Tax planning for divorce refers to the process of analyzing and strategizing the financial and tax implications of a divorce to minimize tax liabilities and maximize financial outcomes for both parties involved. In divorce proceedings, it is crucial to consider the tax implications of various decisions, including the division of assets, alimony payments, and child support arrangements, as these can significantly impact each party's financial situation. The primary objectives of tax planning in divorce are to minimize tax liabilities, ensure compliance with tax laws, and achieve equitable financial outcomes for both parties. When a couple divorces, their filing status changes from married filing jointly to single or head of household, which can affect tax rates and the availability of certain deductions and credits. In a divorce, determining which parent can claim the dependency exemption and child tax credits is essential for maximizing tax benefits and ensuring compliance with tax laws. The division of assets, such as real estate and investments, can trigger tax implications, including capital gains or losses, which should be considered when negotiating property settlements. Alimony payments may have tax implications for both the payer and the recipient, which should be taken into account when determining the amount and structure of spousal support. Child support payments are generally not tax-deductible for the payer and not considered taxable income for the recipient, but other tax implications, such as the allocation of dependency exemptions, should be considered. The division of retirement accounts, such as pensions, 401(k)s, and IRAs, can have significant tax implications, and proper planning is essential to avoid penalties and unfavorable tax outcomes. The sale or transfer of assets during a divorce can result in capital gains or losses, which should be considered when planning for the tax implications of property division. When dividing assets, considering the tax basis of each asset can help minimize potential tax liabilities and ensure a more equitable division of property. The timing of asset transfers can impact the tax implications of property division, so it's essential to strategize the best time to transfer or sell assets during divorce proceedings. Selling the marital home during a divorce may result in capital gains taxes, and proper planning can help minimize tax liabilities or qualify for available exclusions. When transferring investment accounts during a divorce, it's crucial to consider the tax implications of the transfer, such as potential capital gains taxes or penalties for early withdrawal. Alimony payments can have tax implications for both the payer and the recipient, so understanding the current tax laws and structuring payments accordingly is crucial. By strategically structuring alimony payments, both parties can minimize their tax liabilities and achieve a more equitable financial outcome. Understanding the recapture rules for alimony payments can help avoid potential tax pitfalls and ensure compliance with tax laws. Understanding the tax treatment of child support payments can help both parties comply with tax laws and maximize available tax benefits. Properly allocating dependency exemptions and child tax credits between both parents can maximize tax benefits and ensure compliance with tax laws. Incorporating education savings plans, such as 529 plans or Coverdell Education Savings Accounts, into divorce tax planning can help both parties minimize tax liabilities and plan for their children's future educational expenses. When dividing retirement accounts, such as pensions or 401(k)s, Qualified Domestic Relations Orders (QDROs) should be used to avoid tax penalties and ensure proper division of retirement benefits. Transferring or dividing Individual Retirement Accounts (IRAs) can have tax implications, and proper planning is essential to avoid penalties and unfavorable tax outcomes. Understanding the tax implications of rollovers and conversions during the division of retirement accounts can help both parties minimize tax liabilities and maximize their retirement savings. After a divorce, it's essential to update estate planning documents, such as wills, trusts, and beneficiary designations, to reflect the new financial and familial circumstances. Post-divorce, both parties will need to adjust their tax planning strategies to accommodate their new single or head-of-household filing status, taking into account changes in tax rates and available deductions and credits. Implementing tax-efficient investing strategies after a divorce can help both parties minimize their tax liabilities and maximize their financial outcomes. Working with experienced tax and financial professionals is crucial for navigating the complex tax implications of divorce and developing effective tax planning strategies. Choosing a knowledgeable tax advisor or financial planner with experience in divorce-related tax planning can help ensure that both parties receive appropriate guidance and support throughout the divorce process. Coordinating with divorce attorneys and other professionals involved in the divorce process can help ensure a seamless and comprehensive approach to tax planning and financial decision-making. Tax planning plays a vital role in the divorce process, helping both parties minimize tax liabilities, ensure compliance with tax laws, and achieve equitable financial outcomes. By employing effective tax planning strategies, both parties can minimize their tax liabilities, maximize their financial outcomes, and better prepare for their post-divorce financial future. Working with knowledgeable tax and financial professionals is essential for navigating the complex tax implications of divorce and developing effective tax planning strategies to protect both parties' financial interests.What Is Tax Planning for Divorce?

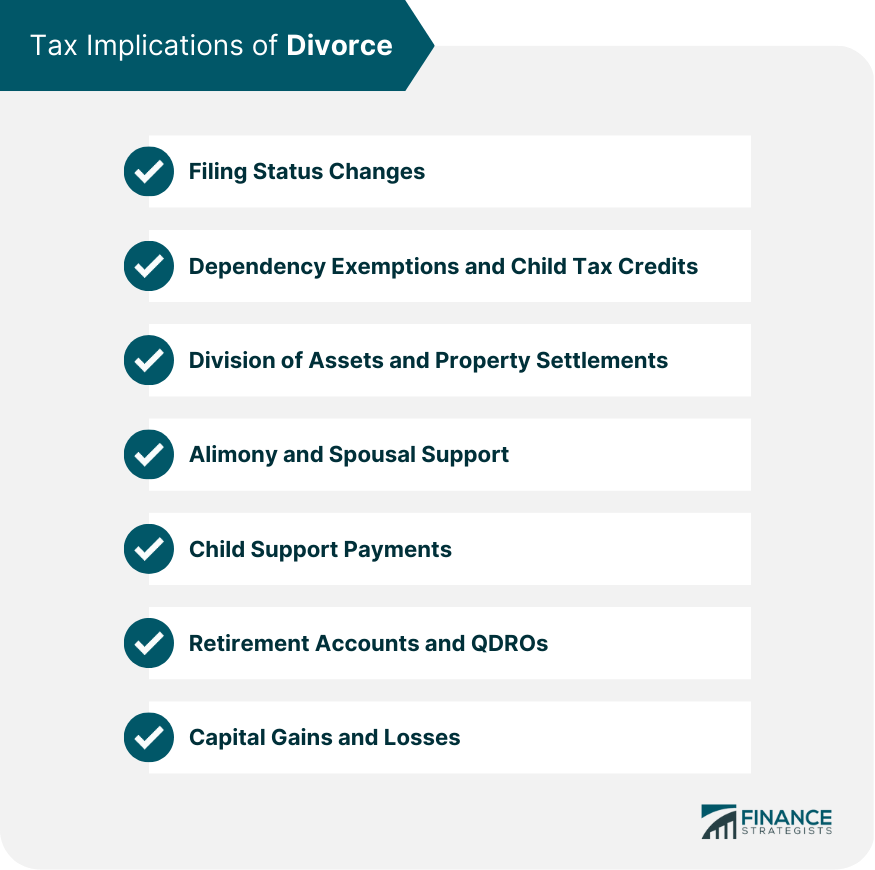

Tax Implications of Divorce

Filing Status Changes

Dependency Exemptions and Child Tax Credits

Division of Assets and Property Settlements

Alimony and Spousal Support

Child Support Payments

Retirement Accounts and QDROs

Capital Gains and Losses

Tax Planning Strategies for Asset Division

Consideration of Tax Basis

Timing of Asset Transfers

Tax Implications of Selling the Marital Home

Transferring Investment Accounts

Tax Planning Strategies for Alimony and Spousal Support

Understanding the Tax Treatment of Alimony

Structuring Alimony Payments for Tax Efficiency

Recapture Rules and Potential Pitfalls

Tax Planning Strategies for Child Support and Dependency Exemptions

Tax Treatment of Child Support Payments

Allocating Dependency Exemptions and Child Tax Credits

Education Savings and Tax Planning

Retirement Accounts and Tax Planning

Dividing Retirement Accounts Using QDROs

Tax Implications of IRA Transfers

Rollovers and Conversions

Tax Planning for Post-divorce Financial Planning

Updating Estate Planning Documents

Tax Planning for Single Individuals

Tax-Efficient Investing Strategies

Working With Tax and Financial Professionals

Importance of Professional Guidance in Tax Planning for Divorce

Selecting a Qualified Tax Advisor or Financial Planner

Coordinating With Attorneys and Other Professionals

Conclusion

The Critical Role of Tax Planning in Divorce

Strategies for Minimizing Tax Liabilities and Maximizing Financial Outcomes

The Importance of Working With Experienced Professionals

Tax Planning for Divorce FAQs

Tax planning for divorce involves strategizing how to divide assets and liabilities in a way that minimizes the tax consequences for both parties.

Some tax issues to consider during a divorce include property division, alimony, child support, and dependency exemptions.

Property division is generally not taxable, but there may be tax implications if certain assets, such as retirement accounts or real estate, are transferred or sold.

Tax planning for divorce is best done before the divorce is finalized, but it may still be possible to make certain tax-related changes after the divorce is finalized, such as adjusting tax withholdings or filing amended tax returns.

Child support payments are not tax-deductible for the payer and are not taxable income for the recipient.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.