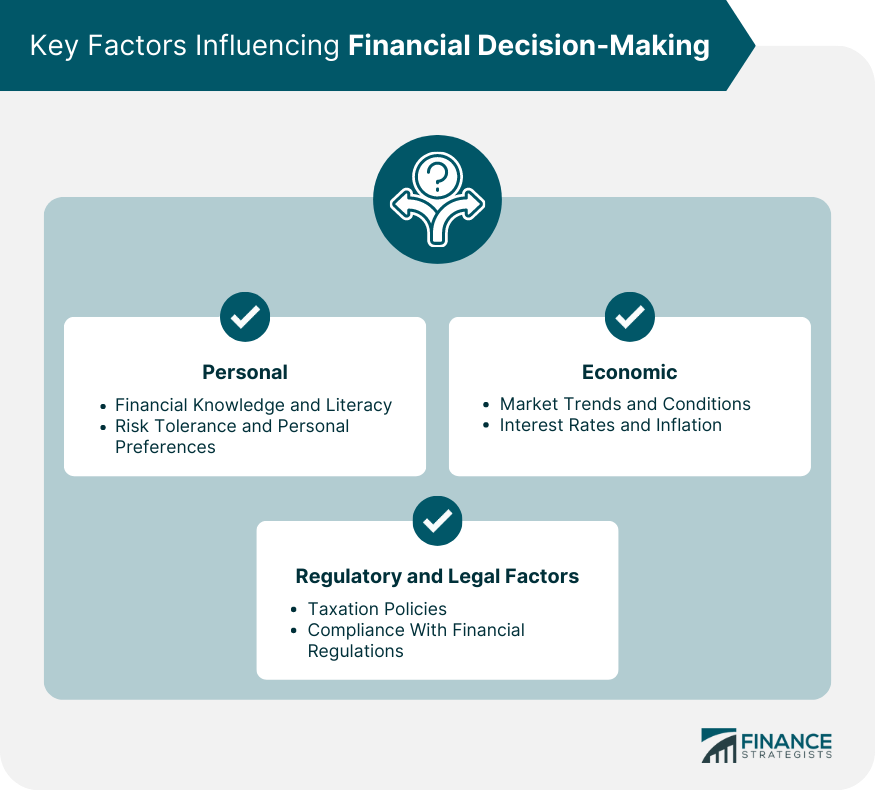

Key Factors Influencing Financial Decision-Making

Personal Factors

Financial Knowledge and Literacy

Risk Tolerance and Personal Preferences

Economic Factors

Market Trends and Conditions

Interest Rates and Inflation

Regulatory and Legal Factors

Taxation Policies

Compliance With Financial Regulations

Tools and Techniques for Financial Decision-Making

Financial Planning Software

Budgeting and Forecasting Tools

Risk Management Techniques

Scenario Analysis and Simulation

Role of Financial Professionals in the Decision-Making Process

Financial Advisors and Consultants

Certified Financial Planners

Benefits of Working With Financial Professionals

Ethical Considerations in Financial Decision-Making

Ethical Dilemmas in Financial Decision-Making

Corporate Social Responsibility and Sustainability

Importance of Ethics in Long-Term Financial Success

The Bottom Line

Financial Decision-Making Process FAQs

The financial decision-making process is a structured approach to making choices about allocating resources, managing risks, and achieving financial goals for both individuals and businesses. It is important because it helps ensure that financial decisions are well-informed, strategic, and aligned with long-term objectives.

The key steps in the financial decision-making process include: identifying financial goals and objectives, gathering relevant financial information, analyzing financial data, developing alternative solutions, selecting the best financial strategy, implementing the selected strategy, and monitoring and evaluating its performance.

Personal factors, such as financial knowledge and literacy, risk tolerance, and personal preferences, can significantly influence the financial decision-making process. These factors shape an individual's approach to financial management, guiding their choice of strategies and their willingness to take on risk.

Tools and techniques that can support the financial decision-making process include financial planning software, budgeting and forecasting tools, risk management techniques, and scenario analysis and simulation. These resources can help individuals and businesses organize financial data, develop budgets, forecast future performance, and evaluate the potential outcomes of different financial strategies.

Ethical considerations play a crucial role in the financial decision-making process, as individuals and businesses must balance the pursuit of financial goals with adherence to ethical standards and principles. This may involve addressing ethical dilemmas, incorporating corporate social responsibility and sustainability initiatives, and considering the environmental, social, and governance (ESG) impacts of financial decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.