A Swap Execution Facility (SEF) is a platform or facility that provides a venue for trading swaps in a regulated manner. It was introduced as part of the Dodd-Frank Act to enhance transparency and promote a more competitive and efficient trading environment for derivative instruments. SEFs enable market participants to execute swap transactions electronically, fostering price discovery and pre-trade transparency. These platforms facilitate the trading of various types of swaps, including interest rate swaps, credit default swaps, and foreign exchange derivatives. SEFs play a crucial role in promoting standardized trading protocols, risk mitigation, and regulatory oversight in the global derivatives market. The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, aimed to address the shortcomings of the financial system exposed by the 2008 financial crisis. One of the key provisions of the act was the establishment of SEFs, which sought to bring transparency and regulation to the OTC derivatives market. Prior to Dodd-Frank, OTC derivatives were primarily traded bilaterally, with limited transparency and higher counterparty risk. The introduction of SEFs has had a significant impact on the OTC derivatives market, leading to increased transparency, improved price discovery, and reduced counterparty risk. Under the new regulatory framework, OTC derivatives must be traded on SEFs or other regulated trading platforms and cleared through CCPs, reducing the likelihood of another financial crisis caused by unchecked derivatives trading. Additionally, the introduction of SEFs has increased competition in the market, leading to tighter bid-ask spreads and better pricing for investors. Since their inception, SEFs have evolved in response to changing market dynamics and regulatory requirements. Technological advancements have led to the development of various types of SEFs, catering to different trading preferences and strategies. As the OTC derivatives market continues to grow and evolve, SEFs will likely adapt to meet the changing needs of market participants. Central Limit Order Books (CLOBs) are electronic trading platforms that allow market participants to place orders for OTC derivatives in a central order book, where they are matched with orders from other participants. CLOBs provide enhanced price discovery and transparency, as market participants can view the entire order book, including the best bid and offer prices. Request for Quote (RFQ) systems enable market participants to request quotes from multiple liquidity providers simultaneously, fostering competition and improving price discovery. In an RFQ system, a market participant submits a request for a quote to buy or sell a specific OTC derivative, and liquidity providers respond with their respective quotes. Voice and hybrid platforms combine the traditional voice-brokered method of trading with electronic trading capabilities. These platforms allow market participants to choose between using voice brokers to negotiate trades or executing trades electronically. Hybrid platforms cater to the varying preferences of market participants, providing the flexibility to switch between voice and electronic trading depending on market conditions and the specific needs of the investor. SEFs have significantly increased transparency in the OTC derivatives market by providing real-time trade data, including price, volume, and counterparty information. This increased transparency allows wealth managers to make more informed investment decisions and better assess the fair value of OTC derivatives. Moreover, SEFs facilitate price discovery by offering multiple trading mechanisms, such as CLOBs and RFQ systems, which encourage competition among liquidity providers and lead to better pricing for investors. SEFs contribute to improved risk management in wealth management by reducing counterparty risk. By requiring trades to be cleared through a central counterparty clearinghouse (CCP), SEFs mitigate the risk of one party defaulting on their obligations, which was a significant concern during the 2008 financial crisis. Additionally, SEFs enable wealth managers to hedge their clients' portfolios more effectively by providing access to a broader range of OTC derivatives. SEFs promote operational efficiency and cost reduction in the wealth management industry by providing an electronic trading platform for OTC derivatives. Electronic trading reduces the time and effort required to execute trades, leading to lower transaction costs for investors. Furthermore, SEFs streamline the trade confirmation and settlement process, further reducing operational costs for market participants. By offering a regulated trading environment, SEFs help wealth managers comply with the requirements set forth by the Dodd-Frank Act and other financial regulations. SEFs provide standardized trade reporting, facilitating regulatory oversight and reducing the likelihood of non-compliance penalties for wealth management firms. Regulatory changes continue to shape the landscape of the SEF market. As global regulators monitor the effectiveness of current regulations, they may introduce new rules or modify existing ones, potentially impacting the way SEFs operate. SEFs must remain agile and adapt to regulatory changes to ensure continued compliance and maintain their competitive edge in the market. Technological advancements and innovations play a crucial role in the evolution of SEFs. As new technologies emerge, SEFs must continually update and enhance their platforms to provide market participants with cutting-edge trading tools and capabilities. For example, the adoption of artificial intelligence and machine learning in trading platforms could lead to more efficient and intelligent order execution, further improving the benefits of SEFs for market participants. The financial industry is constantly evolving, with new financial instruments and products being introduced regularly. SEFs must be prepared to adapt their platforms to accommodate these emerging instruments, ensuring they remain relevant and valuable to market participants. For instance, the growing interest in cryptocurrencies and digital assets may drive the need for SEFs to facilitate trading in these new asset classes. A Swap Execution Facility (SEF) is a regulated trading platform designed to facilitate the execution of over-the-counter (OTC) derivative transactions, enhancing market transparency, improving price discovery, and reducing counterparty risk. SEFs offer a variety of trading mechanisms, including Central Limit Order Books (CLOBs), Request for Quote (RFQ) systems, and voice and hybrid platforms, catering to different trading preferences and strategies. SEFs face challenges such as regulatory changes, technological advancements, and the integration of emerging financial instruments, which may impact their operations and competitiveness. Despite these challenges, SEFs have a promising outlook driven by the growth of wealth management and alternative investments. To fully capitalize on the benefits of SEFs, it is advisable to seek professional services that can help navigate the complexities of these trading platforms and optimize investment strategies.Overview of a Swap Execution Facility (SEF)

Evolution of Swap Execution Facilities

Dodd-Frank Wall Street Reform and Consumer Protection Act

Regulatory Impact on OTC Derivatives Market

Development of SEFs Over Time

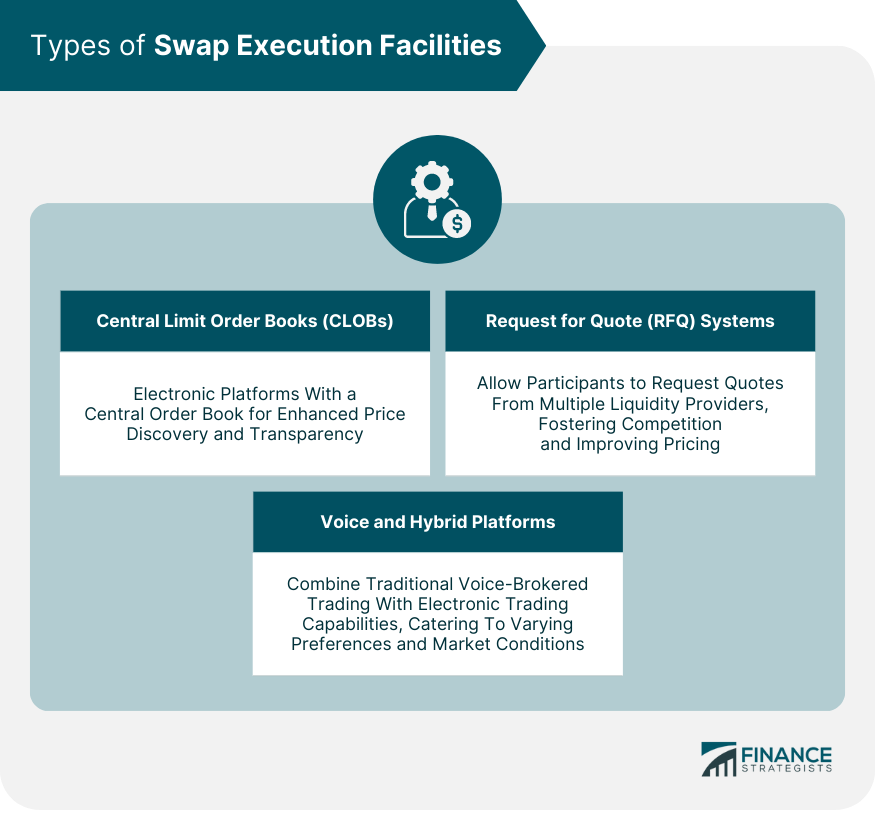

Types of Swap Execution Facilities

Central Limit Order Books (CLOBs)

Request for Quote (RFQ) Systems

Voice and Hybrid Platforms

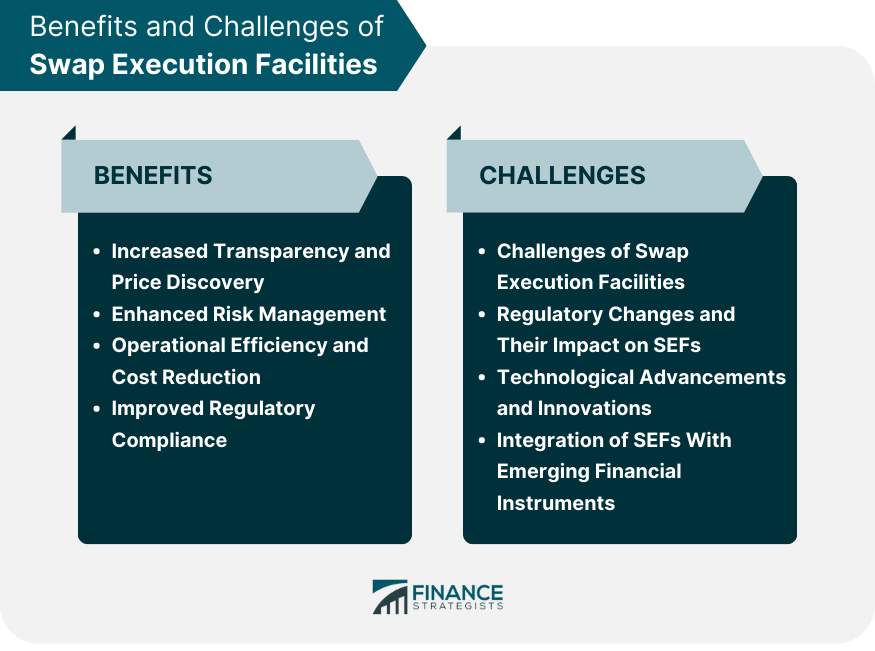

Benefits of Swap Execution Facilities

Increased Transparency and Price Discovery

Enhanced Risk Management

Operational Efficiency and Cost Reduction

Improved Regulatory Compliance

Challenges of Swap Execution Facilities

Regulatory Changes and Their Impact on SEFs

Technological Advancements and Innovations

Integration of SEFs With Emerging Financial Instruments

Conclusion

Swap Execution Facility (SEF) FAQs

A Swap Execution Facility (SEF) is a trading platform designed for executing over-the-counter (OTC) derivative transactions, primarily interest rate swaps and credit default swaps. Its primary purpose is to enhance market transparency, improve price discovery, and reduce counterparty risk by ensuring trades are cleared through a central counterparty clearinghouse (CCP).

SEFs were introduced as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 to increase transparency and regulation in the OTC derivatives market. Since then, SEFs have evolved in response to changing market dynamics, regulatory requirements, and technological advancements, leading to the development of various types of SEFs catering to different trading preferences and strategies.

The main types of SEFs include Central Limit Order Books (CLOBs), Request for Quote (RFQ) systems, and voice and hybrid platforms. CLOBs are electronic trading platforms that allow market participants to place and match orders in a central order book. RFQ systems enable participants to request quotes from multiple liquidity providers simultaneously. Voice and hybrid platforms combine traditional voice-brokered trading with electronic trading capabilities, offering flexibility for market participants.

SEFs play a critical role in alternative investments by enabling market participants to access and trade OTC derivatives used as part of sophisticated investment strategies. Hedge funds, private equity firms, and real estate investment trusts (REITs) often utilize OTC derivatives to achieve their investment objectives. By providing a regulated and transparent trading environment, SEFs contribute to the overall stability and growth of the alternative investment industry.

SEFs face challenges related to regulatory changes, technological advancements, and the integration of emerging financial instruments. They must adapt to new regulations and adopt innovative technologies to stay competitive. The growth of wealth management and alternative investments presents opportunities for SEFs, as more investors and wealth managers recognize the benefits of trading OTC derivatives on these platforms, leading to increased demand and growth potential.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.