APR (Annual Percentage Rate) and EAR (Effective Annual Rate) are two critical financial metrics that help individuals and businesses make informed decisions about borrowing and investing. While both offer insight into the cost or return on borrowing or investing, they do so in slightly different ways, considering different factors and making them suitable for different scenarios. Understanding the distinctions between APR and EAR is crucial for financial decision-making. While they both relate to interest, they provide different perspectives. APR offers a straightforward view, while EAR accounts for the effects of compounding. Failing to discern between the two could lead to underestimating or overestimating the cost of borrowing or the return on an investment. While APR is a more accurate estimation of the total cost of a loan than the nominal interest rate, it is limited because it only considers a simple interest rate. If the interest compounds on a smaller time frame than annually (such as monthly or semi-annually), the actual interest paid will be higher than the APR advertised. Factoring in compounding interest that happens within a year gives you a loan's EAR, or Effective Annual Rate (sometimes also called APY, or Annual Percentage Yield). APR represents the annualized interest rate that is charged to borrowers or paid to investors, without accounting for the effects of compounding. It provides a simplistic view of the interest rate, making it easier to compare different financial products. However, it might not always reflect the true cost or return over time, especially when interest is compounded more frequently than annually. The calculation of APR is relatively straightforward. It is derived by multiplying the periodic interest rate (the rate applied to each period) by the number of periods in a year. For instance, if a credit card company charges 2% interest monthly, the APR would be 24% (2% x 12 months). This doesn’t take into account the interest on interest, which would be covered by EAR. APR serves as a benchmark for comparing different financial products, particularly in the lending sector. It offers consumers a straightforward way to understand and compare the cost of loans or credit cards. Regulatory bodies in many countries mandate the disclosure of APR to ensure transparency in financial products and to prevent institutions from advertising misleadingly low rates. APR is most beneficial when comparing products that have similar compounding intervals or when compounding effects are minimal. For instance, when comparing two loan offers with annual compounding or two credit cards with monthly compounding, APR is a valuable metric. It’s also commonly referenced in advertisements and official disclosures to give consumers a basic understanding of a product's cost. EAR, often also called the annual equivalent rate, provides a more holistic view of interest than APR by incorporating the effects of compounding. It represents the actual annual rate at which interest accumulates or is paid, taking into account the frequency of compounding during the year. It’s especially pertinent for products where interest is compounded more frequently than once a year. The formula to calculate EAR is: EAR = (1+in)n-1 Where: i is the nominal interest rate (or APR). n is the number of compounding periods per year. For example, if a savings account offers a 6% APR with monthly compounding, the EAR would be: EAR = (1+ 0.0612)12 − 1 EAR ≈ 6.17 Thus, the savings account would effectively yield a 6.17% return annually due to compounding. EAR provides a clearer picture of the actual returns or costs associated with financial products that involve compounding. It's especially vital for understanding products with frequent compounding intervals, such as daily or monthly. By presenting a truer annual rate, EAR allows individuals and businesses to gauge the real impact of interest on their finances. EAR is essential when assessing products with compounding effects, especially when the compounding frequency varies between products. For instance, when comparing a daily compounded savings account to a monthly compounded one, EAR offers a direct comparison, accounting for the different compounding effects. This ensures that decisions are made based on the genuine annual impact of interest. APR and EAR, while both pertaining to interest rates, stem from different conceptual bases. The APR is rooted in a simplistic notion, aiming to provide a transparent, immediate understanding of the interest associated with a financial product. It often acts as the front-facing figure in advertisements and disclosures, representing the basic rate without the nuances of compounding. On the other hand, EAR delves deeper. It is designed to provide a more accurate portrayal of how interest rates affect an investment or loan over a year, considering the intricate effects of compounding. The most significant difference between APR and EAR lies in their treatment of compounding. APR doesn’t account for compounding, which is the process where interest is added to the principal amount, and then further interest is calculated on this new amount. In contrast, EAR is all about compounding. It considers how often interest is added to the principal within a year and provides a more comprehensive view of how much interest one would earn or owe over that period. In essence, while APR gives you a surface-level rate, EAR dives into the accumulative impact. When it comes to painting a realistic picture of the cost of a loan or the potential benefit of an investment, EAR takes the lead. Because it factors in compounding, it can provide potential borrowers and investors with a clearer image of their financial commitment or gains over time. APR, on the other hand, might at times underrepresent the cost or benefit, especially in contexts where compounding occurs frequently, like daily or monthly. It's like looking at a product's price without considering additional costs that might come with it. While both APR and EAR have their rightful places in the financial world, their applicability differs based on scenarios. APR is commonly used in environments where a straightforward representation of interest is required, like in advertising or initial disclosures. It's also more prevalent in contexts where compounding effects are minimal. EAR, conversely, is the go-to in situations demanding a comprehensive understanding of interest's real-world impact, especially when comparing products with different compounding frequencies. The frequency of compounding can significantly impact both the APR and the EAR. While APR remains unchanged irrespective of how often interest is compounded, EAR rises with an increase in compounding frequency. For instance, an APR of 6% compounded monthly will have a higher EAR than the same APR compounded annually. This is because the more frequently interest is added to the principal, the more often interest is calculated on a larger amount. The duration or time period of a loan or investment can indirectly influence the APR and EAR, especially when there are options for prepayment or early withdrawal. While the APR might remain fixed for a loan, the actual cost of the loan (reflected by the EAR) might be higher if it's paid off early, especially if there are prepayment penalties. Similarly, the benefit from an investment might be different if withdrawn earlier than the maturity date. The nominal interest rate is the base rate before considering compounding. It's the foundational figure from which both APR and EAR are derived. A change in the nominal rate will proportionally affect the APR, given that APR doesn't incorporate compounding. However, the impact on EAR can be more nuanced, given that the compounding effects will also shift with changes in the nominal rate. As a helpful rule of thumb, most credit card companies use an APR compounded monthly, whereas most mortgages use an APR that is calculated on an annual basis and is therefore the same as EAR. If you are carrying credit card debt, your APR is already high to begin with, but your EAR is even greater than the stated APR, plus you may be charged additional fees for late payments! Here is how to remember interest rate, APR, and EAR: Interest rate is the interest on the principal borrowed which does not factor in additional fees, and is usually stated annually. Annual Percentage Rate (APR) is the interest plus additional fees, stated as a percentage. This is stated annually and therefore does not factor in rates compounded on smaller time frames (such as monthly). Effective Annual Rate (EAR) factors in additional fees and whether the rate is compounded on a smaller time frame. An APR is needed to compute the EAR. Compounding interest monthly rather than annually and other maneuvers like these to further enslave those in credit card debt is why credit card companies and other consumer lenders have a poor reputation. Now that you know the difference between the nominal interest rate, annual percentage rate, and effective annual rate, consider sharing this information with a friend to help them with their financial situation. APR (Annual Percentage Rate) and EAR (Effective Annual Rate) are essential metrics guiding financial decisions. While both provide insights into borrowing and investing costs, they differ significantly in terms of conceptual basis, treatment of compounding, and reflection of true costs and benefits. APR offers a simplified perspective, often used for straightforward comparisons and disclosures. Conversely, EAR, accounting for compounding effects, provides a more accurate picture of the real impact on loans and investments. Understanding these distinctions is pivotal to informed decision-making. Failing to differentiate between them could lead to underestimating borrowing costs or investment returns, particularly when compounding occurs frequently. By grasping the interplay between APR and EAR, individuals and businesses can navigate the complex world of finance more effectively, ensuring they make choices aligned with their financial goals and aspirations.Overview of APR and EAR

APR and EAR

What Is APR (Annual Percentage Rate)?

Definition

Calculation of APR

Purpose

When to Use

What Is EAR (Effective Annual Rate)?

Definition

Calculation of EAR

Purpose

When to Use

Key Differences Between APR and EAR

Conceptual Underpinnings

Incorporation of Compounding

Reflecting True Cost and Benefit

Applicability in Varied Scenarios

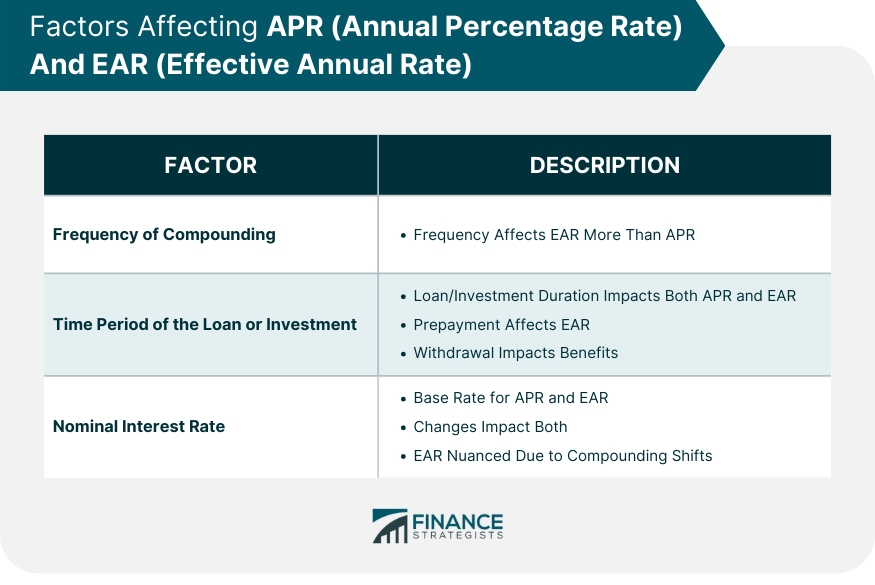

Factors Affecting APR and EAR

Frequency of Compounding

Time Period of the Loan or Investment

Nominal Interest Rate

How Credit Card Companies May Take Advantage

Conclusion

APR vs EAR FAQs

Annual percentage rate is a rate charged per year on an amount of money that is borrowed as a loan or invested, which factors in associated fees in addition to the interest rate.

Effective annual rate is the interest rate on a loan which factors in any associated fees as well as compounding interest that happens on a smaller time frame than one year.

APR factors in any associated fees, but does not account for interest compounding on a smaller time frame than one year, whereas EAR accounts for both associated fees and interest compounding on a smaller time frame than annually.

Another name of EAR is APY.

Most credit card companies use an APR compounded monthly, whereas most mortgages use an APR that is calculated on an annual basis and is therefore the same as EAR.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.