Defined benefit plans are a type of retirement plan in which an employer promises a specified monthly benefit upon retirement. The benefit is usually calculated using a formula that considers factors such as salary, years of service, and age at retirement. Self-employed individuals can establish a defined benefit plan to provide a source of guaranteed retirement income. These plans offer a variety of advantages, including tax benefits, customizable plan design, and lifetime income. Defined benefit plans can be an attractive retirement savings option for self-employed individuals due to their potential for higher contribution limits, tax savings, and guaranteed lifetime income. Self-employed individuals can customize their defined benefit plan to meet their specific retirement goals, such as targeting a specific retirement age or income level. Contributions to a defined benefit plan are generally tax-deductible, and investment earnings grow tax-deferred until distributed. This can result in significant tax savings over time. Defined benefit plans provide a guaranteed income stream for life, offering financial security and peace of mind during retirement. Assets in a defined benefit plan are generally protected from creditors, providing an additional layer of financial security for self-employed individuals. To establish a defined benefit plan, self-employed individuals must have a legitimate business with earned income. Additionally, they must be willing to commit to the ongoing funding and administration requirements of the plan. Establishing a defined benefit plan typically involves hiring a plan administrator or actuary to design the plan, calculate required contributions, and ensure compliance with applicable laws and regulations. The plan document is a legal document that outlines the terms and conditions of the defined benefit plan. This document must be prepared and maintained in accordance with applicable laws and regulations. Once the plan is established, self-employed individuals must make annual contributions to fund the promised benefits. Contribution amounts are determined by the plan's actuary and are generally tax-deductible. The annual benefit under a defined benefit plan is typically calculated using a formula based on factors such as salary, years of service, and age at retirement. The plan's actuary will estimate the required annual contributions needed to fund the promised benefits, considering factors such as investment returns, mortality rates, and plan expenses. Various factors can affect the required contribution amounts for a defined benefit plan, including investment performance, changes in interest rates, and plan amendments. Defined benefit plans offer a range of investment options, such as stocks, bonds, and mutual funds. Self-employed individuals should carefully consider their risk tolerance and investment objectives when selecting investments for their plan. Diversifying investments within a defined benefit plan can help reduce risk and optimize potential returns. Self-employed individuals should consider diversifying across various asset classes and investment styles. Regularly reviewing and adjusting the investment portfolio within a defined benefit plan can help ensure the plan remains on track to meet its funding and retirement income objectives. Defined benefit plans are subject to various annual reporting and disclosure requirements, such as filing Form 5500 with the Department of Labor and providing participants with an annual funding notice. These requirements help ensure the plan remains compliant with applicable laws and regulations. While self-employed individuals may not have employees, any future employees who become eligible to participate in the plan must be treated equitably. Defined benefit plans are subject to nondiscrimination testing to ensure benefits are not disproportionately favoring highly compensated individuals. Defined benefit plans must meet minimum funding standards to ensure the plan has sufficient assets to pay promised benefits. Failure to meet these standards can result in penalties and additional funding requirements. When considering a defined benefit plan, self-employed individuals should evaluate their financial goals, desired retirement age, and income needs during retirement. Establishing and maintaining a defined benefit plan can be costly and administratively complex. Self-employed individuals should weigh the potential benefits of the plan against the costs and administrative burden. Defined benefit plans require a long-term commitment and ongoing funding. Self-employed individuals should carefully consider whether they are prepared to assume the responsibilities and complexities associated with these plans. Defined contribution plans, such as Solo 401(k) plans, Simplified Employee Pension (SEP) IRAs, and Savings Incentive Match Plan for Employees (SIMPLE) IRAs, offer an alternative to defined benefit plans for self-employed individuals. These plans may be easier to establish and maintain, and they offer more flexibility in terms of contributions and investment options. Traditional and Roth IRAs are individual retirement accounts that offer tax advantages and can be used in conjunction with other retirement savings vehicles. Annuities are insurance products that can provide a guaranteed income stream during retirement. Self-employed individuals may consider using annuities as a supplement to their retirement savings strategy. Defined benefit plans can provide significant advantages for self-employed individuals, such as customizable plan design, tax savings, and guaranteed lifetime income. However, these plans can also be complex and require a long-term commitment. Self-employed individuals should carefully consider their options and seek professional advice when determining the most appropriate retirement savings strategy. Financial advisors, actuaries, and tax professionals can provide valuable guidance in selecting and managing a defined benefit plan or alternative retirement savings vehicle. Regardless of the specific retirement savings vehicle chosen, it is crucial for self-employed individuals to actively plan and save for their retirement. By doing so, they can enjoy financial security and peace of mind during their golden years.Defined Benefit Plans for Self-Employed: Overview

Key Features of Defined Benefit Plans for Self-Employed Individuals

Customizable Plan Design

Tax Advantages

Guaranteed Lifetime Income

Creditor Protection

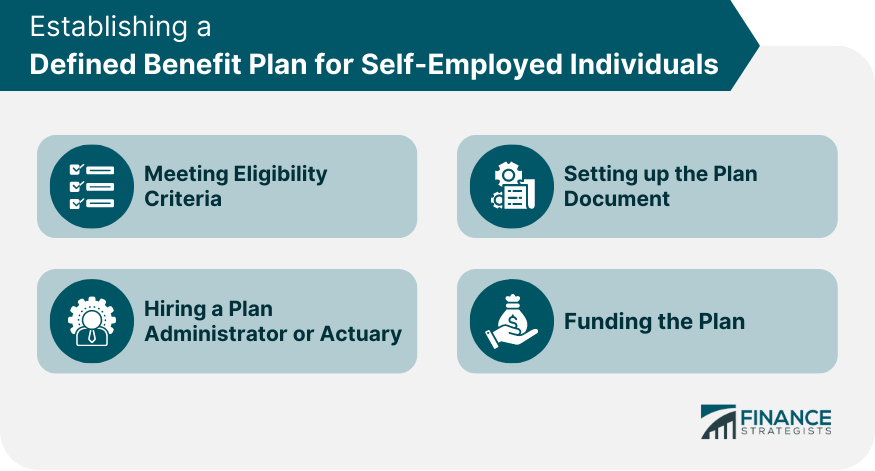

Establishing a Defined Benefit Plan for Self-Employed Individuals

Meeting Eligibility Criteria

Hiring a Plan Administrator or Actuary

Setting up the Plan Document

Funding the Plan

Determining the Annual Benefit and Contribution Amounts

Calculating the Annual Benefit

Estimating Required Contributions

Factors Affecting Contribution Amounts

Investment Options and Strategies for Defined Benefit Plans

Selecting Investment Options

Diversification and Risk Management

Monitoring and Adjusting Investments

Compliance and Reporting Requirements

Annual Reporting and Disclosure Requirements

Nondiscrimination Testing

Meeting Minimum Funding Standards

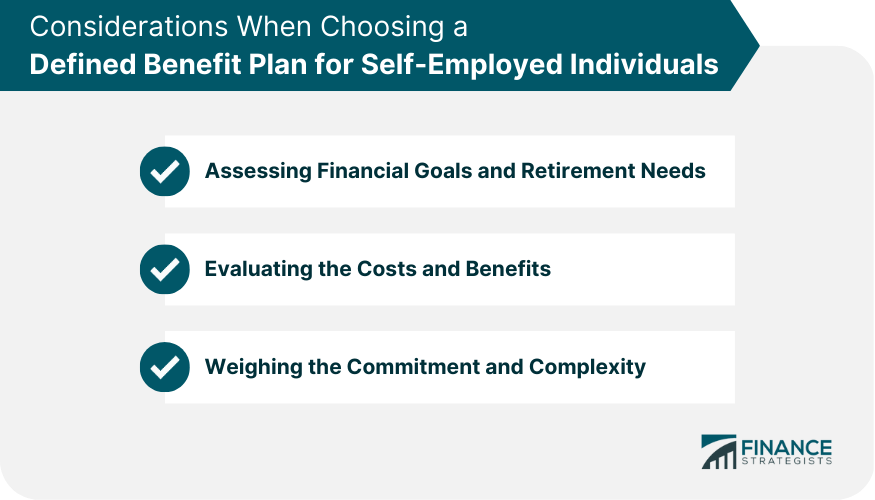

Considerations When Choosing a Defined Benefit Plan for Self-Employed Individuals

Assessing Financial Goals and Retirement Needs

Evaluating the Costs and Benefits

Weighing the Commitment and Complexity

Alternatives to Defined Benefit Plans for Self-Employed Individuals

Defined Contribution Plans

Traditional and Roth IRAs

Annuities

Conclusion

Defined Benefit Plans for Self-Employed FAQs

Yes, self-employed individuals can participate in defined benefit plans, also known as pension plans, if they meet certain requirements and contribute to the plan.

Self-employed individuals must have self-employment income and be able to demonstrate consistent and substantial earnings to participate in a defined benefit plan. They may also need to meet certain age and service requirements.

Defined benefit plans for self-employed individuals may have different contribution limits and funding requirements than traditional defined benefit plans. Self-employed individuals may also have more flexibility in terms of contribution amounts and distribution options.

Some potential benefits of participating in a defined benefit plan as a self-employed individual include the ability to save more for retirement than other types of retirement plans, tax advantages, and the potential for a guaranteed income stream in retirement.

Self-employed individuals should evaluate their retirement goals, financial situation, and tax obligations, and work with a financial advisor to develop a comprehensive retirement income plan that considers all available options. It is important to carefully evaluate the risks and benefits of any retirement plan before making investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.