Wild card options are a unique type of derivative granting the owner the right to engage in a specific transaction before a predetermined date. Their primary distinction from traditional options is their exceptional flexibility, customizable according to the holder's financial strategy. Unlike traditional options, which have fixed exercise prices and expiration dates, wild card options permit parameter adjustments, providing adaptability to various financial strategies and market conditions. This ability to tailor the terms of the options to meet the holder's specific needs, and the opportunity to trade them on secondary markets for profit, are characteristic features. However, this enhanced utility comes at a cost, as wild card options generally carry higher premiums due to their increased versatility. Wild card options are a favorite tool among speculative traders due to their potential for high returns. Traders can leverage these options to earn substantial profits by correctly predicting future market movements. For instance, a trader expecting a significant market move might buy a wild card option to capitalize on this anticipated volatility. Wild card options also serve as effective hedging instruments. A trader might use these options to offset potential losses in their portfolio. For example, if a trader anticipates a downturn in a particular stock they own, they could purchase a wild card option that gains value when the stock price drops. In the realm of corporate finance, wild card options can be used to optimize a company's capital structure. By holding these options, firms can effectively manage their debt and equity mix to minimize the cost of capital and maximize shareholder value. During mergers and acquisitions, wild card options can serve as strategic tools. For example, a company anticipating a takeover bid might issue wild card options to its shareholders, providing them with the right to sell their shares at a premium if the takeover occurs. Risk management professionals often use wild card options to mitigate downside risks. By holding these options, they can protect against unfavorable market movements without limiting potential upside gains. Wild card options are particularly effective in tail risk hedging strategies. These options can be used to insulate a portfolio from extreme market events that could lead to substantial losses. Volatility is a primary determinant of wild card option prices. When market volatility increases, the potential for large price swings grows, increasing the value of wild card options due to the heightened chance of profit. The time to expiration also affects wild card option prices. Options with longer durations until expiration are more valuable, giving holders more time to exercise the option favorably. The price of the underlying asset is another crucial factor. As the underlying asset's price rises, call options (rights to buy) increase in value, while put options (rights to sell) decrease in value, and vice versa. The Black-Scholes model, one of the most famous option pricing models, can be extended to price wild card options. This model uses parameters such as the underlying asset price, strike price, time to expiration, volatility, and risk-free rate to calculate the option's theoretical price. Monte Carlo simulations offer another method for pricing wild card options. This computational algorithm uses randomness to simulate the various paths of the underlying asset price, thereby determining the option's value. 'Greeks' are mathematical values that measure an option's price sensitivity to various factors. They include Delta (sensitivity to asset price changes), Gamma (sensitivity of Delta to asset price changes), Vega (sensitivity to volatility), Theta (sensitivity to time decay), and Rho (sensitivity to interest rate changes). Understanding these Greeks is crucial for managing risks associated with wild card options. While volatility can increase the potential for profits, it also amplifies the risk of losses. Wild card options, being more sensitive to volatility, expose holders to significant market fluctuations. The potential for high returns with wild card options also means a higher loss potential. If market movements do not align with a holder's expectations, the wild card option may expire worthless, leading to a total loss of the initial investment. Due to their complexity, wild card options may be less liquid than traditional options. This limited liquidity can make it more difficult for holders to sell their options, potentially leading to losses. The relatively lower liquidity can also impact execution and transaction costs. Higher bid-ask spreads and lower trading volumes can increase the cost of trading wild card options. Like all financial derivatives, wild card options are subject to strict regulations. Holders must comply with these regulations, including reporting requirements, which can increase the complexity and cost of trading these options. Due to their flexibility, wild card options could be used for market manipulation. Regulators remain vigilant to prevent such abuses and maintain market integrity. Wild card options are frequently used in the finance industry. For instance, in volatile markets, hedge funds might use these options to speculate on price movements or hedge their portfolios against downside risks. On the corporate side, companies may use wild card options to manage their capital structures or as strategic tools in merger and acquisition scenarios. Various strategies involving wild card options have met with both success and failure. Successful strategies often involve meticulous market analysis, careful timing, and proper risk management. For example, a hedge fund might successfully use a wild card option to hedge against potential losses in its portfolio during periods of market uncertainty. On the other hand, successful strategies often result from an adequate understanding of the market, poor timing, or improper risk management. For instance, a trader might suffer significant losses if they overexposed to wild card options without properly hedging their positions or miscalculating market movements. Wild card options, known for their unique flexibility and adaptability, serve as a dynamic financial tool for traders, corporations, and risk management professionals. They can be strategically employed for a variety of purposes, including speculative trading, hedging, capital structure optimization, and risk mitigation. Despite their higher premiums, their versatility makes them an attractive instrument. Their pricing, influenced by factors like volatility, time to expiration, and underlying asset price, can be computed using methods like the Black-Scholes model and Monte Carlo simulations. However, these options also present challenges, such as potential for high losses, limited liquidity, and strict regulatory controls. Therefore, the successful application of wild card options requires a comprehensive understanding of the market, apt timing, and robust risk management. For optimal navigation of wild card options and other financial derivatives, professional wealth management advice is recommended to exploit opportunities and manage inherent risks effectively.What Is a Wild Card Option?

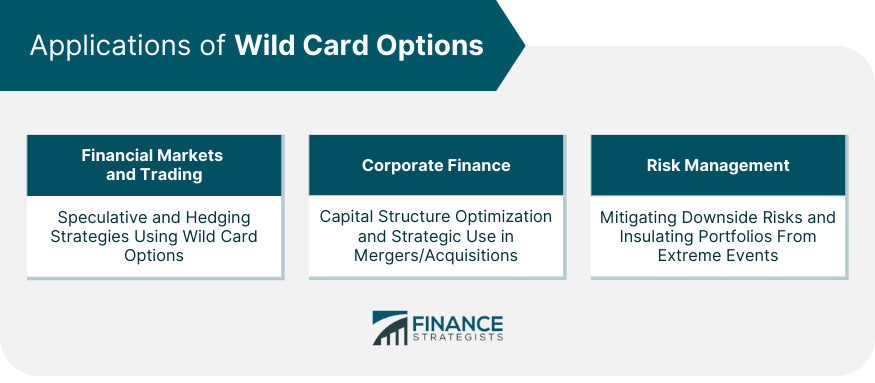

Applications of Wild Card Options

Financial Markets and Trading

Speculative Trading Strategies Using Wild Card Options

Hedging Techniques With Wild Card Options

Corporate Finance

Capital Structure Optimization With Wild Card Options

Merger and Acquisition Scenarios Involving Wild Card Options

Risk Management

Mitigating Downside Risks With Wild Card Options

Tail Risk Hedging Using Wild Card Options

Pricing and Valuation of Wild Card Options

Key Factors Influencing Wild Card Option Prices

Volatility

Time to Expiration

Underlying Asset Price

Pricing Models for Wild Card Options

Black-Scholes Model and Extensions

Monte Carlo Simulations

Sensitivity Analysis and Greeks for Wild Card Options

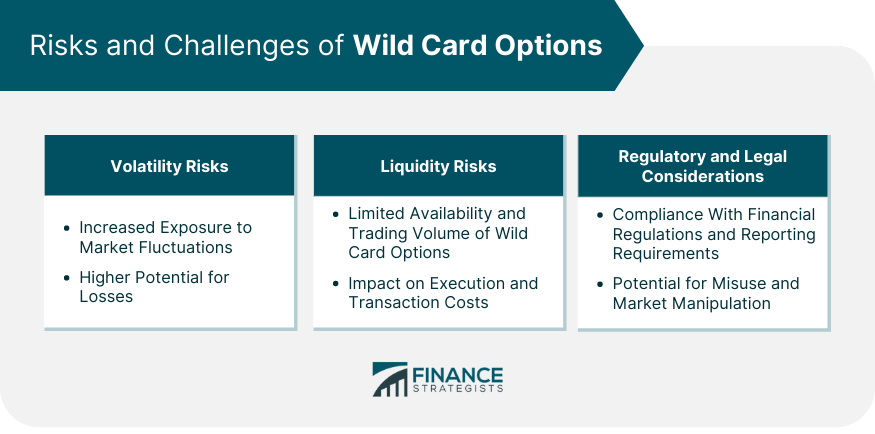

Risks and Challenges of Wild Card Options

Volatility Risks

Increased Exposure to Market Fluctuations

Higher Potential for Losses

Liquidity Risks

Limited Availability and Trading Volume of Wild Card Options

Impact on Execution and Transaction Costs

Regulatory and Legal Considerations

Compliance With Financial Regulations and Reporting Requirements

Potential for Misuse and Market Manipulation

Case Studies and Examples

Real-World Examples of Wild Card Option Usage

Analysis of Successful and Unsuccessful Wild Card Option Strategies

Final Thoughts

Wild Card Option FAQs

A wild card option is a financial derivative that gives the holder the right, but not the obligation, to carry out a specific transaction in the future. It is more flexible than traditional options, which makes it a valuable tool in various financial strategies.

Wild card options are priced based on factors such as the underlying asset price, time to expiration, and market volatility. Pricing models like the extended Black-Scholes model or Monte Carlo simulations can be used to calculate the theoretical price of these options.

Wild card options have several risks, including volatility, liquidity, and regulatory risks. These risks can lead to potential losses, limited trading opportunities, and compliance issues.

Wild card options are used across various finance sectors, including trading, corporate finance, and risk management. They are used for speculative trading, hedging, capital structure optimization, and tail risk management.

The future of wild card options looks promising, with the potential for more complex structures, advanced pricing models, and innovative applications. However, these developments may also bring about additional risks, highlighting the need for professional wealth management advice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.