Estate and Gift Tax Planning refers to the process of organizing one's financial affairs to minimize estate and gift taxes and ensure the efficient transfer of wealth to heirs, beneficiaries, or charitable organizations. This process often involves strategic decisions, such as gifting assets, creating trusts, and choosing suitable estate planning vehicles. Effective tax planning for estate and gifts is essential to preserve wealth for future generations, minimize tax liabilities, and maintain control over how assets are distributed. Proper planning can also help reduce the likelihood of disputes among family members and ensure that estate administration runs smoothly. The primary objectives of tax planning for estate and gift include minimizing estate and gift taxes, ensuring the efficient transfer of assets, providing financial security for loved ones, and preserving family harmony.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Maximize your estate's value by leveraging annual gift tax exclusions and lifetime exemption limits. Consider creating a trust to manage assets and minimize taxes. Gifting appreciated assets to lower-income family members can also reduce your estate's tax liability. Early planning and strategic use of exemptions and deductions are key. Let's discuss further how to optimize your estate and gift tax planning today. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Estate tax is a federal tax levied on transferring a deceased person's assets to their heirs or beneficiaries. The estate tax aims to prevent the concentration of wealth within a few families and generate revenue for the federal government. The taxable estate includes the fair market value of all assets owned by the decedent at the time of death, reduced by deductions for expenses, debts, and other allowable items. The applicable exclusion amount is the portion of a decedent's estate that is exempt from federal estate tax. This amount is subject to change and can be adjusted for inflation. Estate tax rates are progressive, meaning that the rate increases as the taxable estate's value increases. The rates generally range from 18% to 40% for estates exceeding the applicable exclusion amount. Gift tax is a federal tax imposed on transferring assets from one person to another without receiving full and adequate consideration in return. The purpose of the gift tax is to prevent individuals from avoiding estate taxes by gifting their assets during their lifetime. The annual exclusion is the maximum amount that an individual can gift to another person each year without incurring gift tax. This amount is subject to change and can be adjusted for inflation. The lifetime gift tax exemption is the cumulative amount of tax-free gifts that an individual can make during their lifetime, in addition to the annual exclusion. Gift tax rates are progressive and generally range from 18% to 40%, depending on the cumulative value of taxable gifts made by the donor during their lifetime. Individuals can take advantage of the annual exclusion by giving multiple recipients the maximum amount allowed each year without incurring gift tax. Direct payments to medical providers or educational institutions on behalf of others are excluded from gift tax and do not count toward the annual exclusion or lifetime gift tax exemption. Gifting appreciating assets, such as stocks or real estate, can help minimize estate and gift taxes by transferring future appreciation to the recipient and removing the asset's value from the donor's taxable estate. Gifts made to qualified charitable organizations are not subject to gift tax and can provide income tax deductions for the donor, reducing their overall tax liability. A revocable living trust is a flexible estate planning tool that allows individuals to retain control over their assets while avoiding probate and providing for the management of assets in the event of incapacity. Irrevocable trusts, once established, cannot be changed or revoked by the grantor. These trusts can help minimize estate taxes by removing assets from the grantor's taxable estate and provide creditor protection for beneficiaries. A GRAT is an irrevocable trust designed to transfer appreciating assets to beneficiaries at a reduced gift tax cost. The grantor retains an annuity interest in the trust for a specified term, and at the end of the term, the remaining trust assets pass to the beneficiaries. A CRT is an irrevocable trust that provides an income stream to the grantor or other non-charitable beneficiaries for a specified term, with the remaining trust assets passing to one or more qualified charitable organizations. Donors are required to file a gift tax return (Form 709) for any year in which they make taxable gifts exceeding the annual exclusion amount or gifts to non-U.S. citizen spouses above a specific threshold. An estate tax return (Form 706) must be filed within nine months of the decedent's death if the gross estate exceeds the applicable exclusion amount. The generation-skipping transfer (GST) tax applies to transfers made to beneficiaries who are two or more generations younger than the donor. Proper planning can help minimize GST tax exposure. Estate and gift planning can have income tax implications for donors, beneficiaries, and the estate itself. These implications should be considered when developing a comprehensive tax planning strategy. When choosing a tax planning strategy for estate and gift taxes, there are several factors to consider. Here are some important factors to keep in mind: The size of an individual's estate is one of the most important factors to consider when planning for estate and gift taxes. If an estate is valued at less than the federal estate tax threshold, there is no federal estate tax owed. However, if an estate is valued over the threshold, there is a significant tax liability. The size of an estate will determine the best tax planning strategy to minimize the tax impact. An individual's financial goals are another important factor to consider when planning for estate and gift taxes. For example, some individuals may want to preserve their assets for future generations, while others may want to provide for their beneficiaries during their lifetime. Different tax planning strategies may be better suited to different financial goals. Family dynamics can also play a role in tax planning. For example, if an individual has children or grandchildren with different financial needs, it may be necessary to tailor a tax planning strategy to ensure that all beneficiaries are treated fairly. Additionally, if an individual has a complicated family situation, such as blended families or estranged relatives, it may be necessary to take additional steps to ensure that their wishes are carried out. Business succession planning is critical to ensure the smooth transition of a family-owned or closely-held business to the next generation and to minimize potential tax liabilities. Estate planning for blended families requires careful consideration of the needs and desires of both the current spouse and children from previous relationships to ensure that all parties are treated fairly. Non-traditional couples, such as unmarried cohabitating couples and same-sex couples, may face unique estate planning challenges and should consult with an experienced estate planning attorney to address these issues. Non-U.S. citizens may face additional estate and gift tax challenges and should seek professional advice to navigate these complex rules. Financial planners can help clients evaluate their overall financial situation, identify estate planning goals, and develop strategies to minimize estate and gift taxes. Estate planning attorneys can assist with drafting essential estate planning documents, such as wills and trusts, and provide legal advice on strategies to minimize estate and gift taxes. Tax advisors can help clients understand the tax implications of their estate and gift planning decisions and offer guidance on tax-efficient strategies. Trust administrators are responsible for managing the day-to-day operations of a trust, ensuring compliance with trust provisions, and making distributions to beneficiaries as required. Estate and Gift Tax Planning is essential for individuals who want to minimize tax liabilities, ensure the efficient transfer of wealth to heirs or beneficiaries, and preserve family harmony. This process involves strategic decisions such as gifting assets, creating trusts, and choosing suitable estate planning vehicles. There are various tax planning strategies for minimizing estate and gift taxes, such as utilizing the annual exclusion, direct payments for medical and educational expenses, gifting appreciating assets, and gifting to charity. Understanding tax implications and factors such as the size of the estate, financial goals, family dynamics, and unique circumstances such as business succession planning, estate planning for blended families, non-traditional couples, and non-U.S. citizens, is crucial when choosing the most suitable tax planning strategy. Professionals such as financial planners, estate planning attorneys, tax advisors, and trust administrators can help in this process. By understanding the basics of estate and gift taxation and planning, individuals can preserve their wealth and provide for their loved ones in the most tax-efficient and effective way possible.What Is Estate and Gift Tax Planning?

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Basics of Estate and Gift Taxation

Estate Tax

Definition and Purpose

Taxable Estate

Applicable Exclusion Amount

Estate Tax Rates

Gift Tax

Definition and Purpose

Annual Exclusion

Lifetime Gift Tax Exemption

Gift Tax Rates

Strategies for Minimizing Estate and Gift Taxes

Gifting Strategies

Utilizing Annual Exclusion

Direct Payments for Medical and Educational Expenses

Gifting Appreciating Assets

Gifting to Charity

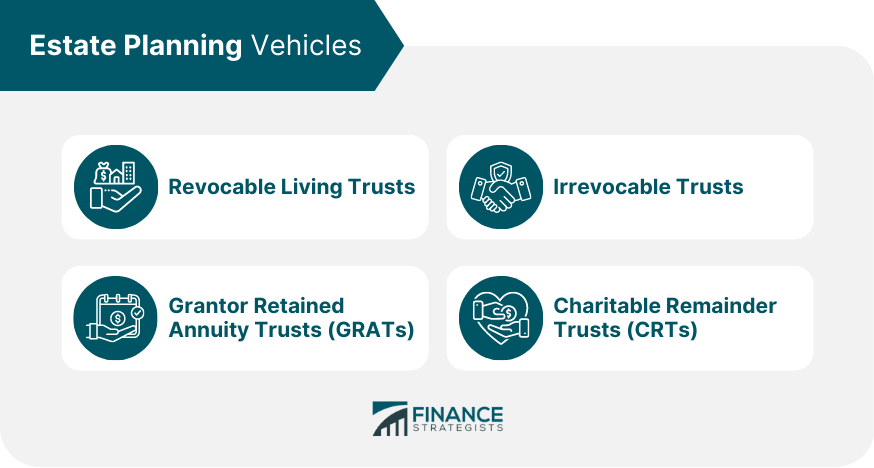

Estate Planning Vehicles

Revocable Living Trusts

Irrevocable Trusts

Grantor Retained Annuity Trusts (GRATs)

Charitable Remainder Trusts (CRTs)

Tax Implications of Estate and Gift Planning

Gift Tax Returns and Reporting Requirements

Estate Tax Returns and Filing Deadlines

Generation-Skipping Transfer Tax

Income Tax Considerations

Factors to Consider in Estate and Gift Tax Planning

Size of Estate

Financial Goals

Family Dynamics

Planning for Unique Circumstances

Business Succession Planning

Estate Planning for Blended Families

Estate Planning for Non-Traditional Couples

Estate Planning for Non-U.S. Citizens

Role of Professionals in Estate and Gift Tax Planning

Financial Planners

Estate Planning Attorneys

Tax Advisors

Trust Administrators

Conclusion

Estate and Gift Tax Planning FAQs

Tax planning for estate and gift is the process of minimizing tax liabilities by using various strategies, such as gifting, trusts, and charitable donations, to transfer assets to heirs or beneficiaries.

Tax planning is important for estate and gift because estate and gift taxes can be significant and reduce the wealth beneficiaries receive. By using tax planning strategies, individuals can reduce their tax liabilities and transfer more wealth to their heirs or beneficiaries.

Some tax planning strategies for estate and gift include lifetime gifting, charitable giving, irrevocable life insurance trusts, family limited partnerships, and grantor-retained annuity trusts.

Estate taxes are taxes imposed on the transfer of property at death, while gift taxes are taxes imposed on the transfer of property during an individual's lifetime. Both estate and gift taxes share the same exemption limit and are subject to the same tax rate.

Yes, it is recommended to consult with a tax professional to determine the most effective tax planning strategies for your specific situation. A tax professional can provide guidance on tax laws, regulations, and strategies to minimize tax liabilities and achieve your estate and gift planning goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.