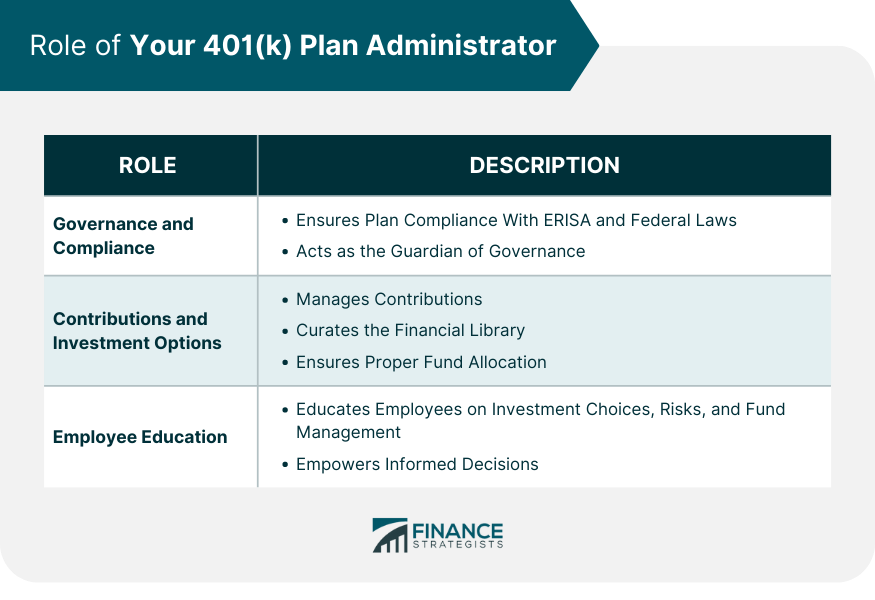

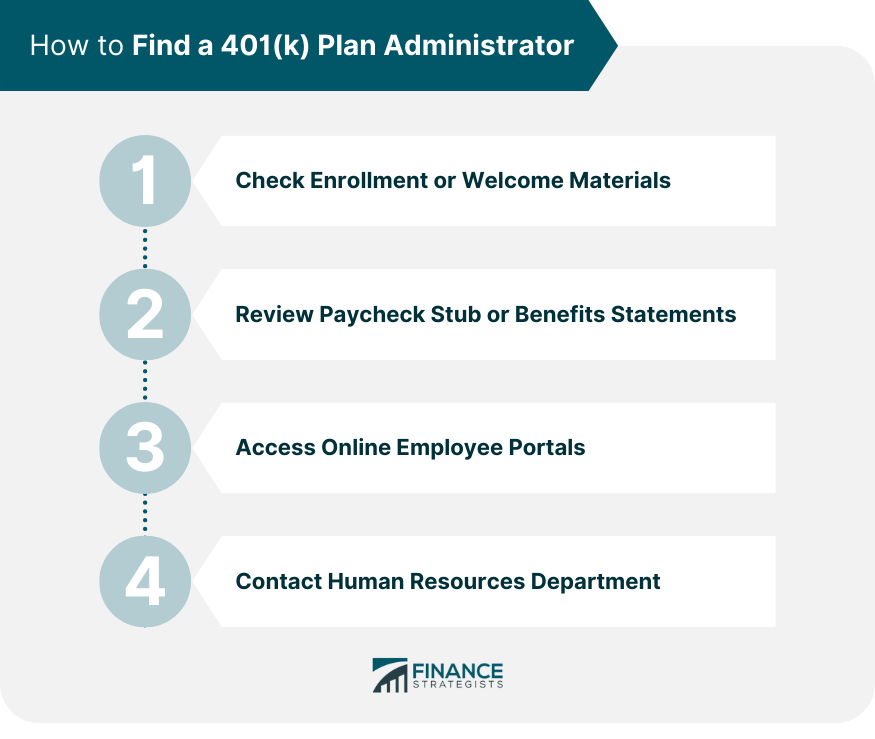

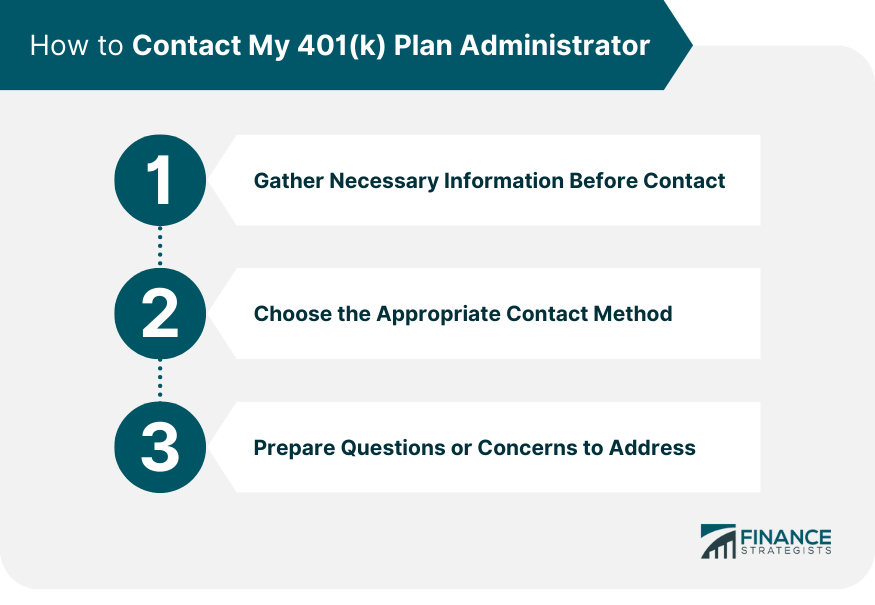

All 401(k) plans involve several different parties. The employer is the plan sponsor that established the plan and encouraged its employees to participate in it. The custodian holds the funds that are contributed into the plan and keeps them safe. And the administrator handles the day-to-day nuts and bolts operations of the plan. The administrator handles tasks such as issuing loans from the plan, moving money around from one investment to another within the plan at the request of a participant and sending account statements to each participant, among other things. Administrators have a long list of responsibilities related to administering the plan that typically go unnoticed by the vast majority of participants. For this reason, many employers outsource this important function to a third-party administrator that is in the business of managing 401(k) plans. Ensuring that a 401(k) plan is compliant with the Employee Retirement Income Security Act (ERISA) and other federal laws is paramount. That's where the plan administrator steps in, becoming the guardian of governance, ensuring that the plan operates within the confines of the law. The 401(k) plan administrator curates this financial library, overseeing contributions and ensuring they're invested according to each participant's elections. They ensure fluidity in processes, from enrollment of new employees to the accurate and timely allocation of funds. Plan administrators wear the educator's hat, ensuring employees are well-informed about their investment choices, potential risks, and the nuances of managing their funds. Through workshops, informational materials, or one-on-one sessions, they empower employees to make informed decisions. The quest to identify your plan administrator often starts at the very beginning. Delve into your enrollment kit or the welcome package you received when you first joined the company. More often than not, these materials harbor details about your plan administrator. Details about your 401(k) plan administrator might be sprinkled in your paycheck stub or benefits statements. A quick scan might reveal contact information or even insights about the company or entity overseeing your retirement funds. In the digital age, many answers lie a click away. Log into your online employee portal or benefits platform. These digital gateways often house vital information about your 401(k) plan, including details about the plan administrator. When in doubt, turn to your human resources (HR) department. They're not just the custodians of company culture but also the treasure trove of information about employee benefits, including details about the 401(k) plan administrator. If you need to find out how to get hold of your plan administrator, your employer's human resources officer or department will have this information. The plan statements that you receive will also most likely show the contact information of the administrator so that you can call or email them if you need to. It may also list the administrator's website, where you can go to get further contact information if necessary. The plan administrator will most likely have a group of employees working in a call center who are devoted to servicing the individual requests and demands of the plan participants. Ensure you have your employee ID, plan number, and any recent statements or documents related to your 401(k) at hand. Preparedness can pave the way for a smooth and productive conversation. While urgency might propel you to pick up the phone, it's essential to gauge the nature of your query. For intricate concerns or detailed documentation, email might be a more prudent choice. Conversely, for immediate queries, a phone call could be more effective. Tailor your communication mode to the nature and urgency of your concern. Clarity is the cornerstone of effective communication. Before reaching out, jot down your questions or concerns. A structured list can not only ensure you address all points but can also make the conversation more efficient. For example, if you want to change your fund allocations so that you're invested more conservatively (or more aggressively, depending upon your investment objectives, risk tolerance and time horizon). Then you'll call or email your plan's administrator and talk to a customer service representative to accomplish this. Your call may be recorded for quality assurance. While it's natural to harbor emotions, especially when it pertains to finances, maintaining a professional and respectful tone is vital. Approach the conversation as a collaborative endeavor, ensuring the dialogue remains constructive. In the realm of finance, documentation is gold. Whenever you communicate with your plan administrator, be it via email, phone, or in person, maintain records. These could serve as invaluable references in future interactions or if disputes arise. While plan administrators can offer insights about the 401(k) plan, they might not provide personalized financial advice. If you're grappling with intricate financial decisions, it might be prudent to consult with a financial advisor who can offer tailored guidance. A 401(k) plan administrator plays a crucial role in the efficient management of retirement funds. As the guardian of governance and compliance, they ensure the plan operates within legal boundaries. To find your 401(k) plan administrator, start by checking enrollment or welcome materials, reviewing paycheck stubs, accessing online employee portals, or contacting the HR department. When reaching out to the administrator, be prepared with necessary information, choose the appropriate contact method, and have your questions ready. Maintaining a professional tone and documenting communications are essential for effective communication. Understanding the role of a plan administrator and effectively reaching out to them can ensure a smooth retirement planning process.Overview of a 401(k) Plan Administrator

Role of a 401(k) Plan Administrator

Governance and Compliance

Contributions and Investment Options

Employee Education

How to Find a 401(k) Plan Administrator

Check Enrollment or Welcome Materials

Review Paycheck Stub or Benefits Statements

Access Online Employee Portals

Contact Human Resources Department

How to Contact My 401(k) Plan Administrator

Gather Necessary Information Before Contact

Choose the Appropriate Contact Method

Prepare Questions or Concerns to Address

401(k) Plan Administrator Contact

How to Communicate With Your 401(k) Plan Administrator

Maintain a Professional and Respectful Tone

Keep Documentation of Communications

Seek Professional Financial Advice When Needed

Conclusion

How Do I Find My 401(k) Plan Administrator? FAQs

Your 401(k) plan administrator is typically the employer that sponsors your retirement savings account. The name of this individual or organization will be listed on your retirement account statements.

You can find contact information for your 401(k) plan administrator by calling the customer service number provided in your retirement account statement, or you can visit their website to locate a phone number or email address for a representative.

The primary role of your 401(k) plan administrator is to manage and administer the contributions and investments of all participants in the plan. They are also responsible for providing accurate and timely account information, handling distributions, and facilitating other related services requested by you or your employer.

You should direct any questions or concerns regarding your 401(k) plan administrator to the customer service representative whose number is listed on your retirement statement. Alternatively, if you have access to the website of the administrator, then you can reach out via email or a contact form directly through their website.

Most employers provide materials that explain how their 401(k) plan works and the available investment options. Additionally, there are many online resources that can provide additional information about 401(k) plans such as mutual fund company websites, financial advisors or retirement planning websites. It is important to do your research and understand all the terms and conditions associated with investing in a 401(k) plan before taking any action. Additionally, you should always consult your tax advisor for specific advice based on your individual situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.