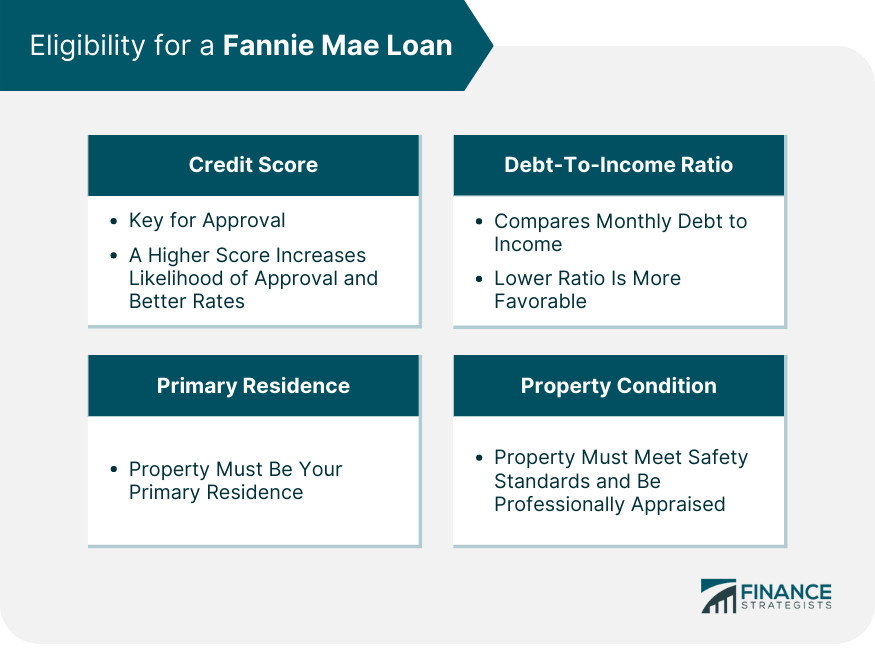

Fannie Mae, the Federal National Mortgage Association, significantly impacts the housing market by providing liquidity to lenders through mortgage-backed securities. This mechanism enables lenders to issue more loans, facilitating access to home loans with lower interest rates for borrowers. Fannie Mae's role is not to offer mortgages directly but to buy mortgages from compliant lenders and bundle them into securities for investors. This process aims to stimulate the housing market and make mortgages more accessible to low-to-moderate-income families. Fannie Mae loans offer numerous benefits, including low down payments and competitive interest rates, making homeownership more attainable. Nevertheless, the decision to take on a mortgage requires careful consideration, ensuring the capacity for consistent monthly payments. When applying for a Fannie Mae loan, lenders will consider two primary personal circumstances: your credit score and your debt-to-income ratio. Your credit score is one of the most crucial elements when applying for a Fannie Mae loan. It serves as a snapshot of your creditworthiness, summarizing your credit history into a single number. The credit score required by Fannie Mae can vary, but it typically requires a minimum credit score that falls into the 'fair' or 'good' range. A good credit score indicates to lenders that you're less likely to default on your loan. The higher your credit score, the more likely you are to be approved for a Fannie Mae loan, often at a more favorable interest rate. The debt-to-income ratio is another critical aspect of your financial profile. It's a metric that compares your total monthly debt payments (such as credit cards, student loans, car loans) to your gross monthly income. A lower DTI indicates that you have a good balance between debt and income, which suggests to lenders that you're more likely to manage your monthly mortgage payments successfully. In contrast, a high DTI may signal that you have too much debt for your income level, which can make lenders hesitant to approve your loan. For a property to be eligible for a Fannie Mae loan, it must meet certain criteria. The property you plan to purchase with a Fannie Mae loan must be intended as your primary residence. This stipulation ensures the loan supports homeownership for borrowers who will actually live in the homes they purchase. Fannie Mae loans typically do not support investment properties or second homes, as these are considered less critical for housing stability. The condition of the property is also vital for eligibility. Fannie Mae requires the property to meet certain safety, quality, and condition standards. This means the home must be safe to live in, structurally sound, and free from health hazards. The home must also be appraised by a professional who can confirm that its value matches the amount of the loan. Before applying for any loan, understanding your financial status is crucial. It's important to review your credit score, calculate your debt-to-income ratio, and have a clear understanding of your monthly income and expenses. Fannie Mae does not directly lend to borrowers. Instead, you'll need to locate a Fannie Mae-approved lender. This can be a commercial bank, a credit union, or another type of lending institution. You can find a list of Fannie Mae-approved lenders on the Fannie Mae website. Loan applications require a lot of paperwork. You'll need proof of income, such as pay stubs or tax returns, proof of assets, credit history, and more. It's best to gather these documents ahead of time to streamline the application process. Once you've gathered your documentation, it's time to submit the application. Your lender will guide you through this process, but it's always beneficial to double-check everything for accuracy before submitting. After submission, your application goes into the review process. Your lender will examine all the information provided, possibly ask for additional information, and then make a decision. Approval may depend on various factors, including credit score, debt-to-income ratio, and the appraised value of the property. An insufficient credit score is a common reason for loan denial. However, there are ways to improve your credit score, including paying your bills on time, paying down debt, and keeping credit card balances low. Regularly reviewing your credit report for errors can also help maintain a good score. A high debt-to-income ratio is another common reason for denial. Lowering this ratio might involve paying down debts, avoiding new debt, and increasing income. It's also important to consider future expenses, so not to risk increasing your DTI ratio. An unstable employment history can be another red flag for lenders. If possible, stick with the same employer for a while before applying for a loan. Having a stable income shows lenders that you're likely to manage your loan payments. Once your loan is approved, it's crucial to understand your loan terms. This includes the interest rate, the length of the loan, and the amount of your monthly payments. Make sure you understand all the terms and conditions before signing any loan documents. Meeting your monthly payment requirements is crucial for maintaining your loan and avoiding foreclosure. It's a good idea to set up automated payments to ensure that you never miss a due date. Even with careful planning, financial challenges can arise. If you're struggling to make payments, reach out to your lender immediately. They may be able to work out a modified payment plan or find other ways to assist you. Navigating the world of Fannie Mae loans may seem complex, but with proper understanding and planning, it's a path that can lead to homeownership. As a unique entity within the housing market, Fannie Mae facilitates access to affordable home loans by buying mortgages from compliant lenders, ultimately supporting low-to-moderate-income families. When applying, key factors like your credit score, debt-to-income ratio, and the eligibility of your desired property play crucial roles. Each step of the application process, from understanding your financial status to the final submission, requires meticulous attention. Despite the potential for loan denial due to insufficient credit score, high debt-to-income ratio, or unstable employment history, various strategies can improve your chances. Upon approval, managing your loan entails understanding the terms, meeting monthly payments, and proactively navigating any financial challenges. Securing a Fannie Mae loan is a journey filled with careful preparation, consideration, and commitment to stable homeownership.Overview of Fannie Mae Loans

Eligibility for a Fannie Mae Loan

Qualifying Personal Circumstances

Credit Score

Debt-To-Income Ratio (DTI)

Property Eligibility Requirements

Primary Residence

Property Condition

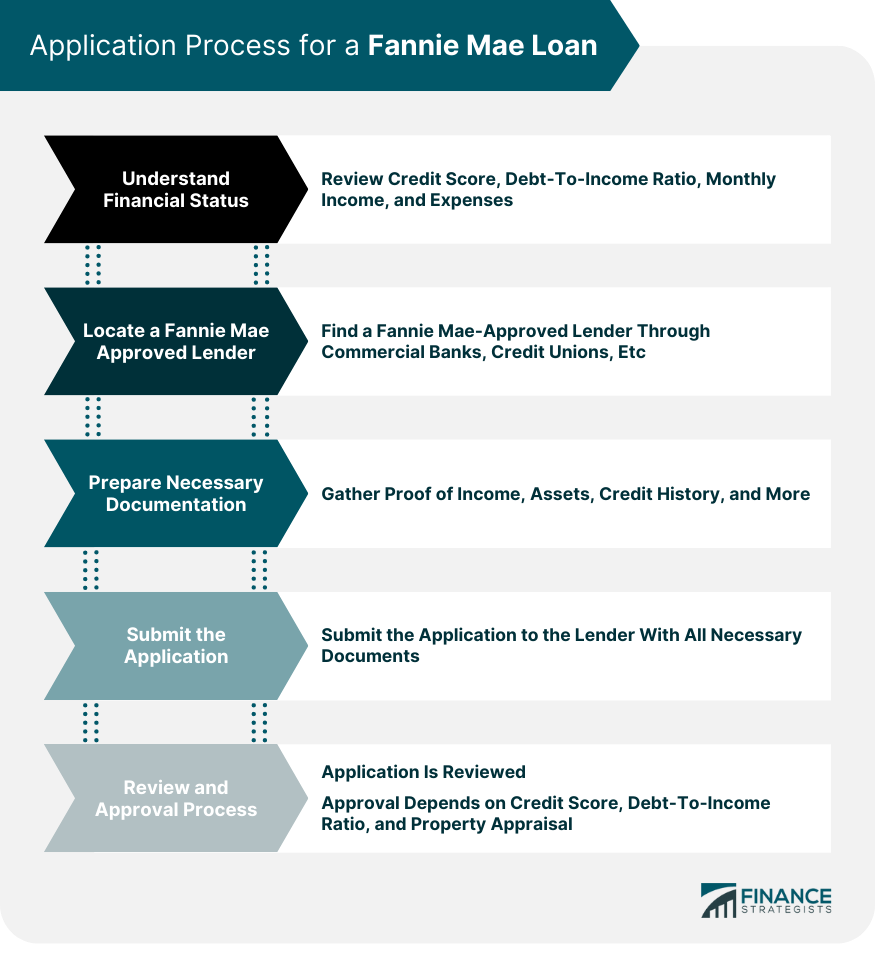

Application Process for a Fannie Mae Loan

Step-By-Step Guide of the Application Process

Understand Financial Status

Locate a Fannie Mae Approved Lender

Prepare Necessary Documentation

Submit the Application

Review and Approval Process

Common Reasons for Loan Denial and Strategies to Improve Your Chances

Insufficient Credit Score and Tips for Maintenance

High Debt-To-Income Ratio and Reduction Strategies

Unstable Employment History and Building Stability

Managing a Fannie Mae Loan

Understand Loan Terms

Meet Monthly Payment Requirements

Navigate Potential Financial Challenges

Bottom Line

How to Apply for a Fannie Mae Loan FAQs

Fannie Mae loans aim to stimulate the housing market and increase mortgage availability for low-to-moderate-income families.

You need a suitable credit score and debt-to-income ratio. Also, the property you wish to purchase must be your primary residence.

Understand your financial status, locate a Fannie Mae approved lender, prepare necessary documentation, and submit your application.

Common reasons include insufficient credit score, high debt-to-income ratio, and unstable employment history.

Understand your loan terms, meet monthly payment requirements, and navigate potential financial challenges with your lender's help.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.