Mortgage prequalification is an initial evaluation by a lender to determine a borrower's eligibility for a mortgage loan based on their income, credit history, and other relevant financial information. This process provides an estimate of the loan amount a borrower may qualify for, allowing them to understand their budget better and make informed decisions during the home buying process. The main purpose of mortgage prequalification is to give borrowers an idea of their mortgage eligibility before they begin their house-hunting journey. Prequalification offers several benefits, such as enhancing credibility with sellers, providing a better understanding of budget constraints, speeding up the homebuying process, and increasing negotiation power. The mortgage prequalification process involves gathering necessary financial documents, evaluating eligibility criteria, and choosing the right lender. Before beginning the mortgage prequalification process, borrowers should gather the following financial documents: Lenders require proof of income to ensure borrowers can afford the mortgage payments. This may include pay stubs, W-2 forms, or tax returns. Lenders may also request information about a borrower's employment history to assess the stability of their income. This includes documentation of savings, investments, and other assets that can be used as a down payment or to cover closing costs. Lenders will review a borrower's existing debts and liabilities to determine their ability to manage additional financial obligations. A borrower's credit report is a key factor in determining mortgage eligibility. Borrowers should obtain a copy of their credit report and correct any errors before starting the prequalification process. Lenders evaluate several key factors when determining a borrower's eligibility for a mortgage: The Debt-to-Income Ratio (DTI) compares a borrower's monthly debt obligations to their monthly income. Lenders typically prefer a DTI of 43% or lower. The LTV ratio is calculated by dividing the mortgage amount by the property's appraised value. A lower LTV ratio is generally more favorable. A borrower's credit score is a numerical representation of their creditworthiness. Lenders typically require a minimum credit score for mortgage prequalification. Borrowers should compare multiple lenders to find the best fit for their needs: Different lenders may offer varying interest rates. Borrowers should shop around to find the most competitive rates. Researching a lender's reputation can help ensure a smooth and reliable prequalification process. Different lenders may offer different loan products and services. Borrowers should carefully review their options to find the best fit. Prequalified borrowers are often viewed as serious and reliable by sellers, which can improve their chances of having their offers accepted. Prequalification helps borrowers determine their budget and avoid wasting time looking at homes outside their price range. A prequalification letter can streamline the home buying process, as it demonstrates to sellers that the borrower has already taken the first step in securing financing. A prequalification letter can provide borrowers with a stronger negotiating position, as it shows that they are financially capable of purchasing the property. Mortgage prequalification is an initial assessment and does not guarantee final approval for a mortgage loan. Borrowers must still go through the full underwriting process before obtaining a mortgage. Prequalification is based on current market conditions and a borrower's financial situation at the time of assessment. Changes in interest rates, property values, or the borrower's financial situation can impact the final loan approval. Some lenders may conduct a hard credit inquiry during prequalification, which can temporarily lower a borrower's credit score. Mortgage prequalification letters typically expire after a certain period, usually 60 to 90 days. Borrowers should be aware of this timeframe and be prepared to update their prequalification if necessary. Mortgage preapproval is a more formal evaluation of a borrower's financial situation, where a lender conditionally commits to providing a mortgage loan up to a specified amount. While both preapproval and prequalification offer insights into a borrower's mortgage eligibility, there are key differences in the process and requirements: Preapproval requires a more thorough review of a borrower's financial situation, including a detailed credit check, income verification, and review of assets and liabilities. Preapproval typically results in a conditional commitment from the lender, whereas prequalification only provides an estimate of the loan amount. Preapproval carries more weight with sellers and can provide a competitive advantage in a tight housing market. While preapproval offers several advantages, it also has some drawbacks compared to prequalification: Preapproval requires more time and effort, as it involves a more detailed assessment of a borrower's financial situation. The preapproval process may involve multiple hard credit inquiries, which can impact a borrower's credit score. Preapproval letters have a shorter validity period, typically 30 to 60 days. Borrowers should carefully consider their individual circumstances and housing market conditions to determine whether preapproval or prequalification is the best option for them. Borrowers should strive to maintain good credit by paying bills on time, keeping credit card balances low, and avoiding unnecessary debt. Paying down existing debt can improve a borrower's DTI ratio, making them more attractive to lenders. Borrowers should ensure that all documentation provided during the prequalification process is accurate and up to date to avoid delays or discrepancies. Consulting with a mortgage broker or financial advisor can provide valuable guidance throughout the prequalification process and help borrowers navigate the complexities of the mortgage market. Mortgage prequalification plays a crucial role in homebuying, offering borrowers valuable insights into their mortgage eligibility and helping them make informed decisions as they search for their dream home. Mortgage prequalification is useful for gauging a borrower's eligibility for a mortgage loan and serves as a valuable financial planning tool. By understanding their budget constraints, borrowers can make better decisions about saving for a down payment, paying off existing debts, and improving their overall financial standing. Mortgage prequalification is an essential first step in the home-buying process. It provides borrowers with valuable information about their mortgage eligibility and helps them make informed decisions about the type of property they can afford. By carefully considering the benefits, limitations, and differences between prequalification and preapproval and by working with a mortgage broker or financial advisor, borrowers can navigate the complexities of the mortgage market and secure the best possible financing for their new home.What Is Mortgage Prequalification?

The Mortgage Prequalification Process

Gathering Necessary Financial Documents

Income Verification

Employment History

Asset Documentation

Debt and Liability Documentation

Credit Report

Evaluating Eligibility Criteria

Debt-to-Income Ratio (DTI)

Loan-to-Value Ratio (LTV)

Credit Score

Choosing the Right Lender

Comparing Interest Rates

Assessing Lender Reputation

Evaluating Loan Products and Services

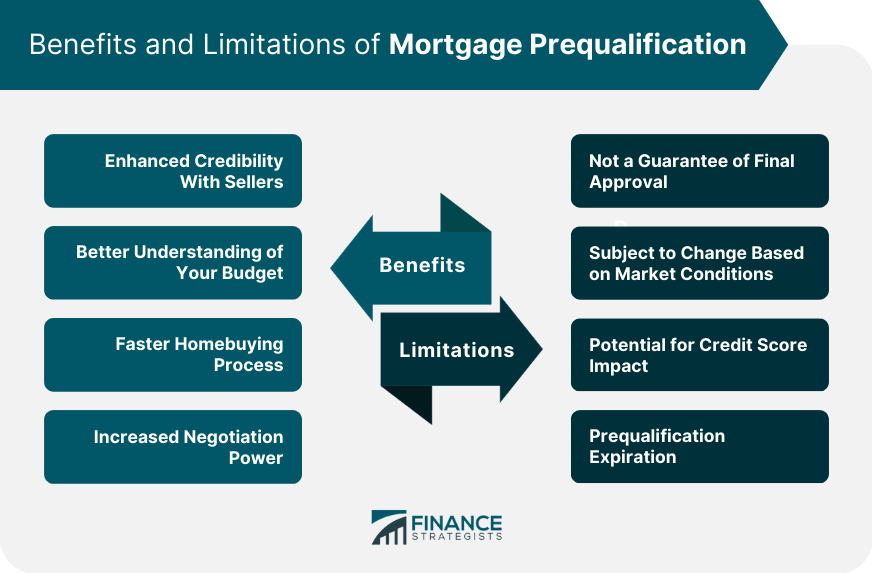

Benefits of Mortgage Prequalification

Enhanced Credibility With Sellers

Better Understanding of Your Budget

Faster Homebuying Process

Increased Negotiation Power

Limitations of Mortgage Prequalification

Not a Guarantee of Final Approval

Subject to Change Based on Market Conditions

Potential for Credit Score Impact

Prequalification Expiration

Mortgage Preapproval vs. Prequalification

Definition of Mortgage Preapproval

Differences in Process and Requirements

Pros and Cons of Preapproval vs Prequalification

Choosing the Best Option for Your Situation

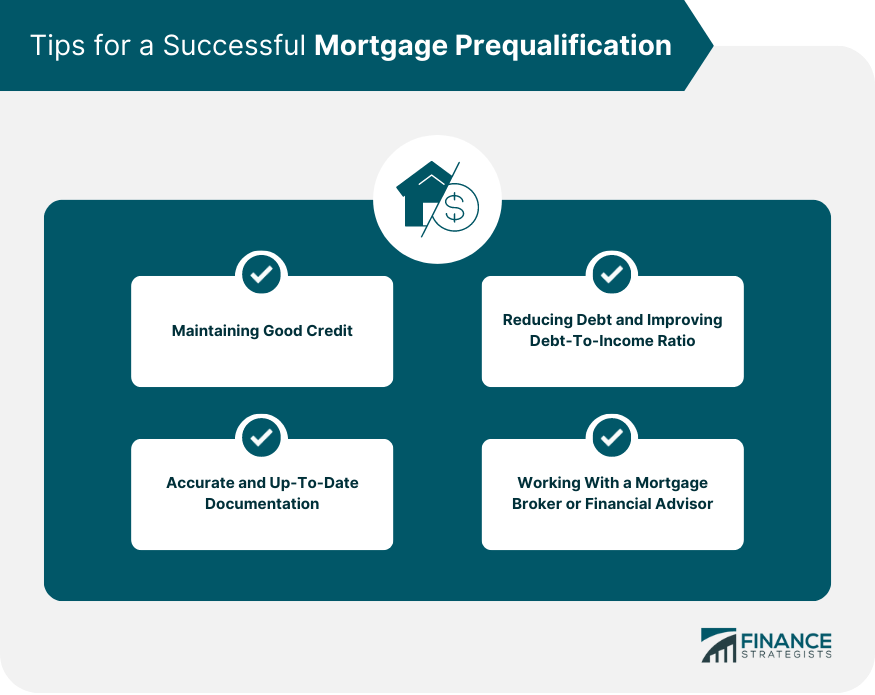

Tips for a Successful Mortgage Prequalification

Maintaining Good Credit

Reducing Debt and Improving Debt-to-Income Ratio

Accurate and Up-to-Date Documentation

Working With a Mortgage Broker or Financial Advisor

Conclusion

Mortgage Prequalification FAQs

Mortgage prequalification is the initial step in the mortgage process, where a lender assesses a borrower's financial situation to estimate the amount they could potentially borrow for a mortgage.

Mortgage prequalification involves a lender reviewing a borrower's income, debt, and credit history to determine their ability to repay a mortgage. Based on this information, the lender provides an estimate of the mortgage amount the borrower could qualify for.

No, mortgage prequalification is not the same as preapproval. Prequalification is an initial assessment of a borrower's financial situation, while preapproval involves a more thorough review of the borrower's financial history and creditworthiness.

Mortgage prequalification can give borrowers an idea of how much they could potentially borrow for a mortgage and help them narrow down their home search. Additionally, prequalification can signal to sellers that the borrower is serious about buying a home and has taken steps toward securing financing.

No, mortgage prequalification does not guarantee a loan. It is only an estimate of the amount a borrower could potentially qualify for based on their financial situation. The lender will still need to review additional information and complete the underwriting process before a loan can be approved.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.