Reverse Morris Trust is a tax-efficient transaction structure used in corporate mergers and acquisitions. It allows a company to divest a subsidiary or business unit by spinning it off to its shareholders and subsequently merging it with another company. The transaction is structured in a way that qualifies for tax-free treatment, enabling the selling company to avoid capital gains taxes. The Reverse Morris Trust structure is often employed when a company seeks to separate a non-core business while providing its shareholders with ownership in the acquiring company.

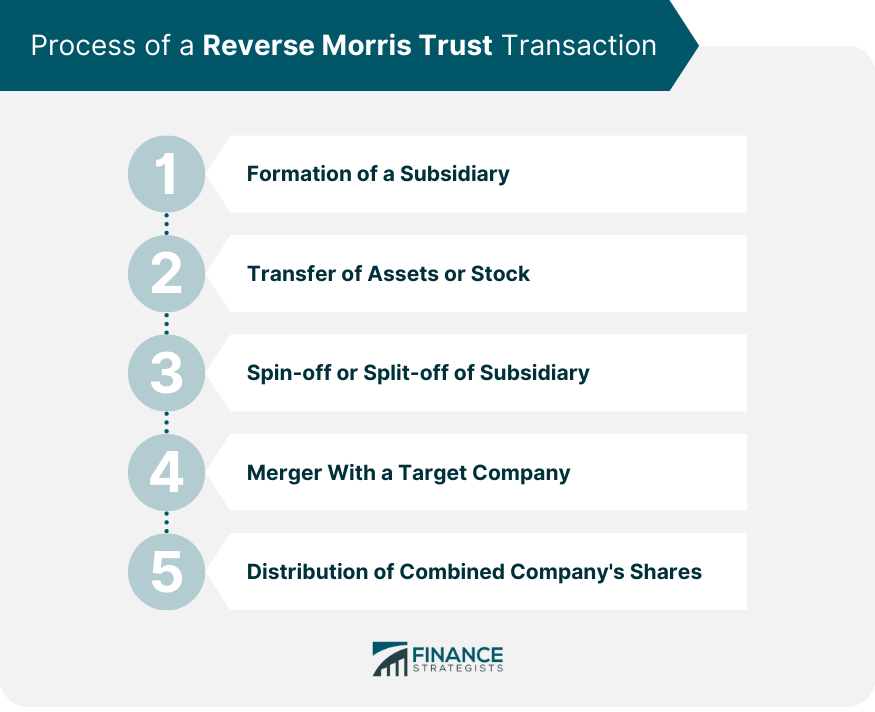

The process of a Reverse Morris Trust transaction involves several steps that must be carefully executed in order to achieve the desired tax-free treatment. The parent company creates a subsidiary to hold the assets or business it wishes to divest. This subsidiary must have a valid business purpose and may include existing operations, newly acquired assets, or a combination of both. The parent company transfers the assets or stock of the business to be divested to the newly formed subsidiary. The parent company then proceeds to spin off or split off the subsidiary, distributing its shares to the parent company's shareholders either pro-rata or through an exchange offer. The spun-off subsidiary merges with a target company, typically a smaller firm that is interested in acquiring the assets or business of the subsidiary. The shareholders of the target company receive shares in the combined entity in exchange for their shares in the target company. Finally, the parent company's shareholders receive shares in the combined company, resulting in the parent company effectively divesting itself of the business or assets held by the subsidiary. A Reverse Morris Trust transaction can qualify for tax-free treatment under IRC Section 355, which means that the parent company and its shareholders will not be subject to federal income taxes on the transaction. To achieve this tax-free treatment, certain requirements must be met. The transaction must involve an active trade or business that has been conducted for at least five years prior to the transaction. This requirement ensures that RMT transactions are not used purely for tax avoidance purposes. The parent company must have control of the spun-off subsidiary immediately before the distribution. Control is generally defined as owning at least 80% of the total combined voting power and at least 80% of the total number of shares of each class of nonvoting stock. The parent company must distribute all of the stock of the subsidiary to its shareholders, either pro-rata or through an exchange offer, in a transaction that qualifies as a distribution under IRC Section 355. The transaction must have a valid business purpose, which may include a desire to separate different lines of business, unlock shareholder value, or facilitate a merger or acquisition. A substantial part of the value of the stock of the target company must be exchanged for stock in the combined company. This requirement ensures that the shareholders of the target company maintain a continuing interest in the combined company. If the requirements for tax-free treatment under IRC Section 355 are not met, the transaction may be subject to federal income taxes. The parent company may be required to recognize gain on the distribution of the subsidiary's stock, and the shareholders may be subject to taxes on the receipt of the combined company's shares. Therefore, it is crucial for companies engaging in Reverse Morris Trust transactions to carefully structure the transaction to meet the necessary requirements. Companies engaging in Reverse Morris Trust transactions must comply with SEC rules and regulations. This includes filing appropriate documents, such as registration statements, proxy statements, and other required disclosures. Additionally, the SEC may review the transaction to ensure compliance with federal securities laws. A Reverse Morris Trust transaction may be subject to review by the FTC and other antitrust authorities. These agencies may scrutinize the transaction to ensure that it does not result in anticompetitive effects, such as the creation of a monopoly or substantial lessening of competition in a particular market. Depending on the structure of the transaction and the specific circumstances, a Reverse Morris Trust may require approval from the parent company's board of directors and its shareholders. Companies should consult with their legal advisors to determine the appropriate corporate governance procedures and shareholder approval requirements. When a Reverse Morris Trust transaction involves a target company located outside the United States or has other cross-border elements, additional regulatory considerations may arise. Companies must ensure compliance with foreign securities laws, tax regulations, and other applicable rules in the jurisdictions involved. Tax Efficiency: One of the main advantages of a Reverse Morris Trust is the potential for tax-free treatment, allowing companies to divest assets or businesses without incurring significant tax liabilities. Unlocking Shareholder Value: RMT transactions can help unlock shareholder value by separating different lines of business or facilitating strategic mergers and acquisitions. Flexibility in Structuring Transactions: RMT provides a flexible framework that can be tailored to meet the specific needs and objectives of the companies involved. Complexity of the Transaction: Reverse Morris Trust transactions are complex and require careful structuring to ensure compliance with tax, legal, and regulatory requirements. Regulatory Scrutiny: RMT transactions may be subject to regulatory review, including SEC and antitrust scrutiny, which could delay or impede the transaction. Potential Impact on Company Culture: The merger of the spun-off subsidiary with a target company may result in a significant change in company culture, which could create challenges for the combined entity. Reverse Morris Trust transactions offer tax efficiency, allowing companies to divest assets while avoiding significant tax liabilities. They also unlock shareholder value by separating different business lines or facilitating strategic mergers. The process involves forming a subsidiary, transferring assets or stock to it, spinning off or splitting off the subsidiary, merging it with a target company, and distributing shares to shareholders. To qualify for tax-free treatment, certain requirements must be met, including an active trade or business, control by the parent company, distribution of all subsidiary stock, a valid business purpose, and continuity of interest. However, Reverse Morris Trust transactions can be complex, subject to regulatory scrutiny, and may impact company culture. Careful structuring and compliance with legal and regulatory considerations are essential. To ensure the best outcome, companies should seek the guidance of experienced legal, tax, and financial professionals who can provide expert advice and support throughout the RMT transaction process.Definition of Reverse Morris Trust

Process of a Reverse Morris Trust Transaction

Formation of a Subsidiary

Transfer of Assets or Stock

Spin-off or Split-off of the Subsidiary

Merger of the Subsidiary With a Target Company

Distribution of the Combined Company’s Shares

Tax Implications of Reverse Morris Trust

Tax-Free Treatment Under Internal Revenue Code (IRC) Section 355

Requirements for Tax-Free Treatment

Active Trade or Business Requirement

Control Requirement

Distribution Requirement

Business Purpose Requirement

Continuity of Interest Requirement

Potential Tax Consequences if Requirements Are Not Met

Legal and Regulatory Considerations in Reverse Morris Trust

Securities and Exchange Commission (SEC) Requirements

Federal Trade Commission (FTC) and Antitrust Regulations

Corporate Governance and Shareholder Approval

Cross-Border Transactions and Foreign Regulatory Compliance

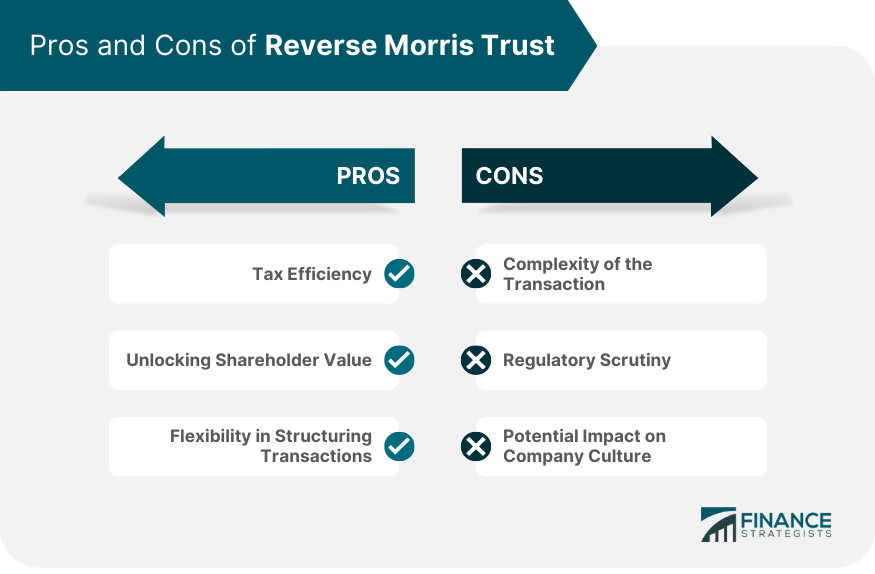

Pros and Cons of Reverse Morris Trust

Pros

Cons

Conclusion

Reverse Morris Trust FAQs

A Reverse Morris Trust (RMT) is a financial transaction that enables a company to divest a business or assets in a tax-efficient manner. Companies may consider using a Reverse Morris Trust to unlock shareholder value, separate different lines of business, or facilitate strategic mergers and acquisitions without incurring significant tax liabilities.

A Reverse Morris Trust transaction can qualify for tax-free treatment under the Internal Revenue Code (IRC) Section 355. To achieve this status, the transaction must meet specific requirements, including active trade or business, control, distribution, business purpose, and continuity of interest. If these conditions are met, the parent company and its shareholders will not be subject to federal income taxes on the transaction.

The primary advantages of a Reverse Morris Trust transaction include tax efficiency, unlocking shareholder value, and flexibility in structuring transactions. However, there are also potential disadvantages, such as the complexity of the transaction, regulatory scrutiny, and potential impact on company culture following the merger of the spun-off subsidiary with a target company.

Some successful Reverse Morris Trust transactions include the merger of Tyco International's flow control business with Pentair and the merger of Procter & Gamble's specialty beauty business with Coty. These examples demonstrate the potential benefits of using an RMT transaction to unlock shareholder value and achieve strategic objectives.

When considering a Reverse Morris Trust as a strategic option, companies should evaluate factors such as the tax efficiency and potential benefits of the transaction, the ability to meet the requirements for tax-free treatment, the potential impact on shareholder value, the complexity and potential challenges associated with executing the transaction, and the availability of suitable target companies for the merger component of the RMT transaction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.