An unlimited tax bond is a type of municipal bond backed by the full taxing power of the issuing municipality or local government. These bonds enable local governments to borrow money to fund public projects without a limit on the tax rate that can be levied to repay the debt. Essentially, the government can raise taxes as much as necessary to cover the bond's principal and interest payments. Unlimited tax bonds represent a commitment from the issuing entity to use all available resources, including property tax increases, to ensure the timely repayment of the bond. This guarantee of payment makes unlimited tax bonds an attractive option for investors seeking a secure and stable investment with a relatively lower risk profile. Unlimited tax bonds serve as a financing tool for state and local governments to raise funds for various public projects and initiatives. They provide a means for governments to invest in essential infrastructure, such as roads, bridges, and schools, without depleting their operating budgets. The use of unlimited tax bonds enables governments to spread the cost of these projects over a longer period, making them more manageable for taxpayers. In addition to infrastructure projects, unlimited tax bonds can also be used to fund public services, such as education, healthcare, and public safety. By issuing these bonds, governments can allocate resources to critical areas, improving the overall quality of life for their citizens and fostering economic growth within their communities. When a local government or municipality requires funding for a specific project or service, it can issue an unlimited tax bond to raise the necessary capital. Investors purchase these bonds, providing the government with the funds it needs. In return, the bondholders receive periodic interest payments and the return of their principal upon the bond's maturity. The government pledges to use its taxing authority to generate sufficient revenue to repay the bondholders. This may involve raising property taxes, sales taxes, or other forms of taxation. The government's commitment to repay the bond, regardless of the tax rate required, gives investors confidence in the security of their investment and generally results in a lower interest rate for the issuing entity. General obligation (GO) bonds are a common type of unlimited tax bond issued by state and local governments. They are backed by the full faith and credit of the issuing entity, meaning that the government commits to using its taxing power to repay the bondholders. GO bonds are typically used to finance a wide range of public projects, including schools, roads, and public buildings. GO bonds can be further divided into two categories: voter-approved and non-voter-approved. Voter-approved GO bonds require the consent of the electorate before issuance, while non-voter-approved bonds can be issued without a public vote. Regardless of the approval process, the security provided by the government's taxing authority makes GO bonds a popular choice for investors seeking a stable investment. School district bonds are a specific type of unlimited tax bond issued by school districts to fund the construction, renovation, or improvement of educational facilities. These bonds enable school districts to invest in modernizing classrooms, upgrading technology, and expanding facilities to accommodate growing student populations. Like other unlimited tax bonds, school district bonds are backed by the taxing authority of the issuing entity, which can raise property taxes as needed to meet its payment obligations. This security attracts investors and helps school districts secure the necessary funds to improve their educational infrastructure. Municipal bonds are debt securities issued by cities, towns, and other local governments to finance public projects and services. Unlimited tax municipal bonds are a subset of this broader category, distinguished by the issuing government's commitment to raise taxes without limitation to repay the debt. Municipal bonds can be used to fund various projects, including transportation infrastructure, water and sewer systems, parks and recreational facilities, and public safety initiatives. Unlimited tax municipal bonds offer investors a safe investment option with a predictable income stream. Additionally, these bonds often provide tax benefits, such as exemption from federal income tax and, in some cases, state and local taxes. This combination of security and tax advantages makes unlimited tax municipal bonds an appealing choice for many investors. One key feature of unlimited tax bonds is their favorable tax treatment. Interest income generated by these bonds is generally exempt from federal income tax, and in some cases, state and local taxes as well. This tax-exempt status makes unlimited tax bonds particularly attractive to investors in high tax brackets, as it can enhance their after-tax returns. However, it is important to note that the tax-exempt status of unlimited tax bonds may be subject to change due to legislative action or changes in tax regulations. Investors should consult with a tax professional to fully understand the tax implications of investing in unlimited tax bonds. Unlimited tax bonds typically offer lower interest rates compared to other types of bonds due to the strong security provided by the issuing government's taxing authority. The issuer's commitment to using its full taxing power to repay the bond, if necessary, reduces the risk of default and makes these bonds more attractive to investors. The interest rate on an unlimited tax bond is influenced by various factors, including the credit rating of the issuing entity, prevailing interest rates in the market, and the bond's maturity. While the lower interest rates may result in a lower yield for investors, the reduced risk and favorable tax treatment often offset this drawback. Credit rating agencies assign credit ratings to unlimited tax bonds to help investors assess the creditworthiness and overall risk associated with the investment. These ratings are based on the financial health of the issuing entity, its ability to generate sufficient revenue to meet its payment obligations, and the overall economic conditions in the area. Higher credit ratings generally translate to lower interest rates, as investors perceive the bonds as less risky. Conversely, lower credit ratings may result in higher interest rates, reflecting the increased risk associated with the investment. Investors should carefully consider the credit rating of an unlimited tax bond before investing, as it can provide valuable insights into the potential risks and rewards. As mentioned earlier, unlimited tax bonds tend to offer lower interest rates compared to other types of bonds. This is primarily due to the strong security provided by the issuing government's commitment to use its full taxing power to repay the bond. Lower interest rates can result in reduced borrowing costs for the issuer, making it more affordable to finance public projects and services. Unlimited tax bonds offer flexibility in terms of maturity and interest payment schedules. Issuers can structure the bonds to meet their specific financing needs and repayment capabilities. This flexibility allows governments to tailor their debt issuance to align with their revenue streams, making it easier to manage their debt obligations. The primary advantage of unlimited tax bonds for investors is the guaranteed payment of principal and interest. The issuer's commitment to using its full taxing power to repay the bond provides a high level of security and reduces the risk of default. This guarantee makes unlimited tax bonds an attractive investment option for risk-averse investors seeking a stable and predictable income stream. One potential drawback of unlimited tax bonds is the possibility of higher taxes for residents within the issuing entity's jurisdiction. As the government has the authority to raise taxes without limitation to repay the bond, taxpayers may face increased tax burdens to cover the debt service. This may lead to public opposition to the issuance of unlimited tax bonds, particularly in areas with already high tax rates. While the risk of default on unlimited tax bonds is generally lower than other types of bonds, it is not entirely eliminated. Economic downturns, declining property values, or fiscal mismanagement can adversely affect the issuer's ability to generate sufficient revenue to meet its payment obligations. In such cases, even the full taxing power of the issuing entity may not be enough to prevent default, resulting in potential losses for investors. Issuing unlimited tax bonds often requires compliance with strict regulations and disclosure requirements, which can be time-consuming and costly for governments. These requirements are intended to protect investors by ensuring transparency and accountability. However, they can also act as a barrier to the efficient issuance of debt, particularly for smaller municipalities with limited resources and expertise in navigating the regulatory landscape. Unlimited tax bonds are commonly used to finance capital projects, such as the construction or renovation of public facilities, transportation infrastructure, and utility systems. These projects often require significant upfront investment, and the use of unlimited tax bonds allows governments to spread the cost over a longer period, making it more manageable for taxpayers. Infrastructure development is a critical component of economic growth and prosperity. Unlimited tax bonds provide governments with a means to invest in the improvement and expansion of vital infrastructure, such as roads, bridges, water and sewer systems, and public transit. These investments can lead to increased economic activity, job creation, and an improved quality of life for residents. In addition to funding capital projects and infrastructure development, unlimited tax bonds can also be used to support essential public services, such as education, healthcare, and public safety. By issuing these bonds, governments can allocate resources to critical areas and ensure the continued delivery of services that contribute to the well-being of their citizens. An unlimited tax bond is a type of municipal bond backed by the full taxing power of the issuing municipality or local government. These bonds offer several advantages for both issuers and investors, including lower interest rates, flexibility in terms, and guaranteed payment. However, they also come with potential drawbacks, such as higher taxes, risk of default, and strict regulations. There are various types and applications of unlimited tax bonds, such as general obligation bonds, school district bonds, and municipal bonds. They are used to finance capital projects, fund infrastructure development, and support public services. When considering investing in unlimited tax bonds, it is essential to understand their features, such as tax implications, interest rates, and credit ratings. By weighing the advantages and disadvantages and considering the specific circumstances of the issuing entity, investors can make informed decisions about whether unlimited tax bonds are a suitable investment option for their portfolio.What Is an Unlimited Tax Bond?

How It Works

Types of Unlimited Tax Bonds

General Obligation Bonds

School District Bonds

Municipal Bonds

Features of Unlimited Tax Bonds

Tax Implications

Interest Rates

Credit Ratings

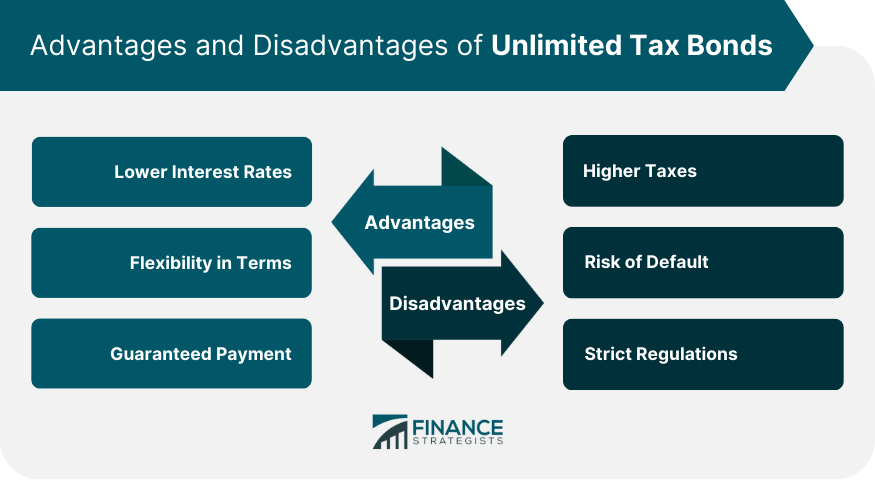

Advantages of Unlimited Tax Bonds

Lower Interest Rates

Flexibility in Terms

Guaranteed Payment

Disadvantages of Unlimited Tax Bonds

Higher Taxes

Risk of Default

Strict Regulations

Applications of Unlimited Tax Bonds

Financing Capital Projects

Funding Infrastructure Development

Supporting Public Services

Bottom Line

Unlimited Tax Bond FAQs

An Unlimited Tax Bond is a type of bond where a municipality or government agency guarantees repayment using property taxes.

When issuing an Unlimited Tax Bond, a government agency or municipality pledges to use property taxes to repay bondholders, providing them with guaranteed repayment.

The three types of Unlimited Tax Bonds are General Obligation Bonds, School District Bonds, and Municipal Bonds.

Investing in Unlimited Tax Bonds offers lower interest rates, flexible terms, and guaranteed payment.

Investing in Unlimited Tax Bonds can lead to higher taxes, a risk of default, and strict regulations that can limit investment options.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.