Ex-Ante, a Latin term meaning 'before the event,' is a pivotal concept in finance that pertains to the forecasting and analysis of future events, based on predictions and expectations. A key component of the ex-ante analysis is the calculation of 'expected value,' a statistical concept representing the average outcome of an event if it were to be repeated multiple times. This informs decision-making processes in various financial contexts, such as investment strategies, economic policy-making, and risk management. However, ex-ante analysis is not without challenges and limitations. It is subject to the inherent uncertainty of predicting future events, the dynamic nature of economic conditions, and the potential limitations and biases in data and models used. Despite these challenges, ex-ante remains a crucial tool in navigating the complex landscape of finance and economics. The ex-ante analysis is grounded in the theory of expected utility, which assumes that economic agents are rational and make decisions based on the expected utility or value of different outcomes. It involves forecasting future events or situations, such as market trends, asset prices, or economic conditions, and making decisions based on these forecasts. Expected value is a statistical concept that represents the average outcome of a series of events if those events were to be repeated many times. In ex-ante analysis, expected value refers to the predicted average outcome of a financial decision, such as an investment or a business project, given the probabilities of different possible outcomes. Ex-Ante analysis often involves assigning probabilities to future events or outcomes. For example, a financial analyst may assign probabilities to various possible future stock prices based on historical data and economic indicators. These probabilities are then used to calculate the expected value of the stock, which can guide investment decisions. Ex-Ante returns refer to the expected return on an investment, which can be calculated using data on past returns and expectations about future market conditions. Investors and portfolio managers use ex-ante returns to decide which assets to include in their portfolio and how much to invest in each asset. Risk measures such as Value-at-Risk (VaR) and Expected Shortfall (ES) can also be calculated on an ex-ante basis. Ex-Ante VaR, for example, is the maximum loss that an investor is prepared to tolerate over a specific time horizon at a certain confidence level, given the current portfolio composition and expected market conditions. In the stock market, ex-ante analysis can be used to forecast future stock prices and returns. For example, analysts may use financial ratios, earnings forecasts, and economic indicators to predict a company's future stock price. These predictions can then be used to guide investment decisions. In the bond market, ex-ante analysis can be used to estimate the future yield of a bond, given expectations about interest rates, inflation, and the issuer's creditworthiness. This can help investors decide whether to buy, hold, or sell a bond. Ex-Ante analysis plays a crucial role in economic forecasting. Economists use ex-ante analysis to predict future economic conditions, such as GDP growth, inflation, and unemployment, based on current data and economic models. These forecasts can inform economic policy and guide business and investment decisions. While ex-ante predictions are based on the best available information and sophisticated models, they do not always align with real-world outcomes. This is due to the inherent uncertainty of economic forecasting, which involves predicting complex and dynamic phenomena with many interrelated variables. Ex-Ante analysis is crucial in formulating economic policies. Policymakers use ex-ante analysis to predict the impact of various policy options and make informed decisions. For example, before implementing a tax policy, policymakers may use ex-ante analysis to estimate its potential effects on economic growth, employment, and income distribution. In portfolio management, ex-ante analysis is used in asset allocation, which involves deciding how much of a portfolio's funds should be invested in different asset classes (e.g., stocks, bonds, commodities, etc.) based on their expected returns and risks. Ex-Ante analysis also plays a vital role in performance evaluation. By comparing the expected (ex-ante) and actual (ex-post) performance of a portfolio, portfolio managers can assess their forecasting accuracy and decision-making effectiveness. Ex-Ante risk assessment involves estimating the potential risks associated with a portfolio given its current composition and expected market conditions. This can help portfolio managers make risk-adjusted investment decisions and manage their portfolio's risk level effectively. In corporate finance, ex-ante analysis is essential in capital budgeting, which involves deciding which long-term investments a company should undertake. By estimating the expected cash flows and risks of different investment projects, companies can make informed investment decisions. In the context of mergers and acquisitions, ex-ante analysis is used to assess the potential benefits and risks of a merger or acquisition. This can involve estimating the combined firm's future cash flows, market position, and synergies, as well as potential challenges and risks. Ex-Ante considerations also play a role in financial reporting. For example, when reporting on their financial position and performance, companies may provide ex-ante forecasts of future revenues, costs, and profits. These forecasts can inform investors, creditors, and other stakeholders' decisions. In financial regulation, ex-ante analysis is used to assess the potential impact of regulatory proposals. This can involve estimating the likely effects of a proposed regulation on market stability, efficiency, and fairness. Ex-Ante impact assessments are a common tool in financial regulation. They involve a detailed analysis of the potential effects of a proposed regulation, including its benefits, costs, and risks, and the distribution of these effects among different stakeholders. One example of ex-ante analysis in financial regulation is the impact assessment conducted by the European Securities and Markets Authority (ESMA) before introducing new regulations on short selling. The ex-ante analysis helped ESMA evaluate the potential effects of the proposed regulations on market stability and investor confidence and make an informed decision. One of the main challenges of ex-ante analysis is the difficulty in accurately predicting future events. This is due to the inherent uncertainty of the future and the complexity of financial and economic phenomena. Ex-Ante analysis involves a degree of uncertainty and risk. While it is based on the best available information and sophisticated models, it is always subject to the risk of unforeseen events or changes in circumstances. Ex-Ante analysis also has limitations related to data and models. For example, it often relies on historical data, which may not always be a reliable guide to the future. Moreover, the models used in ex-ante analysis are simplifications of reality and may not capture all relevant factors or their interrelationships accurately. Ex-Ante plays a pivotal role in financial decision-making and risk management, offering a theoretical framework for anticipating future events based on current information and expectations. In financial markets, ex-ante analysis is utilized in forecasting expected returns, assessing risk measures, and conducting stock and bond market analyses. This aids in making informed decisions that can potentially optimize returns and minimize risks. However, despite its considerable utility, ex-ante analysis is not without challenges and limitations. The inherent uncertainty of future events, coupled with the limitations of data and models used, can impact the accuracy of ex-ante predictions. Despite these challenges, understanding the concept of ex-ante remains crucial as it fosters proactive rather than reactive financial strategies, laying the groundwork for more resilient and agile financial markets.Definition of Ex-Ante

Understanding the Concept of Ex-Ante

Theoretical Basis for Ex-Ante

The Concept of Expected Value in Ex-Ante

The Role of Probability in Ex-Ante Analysis

Ex-Ante in Financial Markets

Ex-Ante Returns

Ex-Ante Risk Measures

Ex-Ante Analysis in Stock Market

Ex-Ante Analysis in Bond Market

Ex-Ante in Economic Forecasting

The Role of Ex-Ante in Economic Models

Ex-Ante Predictions and Real-World Outcomes

The Importance of Ex-Ante Analysis in Economic Policy

Ex-Ante in Portfolio Management

Ex-Ante Asset Allocation

Ex-Ante Performance Evaluation

Ex-Ante Risk Assessment

Ex-Ante in Corporate Finance

Ex-Ante Analysis in Capital Budgeting

Ex-Ante Evaluation in Mergers and Acquisitions

Ex-Ante Considerations in Financial Reporting

Ex-Ante in Financial Regulation

Role of Ex-Ante Analysis in Regulatory Decisions

Ex-Ante Impact Assessments in Financial Regulation

Case Studies of Ex-Ante Analysis in Financial Regulation

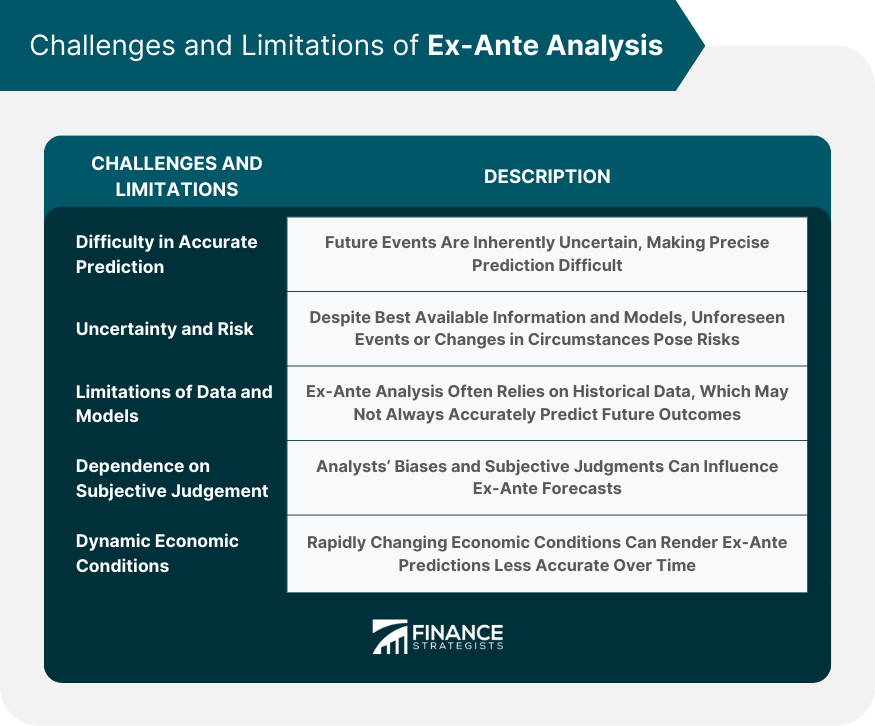

Challenges and Limitations of Ex-Ante Analysis

Difficulty in Accurate Prediction

Uncertainty and Risk in Ex-Ante Analysis

Limitations of Data and Models in Ex-Ante

Conclusion

Ex-Ante FAQs

Ex-Ante, from Latin meaning 'before the event,' refers to the analysis and forecasting of future events based on predictions and expectations. It plays a crucial role in various financial decisions, including investment strategies, economic policy-making, and risk management.

Expected value is a cornerstone of ex-ante analysis. It represents the predicted average outcome of a financial decision, given the probabilities of different potential outcomes. It guides decision-making by providing a statistical forecast of expected returns or outcomes.

Ex-Ante analysis is integral to economic forecasting. It's used to predict future economic conditions such as GDP growth, inflation, and unemployment, based on current data and economic models. These forecasts can inform economic policies and guide business and investment decisions.

Ex-Ante analysis faces several challenges and limitations, including the inherent uncertainty of predicting future events, the dynamic nature of economic conditions, limitations of data and models, and potential biases in decision-making processes.

With advancements in technology, the tools for conducting ex-ante analysis are becoming more sophisticated. Developments in artificial intelligence, big data analytics, and blockchain are enhancing the ability to make accurate and efficient forecasts, promising a future where ex-ante analysis becomes even more integral to financial decision-making.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.