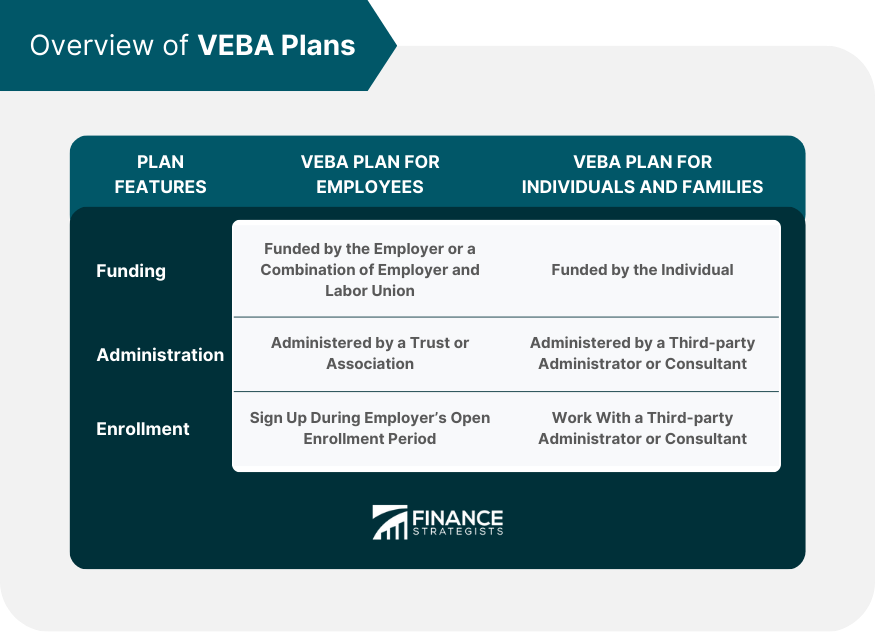

A Voluntary Employees' Beneficiary Association Plan (VEBA) is a type of healthcare plan that allows employees to pay for their healthcare expenses with pre-tax dollars. VEBA plans are generally funded by employers, labor unions, or a combination of the two. They are administered by a trust or association that is formed for this purpose. A VEBA can provide a range of benefits for employees and their families, including comprehensive medical coverage, dental and vision care, and wellness programs. Have questions about the VEBA Plan? Click here. A VEBA plan for employees is a healthcare plan that is offered as part of an employee benefits package. These plans are typically funded by the employer, who contributes a set amount of money into a trust or association that is used to pay for employees' healthcare expenses. With pre-tax dollars, employees can then use these funds to pay for their medical, dental, and vision expenses. One of the main advantages of a VEBA plan for employees is that it allows them to save money on their healthcare expenses. Because the funds used to pay for these expenses are pre-tax dollars, employees can reduce their taxable income and save money on their taxes. VEBA plans typically offer comprehensive coverage, including preventative care, prescription drugs, and other medical services. To enroll in a VEBA plan, employees will typically need to sign up during their employer's open enrollment period. Employees can review their healthcare options and choose the best plan during this time. It is important to carefully review the details of each plan before making a decision, as some plans may have limitations or exclusions that could affect an employee's coverage. A VEBA plan can provide an alternative to traditional health insurance for individuals and families not covered by an employer-sponsored healthcare plan. These plans can offer comprehensive coverage for medical, dental, and vision expenses, as well as wellness programs and other healthcare benefits. One of the main advantages of a VEBA plan for individuals and families is that it can help them save money on their healthcare expenses. Because these plans are funded with pre-tax dollars, individuals can reduce their taxable income and save money on their taxes. VEBA plans may offer more flexibility and control over healthcare spending than traditional health insurance plans. To enroll in a VEBA plan, individuals will typically need to work with a third-party administrator or consultant specializing in this type of plan. The administrator can help individuals understand their healthcare options and choose the plan that best meets their needs. However, there are also some disadvantages to VEBA plans for individuals and families. For example, these plans may have more limited provider networks or require individuals to pay more out-of-pocket expenses than other plans. VEBA plans may be unavailable in all states or subject to more stringent regulations than traditional health insurance plans. There is a growing body of research on the effectiveness and impact of VEBA plans on individuals, employers, and the healthcare system as a whole. Some studies have found that VEBA plans can help employers reduce their healthcare costs while offering comprehensive coverage to their employees. Other studies have found that VEBA plans can help individuals and families save money on their healthcare expenses and provide more flexibility and control over healthcare spending. However, there are also some concerns about the impact of VEBA plans on the healthcare system. Some critics have argued that these plans may not provide enough funding to support the healthcare needs of employees and their families or that they may encourage employees to delay or avoid necessary medical care. Despite these concerns, there is growing interest in VEBA plans as a potential solution to rising healthcare costs and the challenges of providing affordable and comprehensive healthcare coverage to employees and their families. Policymakers are exploring ways to expand access to VEBA plans and promote their use as part of a broader strategy to reform the healthcare system. Voluntary Employees' Beneficiary Association Plans can provide a range of benefits for employees, employers, individuals, and families who are looking for an alternative to traditional health insurance. These plans offer comprehensive coverage for medical, dental, and vision expenses, as well as wellness programs and other healthcare benefits. However, there are also some disadvantages to VEBA plans, and it is important to carefully consider the advantages and disadvantages of these plans before making a decision. By understanding the various aspects of VEBA plans, including how they work, their advantages and disadvantages, and their impact on individuals, employers, and the healthcare system as a whole, we can make more informed decisions about our healthcare coverage and help promote a more affordable and comprehensive healthcare system for everyone. To make an informed decision about whether a VEBA plan is right for you, it is essential to understand the advantages and disadvantages of these plans and their impact on the healthcare system. Consulting with a financial advisor specializing in retirement planning can help you navigate the complexities of these plans and make a decision that is right for your unique situation.Overview of Voluntary Employees' Beneficiary Association Plan (VEBA)

VEBA Plan for Employees

VEBA Plan for Individuals and Families

Research and Policy on VEBA Plans

Conclusion

Voluntary Employees' Beneficiary Association Plan (VEBA) FAQs

A VEBA is a type of healthcare plan that allows employees to pay for their healthcare expenses with pre-tax dollars. The employer, labor union, or a combination typically funds these plans. They are administered by a trust or association formed for this purpose.

The main advantage of a VEBA plan for employees is that it allows them to save money on their healthcare expenses. Because the funds used to pay for these expenses are pre-tax dollars, employees can reduce their taxable income and save money on their taxes. Additionally, VEBA plans typically offer comprehensive coverage, including preventative care, prescription drugs, and other medical services.

One of the main disadvantages of a VEBA plan is that it may have more limited provider networks or require employees to pay more out-of-pocket expenses than other types of plans. Additionally, VEBA plans may be unavailable in all states or subject to more stringent regulations than traditional health insurance plans.

A financial advisor specializing in healthcare plans can help you navigate the complexities of VEBA plans and make an informed decision about your healthcare coverage. They can guide the advantages and disadvantages of these plans and help you choose the right plan for your unique situation.

There is growing interest in VEBA plans as a potential solution to rising healthcare costs and the challenges of providing affordable and comprehensive healthcare coverage to employees and their families. Policymakers are exploring ways to expand access to VEBA plans and promote their use as part of a broader strategy to reform the healthcare system.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.