An exchange-traded derivative (ETD) is a financial instrument that derives its value from an underlying asset, such as a commodity, a currency, or a stock index. ETDs are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Stock Exchange (NYSE), and are standardized contracts that can be bought and sold like any other security. ETDs play an important role in financial markets because they allow investors to manage risk and gain exposure to a wide range of assets without actually owning them. ETDs are widely used by investors, traders, and corporations to hedge against price movements, speculate on future price changes, and arbitrage price discrepancies between different markets. Futures contracts are a type of ETD that obligates the buyer to purchase an underlying asset at a future date, at a specified price, and in a specified quantity. Futures contracts are traded on organized exchanges and are used by investors and corporations to manage price risk and gain exposure to commodities, currencies, and other assets. Options contracts are a type of ETD that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price, on or before a specified date. Options contracts are traded on organized exchanges and are used by investors and corporations to manage price risk, speculate on future price changes, and generate income from premiums. Swaps contracts are a type of ETD that involve the exchange of cash flows between two parties, based on the price movements of an underlying asset. Swaps contracts are customized agreements that are negotiated between the parties and are used by investors and corporations to manage interest rate risk, currency risk, and credit risk. Hedgers are market participants who use ETDs to manage price risk associated with the underlying asset. Hedgers include corporations, farmers, and other market participants who are exposed to price fluctuations in commodities, currencies, and other assets. By using ETDs, hedgers can protect themselves from adverse price movements and stabilize their cash flows. Speculators are market participants who use ETDs to profit from price movements in the underlying asset. Speculators include individual investors, hedge funds, and other traders who seek to generate profits from buying and selling ETDs. Speculators are often characterized as adding liquidity to the market and promoting price discovery. Arbitrageurs are market participants who use ETDs to exploit price discrepancies between different markets. Arbitrageurs are typically sophisticated investors who use computer algorithms and other advanced trading techniques to identify and exploit pricing inefficiencies in the market. By doing so, arbitrageurs help to promote price efficiency and reduce market volatility. One of the primary benefits of ETDs is their ability to help market participants manage risk associated with the underlying asset. ETDs allow hedgers to protect themselves from adverse price movements and stabilize their cash flows, while also allowing speculators to profit from price movements and arbitrageurs to exploit pricing inefficiencies in the market. ETDs also promote price discovery by providing a mechanism for market participants to express their views on the future price of the underlying asset. By trading ETDs, market participants can provide information to the market about their expectations for future price movements, which can help to establish a more efficient and accurate market price. ETDs also provide liquidity to the market by allowing market participants to easily buy and sell contracts without having to physically exchange the underlying asset. This makes it easier for investors and traders to enter and exit positions in the market, which can help to improve market efficiency and reduce trading costs. One of the main risks associated with ETDs is counterparty risk, which is the risk that the other party to the contract will default on their obligations. To mitigate counterparty risk, organized exchanges typically require market participants to post collateral, such as cash or securities, which can be used to cover losses in the event of a default. ETDs are also subject to market risk, which is the risk that the underlying asset will experience price movements that are adverse to the market participant's position. Market risk can be managed through the use of various hedging strategies, such as buying or selling offsetting contracts or adjusting exposure to the underlying asset. ETDs are also subject to liquidity risk, which is the risk that there may not be enough market participants willing to buy or sell the contracts at a given time, which can lead to wider bid-ask spreads and difficulty in exiting a position. This risk can be mitigated by trading ETDs on liquid markets and by carefully managing exposure to the underlying asset. In the United States, ETDs are regulated by the Securities and Exchange Commission (SEC). The SEC is responsible for ensuring that ETDs are traded in a fair and orderly manner, and that market participants are provided with adequate disclosure and transparency. The SEC also has the authority to investigate and prosecute market participants who engage in illegal or unethical trading activity in ETDs. The Commodity Futures Trading Commission (CFTC) is another regulatory body that oversees the trading of ETDs in the United States. The CFTC is responsible for regulating the futures and options markets, and for ensuring that market participants are provided with adequate risk management tools and protections. An Exchange Traded Derivative is a type of financial contract whose value is based on an underlying asset, such as a stock, commodity, or currency. These derivatives are traded on organized exchanges, with standardized terms and pricing. ETDs are an important financial instrument that play a critical role in financial markets. They allow market participants to manage risk, gain exposure to a wide range of assets, and promote price discovery and liquidity. However, ETDs also come with risks, such as counterparty risk, market risk, and liquidity risk, which must be carefully managed by market participants. By understanding the benefits and risks of ETDs and following regulatory requirements, market participants can use ETDs effectively to achieve their investment objectives and manage risk in an increasingly complex financial landscape.What Is an Exchange Traded Derivative?

Types of Exchange Traded Derivatives

Futures Contracts

Options Contracts

Swaps Contracts

Market Participants in Exchange Traded Derivatives

Hedgers

Speculators

Arbitrageurs

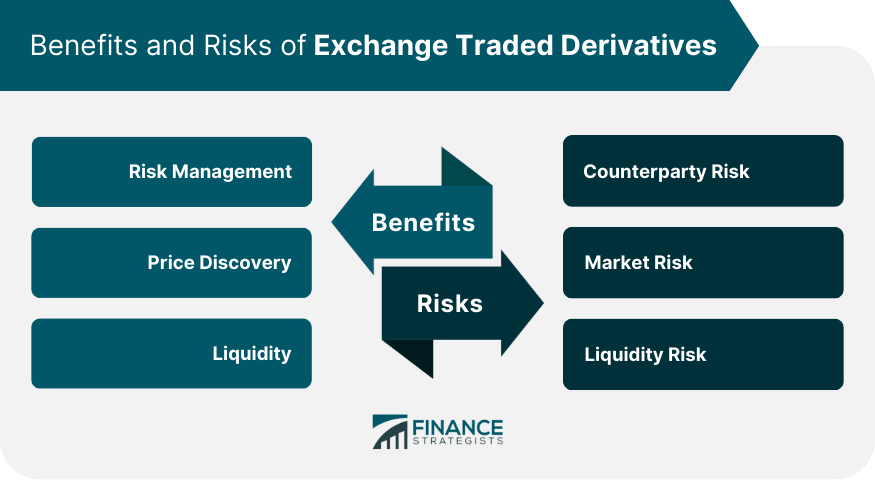

Benefits of Exchange Traded Derivatives

Risk Management

Price Discovery

Liquidity

Risks Associated With Exchange Traded Derivatives

Counterparty Risk

Market Risk

Liquidity Risk

Regulation of Exchange Traded Derivatives

SEC Regulations

CFTC Regulations

Final Thoughts

Exchange Traded Derivative FAQs

Exchange traded derivative is a financial instrument traded on an exchange whose value is based on an underlying asset, index, or security.

The common types of exchange traded derivatives include futures contracts, options contracts, and swaps contracts.

Hedgers use exchange traded derivatives to manage their financial risks by offsetting their exposure to price movements in the underlying asset.

The main risks associated with exchange traded derivatives include counterparty risk, market risk, and liquidity risk.

Exchange traded derivatives are regulated by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in the United States.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.