An ultra-short bond fund is a type of mutual fund or exchange-traded fund (ETF) that invests in fixed-income securities with short-term maturities. These funds are designed to provide investors with a higher yield than traditional cash investments, such as money market funds or savings accounts, while maintaining relatively low interest rate risk. Ultra-short bond funds typically invest in a variety of debt instruments, including government securities, corporate bonds, asset-backed securities, and certificates of deposit (CDs). However, they focus on securities with shorter maturities, usually ranging from a few weeks to a year. The primary objective of an ultra-short bond fund is to preserve capital and generate income through interest payments. Since the fund invests in securities with shorter durations, the risk of price fluctuations due to changes in interest rates is relatively lower compared to longer-term bond funds. However, it's important to note that ultra-short bond funds are not risk-free investments. When choosing an ultra-short bond fund, investors should consider several key factors, such as the fund's average maturity, yield, credit quality of the bonds, expense ratio, and the track record of the fund manager. It's also important to consider the level of diversification within the fund to ensure risk is appropriately managed. In the financial market, ultra-short bond funds play a pivotal role in bridging the gap between money market funds and short-term bond funds. They are seen as a viable investment choice for individuals looking for a balance between return and risk, especially during volatile market conditions. Ultra-short bond funds typically invest in bonds that mature in less than a year, but the exact maturity range can vary by fund. The shorter maturity period results in lower sensitivity to interest rate changes compared to longer-term bonds. Ultra-short bond funds invest in a diverse array of bonds, including corporate bonds, government bonds, and mortgage-backed securities. The type of bonds a fund invests in affects its risk and return profile. Although ultra-short bond funds generally provide higher yields than money market funds, they are also subject to greater volatility due to the broader range of securities they invest in. The primary advantages of investing in ultra-short bond funds include potentially higher returns than other low-risk investments, limited exposure to interest rate risk due to short maturities, and higher liquidity compared to longer-term bond funds. While ultra-short bond funds are lower risk than many investments, they are not risk-free. The risks include interest rate risk (though minimal due to short maturities), credit risk if the bond issuer defaults, and liquidity risk if the market for a particular bond dries up. Before investing, consider your risk tolerance, investment goals, and the fund's portfolio composition. Understand the fund's strategy, the types of bonds it invests in, and its response to market conditions. While both investment types offer relatively low-risk options, ultra-short bond funds typically provide higher yields than money market funds but with slightly higher risk. Compared to traditional bond funds, ultra-short bond funds have shorter maturities, leading to lower yields but also lower volatility and interest rate risk. While CDs offer fixed returns and federal insurance, ultra-short bond funds offer higher liquidity and potentially higher returns, although with more risk. Ultra-short bond funds generally perform better than longer-term bonds in a rising interest rate environment due to their shorter maturities and quicker turnover of securities. In a falling interest rate environment, ultra-short bond funds may underperform compared to longer-term bond funds as they cannot lock in higher rates for long periods. Adapting your investment strategy based on market conditions is crucial. In a volatile market, ultra-short bond funds can act as a protective measure, while in stable markets, they can offer attractive yields with low risk. When choosing an ultra-short bond fund, consider factors such as the fund's average maturity, yield, credit quality of the underlying bonds, expense ratio, and the fund manager's expertise and track record. Fund managers play a crucial role in the performance of ultra-short bond funds. Their expertise in selecting high-quality bonds, managing risk, and navigating different market conditions significantly impacts the fund's returns. Investing in a diversified portfolio of ultra-short bonds can help mitigate risks associated with a single issuer or bond type. Diversification ensures that potential losses on one bond can be offset by gains on others. Investors in ultra-short bond funds are subject to income tax on the interest and capital gains tax on any profits made from selling the fund shares. However, the rate may vary depending on the investor's tax bracket and how long they've held the shares. Ultra-short bond funds can serve as a useful tool in tax planning. For instance, investing in municipal ultra-short bond funds can offer tax-exempt interest, making them a suitable choice for investors in high tax brackets. Ultra-short bond funds, an attractive investment choice that bridges the gap between money market funds and short-term bond funds, primarily invest in bonds with very short maturities. These funds are characterized by potential for higher yields than other low-risk investments, and they exhibit less sensitivity to interest rate changes due to the short maturities of their investments. They offer a diversified range of bonds, such as corporate, government, and mortgage-backed securities, which affects the fund's risk and return profile. When choosing an ultra-short bond fund, it's important to consider factors like the fund's average maturity, yield, credit quality, expense ratio, and the fund manager's expertise. By understanding these features, investors can make informed decisions that align with their risk tolerance and investment goals.Definition of Ultra-Short Bond Fund

Role of Ultra-Short Bond Funds in the Financial Market

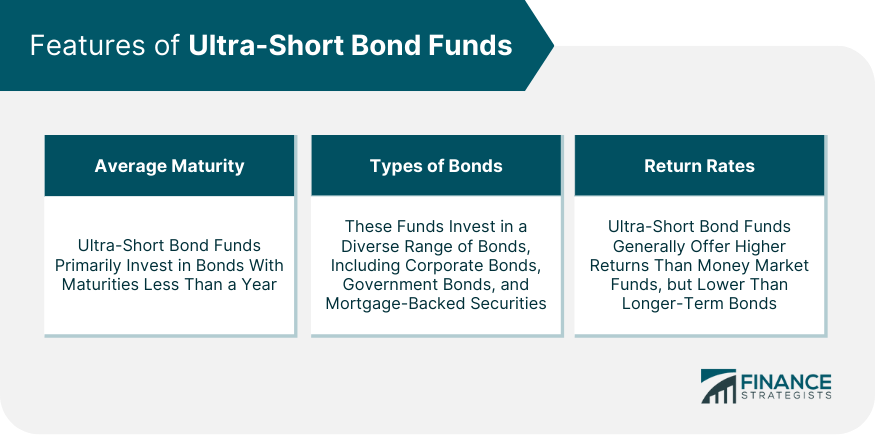

Features of Ultra-Short Bond Funds

Average Maturity

Types of Bonds

Return Rates and Volatility

Investing in Ultra-Short Bond Funds

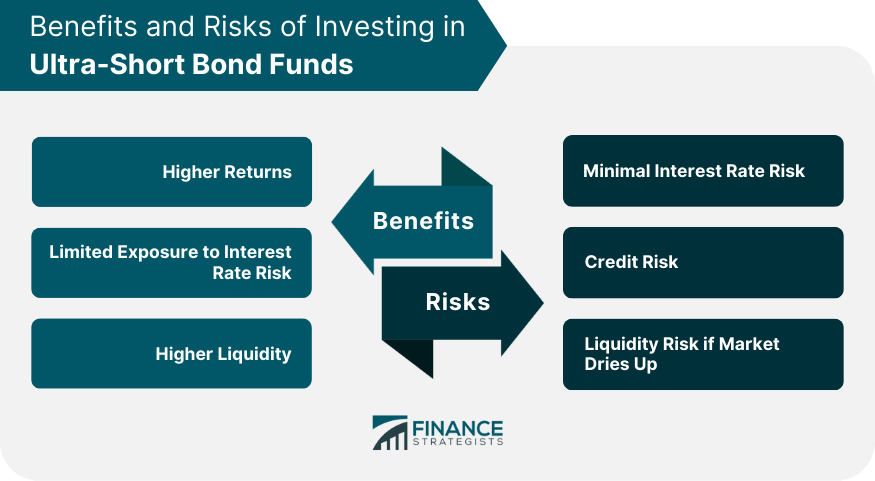

Potential Benefits

Potential Risks

Considerations Before Investing

Comparison Between Ultra-Short Bond Funds and Other Investment Vehicles

Ultra-Short Bond Funds vs Money Market Funds

Ultra-Short Bond Funds vs Traditional Bond Funds

Ultra-Short Bond Funds vs CDs (Certificates of Deposit)

Ultra-Short Bond Funds and Market Conditions

Performance in a Rising Interest Rate Environment

Performance in a Falling Interest Rate Environment

Strategies for Different Market Conditions

How to Choose an Ultra -Short Bond Fund

Key Factors

Role of Fund Managers

Importance of Diversification

Ultra-Short Bond Funds and Taxes

Tax Implications for Investors

How Ultra-Short Bond Funds Can Be Used for Tax Planning

Conclusion

Ultra-Short Bond Fund FAQs

An Ultra-Short Bond Fund is a type of investment fund that focuses on bonds with extremely short maturities, typically less than a year. These funds offer a balance between risk and return, with typically higher yields than money market funds and lower risk than longer-term bonds.

Key features of Ultra-Short Bond Funds include their short average maturity, diversity of bonds in their portfolio, potential for higher return rates than other low-risk investments, and relatively low volatility.

In a rising interest rate environment, Ultra-Short Bond Funds generally perform better than longer-term bonds due to their shorter maturities. In contrast, they may underperform in a falling interest rate environment as they cannot lock in higher rates for long periods.

When choosing an Ultra-Short Bond Fund, consider factors such as the fund's average maturity, yield, credit quality of the bonds, expense ratio, and the expertise and track record of the fund manager. Diversification within the fund is also a key factor to consider.

Yes, investors in Ultra-Short Bond Funds are typically subject to income tax on the interest and capital gains tax on any profits from selling the fund shares. However, the exact tax implications can vary depending on the investor's tax bracket and how long they've held the shares.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.