A 10 Year Treasury Note is a 10-year debt security issued by the U.S. Treasury Department, backed by the government. It is sold to investors to finance public expenses and involves an interest rate and principal repayment at the end of the term. These notes serve as a loan from investors to the government and hold significant importance in the economy. They are crucial tools for the Federal Reserve and economists in assessing the health of the U.S. economy. The yield, or interest rate, on these notes is closely monitored as an indicator of investor confidence. Higher yields indicate greater risk compensation and economic uncertainty, while lower yields signal stability. Additionally, the yield on these notes impacts borrowing costs across the economy, affecting mortgage rates and savings account interest. Understanding the components of 10 Year Treasury Notes provides valuable insights into their role in the financial landscape. The face value of a 10 Year Treasury Note is the amount that the U.S. government promises to pay the note holder upon maturity. This is often referred to as the note's par value. The purchase price, on the other hand, can fluctuate depending on the demand for these notes. If the demand is high, the notes might sell for more than their face value; conversely, lower demand might mean the notes sell for less. The interest rate, or coupon rate, of the 10 Year Treasury Note is determined during an auction process. This interest is typically paid semi-annually. It's important to note that the coupon rate isn't the same as the yield of the note. The yield is the overall return an investor can expect to receive when they buy the note. It takes into account both the coupon rate and any difference between the purchase price and the face value. The maturity date of a 10 Year Treasury Note is simply the date 10 years after the issue date, at which point the U.S. government repays the face value of the note to the holder. The relevance of the maturity date lies in the fact that it marks the end of the contractual obligations between the U.S. government and the note holder. It's the point at which the investment period ends, and any remaining balance is returned to the investor. Investors can buy a 10 Year Treasury Note through several avenues, including brokerages, banks, and directly from the U.S. Treasury at auction. The Treasury Department conducts regular auctions, during which it sells these notes to the highest bidder. The winning bid determines the coupon rate for the note, with the highest bid typically resulting in the lowest interest rate. Investors receive interest payments from their 10 Year Treasury Note every six months for the life of the note. These payments are based on the coupon rate established at the auction. Upon maturity, the U.S. government repays the face value of the note. This predictable return and the backing of the U.S. government make 10 Year Treasury Notes an appealing investment for risk-averse individuals. Investors have several options upon the maturity of their 10 Year Treasury Note. They can take the return and invest in another financial product or simply use the funds as needed. Many investors, however, choose to reinvest in another Treasury note, maintaining their position in this secure and stable investment. This decision largely depends on the investor's financial goals, the current interest rate environment, and their view on the future of the economy. The 10 Year Treasury Note is an integral part of government financing. The funds raised through the sale of these notes finance various government activities and programs. The government essentially borrows money from investors and pays it back with interest over a decade. This is a reliable way to raise funds without increasing taxes or implementing more drastic financial measures. The 10 Year Treasury Note also contributes to the national debt. The total value of these notes in circulation is included in the calculation of the U.S. government's total outstanding debt. However, the role of these notes in the national debt is nuanced. While they do increase the debt, they also fund essential government activities. Furthermore, the regular interest payments and the repayment of the face value at maturity contribute to the country's debt service obligations. The 10 Year Treasury Note is widely used as a benchmark in the financial markets. Its yield is used as a reference point for various types of debt, including corporate bonds and mortgage rates. This makes it a barometer for broader economic and market conditions. As a risk-free rate, it serves as the minimum return an investor expects for taking on a certain level of risk. Changes in the yield of the 10 Year Treasury Note can significantly impact the stock market. When yields rise, bonds and other fixed-income investments become more attractive, often leading to a sell-off in stocks, particularly in interest-sensitive sectors like utilities and real estate. Conversely, falling yields can make stocks more attractive, potentially driving a stock market rally. The 10 Year Treasury Note yield is closely tied to mortgage rates. When the yield on these notes increases, mortgage rates often follow suit and vice versa. This is because lenders use the 10-year yield as a benchmark to set their own rates on long-term loans, including mortgages. Despite being considered a safe investment, 10 Year Treasury Notes come with certain risks. The most notable is interest rate risk: if interest rates rise after you buy a note, the value of your note will fall. Additionally, while the risk of default is virtually zero, the presence of inflation risk is a concern, as higher inflation can erode the purchasing power of the fixed interest payments you receive. In terms of returns, 10 Year Treasury Notes typically offer lower yields compared to riskier assets like stocks or corporate bonds. This is because they are considered virtually risk-free. However, during periods of economic uncertainty, they can outperform riskier assets as investors seek safety. Inflation is a significant factor for 10 Year Treasury Note investors. Rising inflation can erode the real value of the fixed interest payments you receive. If inflation exceeds the yield on your note, your investment may result in a negative real return. However, during periods of low inflation, the fixed payments can provide a steady, positive real return. Economic indicators such as GDP growth, unemployment rates, and inflation expectations can all influence the yield on the 10 Year Treasury Note. A strong economy tends to push yields higher as investors require less compensation for risk, while economic uncertainty or a downturn can drive investors to the relative safety of Treasury notes, pushing yields lower. Federal Reserve policy greatly impacts the yield of the 10 Year Treasury Note. When the Fed raises short-term interest rates, the yield on these notes often rises. Conversely, when the Fed lowers rates or buys Treasury securities as part of a quantitative easing program, the yield on these notes tends to fall. International events such as geopolitical tensions, global economic shifts, and even pandemics can influence the yield on the 10 Year Treasury Note. These events can lead to increased demand for safe-haven assets like the U.S. Treasury securities, which can push yields lower. Conversely, positive global economic news can boost investor risk appetite, leading to higher yields. The 10 Year Treasury Note is a crucial tool used by the U.S. government for borrowing funds, by offering an investment with regular interest payments over a 10-year period. Its importance lies not just in funding government expenditures, but also in serving as a crucial benchmark for the financial market, impacting everything from mortgage rates to the stock market. Investors need to understand how these notes work, from purchase and semi-annual interest payments to maturity and possible reinvestment. While they offer a stable and low-risk investment opportunity, they also carry potential risks, most notably interest rate and inflation risk. Investing in 10 Year Treasury Notes can be a valuable part of a diversified investment portfolio. However, the decision to invest should be based on individual financial goals, risk tolerance, and market conditions. As always, seeking professional wealth management services can be immensely helpful in navigating these decisions.What Is a 10 Year Treasury Note?

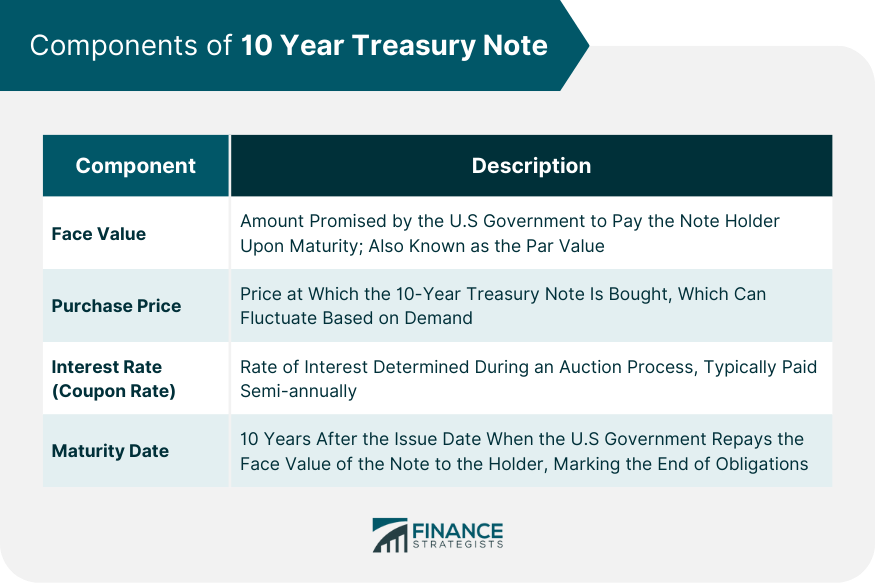

Components of 10 Year Treasury Note

Face Value and Purchase Price

Interest Rate (Coupon Rate) of the 10 Year Treasury Note

Maturity Date and Its Relevance

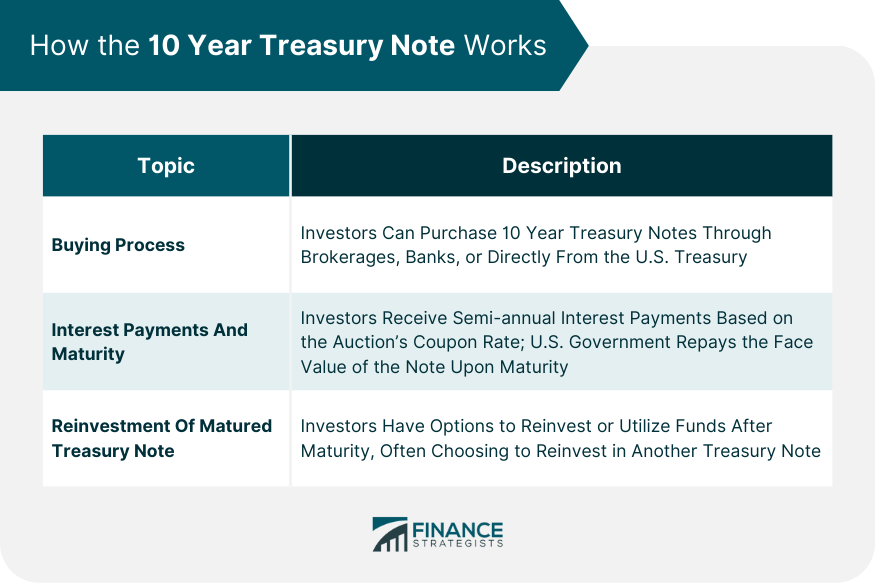

How the 10 Year Treasury Note Works

Buying Process

Interest Payments and Maturity

Reinvestment of Matured

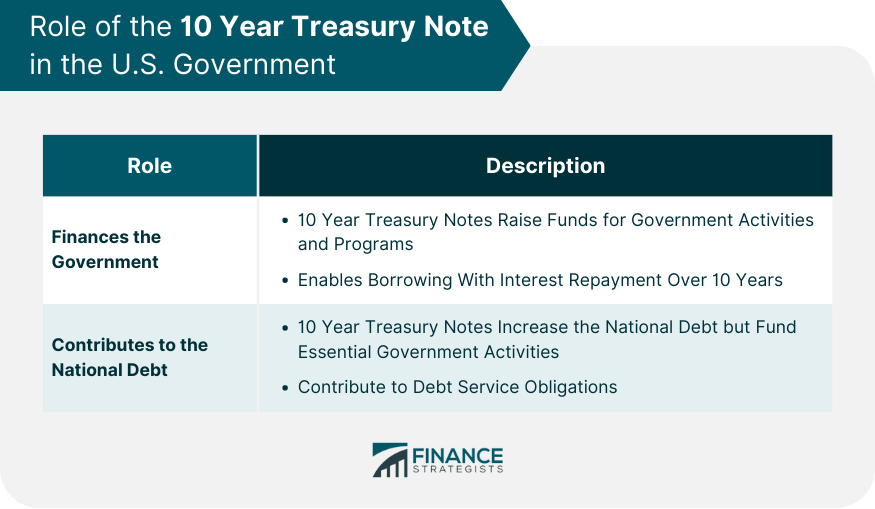

Role of the 10 Year Treasury Note in the U.S. Government

Finances the Government

Contributes to the National Debt

10 Year Treasury Note and the Financial Market

Use of 10 Year Treasury Note as a Benchmark

Impact of 10 Year Treasury Note Yield on the Stock Market

Relationship Between 10 Year Treasury Note and Mortgage Rates

Risks and Returns of Investing in 10 Year Treasury Note

Risk Profile

Comparing Returns of 10 Year Treasury Note With Other Investments

Impact of Inflation on the 10 Year Treasury Note

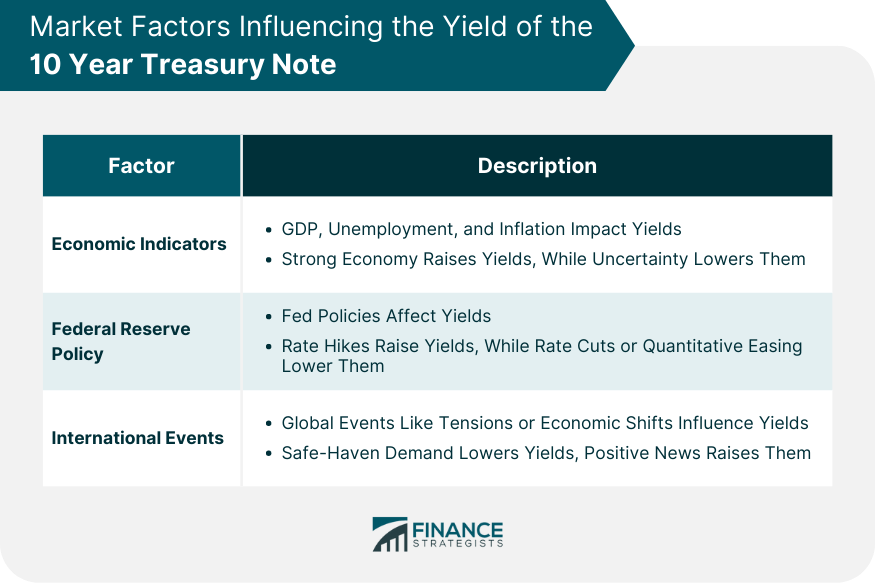

Market Factors Influencing the Yield of the 10 Year Treasury Note

Economic Indicators

Federal Reserve Policy

International Events

Final Thoughts

10 Year Treasury Note FAQs

A 10 Year Treasury Note is a debt security issued by the U.S. government, promising to pay a specific rate of interest over a 10-year period and to repay the principal amount at the end of the term.

The 10 Year Treasury Note is important as its yield serves as a benchmark for various types of debt and reflects broader economic conditions. It influences interest rates on everything from mortgages to savings accounts.

Investors can buy a 10 Year Treasury Note from brokerages, banks, or directly from the U.S. Treasury during auctions. The interest rate is set during the auction process.

The 10 Year Treasury Note is considered a safe investment with a guaranteed return. However, it does carry interest rate risk and inflation risk. Its return is usually lower compared to riskier assets like stocks.

The yield of the 10 Year Treasury Note is influenced by various factors, including economic indicators, Federal Reserve policy, and international events.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.