The 30-Year Treasury, also known as the 30-Year Treasury bond, is a U.S. government debt instrument issued by the U.S. Department of the Treasury. It serves as an alternative to taxation to finance government spending. These bonds are purchased by investors who expect repayment at face value after 30 years from the issue date. Interest is paid semiannually to bondholders based on the rate set at issuance, commonly referred to as the "coupon." The 30-Year Treasury has significant importance in the U.S. economy. It acts as a benchmark for mortgage rates, influencing borrowing costs for homeowners. Moreover, its yield serves as a crucial indicator of investor confidence. Higher demand reduces yields, indicating economic uncertainty and a preference for safer investments, while lower demand and higher yields suggest investor confidence in economic growth. The U.S. government started issuing 30-Year Treasury bonds in 1977, primarily to fund its operations and meet its obligations. They have since been a cornerstone of the U.S. and global financial markets, often viewed as a benchmark for long-term interest rates due to their security and liquidity. Their importance stems from their guaranteed yield, making them an attractive option for risk-averse investors, such as retirees and pension funds. Additionally, they serve as a vital tool for economic analysis, with shifts in their yield offering valuable insights into market sentiment regarding future economic conditions. The structure of a 30-Year Treasury bond is straightforward. It has a face value, typically $1,000, which is what the bondholder receives when the bond matures after 30 years. The bond also has a coupon or interest rate, that's set at the time of issuance. This rate remains fixed for the life of the bond, with interest payments made semiannually to the bondholder. Understanding the terminology associated with the 30-Year Treasury is essential to appreciate its value and function in the financial markets. Some key terms include: Face Value: This is the amount paid to the bondholder at maturity. For the 30-Year Treasury, it's usually $1,000. Coupon Rate: This is the interest rate set when the bond is issued. It remains fixed for the duration of the bond and determines the semiannual interest payments. Maturity Date: This is the date when the bondholder will receive the face value of the bond. For the 30-Year Treasury, it's 30 years from the issuance date. Investing in 30-Year Treasury bonds can be a beneficial financial strategy. Here is a detailed step-by-step guide on how to purchase these bonds: Before purchasing, determine whether you intend to hold the bond until maturity to receive the full face value and all scheduled interest payments or plan to potentially sell it on the secondary market. If you decide to purchase directly from the U.S. Treasury, open an account on the TreasuryDirect website. This online platform provides access to U.S. government securities, including 30-Year Treasury bonds. If you decide to use a broker, open an account with a brokerage firm. Ensure that the broker allows for Treasury bond transactions. Determine how much you wish to invest in 30-Year Treasury bonds. Keep in mind that these bonds have a face value of $1,000, which is the minimum amount you can purchase. Decide between a competitive and non-competitive bid. Non-competitive bidders agree to accept any yield determined at the auction, making this a suitable option for smaller, individual investors. Competitive bidders specify the yield they are willing to accept, with the risk that if their specified yield is too high, they may not receive any bonds. On the TreasuryDirect website, enter your bid for the upcoming auction. If using a broker, place your order through the brokerage platform. Wait for the auction results. If successful, the bonds will be added to your TreasuryDirect or brokerage account. If you plan to hold the bond until maturity, keep track of your semiannual interest payments. If you plan to sell on the secondary market, monitor market conditions and bond prices. Purchasing 30-Year Treasury bonds involves careful planning and consideration but can offer a secure and predictable investment for those looking for long-term options. The yield of the 30-Year Treasury bond is the return an investor can expect to earn, expressed as an annual percentage of the bond's price. It's inversely related to the bond's price: as demand for the bonds increases, their price rises and the yield falls, and vice versa. The yield is determined at auction and depends on a variety of factors, including current interest rates, economic conditions, and investor demand for low-risk assets. Several factors can influence the yield of the 30-Year Treasury: Monetary Policy: Decisions by the Federal Reserve, particularly those affecting interest rates, significantly influence Treasury yields. Lower interest rates often lead to lower yields and vice versa. Economic Conditions: Economic factors, such as inflation expectations, economic growth projections, and market volatility, can impact Treasury yields. Investor Demand: If demand for these low-risk bonds increases, prices rise, and yields fall. Demand often increases during times of economic uncertainty. Changes in the yield of the 30-Year Treasury can have significant implications for the broader financial market. Higher yields can lead to higher borrowing costs for both corporations and consumers. For example, mortgage rates often move in tandem with 30-Year Treasury yields. Additionally, changes in yields can signal shifts in investor sentiment regarding future economic conditions. The 30-Year Treasury serves as an essential economic indicator. Its yield is closely watched by economists, investors, and policymakers as a barometer of long-term investor confidence and market expectations of future inflation and economic growth. The yield curve, a graph plotting the yields of Treasury bonds of different maturities, is a tool used to predict economic trends. A "normal" yield curve slopes upward, reflecting higher yields for longer-term bonds, including the 30-Year Treasury. A flattening yield curve, where the difference between short-term and long-term rates narrows, could indicate slowing economic growth. An "inverted" yield curve, where short-term rates exceed long-term rates, has historically been a predictor of economic recession. The yield on the 30-Year Treasury can provide insights into market expectations for future inflation. If investors expect high inflation, they demand higher yields to compensate for the anticipated loss in purchasing power, pushing up Treasury yields. Investing in the 30-Year Treasury comes with several benefits: 1. Safety: Given that these bonds are backed by the full faith and credit of the U.S. government, they are one of the safest investments available. The risk of default is virtually nonexistent. 2. Predictable Income: With a fixed coupon rate, investors can anticipate exactly how much they will earn from interest payments over the bond's life. 3. Liquidity: The 30-Year Treasury is a highly liquid market, making buying and selling these bonds relatively easy and efficient. 4. Tax Advantages: The interest income from these bonds is exempt from state and local taxes, potentially leading to significant savings depending on an investor's tax bracket and location. Despite their benefits, investing in the 30-Year Treasury is not without risks: Interest Rate Risk: If market interest rates rise, the price of existing bonds with lower coupon rates falls. This could lead to capital losses if an investor needs to sell the bond before maturity. Reinvestment Risk: The risk that future proceeds will have to be reinvested at a lower potential interest rate. Inflation Risk: If inflation increases, the purchasing power of the fixed interest payments can decline. While all Treasury securities are backed by the U.S. government, they differ in terms of maturity and yield. Shorter-term Treasuries, such as the 2-year or 5-year notes, generally offer lower yields but come with less interest rate risk. The 30-Year Treasury typically offers the highest yield of all Treasury securities, compensating investors for assuming greater interest rate risk. The 30-Year Treasury is generally considered less risky than corporate bonds and equities. Corporate bonds carry credit risk — the risk that the issuer will default on its obligations. Equities, or stocks, offer potentially higher returns but come with higher volatility and risk. The 30-Year Treasury can play a key role in a diversified investment portfolio. For risk-averse investors or those nearing retirement, these bonds can provide a steady, reliable income stream. For other investors, they can serve as a hedge against market volatility, helping to balance riskier assets in a portfolio. As always, an investor's individual circumstances, risk tolerance, and investment goals should guide investment decisions. The 30-Year Treasury, a long-term government debt instrument, is a cornerstone of the financial markets. Its structure involves a face value and a fixed interest rate, with interest payments made semiannually. Investing in the 30-Year Treasury offers benefits such as safety, predictable income, and tax advantages but also involves risks like interest rate risk, reinvestment risk, and inflation risk. Purchasing these bonds is fairly straightforward, either through the TreasuryDirect website or a broker. The yield, or return, on these bonds, is influenced by factors such as monetary policy, economic conditions, and investor demand. Incorporating the 30-Year Treasury into your investment strategy can provide long-term security and income. However, as with any investment, it's crucial to understand the implications fully. To help navigate these considerations, it's beneficial to seek professional wealth management services.What Is the 30-Year Treasury?

Brief History and Importance of the 30-Year Treasury

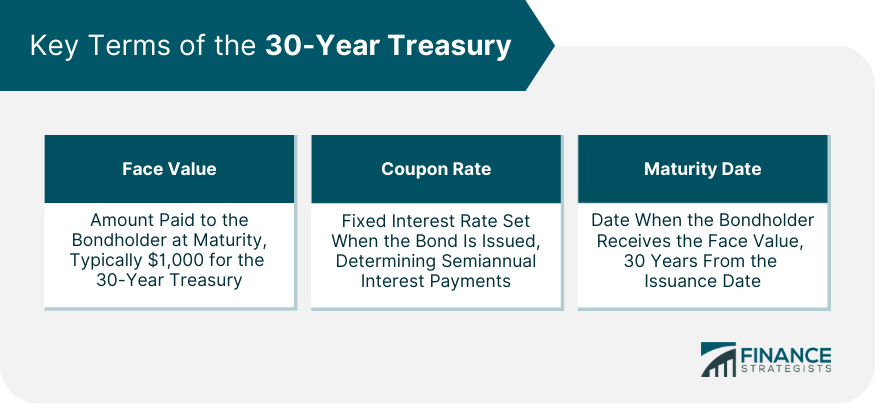

Structure and Key Terms of the 30-Year Treasury

How to Purchase 30-Year Treasury Bonds

Step 1: Decide on Your Investment Strategy

Step 2: Open an Account

Step 3: Choose the Amount to Invest

Step 4: Select Your Bidding Option

Step 5: Make Your Purchase

Step 6: Await Auction Results

Step 7: Plan for the Future

30-Year Treasury Yields

Understanding the Yield of the 30-Year Treasury

Factors Influencing the Yield of the 30-Year Treasury

How Changes in the Yield of the 30-Year Treasury Impact the Broader Financial Market

30-Year Treasury and Economic Indicators

The Role of the 30-Year Treasury as an Economic Indicator

Using the 30-Year Treasury Yield Curve to Predict Economic Trends

The 30-Year Treasury and Inflation Expectations

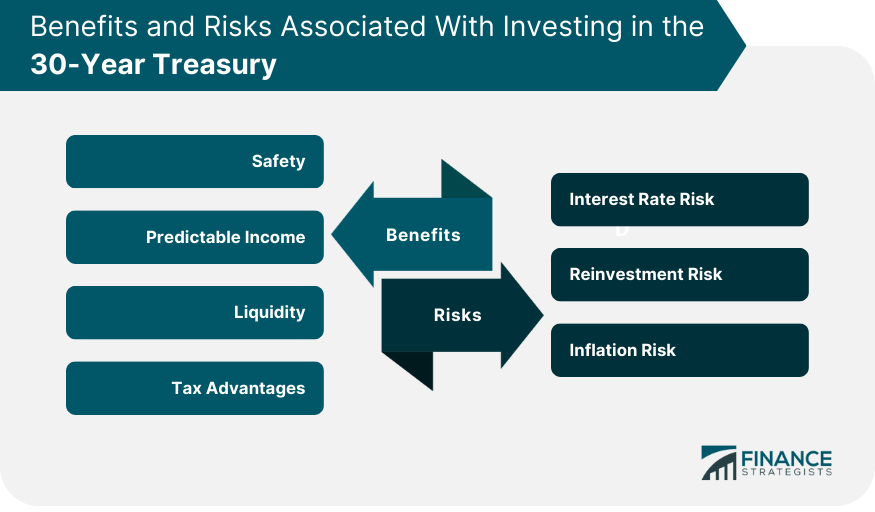

Benefits of Investing in the 30-Year Treasury

Risks Associated With Investing in the 30-Year Treasury

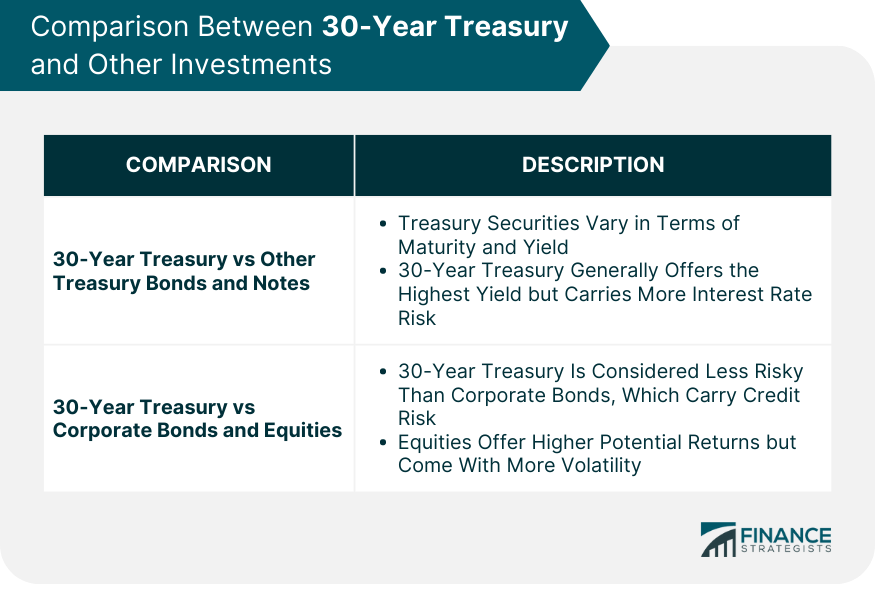

Comparison Between 30-Year Treasury and Other Investments

Comparing the 30-Year Treasury to Other Treasury Bonds and Notes

Comparing the 30-Year Treasury to Corporate Bonds and Equities

Assessing the Role of the 30-Year Treasury in a Diversified Investment Portfolio

Final Thoughts

30-Year Treasury FAQs

The 30-Year Treasury is a government bond issued by the U.S. Department of the Treasury. It has a maturity of 30 years and pays a fixed interest rate to the bondholder semiannually.

Investing in the 30-Year Treasury offers safety, predictable income, liquidity, and tax advantages.

Investors in the 30-Year Treasury face interest rate risk, reinvestment risk, and inflation risk.

You can purchase a 30-Year Treasury bond either directly from the U.S. Treasury through the TreasuryDirect website or through a broker.

The yield of the 30-Year Treasury is influenced by monetary policy, economic conditions, and investor demand.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.