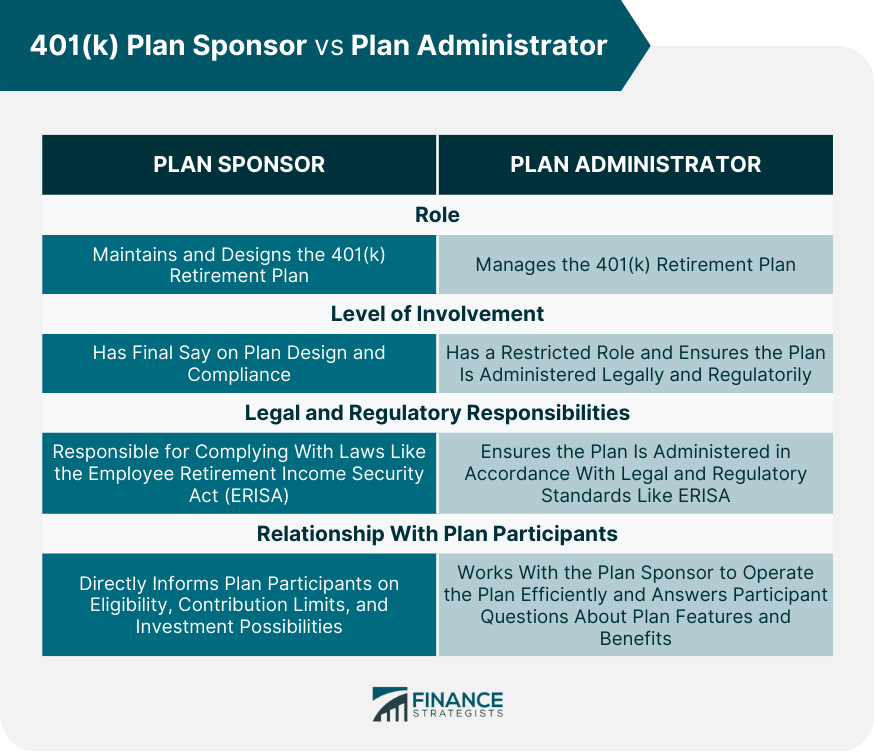

A 401(k) retirement plan is a type of defined contribution plan that employers widely use to help employees save for their retirement. The plan allows employees to contribute a portion of their pre-tax income to a retirement account, which is then invested in various investment options the plan offers. Employers may offer a matching contribution to incentivize employees to save more for retirement. The plan sponsor is typically the employer establishing the 401(k) retirement plan. They are responsible for making key decisions, such as the types of investment options offered, eligibility requirements for employees to participate, and the employer contribution amount. The plan sponsor is also responsible for ensuring that the plan complies with various legal and regulatory requirements, such as the Employee Retirement Income Security Act (ERISA). The plan administrator manages the 401(k) plan. This can include tasks such as enrolling employees in the plan, processing contributions and distributions, ensuring compliance with legal requirements, maintaining accurate plan records, and responding to inquiries. Effective management of both the plan sponsor and plan administrator roles is crucial to the success of a 401(k) retirement plan. When these roles are managed effectively, there can be benefits for both plan participants and the organization or employer sponsoring the plan. For example, legal violations can result in fines or other penalties, while participants may not receive the full benefits they are entitled to. In addition, decreased employee morale and engagement can occur if employees do not feel their retirement needs are being met. A plan sponsor is an organization or employer establishing and maintaining a 401(k) retirement plan to benefit employees. The plan sponsor is responsible for making key decisions about the plan, such as determining the types of investment options offered, setting eligibility requirements for employees to participate, and deciding on the employer contribution amount. Plan sponsors are also responsible for ensuring that the plan complies with various legal and regulatory requirements. This includes adhering to ERISA which sets standards for retirement plans, such as ensuring that the plan is operated in the best interests of plan participants. The plan sponsor has a direct relationship with plan participants and is responsible for communicating important plan information to them, such as eligibility requirements, contribution limits, and investment options. A plan administrator is responsible for the day-to-day management of the 401(k) retirement plan. The plan administrator may be an individual or an organization, such as a third-party administrator (TPA) specializing in providing retirement plan services. The plan administrator's responsibilities include enrolling employees in the plan, processing contributions and distributions, and ensuring that the plan complies with legal and regulatory requirements. The plan administrator is also responsible for maintaining accurate plan records, preparing required tax filings and reports, and responding to participant inquiries about plan features and benefits. The plan administrator works closely with the plan sponsor to ensure the plan is managed effectively and efficiently. While the plan sponsor and plan administrator roles are critical to successfully managing a 401(k) plan, there are key differences between the two roles. One of the primary differences is the level of responsibility. The plan sponsor is responsible for the plan, including making key decisions about plan design and ensuring compliance with legal and regulatory requirements. The plan administrator, on the other hand, is responsible for the day-to-day management of the plan, such as processing contributions and distributions and maintaining accurate records. Another difference is the legal and regulatory requirements associated with each role. The plan sponsor has a fiduciary duty to act in the best interests of plan participants and must adhere to various legal and regulatory requirements, such as ERISA. The plan administrator is also subject to legal and regulatory requirements, but their responsibilities are more focused on ensuring that the plan is being administered in compliance with these requirements. Coordination between the plan sponsor and the plan administrator is crucial to ensure the plan is managed effectively. The plan sponsor and plan administrator should work closely together to ensure that the plan is operating in compliance with legal and regulatory requirements and that the needs of plan participants are being met. Effective management of plan sponsor and plan administrator roles is crucial to the success of a 401(k) retirement plan. When these roles are not managed effectively, there can be negative consequences for both plan participants and the organization or employer sponsoring the plan. Benefits of effective management include: Ensuring that the plan is being managed in compliance with legal and regulatory requirements Maximizing the benefits of the plan for plan participants Minimizing the risks of litigation or other legal issues Enhancing the organization or employer's reputation as a responsible employer Risks of ineffective management include: Legal and regulatory violations that can result in fines or other penalties Plan participants not receiving the full benefits they are entitled to Litigation or other legal issues that can be costly and damaging to the organization or employer's reputation Decreased employee morale and engagement if they do not feel that their retirement needs are being met Strategies for managing plan sponsor and plan administrator roles effectively include: Establishing clear lines of communication between the plan sponsor and plan administrator Defining roles and responsibilities clearly and ensuring that all parties understand their responsibilities Ensuring that the plan sponsor and plan administrator have the necessary resources, such as staff and technology, to manage the plan effectively Regularly monitoring the plan to ensure that it is operating in compliance with legal and regulatory requirements and that the needs of plan participants are being met Conducting regular reviews of the plan to ensure that it is meeting the organization or employer's goals and objectives A third-party administrator is an organization that provides administrative services for retirement plans, including 401(k) plans. TPAs can provide various services, such as plan design, recordkeeping, and compliance monitoring. Using a TPA can have several benefits, such as: Access to specialized expertise in retirement plan administration Reduced administrative burden on the plan sponsor Enhanced compliance monitoring and reporting However, using a TPA can also have drawbacks, such as: Additional costs associated with hiring a third-party provider Reduced control over plan administration It is important for plan sponsors to carefully evaluate the pros and cons of using a TPA before making a decision. Understanding the roles and responsibilities of the plan sponsor and administrator is crucial to effectively managing a 401(k) retirement plan. The plan sponsor is responsible for making key decisions about the plan and ensuring that it complies with legal and regulatory requirements. In contrast, the plan administrator is responsible for the day-to-day management of the plan. Effective management of these roles can lead to benefits such as maximizing plan benefits for participants and enhancing the organization or employer's reputation. However, ineffective management can lead to legal and regulatory violations, decreased employee morale, and other negative consequences. To ensure that a 401(k) plan is managed effectively, hiring a financial advisor who specializes in retirement planning may be beneficial.Overview of 401(k) Retirement Plan

401(k) Plan Sponsor

401(k) Plan Administrator

Differences Between Plan Sponsor and Plan Administrator

Importance of Effective Plan Sponsor and Plan Administrator Management

Third-Party Administrators (TPAs)

Conclusion

401(k) Plan Sponsor vs Plan Administrator FAQs

A plan sponsor is an employer or organization that establishes and maintains a 401(k) retirement plan. In contrast, a plan administrator is responsible for the day-to-day management of the plan.

Effective management of these roles is crucial to the success of a 401(k) retirement plan. It can lead to benefits such as maximizing plan benefits for participants and enhancing the organization or employer's reputation.

Strategies for effective management include establishing clear communication, defining roles and responsibilities, ensuring necessary resources are available, regularly monitoring the plan, and conducting regular reviews.

A TPA is an organization that provides administrative services for retirement plans, including 401(k) plans. They can provide plan design, recordkeeping, and compliance monitoring services.

Hiring a financial advisor with specialized expertise in retirement plan administration can help you navigate the complexities of plan management and ensure that you are meeting the needs of plan participants.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.