A liquid market refers to a financial market where there is a high volume of trading activity, allowing for the quick and efficient buying and selling of assets. In a liquid market, there is a large number of buyers and sellers actively participating, resulting in tight bid-ask spreads and minimal price discrepancies. This facilitates easy entry and exit from positions with minimal impact on prices. Liquidity in the market is typically influenced by factors such as the number of participants, the trading volume, the presence of market makers, and the depth of the order book. A liquid market is desirable for investors and traders as it provides ample opportunities for executing trades at desired prices and reduces the risk of price manipulation. Additionally, a liquid market allows for better price discovery and enhances overall market efficiency. One of the key characteristics of a liquid market is a high trading volume. High trading volume means that a large number of specific assets are being bought and sold. This volume promotes liquidity because it ensures that there are always enough buyers and sellers to absorb order flow changes. Another characteristic of a liquid market is a tight bid-ask spread. The bid-ask spread is the difference between the price that a buyer is willing to pay for an asset (the bid) and the price that a seller is willing to accept for that asset (the ask). A tight spread means that the transaction costs for buying and selling are low, which encourages more trading and, therefore, more liquidity. In a liquid market, trades are executed rapidly. This speed is due to the high number of participants and the high volume of trading activity. Rapid trade execution is beneficial to traders and investors as it reduces the risk of price changes between the time an order is placed and the time it is filled. Price stability is another hallmark of a liquid market. Due to the high volume of transactions and the large number of participants, prices in a liquid market tend to remain stable. Price stability is beneficial to traders and investors as it reduces uncertainty and risk. The Forex market, short for foreign exchange market, is a prime example of a liquid market. It is the largest and most liquid market in the world, with an average daily trading volume exceeding $6 trillion. The high liquidity in the Forex market is due to its size, the number of participants, and the fact that it operates 24 hours a day, five days a week. The U.S. Treasury market is another example of a liquid market. It is one of the largest and most liquid markets in the world. U.S. Treasury securities are considered a benchmark for interest rates and are used by companies and financial institutions worldwide as a form of collateral. The high demand for these securities contributes to their liquidity. The stock market, particularly those of developed countries like the United States, is also a good example of a liquid market. Stocks of large, well-known companies are frequently traded, leading to high liquidity. The presence of various types of participants, such as retail investors, institutional investors, and market makers, also contributes to this liquidity. One of the main benefits of a liquid market is the ease with which participants can enter and exit positions. Because there are numerous buyers and sellers, participants can execute trades quickly and at prices close to the market price. This ease of trading is particularly beneficial to traders and investors who need to make quick decisions and transactions. Another benefit of a liquid market is price transparency. Due to the high volume of transactions and the large number of participants, prices in a liquid market are a true reflection of supply and demand dynamics. This transparency helps traders and investors make informed decisions. Liquid markets also offer the benefit of reduced transaction costs. Because of the tight bid-ask spreads that characterize these markets, the cost of trading is lower compared to less liquid markets. Lower transaction costs can enhance profitability for traders and investors. Finally, liquid markets offer greater predictability. Because prices in these markets are more stable, they are less likely to experience sudden, sharp movements. This stability can help traders and investors anticipate future price movements and formulate their trading strategies accordingly. While liquid markets often display price stability, they can also be subject to periods of high volatility. This is particularly true when there are significant economic announcements or geopolitical events that cause a surge in trading activity. Another risk associated with liquid markets is the potential for overtrading. Because trades can be executed so quickly and easily, investors and traders may be tempted to trade more frequently than necessary, which can lead to poor investment decisions and increased transaction costs. Despite their generally stable nature, liquid markets can still experience rapid price movements. These can occur when large orders are placed or when there are sudden changes in market sentiment. Such movements can impact traders and investors who are unable to react quickly enough. While market liquidity refers to the ease with which assets can be bought or sold in a market without affecting their price, accounting liquidity is a measure of a company's ability to meet short-term obligations without raising additional capital. It's important to distinguish between these two forms of liquidity, as they serve different purposes and offer different insights. Both forms of liquidity are crucial in finance. Market liquidity is important for investors and traders as it impacts the ease and cost of trading. On the other hand, accounting liquidity is important for stakeholders as it provides insight into a company's financial health and operational efficiency. Market makers are financial institutions or individuals that commit to buying or selling securities at publicly quoted prices to ensure there's always a market for said securities. Their role is fundamental to maintaining a liquid market. Market makers contribute to liquidity by providing a continuous presence in the market, standing ready to buy or sell securities. By doing so, they help ensure that other market participants can execute trades when they want to, contributing to the overall fluidity of the market. Market makers face the risk of potential losses if the price of security changes rapidly. However, they are compensated for this risk by the spread between the bid and the ask price - the difference between what they're willing to buy a security for and what they're willing to sell it at. Regulatory bodies like the Securities and Exchange Commission play a key role in maintaining market liquidity. They implement rules and regulations to ensure fair trading and to prevent market manipulation that could impact liquidity. Regulations aimed at preserving market liquidity include requirements for market makers, limits on short selling, and rules against market manipulation. These rules are designed to ensure a smooth functioning of the markets and protect investors. Changes in regulations can have a significant impact on market liquidity. For instance, stricter regulations can reduce liquidity by making it more difficult for market participants to execute trades. Conversely, deregulation can potentially increase liquidity by removing barriers to trade. A liquid market is characterized by high trading volume, tight bid-ask spreads, rapid trade execution, and price stability. It provides benefits such as easy entry and exit, price transparency, reduced transaction costs, and greater predictability. However, risks include market volatility, overtrading, and the risk of rapid price movements. Market liquidity is different from accounting liquidity, both playing crucial roles in finance. Market makers contribute to maintaining market liquidity by providing continuous presence and facilitating trading. Regulatory bodies, like the SEC, enforce rules and regulations to ensure fair trading and prevent market manipulation, thereby safeguarding market liquidity. Changes in regulations can significantly impact market liquidity. Understanding the dynamics of a liquid market is essential for investors and traders to navigate the financial landscape effectively.What Is the Liquid Market?

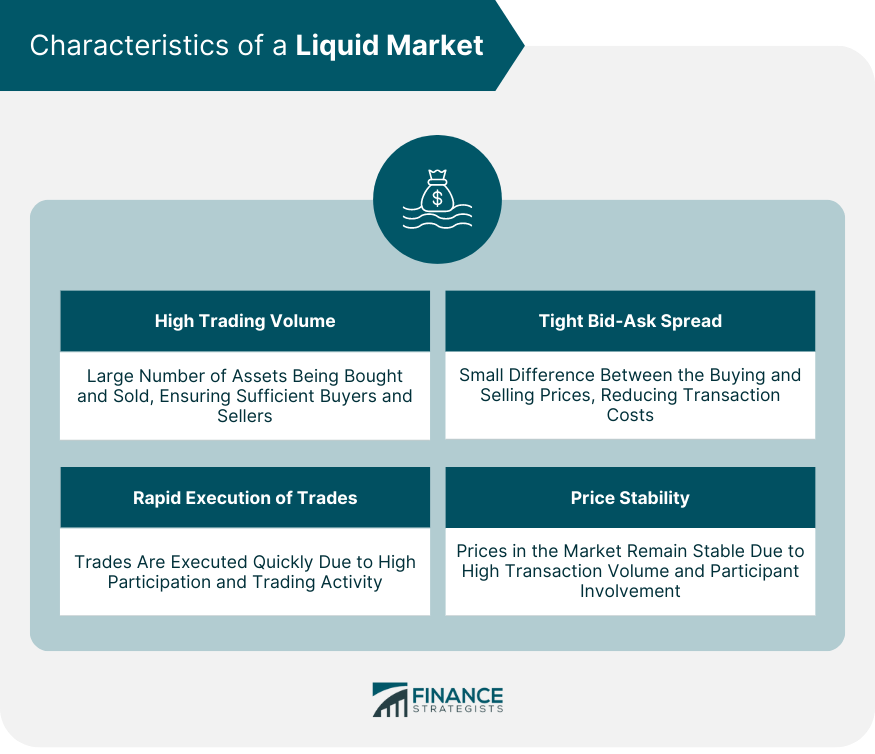

Characteristics of a Liquid Market

High Trading Volume

Tight Bid-Ask Spread

Rapid Execution of Trades

Price Stability

Examples of Liquid Markets

Forex Market

U.S. Treasury Market

Stock Market

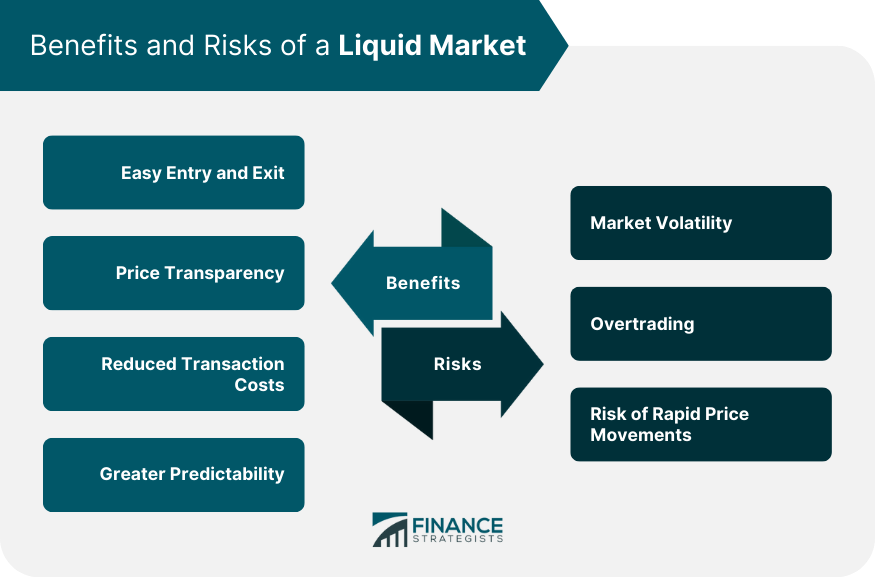

Benefits of a Liquid Market

Easy Entry and Exit

Price Transparency

Reduced Transaction Costs

Greater Predictability

Risks and Limitations of a Liquid Market

Market Volatility

Overtrading

Risk of Rapid Price Movements

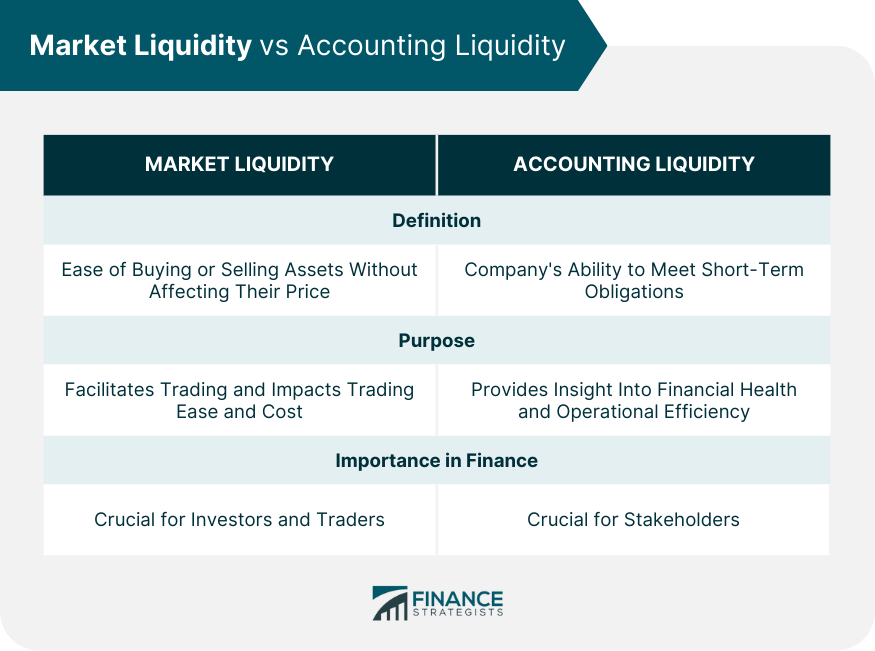

Market Liquidity vs Accounting Liquidity

Definitions and Differences

Importance of Both in Finance

Role of Market Makers in a Liquid Market

Role of Regulation in Ensuring a Liquid Market

Securities and Exchange Commission (SEC) and Other Regulatory Bodies

Rules and Regulations for Maintaining Market Liquidity

Impact of Regulatory Changes on Market Liquidity

Final Thoughts

Liquid Market FAQs

A liquid market is a market with enough trading activity and participants that assets can be bought or sold easily, with minimal impact on their price.

A liquid market is important because it allows investors to enter and exit positions easily, provides price transparency, reduces transaction costs, and offers greater predictability.

Yes, despite the general stability of liquid markets, they can be subject to periods of high volatility, particularly during significant economic or geopolitical events.

Market makers are financial institutions or individuals that buy or sell securities at publicly quoted prices, ensuring that there's always a market for those securities.

Technology, through electronic trading platforms, high-frequency trading, and algorithmic trading, has increased accessibility, reduced trade execution time, and contributed to increased market liquidity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.